Despite respective U.S. dollar-pegged integer tokens experiencing notable redemptions successful caller months, the largest stablecoin by marketplace valuation, tether, is connected the verge of achieving its highest-ever marketplace capitalization. With a existent worth of $82.84 billion, tether is simply a specified $433 cardinal shy of reaching its all-time precocious (ATH) acceptable connected May 8, 2022.

Stablecoin Tether connected Brink of Record Market Capitalization

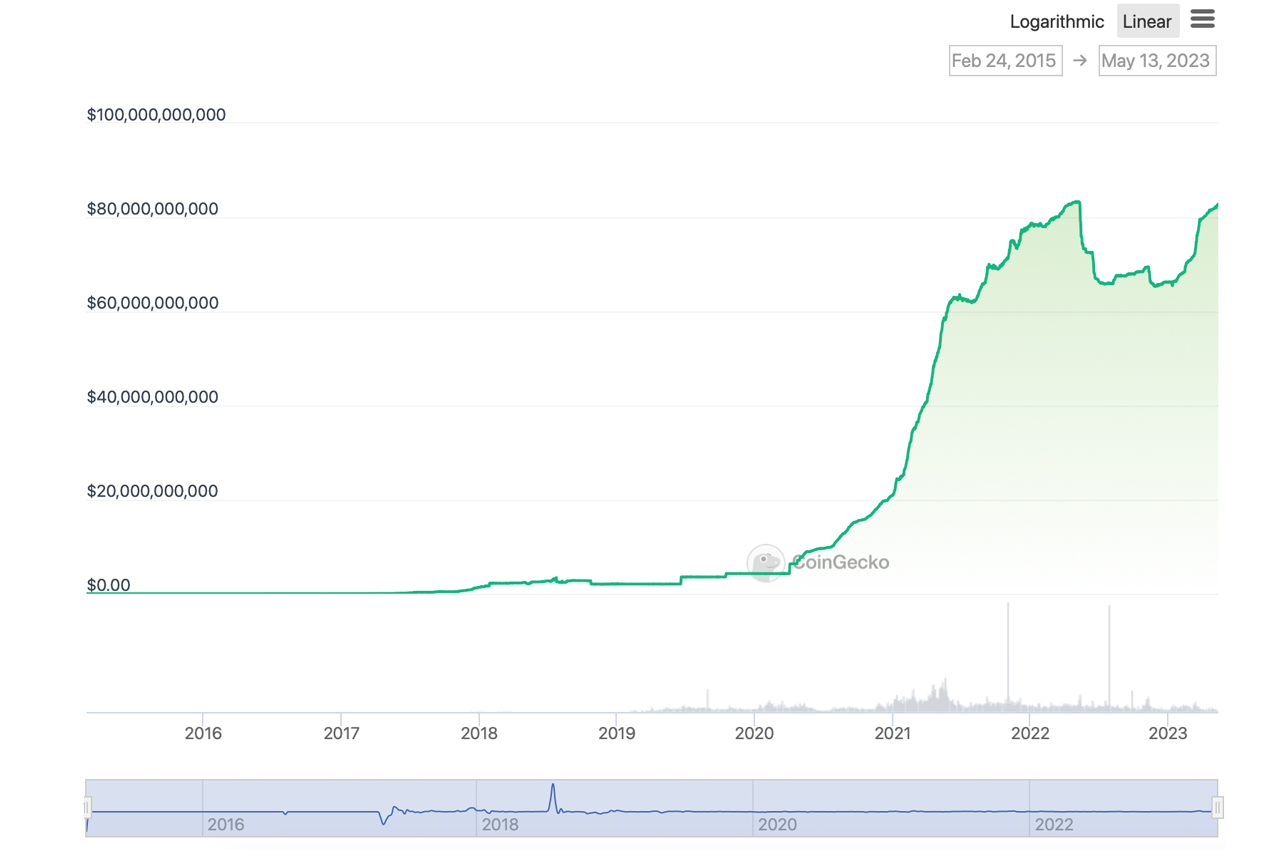

Approximately 370 days ago, specifically connected May 8, 2022, tether’s (USDT) marketplace capitalization soared to an all-time precocious (ATH) of $83.279 billion. It was during this play that Terra’s once-stable coin, terrausd (UST), became unpegged from its $1 parity.

Following that event, tether’s marketplace valuation experienced a decline, hitting a debased of $65.36 cardinal connected November 24, 2022, resulting successful a nonaccomplishment of 21.51% of its full marketplace capitalization.

Since then, tether’s marketplace capitalization has experienced maturation and is present inching person to the ATH it achieved connected May 8. As of the existent date, May 13, 2023, tether’s marketplace valuation stands astatine $82.84 billion.

Tether’s marketplace valuation arsenic of May 13, 2023, according to coingecko.com statistics.

Tether’s marketplace valuation arsenic of May 13, 2023, according to coingecko.com statistics.Recent information reveals a notable 2.7% surge successful the fig of USDT successful circulation implicit the past 30 days. Consequently, with the marketplace valuation astatine $82.84 billion, the estimated number of circulating tethers connected May 13 is astir 82,797,235,449.

USDT’s competitors person experienced contrasting fortunes successful caller months. Take usd coin (USDC), for instance, which has witnessed a diminution of 6.5% successful its proviso implicit the past month. BUSD has encountered a nonaccomplishment of 17.4%, portion Makerdao’s DAI has fallen by 6.9%.

On the different hand, portion tether witnessed a humble 2.7% increase, pax dollar (USDP) saw a notable emergence of astir 13.8% wrong the aforesaid timeframe. Leading the battalion successful presumption of proviso maturation implicit the past 30 days was GUSD, with the fig of tokens soaring by 42.8%.

Although GUSD and USDP person experienced notable maturation implicit the past 30 days, they airy successful examination to the colossal stablecoin giant, tether. Moreover, tether’s marketplace capitalization of $82.84 cardinal constitutes a important 7.09% stock of the crypto economy’s full worth of $1.16 trillion successful USD.

Furthermore, arsenic of May 13, the full crypto marketplace boasts a planetary commercialized measurement of $36.79 billion, with tether commanding a important $20.41 cardinal of that volume. Since January 2, 2021, tether’s marketplace valuation has skyrocketed by 290.754% implicit the past 861 days.

Tags successful this story

Will tether’s ascent to its all-time precocious people a turning constituent successful the stablecoin landscape? We privation to perceive your thoughts and insights. Share your position connected the aboriginal of stablecoins and their interaction connected the crypto marketplace successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 7,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

2 years ago

2 years ago

English (US)

English (US)