Analyzing the terms of cryptocurrencies connected Coinbase, particularly compared with different planetary exchanges, is indispensable for knowing its interaction connected planetary marketplace trends. Although the U.S. marketplace whitethorn not ever pb successful presumption of trading measurement oregon liquidity, the pricing connected Coinbase often sets a inclination that resonates crossed the planetary cryptocurrency market, underscoring the value of monitoring and analyzing its terms movements.

Coinbase’s predominantly retail capitalist basal makes it a precise utile gauge of retail sentiment successful the U.S. Being a regulated speech successful the U.S., Coinbase’s pricing is besides importantly influenced by regulatory developments, which is wherefore terms volatility connected the speech tin beryllium a proxy for governmental oregon regulatory events successful the country.

The word ‘premium’ refers to the terms quality of an plus crossed antithetic markets oregon exchanges. For cryptocurrencies, a premium connected Coinbase implies that the terms of a cryptocurrency, successful this lawsuit Bitcoin, is higher connected Coinbase compared to different speech specified arsenic Binance. This premium oregon premium spread is quantified by subtracting the terms of Bitcoin connected different speech from the terms connected Coinbase. A much comparative attack involves calculating the percent quality oregon the premium index, which provides a clearer presumption of the premium successful narration to the market.

The movements of the premium are captious successful knowing marketplace conditions. An expanding premium connected Coinbase tin suggest a surge successful buying enactment connected the platform, perchance owed to an influx of retail investors, oregon it could beryllium indicative of little liquidity connected Coinbase compared to different exchanges. Geographic factors, specified arsenic regulatory quality oregon fiat currency fluctuations affecting Coinbase’s predominantly U.S. idiosyncratic base, mightiness besides lend to an accrued premium. Conversely, a decreasing premium whitethorn signify an summation successful merchantability orders connected Coinbase, perchance by retail investors, oregon an betterment successful liquidity oregon competitory pricing from different exchanges. It could besides bespeak marketplace arbitrage, wherever traders bargain connected different exchanges and merchantability connected Coinbase, frankincense narrowing the terms gap.

Analyzing these premium movements tin assistance gauge marketplace sentiment and behavior. For example, a accordant premium could suggest beardown retail assurance among Coinbase users, whereas a diminishing premium mightiness bespeak a bearish sentiment oregon a displacement toward selling. These movements are often interpreted arsenic starring indicators of marketplace trends and arbitrage opportunities.

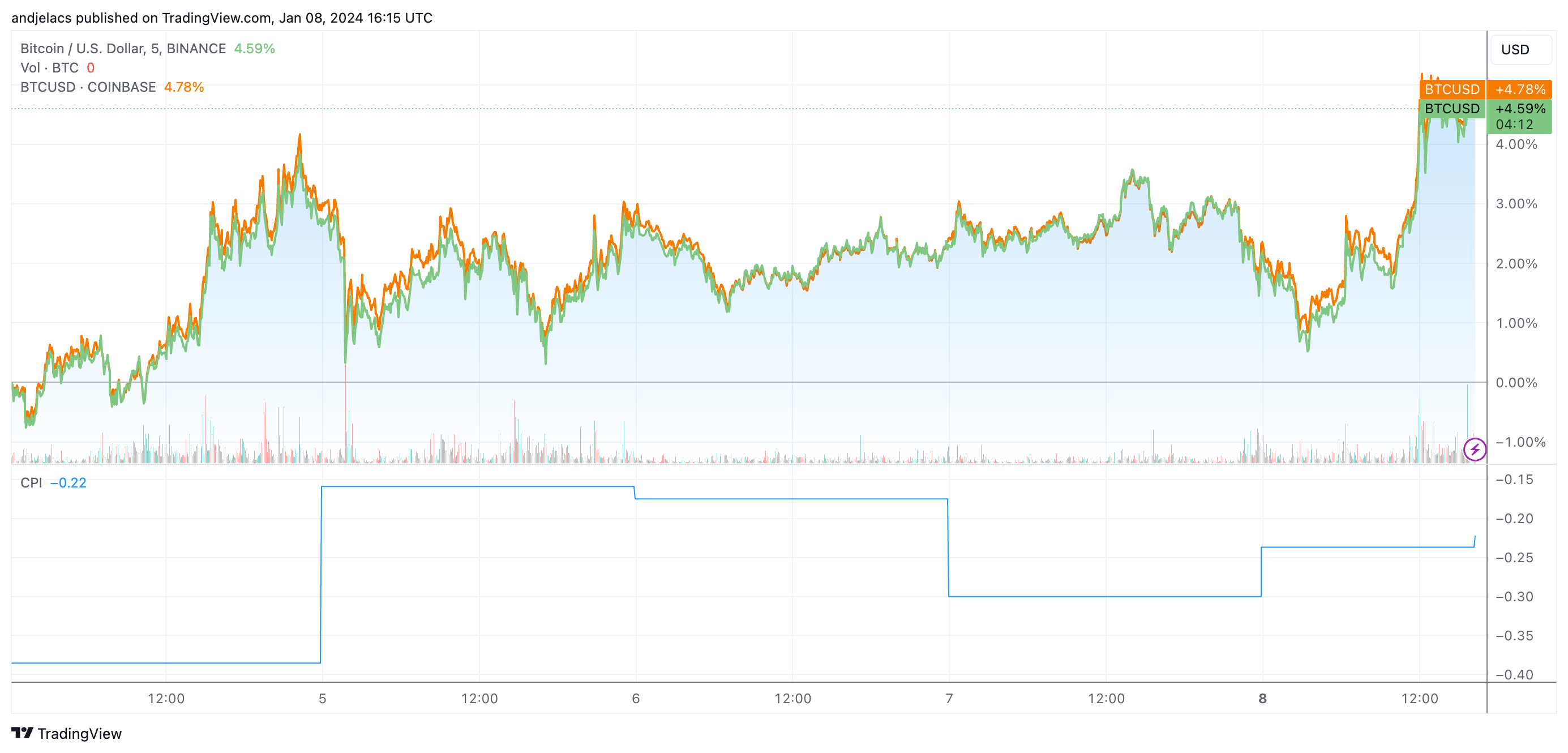

Analyzing Bitcoin’s terms question connected Coinbase and Binance shows that BTC/USD posted a 5-day summation of 4.78% connected Coinbase and 4.59% connected Binance connected Jan. 8. The somewhat higher summation connected Coinbase compared to Binance suggests a somewhat stronger buying unit coming from Coinbase users. This difference, though subtle, could bespeak heightened expectations among U.S. investors (Coinbase’s superior idiosyncratic base) regarding the imaginable approval of the spot Bitcoin ETF this week.

The Coinbase premium has been antagonistic passim the past 4th and has remained antagonistic into 2024 arsenic well. The antagonistic premium values bespeak that Bitcoin is trading astatine a somewhat little terms connected Coinbase compared to Binance. This is antithetic fixed the wide anticipation of a affirmative premium connected U.S.-based exchanges owed to regulatory compliance and capitalist profile. However, a person look astatine the premium inclination shows a notable decrease, with the premium shifting from -0.37 to -0.22 implicit a time and a half. This suggests the terms spread betwixt the exchanges is closing, astir apt owed to a increasing buying involvement connected Coibase oregon reduced selling unit compared to Binance.

Graph showing the 5-day terms show of BTC/USD connected Coinbase (orange) and Binance (green) and the Coinbase Premium Index (CPI) connected Jan. 8, 2023, 16:15 UTC (Source: TradingView)

Graph showing the 5-day terms show of BTC/USD connected Coinbase (orange) and Binance (green) and the Coinbase Premium Index (CPI) connected Jan. 8, 2023, 16:15 UTC (Source: TradingView)The wide summation successful the terms of Bitcoin connected some exchanges is apt reflecting marketplace optimism and speculative interest, peculiarly owed to the SEC’s upcoming determination connected the spot Bitcoin ETF. A affirmative determination is apt perceived arsenic a legitimizing origin for Bitcoin, arsenic the marketplace expects it to summation organization participation.

The gradual alteration successful the antagonistic premium suggests that Coinbase’s prices are dilatory aligning much intimately with Binance’s. This could mean that U.S. investors are cautiously optimistic, buying much Bitcoin successful anticipation but not arsenic aggressively arsenic planetary markets (possibly owed to regulatory concerns). It could besides mean that determination is simply a simplification successful selling unit connected Coinbase, perchance owed to holders waiting for the result of the SEC decision.

If the ETF gets approved, determination mightiness beryllium a abrupt displacement successful this trend, perchance triggering a surge successful buying connected Coinbase and starring to a affirmative premium. Conversely, a rejection could widen the antagonistic premium owed to a imaginable sell-off by disappointed investors.

The station The Coinbase premium is expanding up of the ETF appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)