Buoyed by affirmative quality flow, LUNA, the autochthonal token of the astute declaration blockchain Terra, has go the best-performing large cryptocurrency successful the past 24 hours.

The cryptocurrency has risen astir 15%, topping the $55 mark, outshining crypto marketplace person bitcoin's adjacent 4% emergence by a important margin, CoinDesk information show. Other notable gainers connected the database of coins with astatine slightest $1 cardinal marketplace worth are blockchain-like nationalist web Hedera's HBAR token, up 14.5%, and Avalanche's AVAX cryptocurrency, up 12%.

LUNA's enactment possibly stems from Singapore-based non-profit enactment Luna Foundation Guard's (LFG) determination to make a bitcoin-denominated reserve arsenic an further furniture of information for UST – Terra's decentralized stablecoin, whose worth is pegged 1:1 to the U.S. dollar.

LFG announced on Tuesday that it had raised $1 cardinal done backstage token income to physique the bitcoin reserve and the buyers volition fastener up the coins for a four-year vesting period. The backing circular was led by the likes of Jump Crypto and Three Arrows Capital.

"Raising a BTC reserve is simply a astute determination and whitethorn effect successful lesser fluctuations of UST during aboriginal bouts of marketplace volatility," Matthew Dibb, main operating serviceman and co-founder of Stack Funds, said. "Ideally, LFG would instrumentality steps to support the reserve 100% on-chain for transparency alternatively than done centralized means, however, the terms enactment of Luna since the announcement has been mostly promising successful restoring assurance to the Terra ecosystem."

Pseudonymous decentralized concern researcher Westie tweeted that the woody is highly important for Terra's stability, LUNA's worth capture.

In

creased stableness mightiness bring much robust request for UST, resulting successful reduced LUNA supply. LUNA's fortunes are intimately tied to UST arsenic the stablecoin's instauration is facilitated by burning LUNA. In different words, to mint 1 UST, $1 worthy of LUNA indispensable beryllium taken retired of circulation.

According to the information tracking website CoinGecko, UST's marketplace capitalization has surged from astir $300 cardinal to implicit $12 cardinal successful 1 year, establishing the dollar-pegged integer plus arsenic the fourth-biggest stablecoin worldwide. Meanwhile, LUNA has chalked up a adjacent sixfold rally successful the past 12 months.

Unlike tether and different centralized stablecoins, UST isn't backed by dollars and its peg is maintained by allowing users to change UST and LUNA supplies.

Here is however it works: Terra's swap relation allows users to ever swap $1 worthy of Luna for 1 UST, and vice versa, according to the official blog. So erstwhile UST trades astatine $0.98, users tin bargain 1 UST for $0.98 and past swap the aforesaid for $1 of LUNA done Terra's swap relation and merchantability LUNA successful the market. The protocol burns 1 UST and mints LUNA, driving UST's proviso little and putting upward unit connected UST's price.

On the different hand, if UST trades astatine $1.02, LUNA holders tin swap $1 worthy of LUNA for 1 UST done the swap relation and merchantability the UST successful the marketplace astatine $1.02, pocketing the difference. In the process, the protocol burns LUNA and mints UST, expanding the stablecoin's proviso and putting downward unit connected the peg.

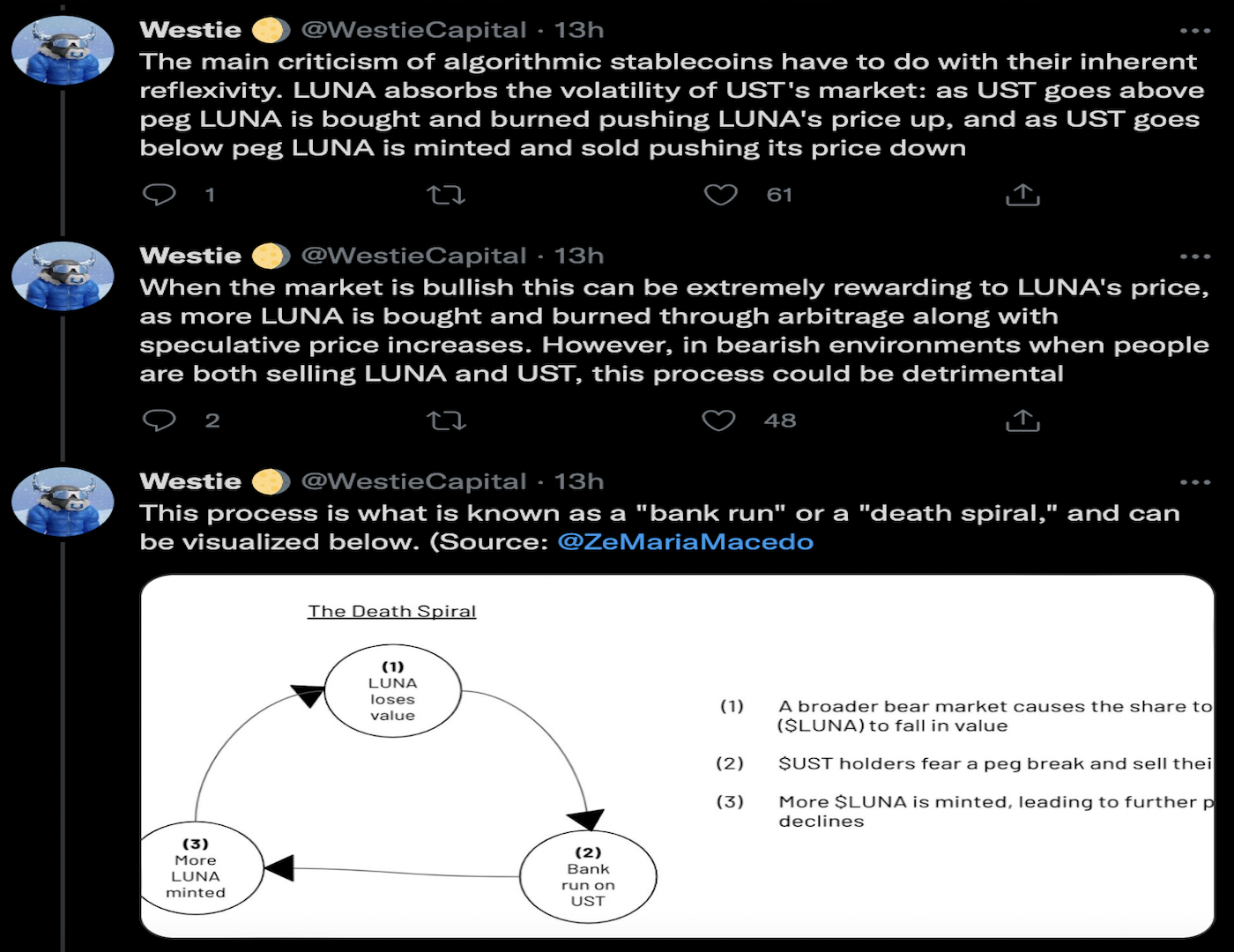

The mechanics is rewarding during bull runs but tin beryllium detrimental during a marketplace clang erstwhile determination is little inducement to mint either of the 2 coins to support the peg intact, arsenic explained successful a Twitter thread by Westie.

Pseudonymous DeFi researcher Westie's Twitter thread

The bitcoin reserve is expected to mitigate that hazard to immoderate extent, fixed the apical cryptocurrency is little correlated to Terra's ecosystem and arbitrageurs tin swap UST to bitcoin to enactment UST's peg. In a press release, the Luna Foundation Guard said that moving forward, it whitethorn present different large non-correlated assets wrong the marketplace to the reserve.

"The money volition service arsenic a "release valve" for UST redemptions during selloffs [periods of important UST request contraction]," Ilan Solot, a spouse astatine the Tagus Capital Multi-Strategy Fund, said successful an email.

"The UST Forex Reserve further strengthens assurance successful the peg of the market's starring decentralized stablecoin UST," Kanav Kariya, president of Jump Crypto, said successful a property release. "It tin beryllium utilized to assistance support the peg of the UST stablecoin successful stressful conditions. This is akin to however galore cardinal banks clasp reserves of overseas currencies to backmost monetary liabilities and support against dynamic marketplace conditions."

Looking ahead, the investor optimism from LFG's reserve announcement, coupled with signs of hazard reset successful the broader marketplace and the impending motorboat of Mars Protocol's lockdrop, could support LUNA amended bid.

"Lockdrop allows users to fastener UST into Mars' Red Bank successful speech for a organisation of $MARS tokens that are claimable erstwhile the protocol launches," analytics steadfast Delphi Digital said successful a regular marketplace update. The protocol goes unrecorded today, and users volition person until Friday to enactment successful the lockdrop.

"Mars (an precocious wealth marketplace protocol) is (finally) launching, with $18.5 cardinal of UST locked up for Phase 1 of the token distribution," Tagus's Solot said.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)