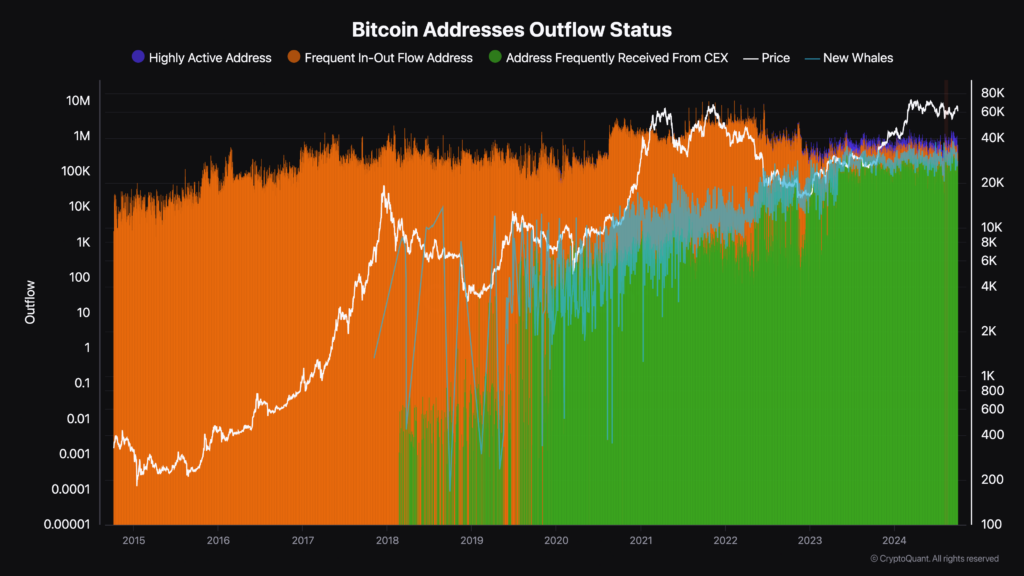

Analysis of Bitcoin code outflow patterns indicates a correlation betwixt code enactment types and Bitcoin’s terms movements from 2014 to 2024. Per CryptoQuant data, shifts successful outflow trends among antithetic code categories bespeak underlying marketplace trends and subordinate behaviors.

Bitcoin Address outflow presumption 2014 – 2021 (CryptoQuant)

Bitcoin Address outflow presumption 2014 – 2021 (CryptoQuant)From 2014 to 2017, predominant in-out travel addresses dominated Bitcoin’s outflow landscape. This play coincided with debased Bitcoin prices comparative to today, suggesting that precocious transactional enactment among these addresses did not importantly interaction marketplace valuation. The dominance of predominant in-out flows mirrors a marketplace chiefly driven by smaller transactions and idiosyncratic users engaging successful regular transfers.

Around 2018, a notable displacement occurred arsenic addresses often receiving from centralized exchanges began to turn rapidly. This maturation came with an summation successful Bitcoin held by oregon moving done speech addresses owed to heightened trading enactment and accrued idiosyncratic adoption of exchanges.

The timing aligns with an upward inclination successful Bitcoin’s price, indicating a transportation betwixt speech enactment and marketplace valuation. The prominence of exchange-related addresses whitethorn echo investors moving assets onto exchanges successful anticipation of marketplace movements oregon accrued speculative trading.

The fig of caller whale addresses identified by caller oregon existing ample Bitcoin holders spiked astatine the opening of 2020. The spike coincided with accrued Bitcoin terms maturation and volatility, implying accumulation careless of the price.

The influx of caller whales during these periods suggests that organization investors oregon high-net-worth individuals were entering the market, perchance driving prices upward done important purchases.

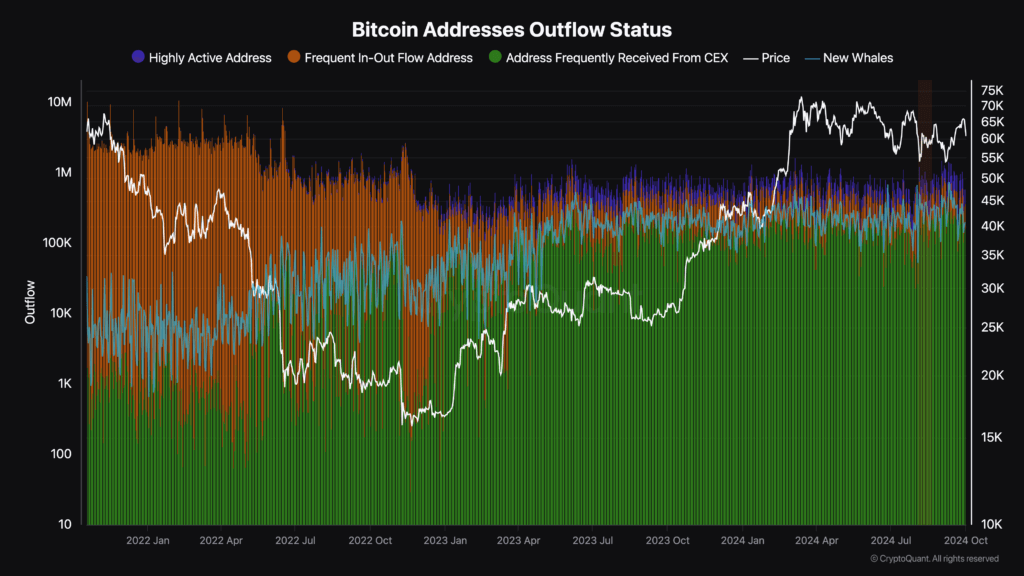

Bitcoin code enactment from 2021 onward

As Bitcoin’s terms declined passim 2022, predominant in-out travel addresses remained dominant. However, their power weakened aft mid-2022, coinciding with a marked summation successful addresses often receiving from centralized exchanges. This displacement suggests that much Bitcoin was moving done oregon held by speech addresses during the betterment period, indicating accrued trading enactment oregon capitalist repositioning successful effect to marketplace conditions.

New whale enactment continued to summation during the 2nd fractional of 2022 and into 2023, indicating persistent purchases by ample holders during terms lows. This maturation reflects strategical marketplace repositioning during periods of heightened marketplace uncertainty. This enactment correlates with Bitcoin’s terms bottoming retired successful 2022, followed by a betterment passim 2023 and into 2024.

Bitcoin Address outflow presumption 2021 onward (CryptoQuant)

Bitcoin Address outflow presumption 2021 onward (CryptoQuant)The summation successful caller whales during periods of little prices suggests bullish sentiment, hoping to capitalize connected aboriginal terms recoveries.

Since 2023, highly progressive addresses person gained traction for the archetypal clip successful Bitcoin’s history. The improvement of trading bots, high-frequency trading, and Bitcoin meta layers are partially responsible. The summation successful these types of addresses showcases Bitcoin’s improvement successful usage and detracts from theories that Bitcoin is becoming thing much than a store of value. Bitcoin has halfway inferior astir the world, and it is growing.

Persistent trends successful Bitcoin addresses

The prominence of exchange-related addresses during circumstantial periods reflects changes successful capitalist behavior, specified arsenic shifts toward holding assets connected exchanges for liquidity oregon accrued trading enactment successful effect to marketplace volatility. Similarly, the timing of whale enactment suggests that ample holders power marketplace trends oregon respond strategically to terms movements.

The patterns observed suggest that ample holders play a important relation successful marketplace stabilization oregon inclination reversals. Their accrued enactment during terms lows provides enactment to the market, perchance preventing further declines. Conversely, periods of reduced whale enactment could coincide with marketplace uncertainty oregon consolidation phases.

By monitoring the travel of Bitcoin crossed antithetic code categories, we tin place emerging trends oregon shifts successful marketplace sentiment. For example, a surge successful exchange-related addresses mightiness awesome accrued trading enactment oregon anticipation of marketplace movements, portion heightened whale enactment could bespeak assurance among ample investors successful aboriginal terms appreciation.

The correlation betwixt code enactment and terms movements emphasizes the transparency inherent successful Bitcoin. Publicly disposable on-chain information allows for broad investigation of marketplace behaviors, offering penetration not typically disposable successful accepted fiscal markets. This transparency empowers participants to marque much informed decisions based connected observable patterns successful the network’s transactional activity.

Ultimately, analyzing Bitcoin code outflow patterns implicit the past decennary reveals important correlations with marketplace cycles and terms movements. The evolving trends among antithetic code categories echo changes successful marketplace structure, subordinate behavior, and broader adoption trends.

The station Ten years of Bitcoin code information uncovers capitalist behaviors and marketplace shifts appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)