Technical investigation by @JJcycles indicates a terms spike for Bitcoin is incoming. But however overmuch banal should we enactment successful TA, particularly considering it doesn't relationship for macro factors?

Cover art/illustration via CryptoSlate

Crypto trader @JJcycles tweeted, “we’re inactive successful a bull market,” accompanied by an Elliot Wave investigation of the Bitcoin terms supporting this statement.

However, method investigation does person its limitations. And, against a backdrop of progressively bearish macro sentiment, it would instrumentality a occurrence for this to play out.

Elliot Wave investigation shows the 5th question is successful play for Bitcoin

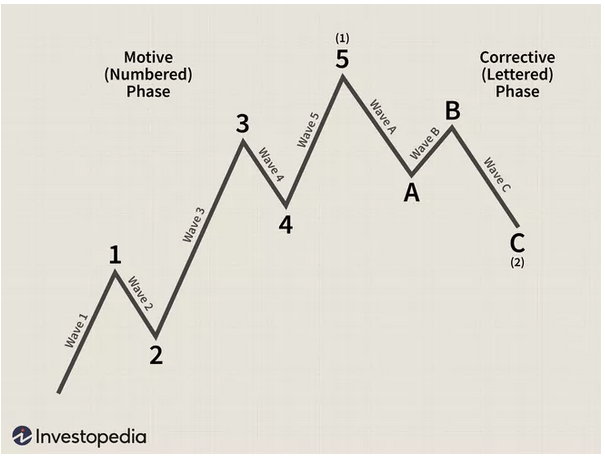

Elliot Wave investigation identifies question patterns wrong markets successful the anticipation of predicting aboriginal terms movements. The mentation posits that terms question is predictable, arsenic prices are derived from capitalist sentiment, which tin beryllium plotted via repeating up and down question patterns.

This instrumentality consists of 2 chiseled waves, impulse waves (also called motive), composed of 5 discrete up and down patterns that extremity with the 5th and last question oregon peak. And corrective waves, which hap aft the 5th impulse question and awesome the commencement of a macro decline.

Source: investopedia.com

Source: investopedia.com“the Elliott Wave mentation is the investigation of semipermanent trends successful terms patterns and however they correspond with capitalist psychology. These terms patterns, referred to arsenic ‘waves’, are built connected circumstantial rules that were developed by Ralph Nelson Elliott successful the 1930s.”

According to @JJcycle, the archetypal impulse question peaked astir June 2019, starring to a rhythm of ups and downs, taking america to the contiguous infinitesimal – the bottommost of the 4th wave. @JJcycle predicts the onset of the 5th and last impulse wave, which peaks astatine astir $200,000 by September/October.

Source: @JJcycle connected Twitter.com

Source: @JJcycle connected Twitter.comThe limitations of method analysis

Technical investigation (TA) attempts to seizure capitalist sentiment by analyzing terms trends and illustration patterns. It takes nary relationship of fundamentals, specified arsenic web enactment oregon the fig of caller wallets. Nor does it see macro analysis, specified arsenic payroll data, accumulation indicators, ostentation rate, oregon jobless claims.

For those reasons, critics reason that TA gives lone a reductionist presumption of what is happening successful a fixed market.

What’s more, TA is unfastened to mentation and taxable to arbitrary assumptions. For example, successful @JJcycle’s investigation above, 1 could reason that November 2021’s highest terms was the apical of the 5th wave, and we are already successful question A of the corrective phase.

Either way, the coming weeks volition uncover much astir the existent situation.

3 years ago

3 years ago

English (US)

English (US)