The Terra collapse, successful which $60 cardinal of worth evaporated, has already gone down arsenic a defining infinitesimal successful cryptocurrency history.

TerraForm Labs co-founder Do Kwon maintains the contented boiled down to weaknesses successful the UST stablecoin protocol design. However, others person openly called retired the task arsenic a scam from the off.

The lawsuit triggered an exodus of capital, tanking prices crossed the committee from which the marketplace has yet to recover.

Nonetheless, on-chain metrics amusement an absorbing alteration successful the dynamics of semipermanent Bitcoin holders resulting from the collapse.

Bitcoin proviso held by semipermanent holders soared

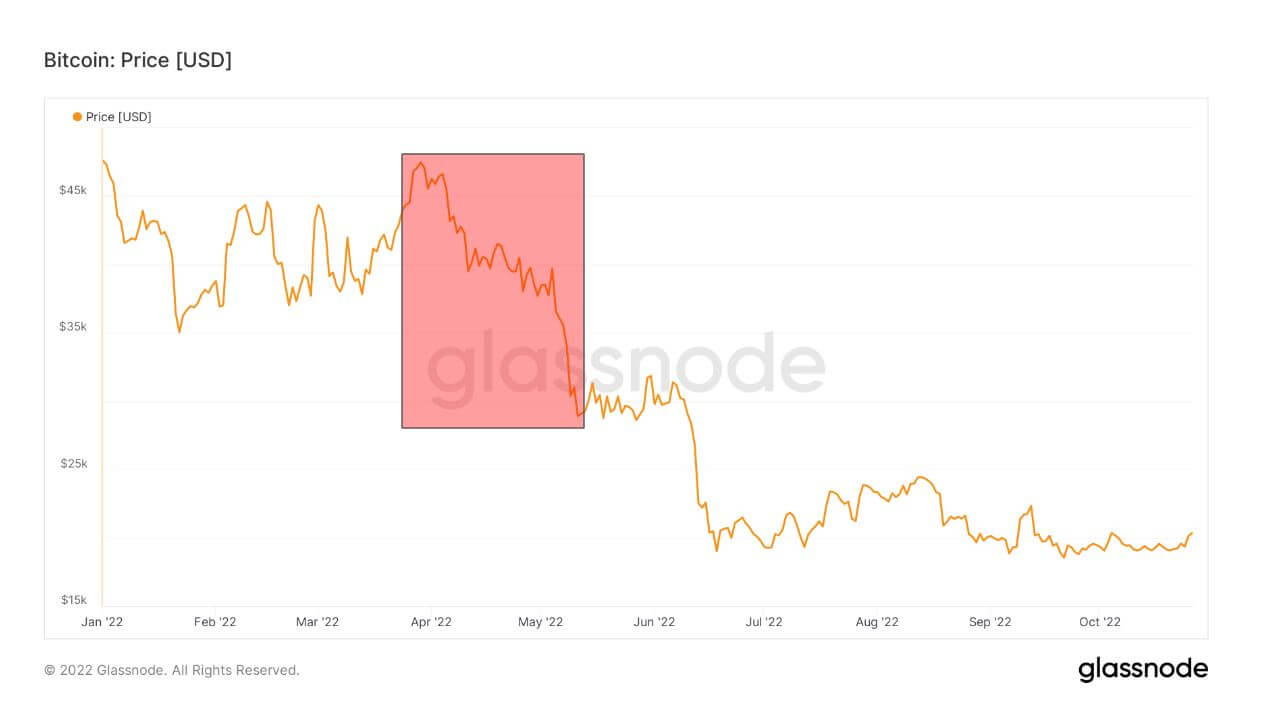

At the extremity of March, Bitcoin was priced astatine $47,000 and ticking on contempt aboriginal warnings of an inflationary spike and occupation successful Eastern Europe escalating further.

Moving into May, BTC opened the period astatine $40,000. But, connected May 7, UST began losing its dollar peg price. By May 13, the UST regular adjacent was $0.13, having dipped arsenic debased arsenic $0.06 connected the day.

As the situation was unfolding, the knock-on effect saw BTC descend to $30,000 by May 11. And by mid-June, the terms had fallen 62% from the extremity of March to $18,000.

Source: Glassnode.com

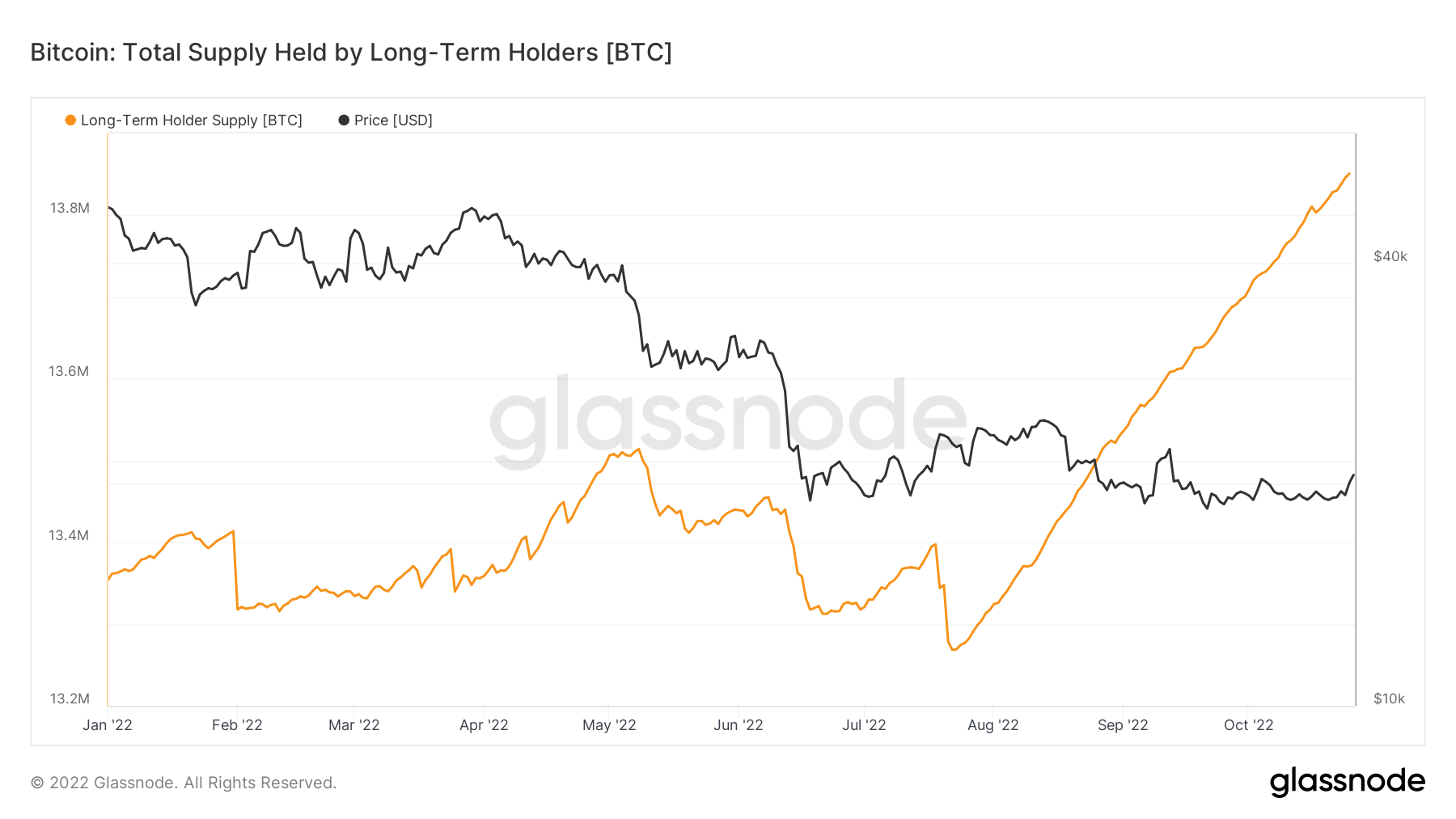

Source: Glassnode.comThe illustration beneath shows the full proviso held by semipermanent holders (LTH) – Glassnode defines LTHs arsenic individuals with a presumption held longer than six months. It highlights a gradual drawdown successful LTHs successful aboriginal May arsenic connection of the UST de-peg spread.

This inclination bottomed by precocious July, starring to a continuous 45-degree takeoff successful LTHs. A important crushed for this signifier relates to buying enactment aboriginal connected successful April and May (six months ago,) which has since matured successful the classification of LTHs.

Source: Glassnode.com

Source: Glassnode.comLTHs Net Position Change

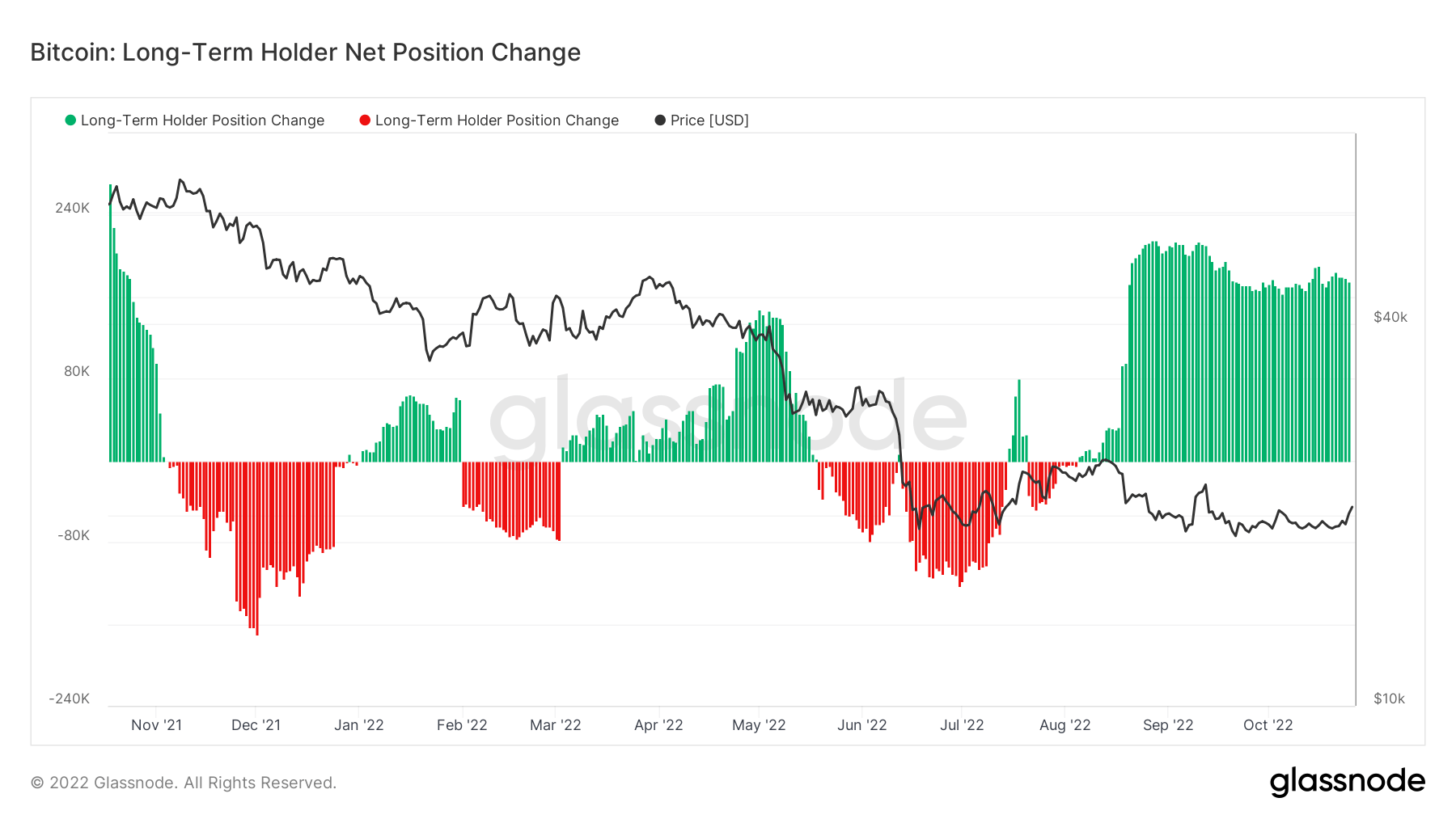

The Bitcoin: Long-Term Holder Net Position Change refers to token organisation by LTHs, who are denoted successful greenish arsenic nett accumulators oregon successful reddish arsenic nett distributors cashing retired of positions.

As the macro scenery worsened successful the 2nd fractional of the year, LTHs began selling their positions. However, the inclination has flipped since September, with LTHs seeing worth astatine these prices and accumulating accordingly.

Source: Glassnode.com

Source: Glassnode.comShort-term vs. semipermanent holders

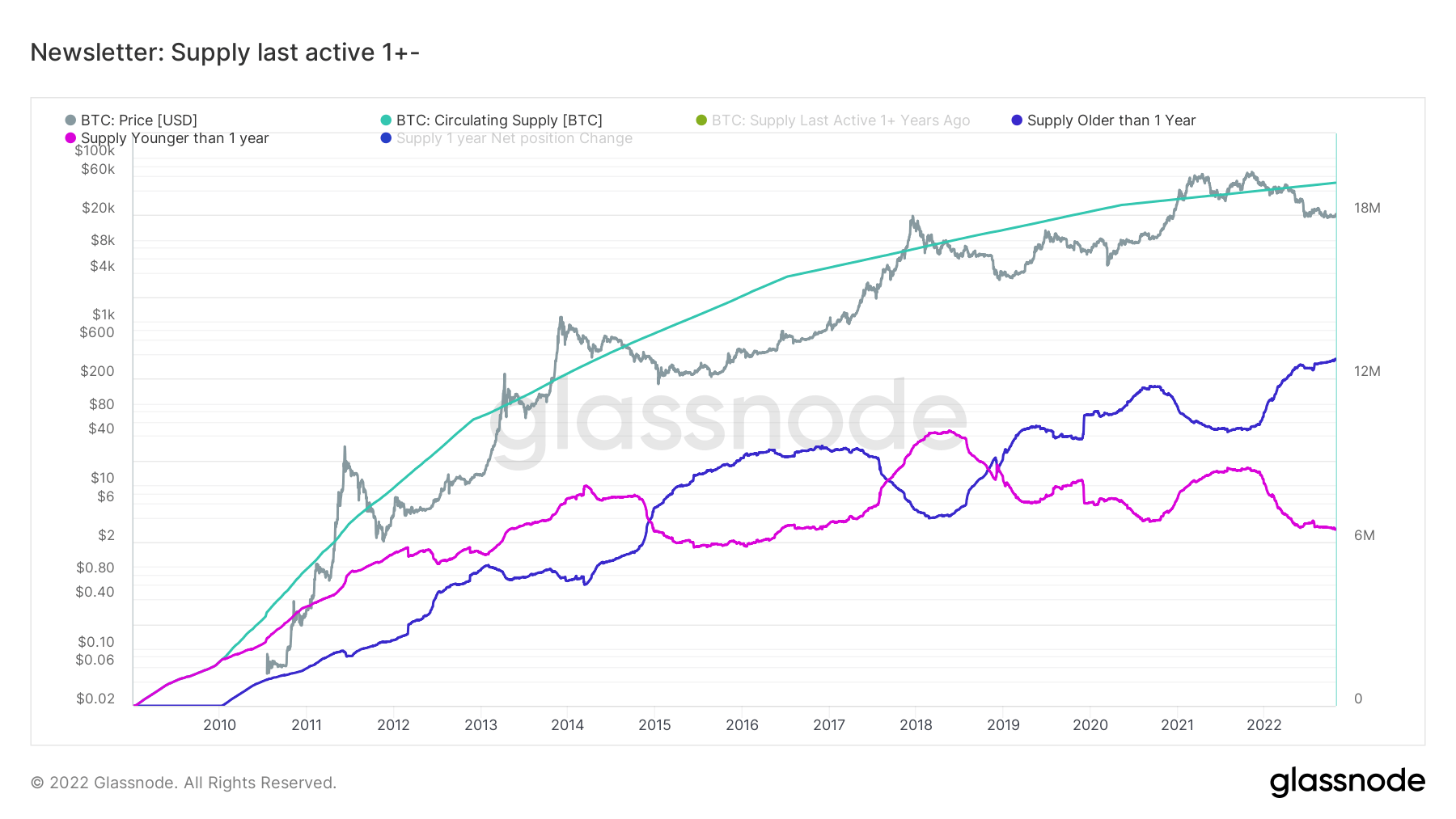

The illustration beneath changes the explanation of LTHs to held for much than 1 year, meaning Short-Term Holders (STHs) notation to holdings of little than a year.

It was noted that terms peaks successful BTC coincided with leveling oregon important drops successful STH supply. The exceptions to this were during the play earlier and including the $900 terms highest successful December 2013. In these instances, nary signifier successful STHs could beryllium discerned.

Similarly, since that outlier period, marketplace lulls were accompanied by an uptick successful LTH supply, arsenic LTHs accumulated tokens.

Fast guardant to the present, LTHs are spiking higher, portion STHs are decreasing rapidly. This has created a dramatically divergent signifier not seen earlier to this degree.

Source: Glassnode.com

Source: Glassnode.comThe station Terra illness sparked explosive maturation successful semipermanent Bitcoin supply appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)