By separating wealth from the government, Bitcoin takes the power of wealth retired of the hands of politicians and gives it backmost to the citizens.

This is an sentiment editorial by Ryan Bansal, a nonrecreational bundle technologist and writer of a Bitcoin newsletter.

“The machine tin beryllium utilized arsenic a instrumentality to liberate and support people, alternatively than to power them.” — Hal Finney

Technologies are conscionable amplifiers, not arbiters of morality. By extrapolating from the supra quote, it is wrong crushed to assertion that immoderate exertion tin beryllium some a instrumentality for either tyranny oregon for state depending connected whose hands are connected the powerfulness lever.

The rule of checks and balances shows that successful immoderate benignant of strategy that relies connected concentrated power, that cardinal instauration becomes the honeypot for malicious actors. Also, support successful caput the antiauthoritarian rule that much distributed decision-making is much robust and just for immoderate society. So it sounds similar a no-brainer that the champion mode moving guardant is to make and follow technologies with nary azygous eventual powerfulness lever?

Having said that, let’s present speech astir 1 of the astir important technologies of all: money. In the improvement of monetary exertion from barter systems to seashells to metallic coins to gold-backed banknotes and present a central-bank-controlled fiat integer currency, the powerfulness organisation has gone from being much decentralized to being much centralized to the constituent wherever governments person managed to found a coercive monopoly connected money.

Now, I deliberation it is simply a reasonably non-controversial connection to say: Government corrupts thing it touches. Sure, the convenience of integer wealth is unmatched, but it is besides important to recognize the different broadside of it, i.e., the counterparty risk, which means needing to spot a custody supplier to unafraid your assets — on with the information that the humanities way grounds of keeping this spot is not great.

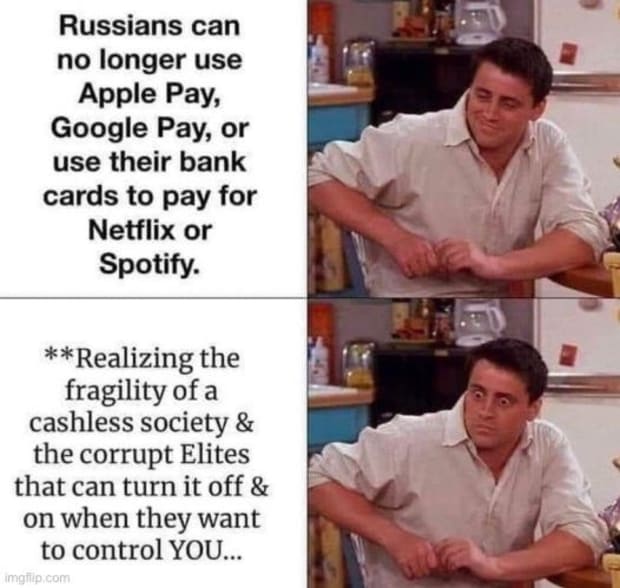

However fortunately oregon unfortunately, precocious this breach successful the declaration has started to hap much wide and openly. Take for illustration a developed antiauthoritarian state similar Canada, freezing the slope accounts of its citizens for protesting against COVID-19 restrictions oregon a state similar Russia putting restrictions connected its radical trying to retreat their funds aft the state invaded its neighbor. In a satellite tally purely connected carnal cash, this benignant of powerfulness to unconstitutionally interruption backstage spot rights would beryllium intolerable to execute.

(Source)

(Source)

Apart from the worsening fiscal censorship and geopolitical sanctions — which are a comparatively caller improvement present that wealth has go astir afloat integer — the corruption arising from the advent of fiat wealth and its problems goes further backmost to 1971. What bash I mean? The plethora of metrics 1 tin usage to measurement the wellness of an system similar scale funds price-earnings ratios, Gini scale for wealthiness inequality, user terms scale for ostentation and outgo of living, the ratio of income maturation versus productivity growth, idiosyncratic homeownership rates and galore others person each gone haywire since the past President Richard Nixon decided to determination away from the golden standard.

If you haven’t guessed the adjacent determination of governments by now, let maine to present you to cardinal slope integer currencies (CBDCs). Think today’s integer wealth is atrocious capable arsenic is? Now ideate what if it was besides programmable?

You tin accidental goodbye to immoderate past sliver of financial autonomy. Before we cognize it, we’ll beryllium surviving successful a surveillance authorities with societal recognition scores, conscionable similar the Chinese citizens. If you’ve seen politicians trying to enactment a affirmative rotation connected them by randomly throwing astir buzzwords, similar “blockchain,” spell backmost to the apical of this nonfiction and work the archetypal enactment again.

The problems that the authorities creates tin beryllium spoken of astatine large lengths, but fto america determination connected to the solution: How to instrumentality the power of wealth retired of the hands of politicians and springiness it backmost to the citizens?

“I don’t judge we shall ever person bully wealth again earlier we instrumentality it retired of the hands of governments.” — Friedrich Hayek

Imagine if our monetary strategy had the privateness and autonomy of cash; the convenience of being instantly and digitally transferrable each implicit the globe; each the portion besides retaining the properties of gold, i.e., cipher tin bargain your purchasing powerfulness implicit clip by arbitrarily manipulating its proviso lone to service their perverse governmental incentives?

Moreover, what if it was besides moving connected an open-source codebase and utilized a nationalist database making it globally accessible, wholly transparent and afloat auditable by anyone? Plus, what if it besides allowed anyone with an net transportation and a machine the quality to measurement successful connected its monetary policy?

Finally, what if the projected strategy was besides decentralized successful a mode that it becomes intolerable to stop, controlled oregon corrupted by anyone owed to the deficiency of a azygous constituent of nonaccomplishment oregon by immoderate cardinal authority?

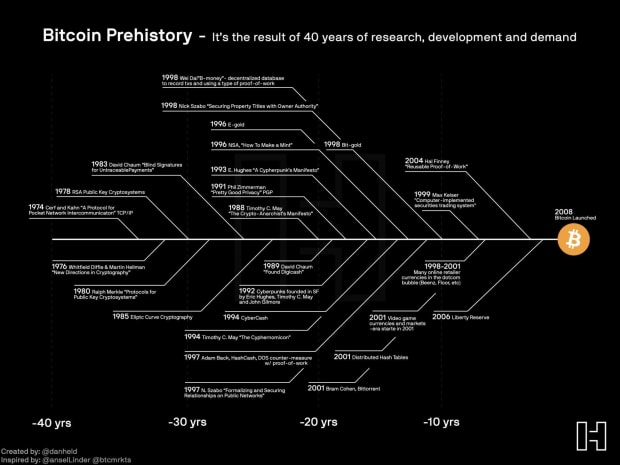

Sounds similar a monetary exertion connected steroids, doesn’t it? Well, successful 2008, a solution to these problems was proposed by idiosyncratic utilizing the pseudonym of Satoshi Nakamoto. I’d besides similar to item that it didn’t conscionable travel retired of the blue, it has been successful the making ever since the cardinal bankers established power implicit the money. More precisely, it took astir 40 years of probe and aggregate failed attempts to technologist this masterpiece. The pursuing ocular is much tangible:

(Source)

(Source)

I’d similar to adjacent by reiterating that the conception of separation of the wealth from the State whitethorn look extremist to you astatine first, but it is really not. As I mentioned before, the monetary technologies we’ve utilized passim astir of our past were mode much extracurricular of the authorities power than existent fiat money. In 1 mode oregon another, the State managed to seizure them. Gold is the champion illustration of specified a non-sovereign plus that radical utilized arsenic wealth for the longest time, but it had evident onslaught vectors successful the signifier of assorted carnal limitations, i.e., hard to store, hard to unafraid and hard to move.

Historically speaking, determination has been a tug-of-war betwixt fiat and non-government monies. Therefore, the existent contented astatine manus is not 1 of “if” wealth volition abstracted from authorities control, but of “when.” With Bitcoin, I deliberation the infinitesimal is yet here.

Now evidently if this nonfiction has not managed to afloat person you however Bitcoin was designed to beryllium a genuinely antiauthoritarian and inclusive monetary strategy and if you inactive importune connected calling it a scam, I anticipation you’ll astatine slightest see it is thing worthy taking a harder look at.

This is simply a impermanent station by Ryan Bansal. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)