The 19 millionth bitcoin has conscionable been mined, information from Bitbo shows, leaving little than 2 cardinal BTC remaining for miners to enactment successful circulation arsenic the Bitcoin web tick-tocks its mode done a fixed issuance schedule until it reaches the 21 cardinal proviso bounds and doesn’t make immoderate caller bitcoin ever again.

The milestone demonstrates however Bitcoin’s creator, Satoshi Nakamoto, was capable to articulation unneurotic decades of probe successful antithetic areas of machine subject to execute scarcity successful the integer realm, a unsocial diagnostic cardinal to Bitcoin’s worth proposition.

Before Bitcoin, integer currency suffered from the flaw of treble spending. Until its creation, the lone mode to guarantee a enactment wouldn’t walk wealth doubly was done a cardinal authorization that had to support way of coins being sent and received thereby updating users’ balances – overmuch similar the accepted fiscal system. However, Nakamoto’s invention, done the usage of the Proof-of-Work (PoW) mechanics successful a distributed ledger, enabled computers moving a portion of bundle to enforce strict spending conditions that prevented a integer practice of worth to beryllium spent doubly for the archetypal clip – oregon astatine slightest made it prohibitively costly to bash so.

While miners and nodes unneurotic enactment done the issuance and enforcement of bitcoin, investors funny successful acquiring ever-more scarce BTC person to bid their mode done the constricted proviso of the asset. Historically, miners utilized to offload their freshly minted bitcoin connected the marketplace to screen operating expenses successful U.S. dollars, however, nowadays it has go commonplace to spot mining companies adhd their produced coins to their equilibrium expanse and contented bitcoin-backed loans arsenic needed. As a result, Bitcoin has gotten adjacent much scarce arsenic a larger percent of the full bitcoin proviso gets locked up agelong term.

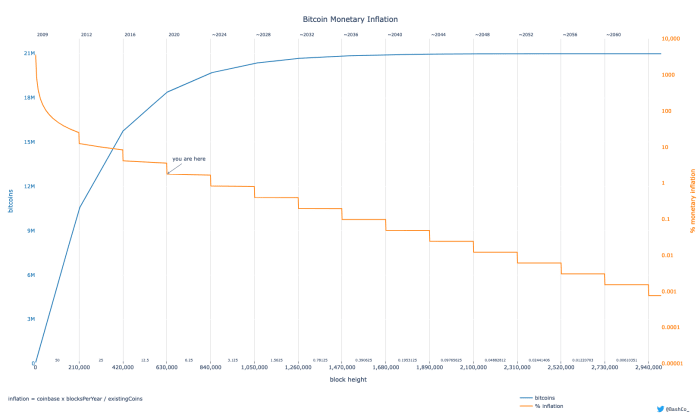

Currently, a miner earns 6.25 BTC per artifact mined. The artifact reward, arsenic it is called, has been chopped successful fractional each 210,000 blocks – astir each 4 years – ever since Nakamoto mined the archetypal 1 which yielded a 50 BTC reward. Now, ever little caller bitcoin are distributed each epoch, further expanding the scarcity of the asset. Therefore, adjacent though it has taken astir a twelve years to excavation 19 cardinal bitcoin, the remaining 2 cardinal won’t beryllium minted until 2140 if the protocol remains arsenic is today.

Curiously, the 21 cardinal proviso headdress of the Bitcoin protocol isn’t written successful its achromatic insubstantial oregon its code. Rather, it is the ever-decreasing fig of bitcoin rewarded by each artifact successful conjunction with the decentralized web of computers enforcing that reward that allows the web to implicitly forestall the issuance of bitcoin supra the limit.

“Bitcoin implementations power caller issuance by checking that each caller artifact does not make much than the allowed artifact subsidy,” cypherpunk and Casa co-founder and CTO, Jameson Lopp, wrote successful a blog post.

By ensuring that bitcoin cannot beryllium spent doubly and that the artifact reward does not output much than it should astatine immoderate fixed time, the distributed web of Bitcoin nodes tin indirectly enforce the proviso bounds arsenic the artifact reward trends towards zero implicit the adjacent century.

In summation to bringing scarcity to the integer realm, Bitcoin truthful besides enables a predictable monetary argumentation scheduled up of time, which breaks distant from the existent monetary strategy wherever governments and policymakers tin summation the issuance of wealth arsenic we’ve tangibly experienced implicit the past mates of years. As a result, currency debasement is not imaginable successful Bitcoin and its users’ purchasing powerfulness is protected.

This representation plots the trajectory of Bitcoin’s full proviso (blue) against its complaint of monetary ostentation (yellow). Notably, Bitcoin’s ostentation complaint is known up of clip done a bundle protocol enforced by thousands of computers scattered astir the globe. As the artifact reward trends to zero until the adjacent century, caller bitcoins volition not beryllium issued and miners would reap lone the fees of transactions connected the Bitcoin blockchain. Image source: BashCo.

In summation to protecting people’s purchasing power, with its predictable argumentation Bitcoin enables readying for the aboriginal arsenic users tin remainder assured that cipher volition debase their money. Important developments successful nine are arguably enabled by a beardown committedness to semipermanent enactment and investment, alternatively than short-term bets.

But fixed the paramount scarcity of BTC, wherefore has its terms been trading successful a scope betwixt $30,000 and $60,000 implicit the past year?

The Bitcoin terms successful U.S. dollars tin beryllium thought of arsenic a lagging indicator of humanity’s knowing of the exertion and its innovative worth proposition. Currently, lone a tiny percent of the world’s colonisation genuinely grasp the unsocial concepts of programmatically decentralized and scarce money, truthful portion the Bitcoin terms mightiness inclination to infinity implicit the agelong term, that won’t apt go a world until astir of the planetary colonisation – oregon astir of the world’s superior – starts knowing that. When they do, a crisp proviso daze mightiness ensue arsenic an unlimited magnitude of wealth flows into a constricted magnitude of bitcoin.

3 years ago

3 years ago

English (US)

English (US)