The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Binance: FUD Or Legitimate Questions?

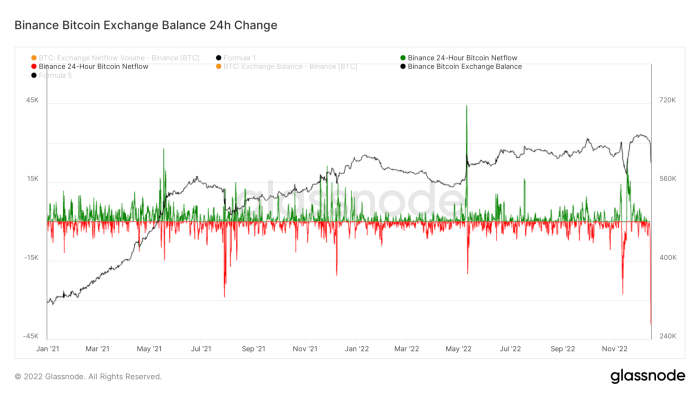

By far, 1 of the biggest winners successful the aftermath of the FTX illness has seemed — connected the aboveground — to beryllium Binance. After lone having 7.82% marketplace stock of the bitcoin proviso connected exchanges successful 2018, their stock is present 27.50% contempt a overmuch broader inclination of bitcoin proviso leaving exchanges. The bitcoin equilibrium connected Binance present totals 595,864 BTC, which is 3.1% of outstanding supply, worthy $10.58 billion. This bitcoin belongs to their customers and reflects a increasing inclination successful marketplace stock implicit the past fewer years that has made Binance the largest bitcoin and cryptocurrency speech successful the world.

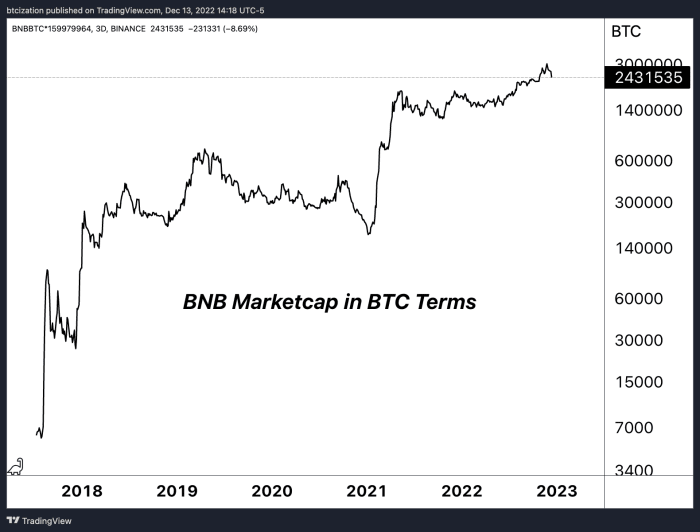

Binance present controls astir 60% of the spot and derivatives volume successful the full market. It’s hard to spot however immoderate speech successful the abstraction tin beryllium a “winner” successful the existent marketplace conditions, but 1 could marque the lawsuit for Binance, with the exchange’s increasing spot successful a decimated industry. On apical of that, Binance’s BNB token, the autochthonal currency of Binance’s ain Ethereum-competing Layer 1 blockchain, is inactive 1 of the amended performing tokens erstwhile valued successful bitcoin presumption this year.

Yet, is this caller “strength” everything that it seems oregon is it a facade? We’ve learned implicit the past period that nary institution is harmless successful this manufacture close present (especially exchanges) and questions are increasing astir Binance’s practices, solvency, BNB token worth and the wide authorities of their concern implicit the past fewer weeks. Is it FUD oregon legit? Let’s effort to interruption immoderate of it down, addressing the concerns done an nonsubjective and skeptical lens.

Binance Flows

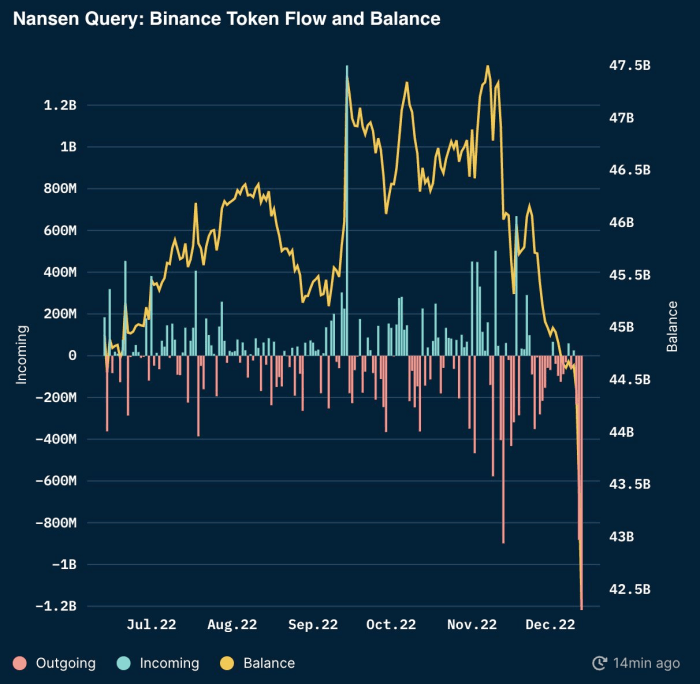

We’ve seen important outflows from Binance crossed antithetic assorted tokens and bitcoin erstwhile looking astatine some Nansen and Glassnode tracking. Across ETH and ERC20 tokens, Binance saw $3 billion leaving the speech successful its largest single-day outflow since June. Across Nansen full wallet tracking, each Binance balances are estimated astatine $62.5 cardinal with astir 50% of those balances successful stablecoins crossed BUSD and USDT.

Source: Nansen

According to Glassnode, the full bitcoin speech equilibrium connected Binance is down astir 6-7% implicit the past day, aft reaching a highest connected December 1. Although balances stay supra 500,000 bitcoin and Binance has shown a rising inclination of bitcoin balances connected the level this year, this is simply a important determination for outflows successful conscionable 24 hours. As a wide comparison, the inclination of bitcoin speech balances was a overmuch antithetic communicative for FTX, whose equilibrium had been falling heavy since June. Binance outflows implicit the past mates days are a spot alarming and rise questions: Is this a one-off lawsuit and conscionable concern arsenic accustomed oregon is this the commencement of thing more?

Readers tin way the on-chain addresses provided by Binance for escaped here.

The main origin for interest is not whether Binance has immoderate bitcoin/crypto oregon not. We tin transparently spot that the steadfast controls tens of billions worthy of crypto assets. What isn’t precisely clear, akin to FTX, is whether the steadfast has commingled users funds oregon whether the steadfast has immoderate outstanding liabilities against idiosyncratic assets.

Binance CEO Changpeng Zhao (CZ) has said that the steadfast has nary liabilities with immoderate different firms, but arsenic caller months person shown, words don’t mean each that much. While we are not claiming that CZ is lying to the nationalist astir the authorities of Binance finances, we person nary mode to beryllium otherwise.

CZ’s effect arsenic to whether the institution was going to audit liabilities against idiosyncratic assets was, “Yes, but liabilities are harder. We don't beryllium immoderate loans to anyone. You tin inquire around.”

Unfortunately, “ask around” isn’t a satisfactory capable reply for an ecosystem supposedly built astir the ethos of “don’t trust, verify.”

While determination is nary uncertainty that Binance is an manufacture elephantine successful the crypto derivatives industry, however bash we cognize the steadfast isn’t doing akin things arsenic past actors successful regards to trading against clients utilizing idiosyncratic funds and/or proprietary data. Things similar the erstwhile Chief Legal Officer of Coinbase departing Binance U.S. past summertime aft conscionable 3 months arsenic the CEO leaves 1 with galore questions.

To adhd to our skepticism, the terms of the Binance speech token BNB is adjacent all-time highs successful bitcoin terms, appreciating an astounding 828% against bitcoin successful the past 785 calendar days.

The coming weeks volition beryllium afloat of headlines astir the authorities of planetary crypto regularisation successful a post-FTX world. In a 48-hour period, Reuters published quality stating that the U.S. Justice Dept is divided implicit charging Binance, Binance withdrawals for bitcoin and aggregate stablecoin pairs person deed all-time highs and the BNB speech token has fallen 10% comparative to bitcoin.

Out of an abundance of caution, we volition proceed to impulse readers operating connected immoderate centralized speech — of which Binance is astir decidedly included — to look into aforesaid custody solutions. There person been acold excessively galore instances of incompetence and/or misconduct from exchanges.

It’s not that we don’t spot CZ oregon Binance, it's the information that we don’t spot anyone.

The full constituent of bitcoin is we present person an plus that is genuinely the liability of nary one. Verify the ownership of an unfastened distributed web with cryptography; don’t spot permissioned IOUs. With the premix of regulatory concerns astir the planetary crypto derivatives industry, a questionable speech token with unbelievable comparative show implicit the past 2 years and a shaky proof-of-reserves attestation — that was incorrectly claimed to beryllium an audit and had manufacture CEOs raising eyebrows — we find the request to impulse our readers to measure their counterparty risk.

3 years ago

3 years ago

English (US)

English (US)