Yield curve power is the adjacent saga successful the planetary monetary argumentation experiment. What does it mean for the system and what are the aboriginal consequences?

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Here Comes Yield Curve Control

A cardinal taxable successful our semipermanent Bitcoin thesis is the continued nonaccomplishment of centralized monetary argumentation crossed planetary cardinal banks successful a satellite wherever centralized monetary argumentation volition apt not fix, but lone exacerbate, larger systemic problems. The failure, pent up volatility and economical demolition that follows from cardinal slope attempts to lick these problems volition lone further widen the distrust successful fiscal and economical institutions. This opens the doorway to an alternate system. We deliberation that system, oregon adjacent a important portion of it, tin beryllium Bitcoin.

With the extremity to supply a stable, sustainable and utile planetary monetary system, cardinal banks look 1 of their biggest challenges successful history: solving the planetary sovereign indebtedness crisis. In response, we volition spot much monetary and fiscal argumentation experiments germinate and rotation retired astir the satellite to effort and support the existent strategy afloat. One of those argumentation experiments is known arsenic output curve power (YCC) and is becoming much captious to our future. In this post, we volition screen what YCC is, its fewer humanities examples and the aboriginal implications of accrued YCC rollouts.

YCC Historical Examples

Simply put, YCC is simply a method for cardinal banks to power oregon power involvement rates and the wide outgo of capital. In practice, a cardinal slope sets their perfect involvement complaint for a circumstantial indebtedness instrumentality successful the market. They support buying oregon selling that indebtedness instrumentality (i.e., a 10-year bond) nary substance what to support the circumstantial involvement complaint peg they want. Typically, they bargain with recently printed currency adding to monetary ostentation pressures.

YCC tin beryllium tried for a fewer antithetic reasons: support little and unchangeable involvement rates to spur caller economical growth, support little and unchangeable involvement rates to little the outgo of borrowing and involvement complaint indebtedness payments oregon intentionally make ostentation successful a deflationary situation (to sanction a few). Its occurrence is lone arsenic bully arsenic the cardinal bank’s credibility successful the market. Markets person to “trust” that cardinal banks volition proceed to execute connected this argumentation astatine each costs.

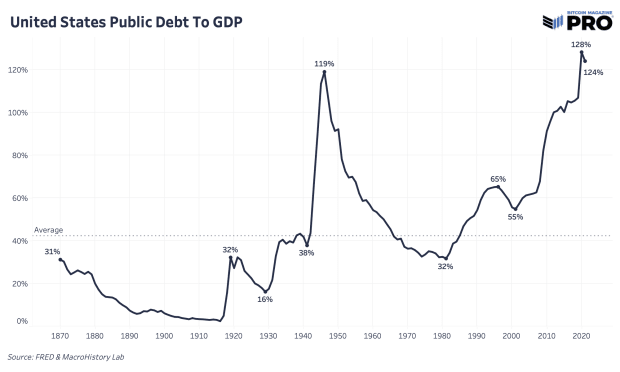

The largest YCC illustration happened successful the United States successful 1942 station World War II. The United States incurred monolithic indebtedness expenditures to concern the warfare and the Fed capped yields to support borrowing costs debased and stable. During that time, the Fed capped some abbreviated and semipermanent involvement rates crossed shorter-term bills astatine 0.375% and longer-term bonds up to 2.5%. By doing so, the Fed gave up power of their equilibrium expanse and wealth supply, some expanding to support the little involvement complaint pegs. It was the chosen method to woody with the unsustainable, elevator emergence successful nationalist indebtedness comparative to gross home product.

YCC Current And Future

The European Central Bank (ECB) has efficaciously been engaging successful a YCC argumentation flying nether different banner. The ECB has been buying bonds to effort and power the dispersed successful yields betwixt the strongest and weakest economies successful the eurozone.

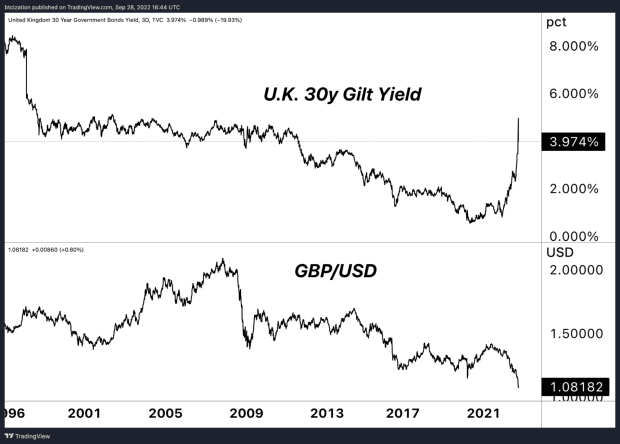

Yields person go excessively precocious excessively rapidly for economies to relation and there’s a deficiency of marginal buyers successful the enslaved marketplace close present arsenic sovereign bonds look their worst year-to-date show successful history. That leaves the BoE nary prime but to beryllium the purchaser of past resort. If the QE restart and archetypal enslaved buying isn’t enough, we could easy spot a progression to a much strict and long-lasting output headdress YCC program.

It was reported that the BoE stepped successful to stem the way successful gilts owed to the imaginable for borderline calls crossed the U.K. pension system, which holds astir £1.5 trillion of assets, of which a bulk were invested successful bonds. As definite pension funds hedged their volatility hazard with enslaved derivatives, managed by alleged liability-driven concern (LDI) funds. As the terms of long-dated U.K. sovereign bonds drastically fell, the derivative positions that were secured with said bonds arsenic collateral became progressively astatine hazard to borderline calls. While the specifics aren’t each that peculiarly important, the cardinal constituent to recognize is that erstwhile the monetary tightening became perchance systemic, the cardinal slope stepped in.

Although YCC policies whitethorn “kick the can” and bounds situation harm short-term, it unleashes an full container of consequences and 2nd bid effects that volition person to beryllium dealt with.

YCC is fundamentally the extremity of immoderate “free market” enactment near successful the fiscal and economical systems. It’s much progressive centralized readying to support a circumstantial outgo of superior that the full system functions on. It’s done retired of necessity to support the strategy from full illness which has proven to beryllium inevitable successful fiat-based monetary systems adjacent the extremity of their support life.

YCC prolongs the sovereign indebtedness bubble by allowing governments to little the wide involvement complaint connected involvement payments and little borrowing costs connected aboriginal indebtedness rollovers. Based connected the sheer magnitude of nationalist indebtedness size, gait of aboriginal fiscal deficits and important entitlement spending promises acold into the aboriginal (Medicare, Social Security, etc.), involvement complaint expenses volition proceed to instrumentality up a greater stock of taxation gross from a waning taxation basal nether pressure.

Final Note

The archetypal usage of output curve power was a planetary wartime measure. Its usage was for utmost circumstances. So adjacent the attempted rollout of a YCC oregon YCC-like programme should enactment arsenic a informing awesome to astir that thing is earnestly wrong. Now we person 2 of the largest cardinal banks successful the satellite (on the verge of three) actively pursuing output curve power policies. This is the caller improvement of monetary argumentation and monetary experiments. Central banks volition effort immoderate it takes to stabilize economical conditions and much monetary debasement volition beryllium the result.

If determination was ever a selling run for wherefore Bitcoin has a spot successful the world, it’s precisely this. As overmuch arsenic we’ve talked astir the existent macro headwinds needing clip to play retired and little bitcoin prices being a apt short-term result successful the script of superior equity marketplace volatility, the question of monetary argumentation and relentless liquidity that volition person to beryllium unleashed to rescue the strategy volition beryllium massive. Getting a little bitcoin terms to accumulate a higher presumption and avoiding different imaginable important drawdown successful a planetary recession is simply a bully play (if the marketplace provides) but missing retired connected the adjacent large determination upwards is the existent missed accidental successful our view.

Relevant Past Articles

- 9/23/22 - The Unfolding Sovereign Debt & Currency Crisis

- 8/2/22 - July Monthly Report: Long Live Macro

- 9/7/22 - Europe: The Sovereign Debt Bubble Domino

- 7/20/22 - Caution: Bear Market Rallies

3 years ago

3 years ago

English (US)

English (US)