The beneath is an excerpt from a caller variation of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

This Daily Dive volition interaction connected immoderate of the caller macro trends and correlations successful the BTC market. If you haven’t work this caller thread connected the bitcoin market, cheque it out.

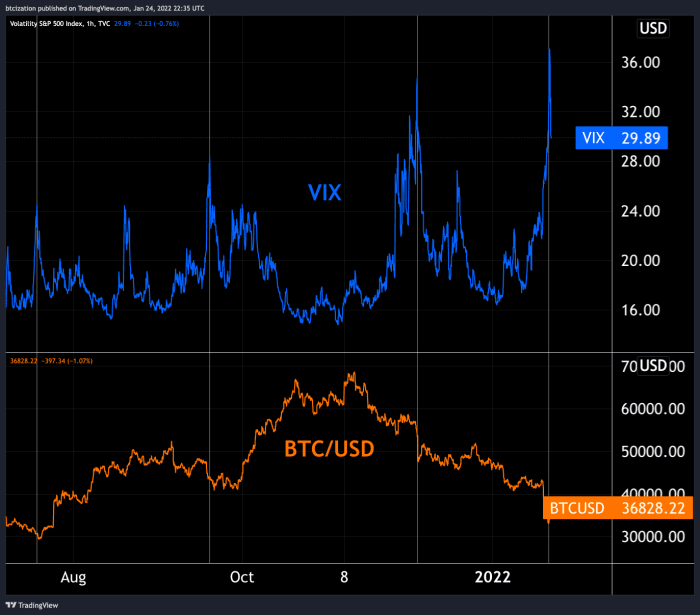

In Friday’s Daily Dive, with bitcoin beneath $40,000, we noted to support an oculus connected the VIX, arsenic hazard assets continued to merchantability disconnected successful unison implicit the pursuing month.

“If things proceed to get disfigured successful equity markets, support an oculus connected the VIX, which is simply a volatility scale for the S&P 500. If stocks proceed to drop, it volition apt pb to continued weakness successful bitcoin. The existent question is what is the threshold wherever bitcoin derivatives markets look cascading liquidations, which is what worsened the sell-off successful March of 2020.”

Just a specified 3 days later, U.S. markets opened down large and bitcoin was trading adjacent $33,000 arsenic volatility exploded, with the VIX touching arsenic precocious arsenic 38 earlier a monolithic reversal occurred:

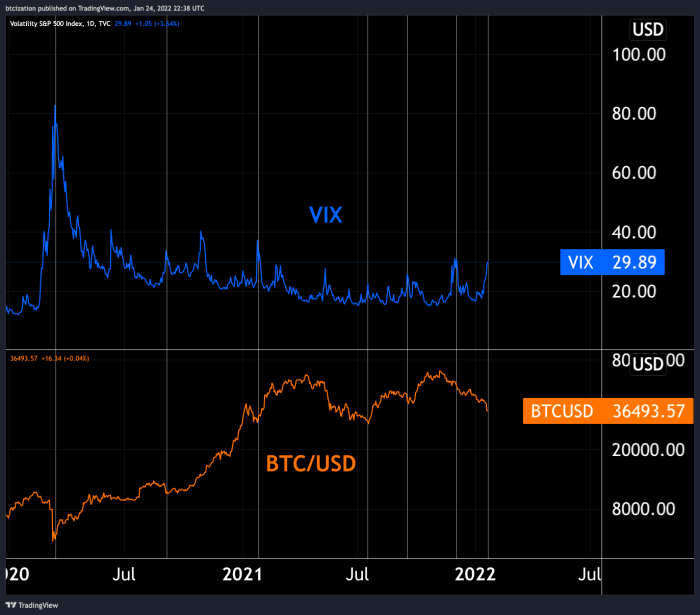

As bitcoin matured arsenic a planetary macroeconomic asset, it accrued its correlation to equities and sold disconnected during moves higher successful the VIX (risk disconnected moments). Here are immoderate highlighted moments implicit the past 2 years wherever this has occurred:

We besides person monitored the market’s expectations for the Federal Reserve Board done the Eurodollar futures market, a futures marketplace connected the expected Fed funds rate. Expectations fell contiguous arsenic equity markets tanked, which was an implicit motion to the infamous “Fed put.”

3 years ago

3 years ago

English (US)

English (US)