Analyzing Federal Reserve argumentation decisions successful summation to information from the purchasing managers’ scale tin springiness america 3 scenarios for the bitcoin price.

Darius Dale is the Founder and CEO of 42 Macro, an concern probe steadfast that aims to disrupt the fiscal services manufacture by democratizing institutional-grade macro hazard absorption processes.

Key Takeaways

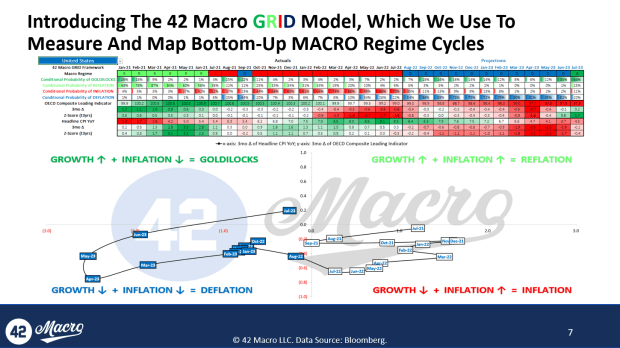

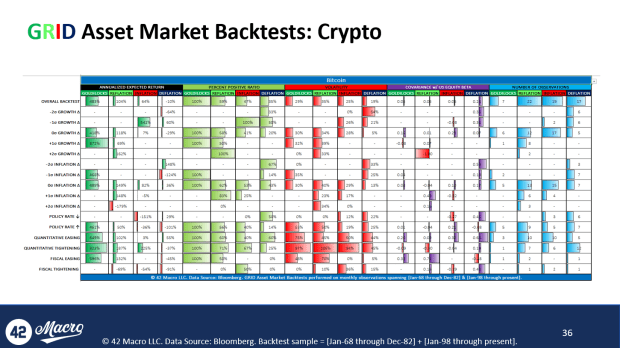

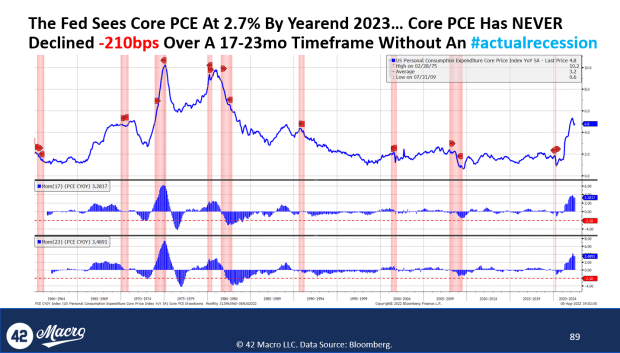

The organisation of probable economical outcomes — and by extension, fiscal marketplace outcomes — is arsenic level and wide arsenic it has been successful caller years. 42 Macro’s base-case script of deflation calls for an expected instrumentality of -10% annualized for bitcoin. Our bull lawsuit script of deflation positive argumentation complaint decreases calls for an expected instrumentality of +29% annualized for bitcoin. Our carnivore lawsuit deflation positive quantitative tightening calls for an expected instrumentality of -37% annualized for bitcoin. Critically, each 3 scenarios are arsenic probable implicit the adjacent 3 to six months. If we sounded highly convinced issuing merchantability warnings astatine each little precocious successful bitcoin’s terms from early-December done July, we should dependable arsenic unconvinced today.

(Chart by 42 Macro)

(Chart by 42 Macro)

(Chart by 42 Macro)

(Chart by 42 Macro)

The Base Case

U.S. and planetary maturation proceed to slow, albeit astatine a much humble gait than successful caller quarters. The Fed and different cardinal banks proceed to procyclically tighten monetary argumentation done twelvemonth end: soft-ish landing.

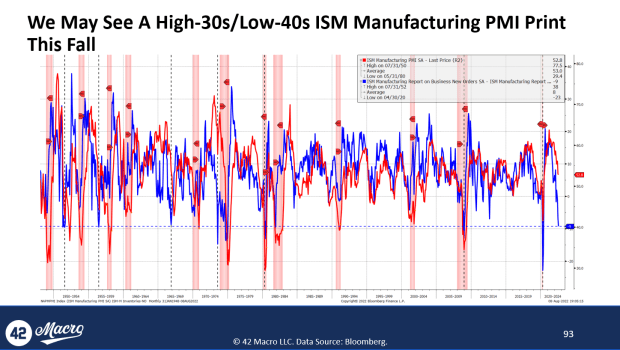

Bayesian spotlight: The slowdown successful the header ISM Manufacturing to the lowest level since June 2020 was an afterthought comparative to the diminution successful the “new orders little inventories” dispersed falling to -9. This is the lowest level since December 2008. There person lone been 8 specified instances wherever the dispersed troughed astatine existent oregon worse levels. The median trough ISM Manufacturing speechmaking successful specified instances is 38.6, which is typically reached 1 period aboriginal connected a median basis. The median trough ISM Manufacturing speechmaking erstwhile the dispersed troughs +/- 1 constituent from its existent level of -9 is 42.5, which is typically reached 3 months aboriginal connected a median ground (n=4). All told, it would beryllium omniscient for investors to accent trial their portfolio holdings for, astatine best, a low-40s ISM Manufacturing statistic this fall.

(Chart by 42 Macro)

(Chart by 42 Macro)

(Chart by 42 Macro)

(Chart by 42 Macro)

The Bull Case

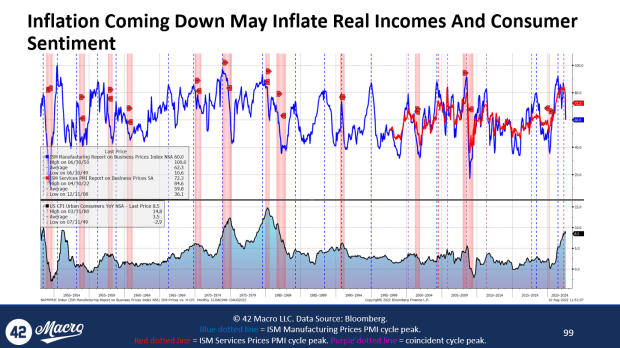

U.S. ostentation momentum continues to diminution sharply, apt causing the Fed to intermission aft a last complaint hike successful September. The betterment successful existent incomes pulls guardant the affirmative inflection successful growth: brushed landing.

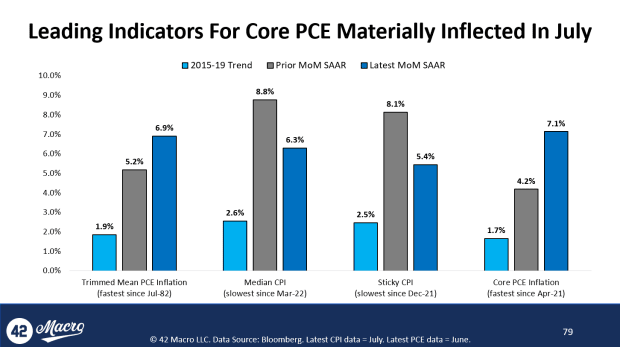

Bayesian spotlight: The July user terms scale (CPI) merchandise represented the stream paper successful a trifecta of information points: July ISM Services PMI, July Jobs Report, July CPI, that each lend credence to the soft-landing view. While the downside surprises connected some header CPI (0.0% month-over period versus 0.2% estimate) and halfway CPI (0.3% month-over-month versus 0.5% estimate) were to beryllium celebrated, the brunt of the bully quality came via the crisp slowdowns successful median CPI (-250 ground points to 6.3% month-over-month annualized) and sticky CPI (-270 ground points to 5.4% month-over-month annualized) due to the fact that these indicators way halfway idiosyncratic depletion expenditures (PCE) — the Fed’s preferred ostentation gauge — amended than astir different CPI clip series. If the deceleration successful these starring indicators continues astatine the aforesaid gait and if humanities correlations persist, we could beryllium looking astatine month-over-month annualized rates of halfway PCE of astir 2% successful the August oregon September data. Those are evidently 2 precise large ifs, particularly considering we are devoid of humanities examples of this benignant of non-recessionary ostentation dynamism to adequately bid a exemplary on. At immoderate rate, the anticipation the Fed could beryllium heading into its November 2 gathering with “clear and confirming evidence” that ostentation is apt to inclination backmost towards its 2% people successful a tenable timeframe is shocking to type, but benignant it we must, considering August PCE is released connected Sept. 30 and September PCE is released connected Oct. 23.

(Chart by 42 Macro)

(Chart by 42 Macro)

The Bear Case

The nascent deceleration successful ostentation momentum stalls retired astatine levels inconsistent with the Fed’s terms stableness mandate, causing the Fed to tighten good into 2023: hard landing.

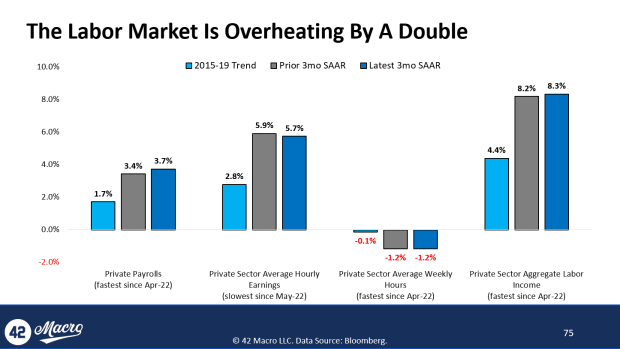

Bayesian spotlight: The labour marketplace is overheating by a double, comparative to pre-COVID trends. The hotly debated 528k month-over-month “headline nonfarm payrolls” figure for July evidently stole the amusement from a marketplace effect perspective. The reacceleration successful the three-month annualized maturation rates for header (+40 ground points to a three-month precocious of 3.5%) and backstage payrolls (+30 ground points to a three-month precocious of 3.7%) is suggestive of a home labour system that is not responding to the argumentation tightening we person accumulated frankincense far. With the three-month annualized maturation complaint of backstage assemblage mean hourly net slowing modestly (-20 ground points to a two-month debased of 5.7%) alongside unchanged backstage assemblage mean play hours maturation of -1.2%, it is wide the +10 ground points uptick successful aggregate backstage assemblage monthly net — to a three-month precocious of 8.3% — was mostly driven by much workers uncovering work.

(Chart by 42 Macro)

(Chart by 42 Macro)

(Chart by 42 Macro)

(Chart by 42 Macro)

This is simply a impermanent station by Darius Dale. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)