Samson Mow recounts the Blocksize War betwixt Big and Small Blockers and takes banal of the companies connected the losing broadside of Bitcoin’s archetypal civilian war.

This is an sentiment editorial by Samson Mow, CEO of JAN3 and erstwhile CSO of Blockstream.

The archetypal large “civil war” successful Bitcoin, which would determine the destiny of the protocol, took spot chiefly betwixt 2015 and 2017 and is referred to arsenic the “Blocksize War” oregon sometimes the “Scaling Debate.” As Bitcoin became much fashionable and the blocks filled up, transactions became slower and much expensive. From divergent visions of Bitcoin, 2 camps emerged: the “Big Blockers,” mostly concern types who supposedly wanted faster, cheaper transactions and Bitcoin to beryllium established arsenic a planetary outgo strategy competing with Visa and PayPal successful the short-term, and the “Small Blockers,” mostly technologist types who saw Bitcoin arsenic a caller wealth web that could alteration our satellite successful the long-term, if it stayed decentralized. They prioritized integrity, resilience and security, arguing that if blocks became big, it would go costly for users to tally a node and would frankincense incentivize hosting nodes successful information centers; a one-way thoroughfare towards centralization and power by a few, not overmuch antithetic from different systems similar banks. This would mean the decease of the imagination of an apolitical, incorruptible, decentralized money.

The Blocksize War was apt the archetypal effort to co-opt Bitcoin and exert power astatine the protocol level. Control the blocksize, power the protocol.

Entering The War

(Image/Samson Mow)

(Image/Samson Mow)

I recovered myself pulled into the warfare successful 2015 portion I was COO astatine BTCC, 1 of the world's largest exchanges and mining pools astatine the time. I got a telephone from Mike Hearn, an aboriginal Bitcoin developer, saying, “It’s clip to upgrade to Bitcoin XT.” Bitcoin XT was a “hard-fork” oregon incompatible upgrade to summation artifact size, but that accusation wasn’t conveyed astatine all. Back then, connection channels weren't great. There was a immense disagreement betwixt developers and businesses, which allowed radical similar Mike Hearn and Gavin Andresen to propulsion thing similar this without statement from different Bitcoin Core developers. As things progressed, they pushed harder for XT and the speech devolved into miners versus developers. Jihan Wu, past co-CEO of Bitmain, drove a batch of the disagreement successful China. “Fire the developers” became a rallying outcry for the Big Blocker faction.

"The Blocksize War" publication written by Jonathan Bier does a bully occupation summarizing the events that transpired. There was nary deficiency of drama, for sure. However, the publication doesn't afloat seizure the unthinkable strength of the experience, which could sometimes beryllium frustrating and adjacent infuriating. Like astir Bitcoiners today, those of america progressive during this play were precise passionate astir Bitcoin, and we took each of the attacks exceptionally seriously. At times, determination were radical connected our broadside who doubted our quality to persevere and win.

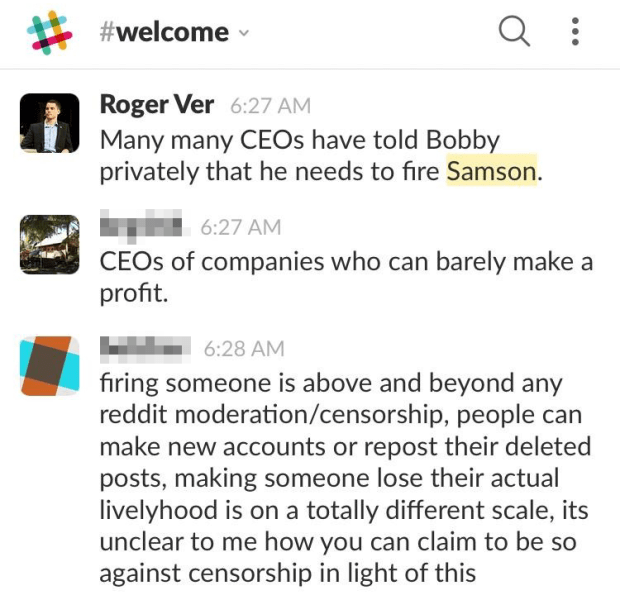

Roger Ver successful the Bitcoin Community Slack

Roger Ver successful the Bitcoin Community Slack

Another magnitude to the warfare that doesn’t get afloat captured is the disparity betwixt the 2 sides. It was virtually each the big, ostensibly pro-Bitcoin companies with a ton of superior astatine their disposal versus a ragtag fistful of developers and users. My relation connected the Small Blocker broadside was perceived arsenic a betrayal of sorts arsenic I was an enforcement astatine a large institution and should person aligned with the different concern radical who “knew better.” That “betrayal” and my quality to skewer the Big Blockers with intellect and wit led to a long-running run to get maine fired from BTCC by lobbying our committee of directors and investors. That should springiness you an thought of what benignant of radical we faced.

Blockstream: Augmenting Bitcoin

The prevailing communicative during the warfare was “Bitcoin can’t scale,” truthful what amended mode to crush that communicative than to beryllium it incorrect done real-world implementation? After warring the warfare alongside Adam Back, I decided to articulation Blockstream arsenic main strategy serviceman successful 2017 to absorption connected augmenting Bitcoin, which would see gathering infrastructure that would assistance standard Bitcoin, namely: Lightning and Liquid.

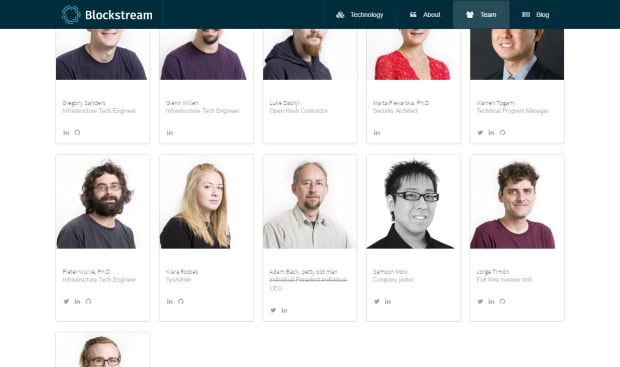

The r/btc assemblage made this to observe my summation to the Blockstream team

The r/btc assemblage made this to observe my summation to the Blockstream team

Blockstream has made galore contributions to the Lightning project, peculiarly with Core Lightning. Lightning is simply a Layer 2 peer-to-peer web that operates connected apical of Bitcoin. It works by opening channels and aggregating smaller transactions off-chain, akin to opening a tab astatine a barroom and paying astatine the end. Lightning is designed to standard micropayments, enabling anyone to transact bitcoin with near-zero fees. It has a theoretical bounds of 40 cardinal transactions per second, yet unleashing bitcoin arsenic a planetary-scale decentralized mean of exchange.

The Liquid Network is simply a Bitcoin sidechain, a blockchain anchored one-to-one to bitcoin. It does not person a autochthonal token; it locks bitcoin connected the main concatenation and unlocks Liquid bitcoin (L-BTC) successful the sidechain, which gives it caller capabilities. Liquid bitcoin is faster due to the fact that determination are one-minute artifact times and you besides payment from confidential transactions. With Liquid, you tin contented integer assets connected Bitcoin, specified arsenic stablecoins, information tokens and integer collectibles, truthful there’s nary request for altcoins.

One of the archetypal initiatives I championed aft joining Blockstream was to summation the decentralization of mining. A captious acquisition of the Blocksize War was that determination was an overconcentration of hashrate successful China, which presented a large onslaught vector. I secured Blockstream’s archetypal mining tract successful Quebec successful aboriginal 2017 and past much miners followed america to North America, starring to a mining golden unreserved of sorts.

Another inaugural I advocated for was getting different artifact explorer onto the market. With Blockchain.info controlled by Blockchain.com and BTC.com owned by Bitmain, if the Big Blockers wanted, they could person made a almighty propulsion to dictate a peculiar fork arsenic being the existent Bitcoin. Many radical backmost past looked to artifact explorers arsenic a root of truth. We mitigated this menace by releasing blockstream.info, which is present utilized successful galore wallets arsenic a default explorer. Later, mempool.space made their debut and has gained a ample marketplace share.

JAN3: Mass Adoption

The champion defence is simply a bully offense. Mass adoption of bitcoin whitethorn assistance america to avert aboriginal wars.

After 5 years astatine Blockstream and accomplishing astir of the things I acceptable retired to do, I decided to commencement JAN3, a Bitcoin exertion institution focused connected wide adoption. At JAN3, we assistance nation-states and their citizens attain existent sovereignty and prosperity done Bitcoin. This includes bitcoin bonds, mining, wallets, security, custody solutions and related infrastructure. Many processing countries, particularly successful Latin America, are nether the bottommost of the International Monetary Fund and tin lone get to refinance debt; a downward spiral. Bitcoin is the mode out. They conscionable don’t each cognize it yet.

We indispensable align incentives with Bitcoin to mitigate aboriginal attacks and efforts to stymie hyperbitcoinization. If nation-states are accumulating bitcoin successful their strategical reserves, they’re not apt to prohibition it. If nation-states are mining bitcoin, they’re securing the web and not apt to onslaught it.

Pushing for much grassroots bitcoin adoption is captious arsenic well. At JAN3, we purpose to physique the go-to bitcoin wallet for Latin America and different processing markets. We’re taking an attack we judge is antithetic from different Bitcoin companies. Our wallet, AQUA, is chiefly a bitcoin and Liquid Tether (USDt) wallet. We purpose to present the champion imaginable idiosyncratic acquisition for users to clasp some assets and easy swap betwixt them.

Why is Tether important? Tether originated arsenic a mode for exchanges to run without requiring accepted banking, but has evolved into banking for the unbanked. Much of the processing satellite uses USDt. Many radical successful countries similar Argentina, Venezuela, Turkey, Ukraine and Lebanon trust connected it to flight ostentation and support purchasing power. If you privation to onboard much radical onto bitcoin, you request to interface with their slope accounts, and for galore successful the processing world, their slope accounts are progressively denominated successful USDt.

The Antagonists

So wherever are the characters we fought against during the Blocksize War and how are they doing today?

Bitmain

During the Blocksize War, Bitmain was the all-powerful megacorporation, with tentacles successful each parts of the mining industry, from hosting to pools to ASIC manufacturing — they besides boasted the largest marketplace stock and hash rate. Bitmain utilized its presumption to bully others and beforehand the forks, and past yet Bitcoin Cash (aka “Bcash”).

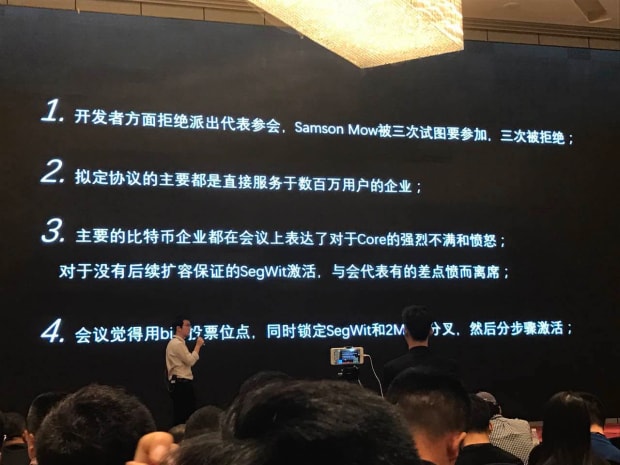

Jihan Wu’s talking points astatine a mining league successful Chengdu successful 2017

Jihan Wu’s talking points astatine a mining league successful Chengdu successful 2017

In caller years, they had their ain interior civilian warfare (who could person imagined?) In October 2019, a powerfulness conflict betwixt Bitmain’s co-founders Micree Zhan and Jihan Wu erupted, and Jihan was yet ousted arsenic CEO. The Blocksize War and their ain civilian warfare had a immense impact, driving their market share down to astir 60% from implicit 75%. Bitmain’s valuation was erstwhile successful the $40 cardinal to $50 cardinal scope erstwhile they were seeking to IPO. Their astir caller valuation was astir $4 billion. They’ve repeatedly failed to motorboat their IPO since 2018. In 2019, I predicted they would ne'er IPO and that has held existent truthful far. Now that they’ve stopped pushing Bcash and Zhan runs the institution arsenic a businessman should, they whitethorn IPO someday.

Coinbase

“Fire the developers” was a rallying outcry that Jihan started and Brian Armstrong amplified it astatine each disposable opportunity. In January 2016, Armstrong published a contentious blog post supporting the large blocks and Bitcoin XT, and past pushed for each azygous consequent fork up to the failed SegWit2X. You person to springiness the feline recognition for trying.

At Mountain View trying to speech immoderate consciousness into Brian Armstrong successful 2016

At Mountain View trying to speech immoderate consciousness into Brian Armstrong successful 2016

So however are they doing today? An SEC probe determined they allowed their users to speculate connected unregistered securities. Separately, the SEC charged an ex-Coinbase merchandise manager with insider trading alongside 2 others. In 2022, Coinbase’s banal dropped much than 75%, resulting from these incidents, arsenic good arsenic their Q1 results, which were astatine a net nonaccomplishment of $430 million. They could besides beryllium $1 cardinal successful the reddish successful Q2. Other questionable acts see conflating its USD and USDC bid books and selling spying software to the U.S. Government done its “Coinbase Tracer” program. A fewer days ago, Cathie Wood of ARK Invest dumped implicit a cardinal shares of COIN.

Circle

Circle, the issuer of the USDC stablecoin, gave up connected Bitcoin successful 2016, stating that Bitcoin was implicit and that successful 5 to 10 years, cipher would beryllium utilizing it, but inactive continued to enactment each of the attacks connected the Bitcoin network.

Circle bought the speech Poloniex and sold it astatine a $146M loss a fewer years later. In February 2022, earlier the Three Arrows Capital (3AC) meltdown and the mini carnivore market, it announced its volition to SPAC to rise capital astatine a $9 cardinal valuation. Recently, aft it raised $400 million from backstage equity, an investigative writer recovered oddities successful USDC’s registration statement, implying USDC holders are unsecured creditors successful lawsuit of bankruptcy. At the aforesaid time, involvement rates connected USDC yields person collapsed from 10.75% to hardly 0.5%, little than a 3-year Treasury. Meanwhile, Circle CEO Jeremy Allaire declares the institution is over-collateralized and successful a stronger presumption than ever, but I’m not truthful sure. This doesn’t look similar an optimal clip to SPAC, and if Circle can’t bring successful much cash, they could beryllium successful trouble.

Digital Currency Group

Barry Silbert, the laminitis of DCG, created the New York Agreement (NYA) successful May 2017, whereby the Big Blockers would “fire Bitcoin Core,” and let the corporations to dictate the rules to the users.

It appears DCG and 3AC could person been colluding to extract worth from Greyscale’s GBTC money trading astatine a premium comparative to spot bitcoin. 3AC utilized this leverage to money galore things similar buying costly non-fungible tokens, portion Greyscale made fees done the arrangement. Terra-Luna's illness made 3AC spell insolvent and Genesis, 1 of DCG’s subsidiaries, filed a $1.2 cardinal assertion against 3AC for defaulted loans totaling $2.36 billion.

Blockchain.com

Blockchain.com (previously blockchain.info) tried hard to propulsion for each of the Big Block forks arsenic well. They were besides the ones that blocked maine from attending the NYA meeting. In July 2022, we learned that they lost $270 million and were forced to chopped unit by 25%, oregon astir 150 people, each due to the fact that of atrocious loans to 3AC.

Roger Ver

Formerly known arsenic “Bitcoin Jesus” and a salient Big Blocker, Roger Ver attacked Bitcoin relentlessly during the Blocksize War. His superior weapons were utilizing the Bitcoin.com domain and the @Bitcoin Twitter grip to dispersed misinformation.

In June 2022, we learned that Roger was over-leveraged connected Bcash, lone to spot it illness to 2019 lows. The CEO of CoinFLEX, the crypto speech helium was trading on, has outed Roger arsenic a defaulter connected a $47 cardinal unsecured loan. The default has forced the institution to halt withdrawals and effort to rise the missing wealth done an ad-hoc token sale. They besides had to marque important layoffs to chopped costs. Despite being a shareholder successful the exchange, Ver refused to judge responsibility, accusing CoinFLEX of owing him money.

The Big Blockers Weren’t Even Bitcoiners

Time has revealed that galore of the Big Blockers were ne'er Bitcoiners oregon adjacent remotely funny successful what Bitcoin could bash to hole the world. Our antagonists turned retired to beryllium heavy into shitcoins, DeFi and fiat-money riches. Many did risky things with their companies, similar unsecured lending, rehypothecation, etc., and they are present paying for it.

It was ne'er astir artifact size oregon transactions per second. It was ever astir power and extraction of value.

As Bitcoin grows and becomes much prevalent, determination volition beryllium much incentives to co-opt it. We request much systems and infrastructure astir Bitcoin that volition let it to defy atrocious actors. We request much acquisition astir however Bitcoin works and wherefore it’s essential. But astir importantly, we request much adoption and alignment of incentives with Bitcoin. That is the champion mode to avert different Blocksize War.

We indispensable retrieve what Bitcoin represents and what’s astatine stake: our past anticipation astatine an apolitical, decentralized, permissionless wealth and the prosperous aboriginal it enables. The terms of state is eternal vigilance.

This is simply a impermanent station by Samson Mow. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)