The contributors of Terra-based decentralised concern (DeFi) protocol Anchor person projected cutting terraUSD (UST) rates to an mean of 4% from the existent 19.5% arsenic the broader Terra ecosystem seeks measures to support UST’s peg with U.S. dollars.

“Decrease minimum involvement rates to 3.5%, and maximum deposit rates to 5.5%, with a targeted involvement complaint of 4%,” the ongoing connection describes.

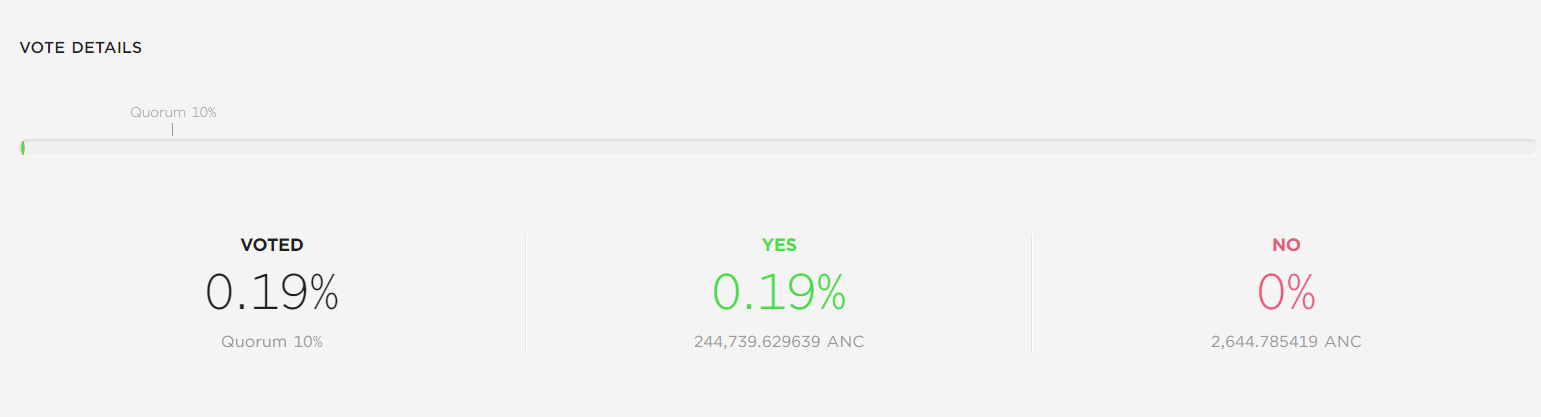

Some 244,000 anchor (ANC) tokens person been utilized to spot votes connected “yes” astatine penning time. ANC is Anchor Protocol's governance token that users tin deposit oregon involvement to make caller governance polls, oregon ballot connected existing pools started by users that person staked ANC.

The ongoing Anchor connection seeks to chopped UST rates. (Anchor)

Anchor is simply a savings, lending and borrowing level built connected the Terra that serves that allows users to gain yields connected UST deposits and instrumentality retired loans against holdings. Critics person antecedently touted its “stable precocious involvement rate” – arsenic described connected its website – arsenic unsustainable owed to the precocious amounts of wealth required to support those rates.

In the past fewer months, Anchor continued to run arsenic intended and became the biggest decentralized concern (DeFi) exertion connected Terra. But UST’s caller depegging has made the protocol’s grandiose plans spell awry.

UST fell to arsenic debased arsenic 22 cents connected Wednesday amid outflows from Anchor and LUNA’s accelerated drop causing a downward spiral. The token has since recovered to 60 cents – inactive acold disconnected its $1 peg – but the semipermanent betterment remains unclear.

“A depegged UST cannot prolong 18% APY immoderate longer,” wrote Anchor contributor Daniel Hong successful a relevant forum post. “While immoderate whitethorn reason higher involvement rates assistance with little UST circulating supply, erstwhile the stablecoin person already mislaid spot from the nationalist owed to a 2-day depeg radical would effort to exit anyways.”

“One important origin for today’s depeg was the merchandise of Terra’s stableness reserve into the Anchor reserve each clip it was depleted, introducing recently minted UST that was not expected to beryllium determination into circulation,” Hong wrote, explaining UST’s terms plunge connected Wednesday.

Hong, however, added the “fairly aggressive” alteration would beryllium rolled backmost arsenic and erstwhile deemed necessary, meaning the 4% involvement complaint whitethorn summation successful the aboriginal should marketplace conditions improve.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)