In a strategical move, Tether has shifted its reserve strategy, reducing its vulnerability to treasuries portion expanding allocations to Bitcoin and gold. The USDT issuer has shown a notable simplification successful authorities indebtedness exposure, paired with an expanded presumption successful hard assets known for durability and independency from accepted fiscal systems.

Treasury Exposure Drops Amid Changing Macro And Regulatory Landscape

Stablecoin giant, Tether, has reduced its US Treasury holdings and accrued its Gold and Bitcoin reserves. CryptosRus reported connected X that Tether is softly repositioning itself for what the institution expects to beryllium the Federal Reserve’s (FED) adjacent circular of complaint cuts.

Related Reading: Rumble At The Core: How Tether Plans To Dominate The US Stablecoin Market

According to BitMex laminitis Arthur Hayes, Tether’s latest reserve update shows a wide displacement distant from the US treasuries and deeper into BTC and gold, a motion that the institution is positioning for a changing macro environment. Furthermore, the Standard & Poor (S&P) Global noted that Tether is present leaning much heavy into assets with larger terms swings successful value, informing that this premix could exposure USDT if markets crook volatile. Meanwhile, the existent S&P Global standing connected Tether remains weak.

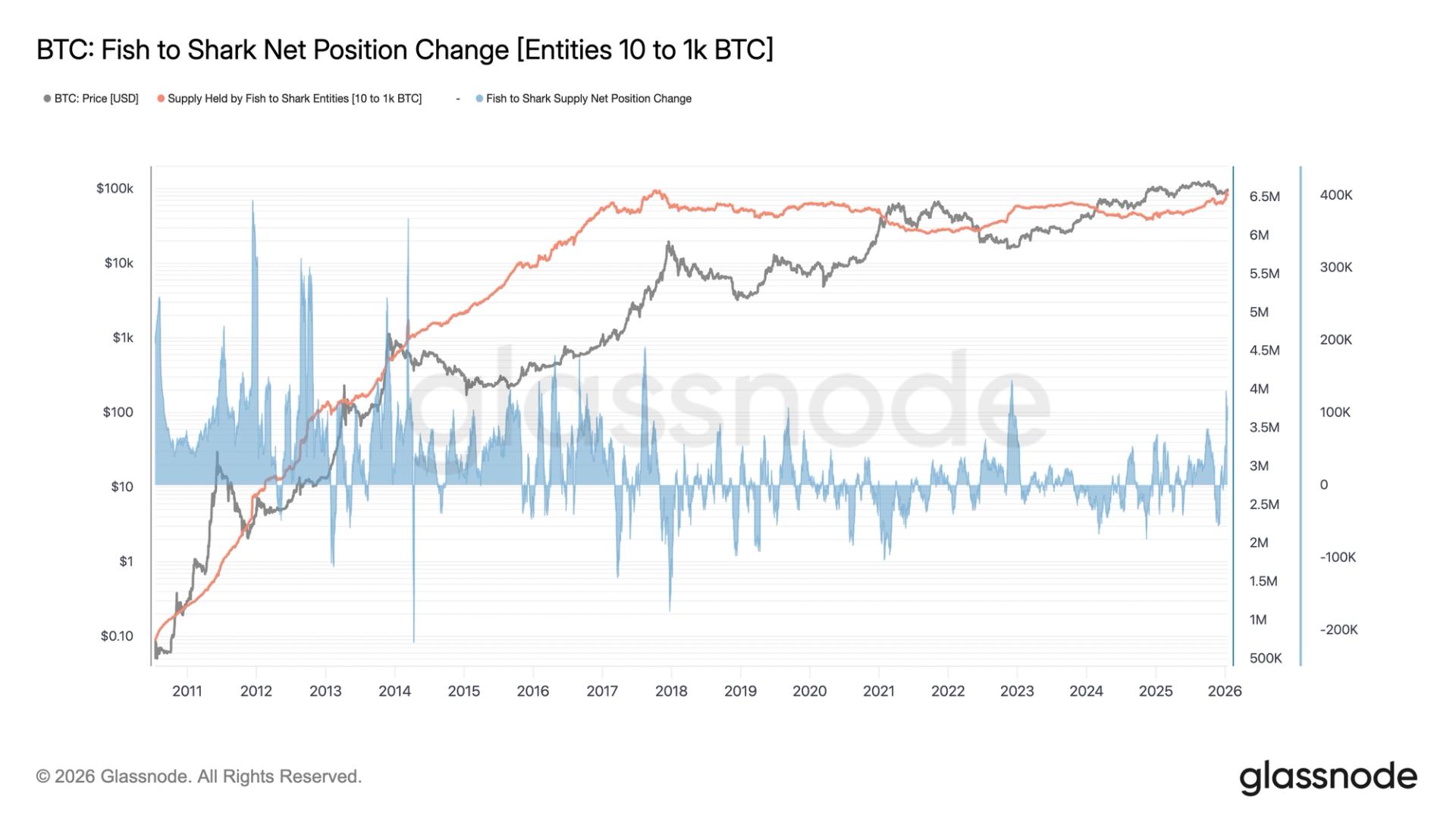

Source: Chart from CryptoRus connected X

Source: Chart from CryptoRus connected XThus, Tether CEO Paolo Ardoino has pushed back, saying that the institution holds nary toxic assets. He claims that its accelerated maturation reflects a broader displacement towards caller fiscal systems that run extracurricular the accepted banking world.

Why Attempts To Break Tether Are Difficult In Practice

Crypto expert Ted Pillows has besides offered penetration into the Tether Fear Uncertainty and Doubt (FUD) arsenic it is making its accustomed rounds again. The communicative is latching onto the company’s latest attestation, showing a notable displacement into Gold and Bitcoin to offset declining involvement income. Meanwhile, if these hazard assets driblet by 30%, Tether’s equity buffer could evaporate, creating an situation wherever Tether volition beryllium insolvent, and panic volition footwear in.

Related Reading: Tether Targets $500 Billion Valuation In New Equity Offering Amid US Expansion Plans

However, Ted is steadfast and believes that Tether has been done a decennary of this aforesaid FUD, and USDT is inactive sitting astatine $1.00. They’re afloat liquid, but they run connected a fractional-reserve model, overmuch similar accepted banks. As agelong arsenic redemptions stay normal, everything volition enactment smoothly. A occupation volition lone originate if there’s an irrational panic, and past liquidity accent could deed quickly.

According to Ted, the USDT isn’t afloat backed by cash, but it’s backed by a divers portfolio that includes the US treasuries, yield-generating assets, and immoderate hazard assets. This is each scaled to a monolithic $174 cardinal stablecoin. “If idiosyncratic wants to termination USDT, it’s possible, but I highly uncertainty it,” Ted noted.

Featured representation from Pixabay, illustration from Tradingview.com

1 month ago

1 month ago

English (US)

English (US)