Earlier successful the week, MicroStrategy announced it purchased $25 cardinal successful bitcoin (BTC) successful January. CEO Michael Saylor joined crypto podcast “UpOnly” to uncover the backmost communicative of his company’s determination to accumulate 125,051 bitcoin successful 2020 and 2021.

Founded successful the precocious 1980s by Saylor, MicroStrategy (MSTR) is simply a publically traded concern quality and bundle provider, but it is present amended known for the $4.7 cardinal successful bitcoin it holds connected its equilibrium sheet.

Before buying each that bitcoin, it was already 1 of the largest independent, publically traded companies successful its industry. In 2020, its gross was astir $480 cardinal and it had an enviable 8.29% EBITDA (earnings earlier interest, taxes, depreciation and amortization) borderline successful the trailing 12 months earlier its archetypal BTC purchase. When discussing the company's presumption during the “UpOnly” podcast, Saylor said, “It's profitable, that's what we are. We emotion it, we’ll support doing it. But you can't truly standard it.”

He past claimed that portion the institution was profitable, it wasn’t viable to reinvest profits into hiring sprees oregon expanding selling spending. That makes MicroStrategy a currency cattle that keeps collecting currency connected its equilibrium sheet.

That sounds similar a bully occupation to have, but it becomes a occupation if those accumulated dollars commencement diminishing successful worth due to the fact that of inflation.

The Federal Reserve’s effect successful 2020 to COVID-19 with monolithic quantitative easing helped propulsion the equities marketplace to caller highs, with investors favoring speculative maturation stocks specified arsenic Tesla (TSLA) and tech monopolies specified arsenic Apple (AAPL) and Amazon (AMZN). Soaring banal prices allows those companies to marque larger acquisitions and usage their valuations to grow their operations with historically inexpensive capital, sending their stocks higher again, rinse and repeat.

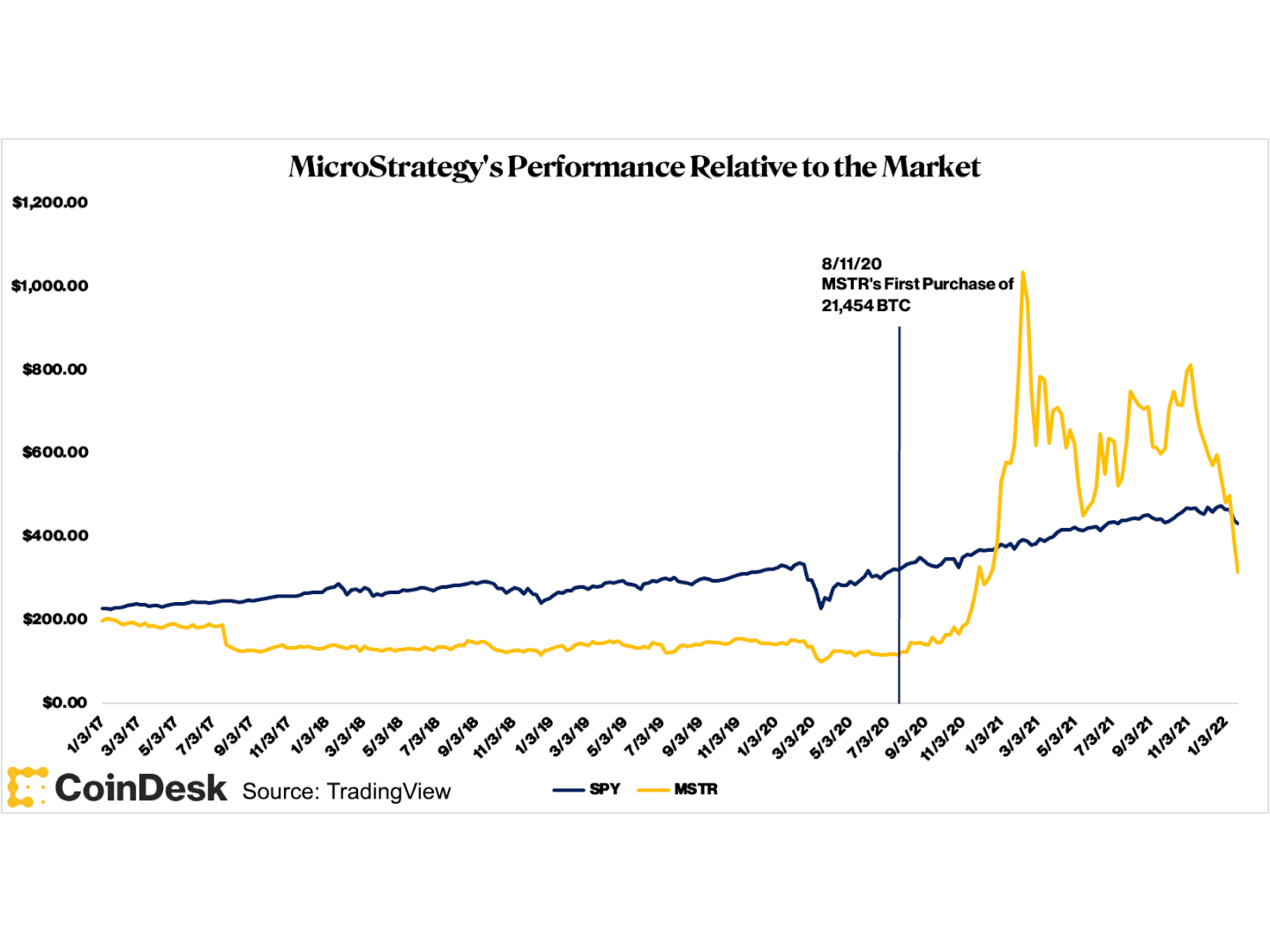

One banal that wasn’t rallying was MicroStrategy’s. In fact, it was a laggard for respective years adjacent earlier the pandemic hit. From the commencement of 2017 to the opening of March 2020, the S&P 500 was up astir 31% portion MicroStrategy shares fell 31%. The Federal Reserve’s pandemic QE effect didn’t alteration things for MicroStrategy. As the S&P 500 and galore maturation stocks approached the highs again conscionable 3 months aft March 2020’s crash, MicroStrategy’s banal continued to fall.

In 1 of his galore sailing analogies, Saylor likened his company’s show to rowing a vessel against upwind blowing harder than 1 tin row. Even worse, ostentation began to prime up and the purchasing powerfulness of currency cows was falling hard against the banal marketplace and against immoderate assets they mightiness buy. Thus, buying bitcoin was similar turning the rowboat astir and sailing with the wind.

On Aug. 11, 2020, MicroStrategy announced the acquisition of 21,454 bitcoins for $250 million. While Saylor considered the acquisition defensive, betwixt Aug. 10, 2020 and the archetypal week of 2021, the terms of MSTR banal roseate 263%, from $146.63 to $531.64.

(TradingView.com)

Since its archetypal bitcoin purchase, MicroStrategy hasn't slowed down. The institution has present purchased 0.66% of the full proviso of bitcoin astatine an mean terms of astir $30,000. The accumulation included purchases astatine $57,000, which present appears to beryllium adjacent the apical for this cycle.

Saylor acknowledged that MicroStrategy has developed a estimation for buying astatine section tops. If the company’s bitcoin thesis is correct, buying tops volition beryllium a portion of a strategy that could beryllium to beryllium precise profitable successful the agelong run, adjacent if the institution takes a short-term deed connected earnings. Under the mostly accepted accounting principles, a institution is required to instrumentality an impairment complaint connected a integer plus if the asset’s marketplace terms falls beneath the company’s acquisition price, portion nary summation tin beryllium realized until the plus is sold. So portion the numbers are deceiving, MicroStrategy took a $147 cardinal impairment complaint during past year’s 4th quarter.

More importantly, if each of its hopes cookware out, MicroStrategy whitethorn support its purchasing power, hedging against ostentation and perchance adjacent outperforming the broader banal market. In the past week, Saylor and MicroStrategy’s main fiscal serviceman person some assured the nationalist that they volition proceed to bargain bitcoin and usage it successful a productive mode that adds much worth for shareholders.

While galore knock bitcoin’s volatility and inclination to driblet by 50% seemingly connected a whim, Saylor appears to beryllium unconcerned. His effect to the disapproval is that either you tin dice a dilatory death, facing the blows of a devaluing dollar and a soaring banal market, oregon you tin fight. If bitcoin’s terms tin outpace inflation, it is simply a bully concern arsenic opposed to holding cash. While it whitethorn beryllium a agelong shot, if bitcoin’s adoption becomes wide successful the adjacent term, MicroStrategy volition person enactment itself successful a amended presumption than the immense bulk of nationalist companies.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)