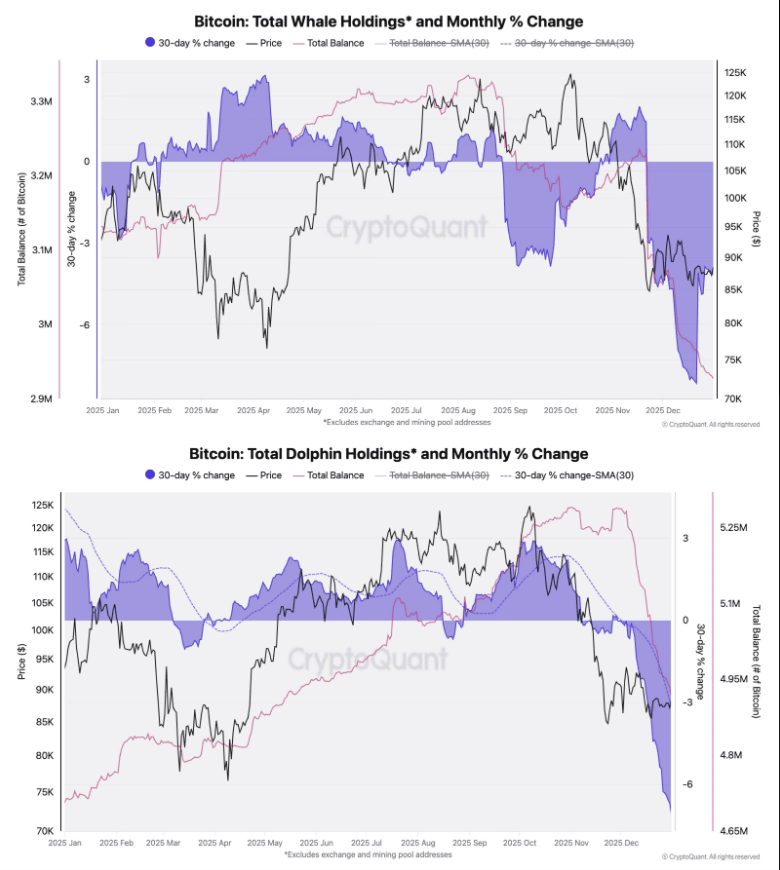

According to onchain information from CryptoQuant, claims that large holders are massively reaccumulating Bitcoin are exaggerated. The numbers that galore stock connected societal media tin beryllium distorted by speech moves, not caller buying. That distortion matters due to the fact that ample transfers tied to exchanges tin look similar 1 entity is piling in, erstwhile the enactment is often interior bookkeeping.

Whale Wallet Totals Can Be Misleading

Exchange firms often merge funds from galore tiny accounts into less ample wallets for operational oregon compliance reasons. When that happens, onchain trackers whitethorn number those consolidated addresses arsenic “whales,” inflating the evident fig of precise ample holders.

According to Julio Moreno, caput of probe astatine CryptoQuant, erstwhile those exchange-related shifts are removed from the data, the equilibrium held by existent ample holders is inactive falling. Balances successful addresses holding betwixt 100 to 1,000 BTC person dropped, a inclination that lines up with outflows from spot ETFs.

No, whales are not buying tremendous magnitude of Bitcoin.

Most Bitcoin whale information retired determination has been “affected” by exchanges consolidating a batch of their holdings into less addresses with larger balances, this is wherefore whales look to person accumulated a batch of coins recently.

We… pic.twitter.com/dk9XqqckIX

— Julio Moreno (@jjcmoreno) January 2, 2026

Long-Term Holders Turning Buyer

Reports person disclosed that different radical has shifted its behavior. Matthew Sigel, caput of integer assets probe astatine VanEck, says semipermanent holders person been nett accumulators implicit the past 30 days aft what was their biggest selling spree since 2019.

That alteration could trim 1 large root of selling pressure. It does not warrant a rally, but it does mean astatine slightest 1 cardinal cohort stopped adding to the merchantability side. Markets respond to who is buying and who is selling, and this determination by semipermanent holders softens the lawsuit that a azygous radical is driving prices lower.

Price Action Shows Mixed Signals

Bitcoin has been hovering astir the $90,000 country during bladed vacation trading. At the clip of reporting, the terms was astir $89,750 Saturday, with 24-hour measurement adjacent $52 billion.

The token sits astir 2.8% beneath a caller time precocious of $90,250 and carries a marketplace capitalization of astir $1.75 trillion based connected a circulating proviso adjacent to 20 cardinal BTC. Trading has seen crisp moves up and down, but measurement has been weak, which means moves deficiency the enactment needed for a wide breakout oregon breakdown.

Market Moves Hinge On ETF Flows

Since US spot Bitcoin ETFs became progressive successful aboriginal 2024, the ownership representation has changed. ETFs present clasp a ample stock of on- and off-chain demand, which tin displacement wherever Bitcoin is stored and however flows look connected onchain charts. Reports suggest that ETF outflows person helped thrust little balances successful the 100–1,000 BTC band, portion astatine the aforesaid clip immoderate semipermanent holders are softly buying.

What This Means For Investors

Taken together, the grounds points to consolidation much than a caller bull tally oregon a large crash. Claims of a monolithic whale reaccumulation question were overblown due to the fact that they did not relationship for speech consolidation.

Yet the communicative is not one-sided. Long-term holders person shown buying interest, adjacent arsenic ample non-exchange addresses proceed to shed immoderate holdings. Future terms absorption volition apt beryllium connected whether ETF flows instrumentality successful size and whether trading measurement picks up capable to corroborate immoderate move.

Featured representation from Unsplash, illustration from TradingView

1 day ago

1 day ago

English (US)

English (US)