The terms of Bitcoin (BTC) saw drastic falls passim 2022 and is trading astatine $16,877.39 arsenic of property clip — down much than 66% from its all-time precocious terms of implicit $68,000 successful November 2021.

Most investors see terms arsenic the astir important metric of growth. While the terms of Bitcoin gives small crushed to beryllium bullish, an valuation of different maturation metrics makes a beardown lawsuit for BTC’s maturation successful the coming years.

Long-term holders deed an all-time high

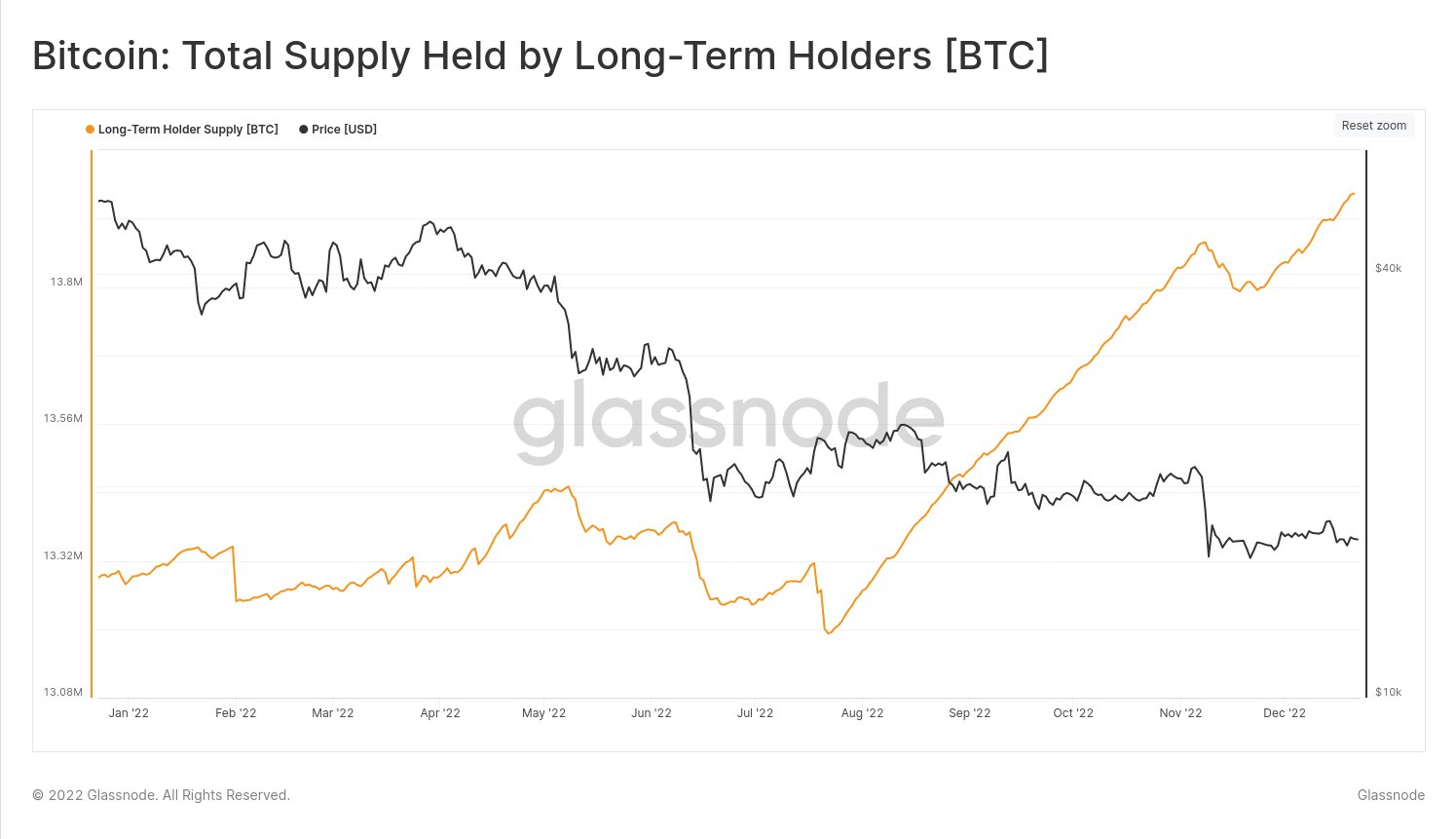

The full proviso of Bitcoin held by semipermanent users has been connected the emergence passim 2022. But it is worthy noting that it staggered during large events similar the Terra-LUNA fiasco successful May, the bankruptcy of hedge money Three Arrows Capital (3AC) successful June and crypto lender Celsius successful July, and the autumn of FTX successful November. These events created a short-term panic starring semipermanent holders to offload their BTC holdings.

Despite the dips, however, the full proviso of semipermanent holders has reached an all-time precocious of implicit 13.9 cardinal BTC, according to Glassnode data analyzed by CryptoSlate. This indicates that semipermanent investors clasp astir 72.7% of Bitcoin’s circulating proviso of 19.24 cardinal coins — the highest ever. Long-term holders are those that person been holding Bitcoin for 155 days oregon more.

Total proviso of BTC held by semipermanent holders. Source: Glassnode

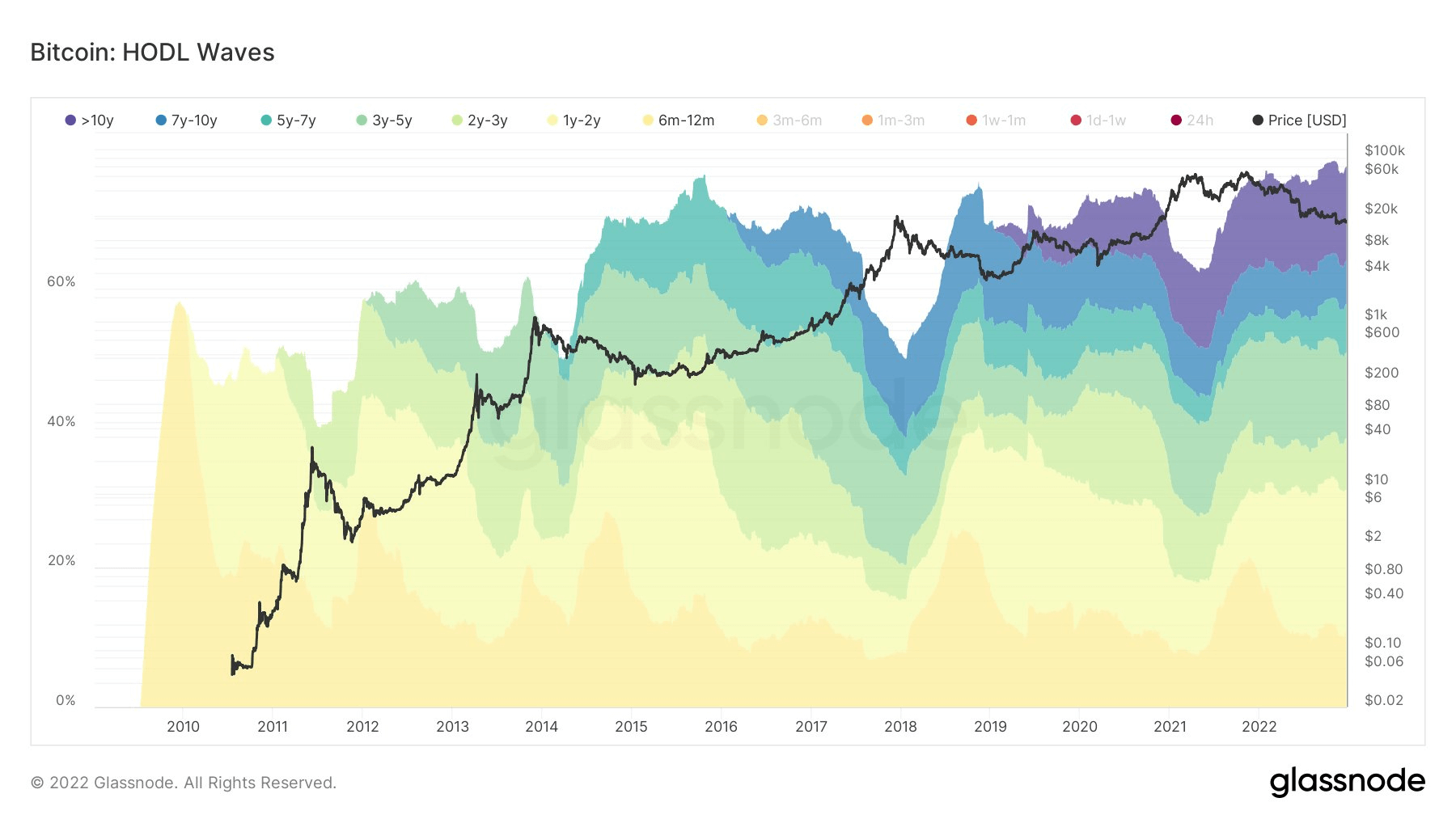

Total proviso of BTC held by semipermanent holders. Source: GlassnodeAdditionally, the BTC HODL Waves illustration indicates that the fig of aboriginal enthusiasts of BTC who person been holding their coins for implicit 10 years (purple) is high, contempt the dip aft the FTX collapse. The HODL Waves illustration shows the magnitude of BTC held for antithetic property bands.

BTC HODL Waves. Source: Glassnode

BTC HODL Waves. Source: GlassnodeThe percent of investors holding their BTC for 7 years to 10 years has held mostly dependable contempt marketplace fluctuations passim 2022, which indicates that semipermanent holders are maintaining their condemnation successful BTC.

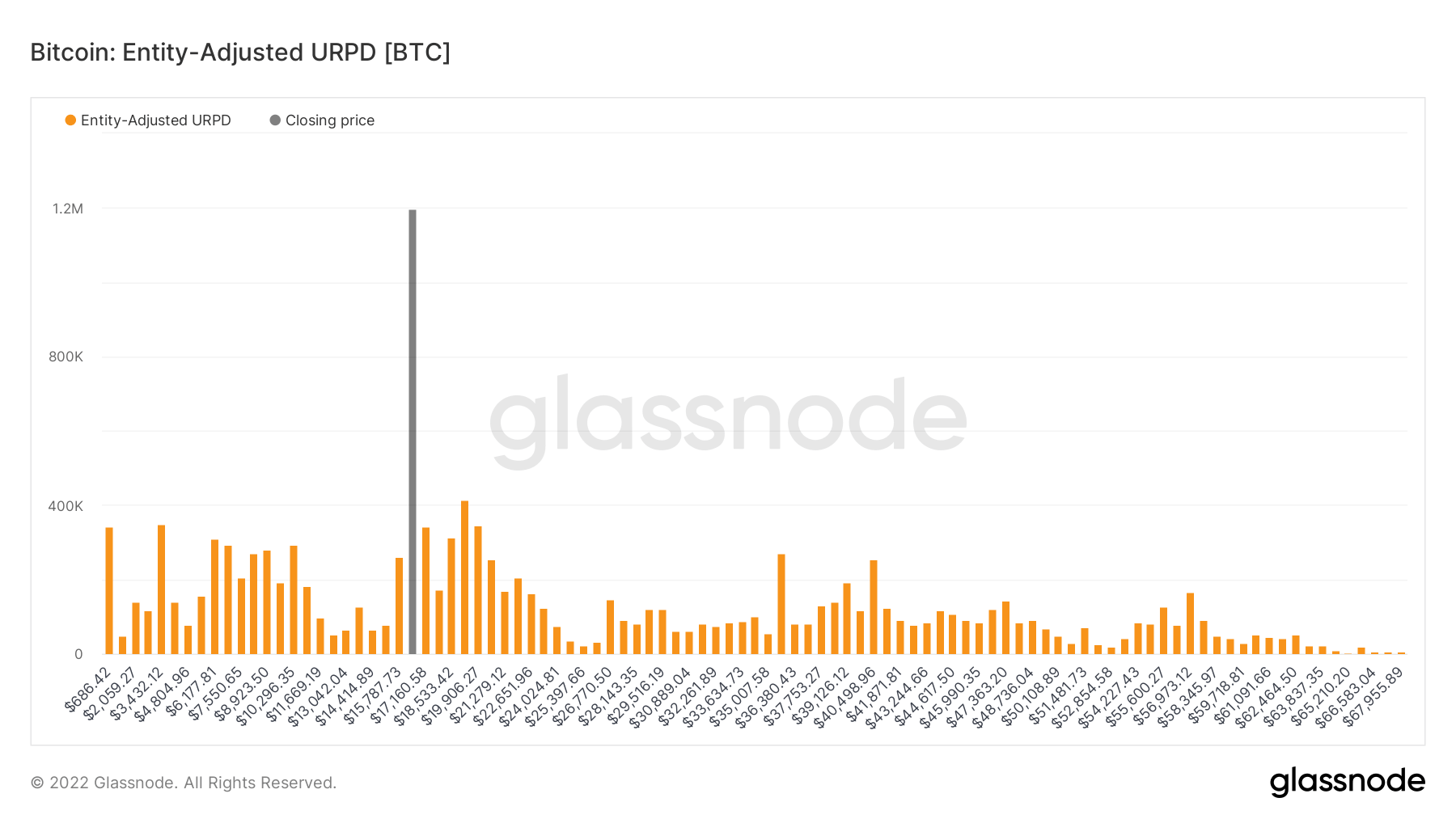

Nearly 1.8 cardinal BTC bought betwixt $15,700 and $17,100

According to Glassnode data, astir 1.8 cardinal BTC — oregon implicit 9% of the circulating proviso — was bought successful the terms scope of $15,787.73 and $17,160.58. BTC has lone traded successful this terms scope successful November 2020 and this year, since November 2022.

While the 9% measurement indicates determination is simply a likelihood of much redistribution, Bitcoin’s consolidation suggests semipermanent holders are successful control.

Entity-adjusted UTXO Realized Price Distribution of BTC. Source: Glassnode

Entity-adjusted UTXO Realized Price Distribution of BTC. Source: Glassnode78% of Bitcoin’s circulating proviso is successful self-custody

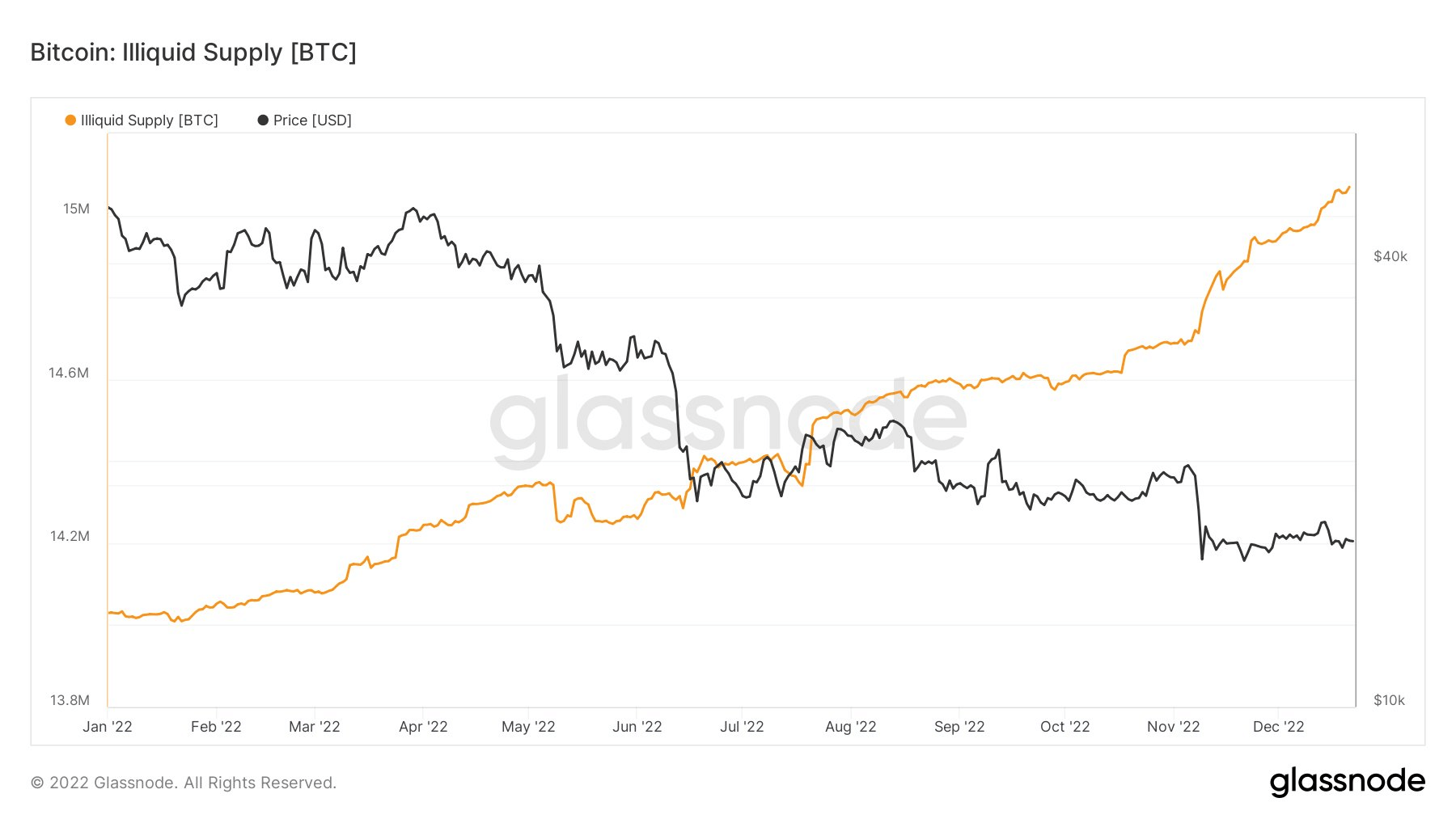

The bid of high-profile bankruptcies of crypto lenders and centralized exchanges, including Celsius and FTX, drilled an important acquisition among investors — not your keys, not your coins. While this operation has been astir for years, with millions of investors collectively losing tens of billions successful 2022, the connection has yet deed home.

Throughout the year, throngs of investors continued to instrumentality power of their assets amid waning spot successful centralized exchanges. Over 15 cardinal coins oregon astir 78% of BTC’s circulating proviso of 19.24 cardinal was illiquid arsenic of Dec. 27. Illiquid proviso indicates BTC stored successful hardware acold retention wallets oregon web and mobile-based non-custodial wallets that are not disposable for trading.

Illiquid proviso of BTC. Source: Glassnode

Illiquid proviso of BTC. Source: GlassnodeThe illiquid proviso of BTC has gone up from astir 14.8 cardinal coins oregon 76% of the circulating proviso successful August. Additionally, Bitcoin’s illiquid proviso has grown by astir 7.4% from conscionable implicit 14 cardinal coins astatine the commencement of the year.

The station The bullish lawsuit for Bitcoin arsenic 2022 comes to an end appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)