As Bitcoin hovers adjacent its all-time high, manufacture experts and investors are keenly watching for signs of its adjacent large move. Alex Thorn, the Head of Research astatine Galaxy, precocious shared his position connected the Bitcoin terms trajectory and the factors influencing its imaginable breakout. In a elaborate post connected X (formerly Twitter), Thorn provided insights grounded successful humanities information and existent marketplace dynamics.

“We Will Climb the Wall of Worry,” Thorn proclaimed, mounting the code for his analysis. Bitcoin’s caller terms enactment saw it reaching $69,324 connected Coinbase connected Tuesday, marking its archetypal all-time precocious since November 10, 2021. This milestone came aft an 846-day play of anticipation and speculation, lone for the terms to retract 14.3% to an intraday debased of $59,224. This volatility, exacerbated by $400 cardinal successful agelong liquidations wrong an hour, underscores the cryptocurrency’s unpredictable nature.

Despite the pullback, Bitcoin recovered, trading backmost astatine $67,000. Thorn remarked, “Volatility is back, and it’s apt to stay arsenic we standard the partition of worry.” He compared the existent concern to 2020 erstwhile Bitcoin archetypal approached its past all-time precocious of astir $20,000 from December 2017.

BTC faced archetypal resistance, experiencing a 12.33% driblet aft tapping the obstruction twice, earlier yet surging ahead. This signifier highlights the intelligence and method challenges astatine erstwhile all-time highs, a earthy absorption constituent for immoderate plus class. A akin (second) determination could beryllium indispensable this clip to shingle each sellers retired of the market.

How Bitcoin surpassed its ATH successful 2020 | Source: X @intangiblecoins

How Bitcoin surpassed its ATH successful 2020 | Source: X @intangiblecoinsDescribing the “Wall of Worry,” Thorn explained, “By my count, from Jan. 1, 2017 to the Dec. 17, 2017 all-time precocious of ~$20k, Bitcoin experienced 13 drawdowns of 12%+ (12 were 15%+, and 8 were 25%+). The aforesaid communicative played retired successful 2020. Between the Mar. 12, 2020 Covid debased ($3858) and the Apr. 14. 2021 ATH of $64,899, determination were 13 drawdowns of 10% oregon much (7 of them were 15% oregon more).”

Bitcoin drawdowns successful a bull marketplace | Source: X @intangiblecoins

Bitcoin drawdowns successful a bull marketplace | Source: X @intangiblecoinsNotably, Bitcoin already had 2 15%+ retracements since the spot ETFs launched connected January 11. This week was the 2nd one, the archetypal large drawdown was straight aft the ETF launch, with terms plunging astir 20%.

Why Bitcoin Is Just Getting Started

In his analysis, Thorn besides touched upon the relation of ‘old coins’ oregon long-held Bitcoin successful shaping marketplace movements. “Some aged coins did revive and astir apt sell, perchance helping to make the intraday top,” helium explained, pointing to blockchain information that indicated question of coins mined arsenic acold backmost arsenic 2010. This displacement from aged to caller hands is diagnostic of bull markets successful Bitcoin, facilitating its broader organisation and acceptance.

Highlighting the value of marketplace sentiment and concern flows, Thorn noted, “And Tuesday was the Bitcoin ETFs largest ever time of inflows and 2nd largest time of nett inflows (+$648m) since DAY 1.” This awesome influx of superior into Bitcoin ETFs underscores the increasing involvement and assurance successful the cryptocurrency, adjacent amidst volatility.

Thorn remains bullish connected Bitcoin’s future, suggesting that the existent terms dynamics are emblematic of the cryptocurrency’s bull markets, known for their non-linear progression and galore corrections. He underscored the resilience and imaginable for maturation contempt the hurdles, stating, “nothing astir yesterday’s terms enactment makes maine deliberation we aren’t going higher.”

In conclusion, Thorn’s investigation provides a nuanced presumption of Bitcoin’s travel towards breaking its all-time high. By comparing existent events with past marketplace behaviors, Thorn offers a compelling lawsuit for Bitcoin’s continued ascent, but aft a imaginable signifier of consolidation with respective taps of the all-time precocious earlier a definitive breakout. “Buckle up, folks. We are inactive conscionable getting started,” helium advises.

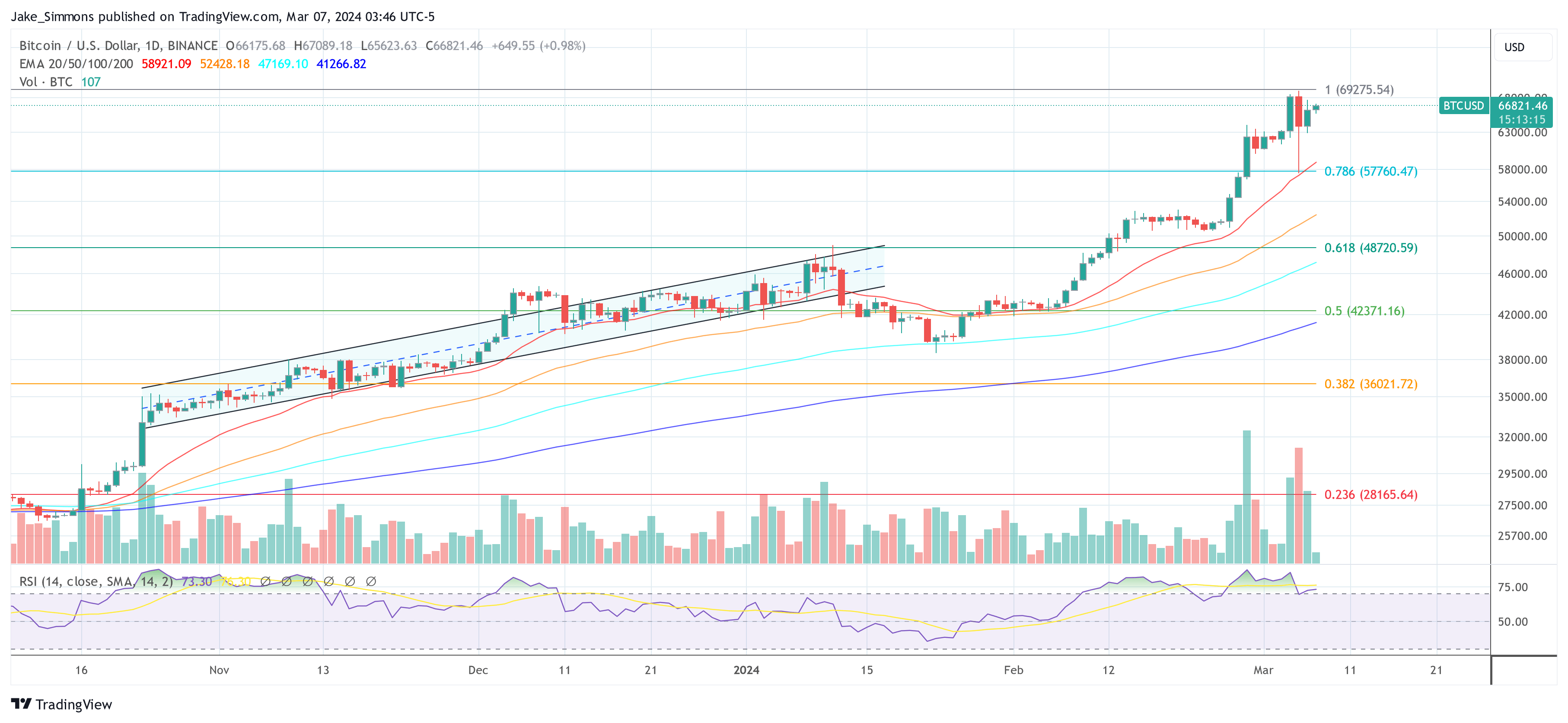

At property time, BTC stood astatine $66,821.

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)