The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

We’re presently successful the mediate of the manufacture contagion and marketplace panic taking shape. Although FTX and Alameda person fallen, galore much players crossed funds, marketplace makers, exchanges, miners and different businesses volition travel suit. This is simply a akin playbook to what we’ve seen earlier successful the erstwhile clang sparked by Luna, but that this 1 volition beryllium much impactful to the market. This is the due cleansing and washout from the misallocation of capital, speculation and excessive leverage that travel with the planetary economical liquidity tide going backmost out.

That said, everyone is speedy to leap connected the adjacent domino to fall. It’s natural. Most accusation surrounding equilibrium sheets and hidden leverage successful the strategy is chartless portion caller accusation and developments successful existent clip are flowing retired each fractional hour, it seems. Exchanges are nether the spotlight close present and the marketplace is watching their each determination and transaction. There’s apt nary speech that is going to beryllium arsenic egregious with lawsuit funds arsenic FTX and Alameda were, but we don’t cognize which exchanges tin oregon cannot past a slope run.

As shown by the market’s reaction, Crypto.com’s Cronos token (CRO), fell 55% successful a week earlier getting immoderate alleviation implicit the past day. There’s been a parabolic inclination of withdrawals — a slope tally — connected the speech implicit the past 2 days with the CEO doing the media rounds to guarantee everyone that withdrawals are processing good and that they volition survive.

Huobi token (HT) follows the aforesaid path, down astir 60% successful the past 2 weeks. Huobi precocious provided their list of assets connected the platform, showing astir $900 cardinal successful HT owned by some Huobi Global and Huobi users. It’s not wide what percent of that $900 cardinal is owned by Huobi Global, but it’s rather the haircut. Exchanges everyplace person been scrambling to supply immoderate mentation of impervious of reserves successful attempting to calm the market.

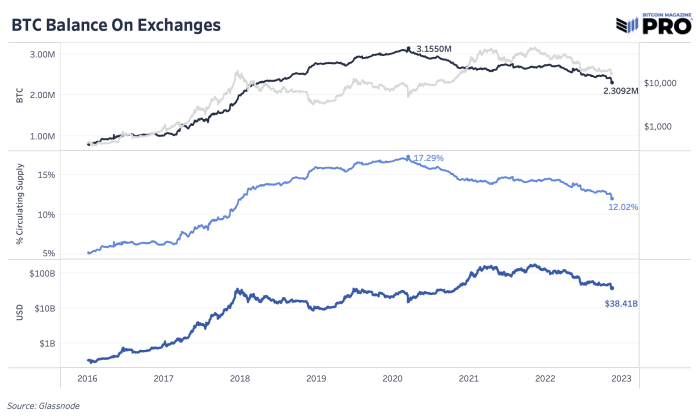

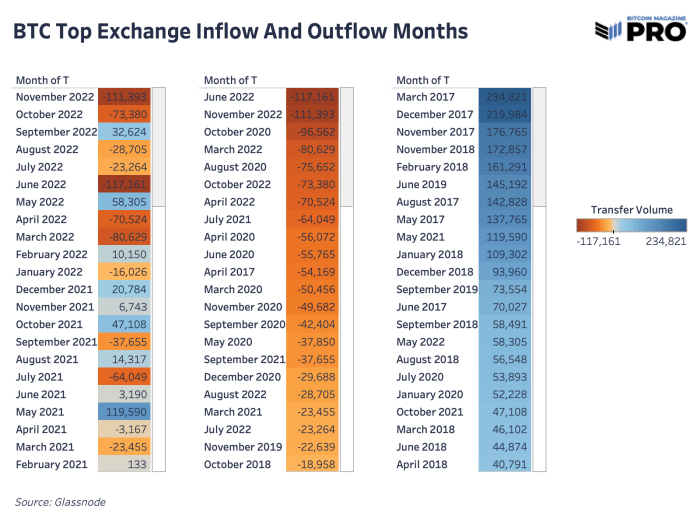

In presumption of bitcoin leaving exchanges, it’s been a akin inclination for the past 3 large marketplace panic events: the March 2020 COVID crash, the Luna clang and present the FTX and Alameda crash. Bitcoin flies disconnected exchanges arsenic speech and counterparty hazard becomes precedence No. 1 to mitigate. Overall, this is simply a invited inclination with implicit 122,000 bitcoin flowing retired of exchanges implicit the past 30 days. It’s the deficiency of transparency, spot and excessive leverage successful centralized institutions that person fueled the latest fall.

Having much of the bitcoin proviso successful self-custody is the mode to antagonistic this hazard successful the future. That said, assuming each of this bitcoin is going to self-custody and is intended to not travel backmost to the marketplace is simply a broad, improbable assumption. Likely, marketplace participants are taking immoderate precaution they tin careless if their intent is to store this bitcoin semipermanent versus sending it backmost to an speech aboriginal on.

In erstwhile times, bitcoin flowing successful and retired of exchanges was much of a awesome for price, but arsenic much insubstantial bitcoin, wrapped bitcoin connected different chains and bitcoin fiscal products person grown, bitcoin speech flows are much reflective of existent idiosyncratic trends contempt the past 2 large speech outflows marking section terms bottoms. Just 12.02% of bitcoin proviso lives connected exchanges today, down from its 2020 precocious of 17.29%. Although we’re lone halfway done the month, November 2022 is shaping up to beryllium the largest outflow period successful history.

The metallic lining of the industry’s largest-ever speech illness is that a wide consciousness of distrust successful counterparties and self-sovereign practices are acceptable to summation among buyers of bitcoin going forward. While galore person been speaking for implicit a decennary connected the value of idiosyncratic custody for the world’s archetypal decentralized integer bearer asset, it often fell connected deaf ears, arsenic fiscal institutions similar FTX seemed credible and trustworthy. Fraud assuredly tin alteration that.

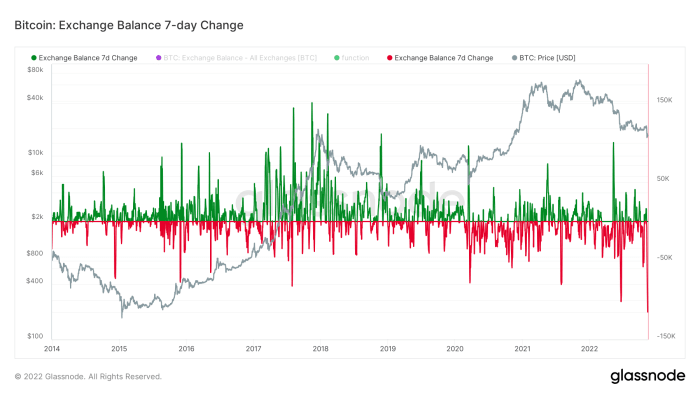

This dynamic, and the imaginable for greater amounts of contagion among the crypto space, has users fleeing to idiosyncratic custody, with this past week bringing successful the largest week-over-week diminution successful bitcoin connected exchanges astatine -115,200 BTC.

Interestingly enough, this sell-off was unsocial successful the consciousness that dissimilar erstwhile sell-offs successful caller years, it wasn’t triggered by a flood of bitcoin being sent to exchanges, alternatively moreso by an implosion of illiquid crypto collateral without galore (or successful the lawsuit of FTT, any) earthy buyers.

Given our immense absorption connected the risks of crypto-native contagion implicit the erstwhile six months, we highly urge our readers larn astir and look into the prospects of self-custody; if thing else, for the easiness of mind.

3 years ago

3 years ago

English (US)

English (US)