Are you keeping bitcoin connected an exchange?

Let maine archer you a communicative astir what happens erstwhile you, and others, permission your bitcoin connected exchanges. You mightiness beryllium amazed to perceive what that means for your holdings. It mightiness dependable a batch similar your own.

Let's telephone our quality Bill. Bill has been cautiously watching bitcoin for years, proceeding astir it successful passing and speechmaking a fewer articles. After inadvertently redeeming a batch of currency owed to lockdowns, helium decided to dive into bitcoin astatine last. A person told him to cheque retired Coinbase, Binance oregon different fashionable and “trusted” speech successful bid to bargain his archetypal chunk of bitcoin.

So, Bill created an relationship and uploaded his face, ID, societal information number, code and each different applicable item astir his beingness until helium yet reached the “Buy Bitcoin” screen. He picked up a fraction of a bitcoin, but aft each that trouble, helium thought to himself:

"I don't request to larn each these analyzable method details astir hardware wallets and self custody — I conscionable privation my bitcoin safe."

Bill reviewed the exchange's website and decided that the information experts astatine the exchange, with their wiz-bang acold retention and state-of-the-art encryption, would beryllium amended astatine securing his bitcoin than helium himself would be.

Bill was precise pleased with himself aft making that determination — not lone did this speech marque investing successful bitcoin simple, it gave him bid of caput knowing that idiosyncratic other was liable for keeping his assets harmless from immoderate benignant of theft oregon malicious activity. After all, wherefore should helium person to interest astir specified things erstwhile determination were professionals disposable who could grip them instead?

Bill has since go rather comfy with the thought of trusting exchanges with his bitcoin — his coins are present harmless from his ain mistakes!

When Trust Disappears: The Fall Of FTX

When Bill turned connected the quality 1 greeting and recovered retired that the monolithic crypto speech FTX had conscionable paused withdrawals and seemed to “accidentally” lose $10 billion, astir a 3rd of its marketplace cap, helium was shocked.

How could a steadfast with its logo connected the broadside of a major sports stadium and a CEO who appeared connected CNBC, Bloomberg and successful beforehand of the U.S. Congress(!) to speech astir integer assets and regularisation person mislaid — oregon apt stolen — truthful overmuch from close nether everyone's nose?

Now Bill was stuck betwixt a stone and a hard place. He was suspicious of his ain exchange, but mounting up his ain hardware wallet seemed truthful hard and scary. It would necessitate him to put successful a carnal device, get the indispensable cognition to unafraid it decently and support way of his effect operation backup. Even if helium figured retired the basics, determination was inactive the hazard of misplacing his instrumentality oregon improperly storing his backup and losing entree to his bitcoin.

FTX was shocking, but surely Bill's speech would ne'er behaviour itself the aforesaid way. People would spot it earlier it was coming, and he'd person clip to get out, right?

Reasons To Take Your Bitcoin Off Exchanges

It's wide that trusting your bitcoin to an speech brings with it the hazard that you'll log successful 1 greeting to find that your bitcoin conscionable isn't there. If you clasp your bitcoin yourself utilizing a hardware wallet, this can't happen.

However, there's different large crushed it's important to instrumentality your bitcoin disconnected exchanges: the bitcoin price.

How could aforesaid custody impact bitcoin's price? Everything successful economics says that buying and selling impact the marketplace terms for a good, not who holds it. However, aforesaid custody is precise important to terms — and it has to bash with thing I'll telephone “paper BTC.”

Introducing The Next Big Thing: Paper BTC

Let's look astatine however an speech works by considering a hypothetical speech called ExchangeCorp, owned and operated by a jolly entrepreneur named Bernie. ExchangeCorp built an uncomplicated mode to bargain bitcoin, and hired a squad of information experts to marque definite hackers are kept astatine bay. Over clip and done large selling campaigns, ExchangeCorp built spot with traders and investors, drafting galore successful to store their bitcoin connected the exchange.

When users support their bitcoin with ExchangeCorp, the CEO Bernie and his squad support power implicit those coins. Customers simply person a assertion connected their coins: they tin log successful and spot their equilibrium arsenic good arsenic petition to retreat their coins. However, if Bernie wants to transportation those coins owed to his customers to different Bitcoin addresses, he's technically capable to bash truthful without immoderate customer's permission.

When Bernie kicks up his feet and looks astatine the balances successful ExchangeCorp's vault, he's pleased to spot tens of thousands of bitcoin that his customers person deposited sitting pretty. Since ExchangeCorp is doing well, much bitcoin are ever coming successful than going out.

So Bernie gets a omniscient idea. He could lend retired immoderate of those lawsuit coins, gain immoderate interest, and get the coins backmost without anyone noticing. He would get richer, and the hazard of capable ExchangeCorp customers asking for withdrawals astatine 1 clip to gully its vault's monolithic equilibrium down to zero is miniscule. So Bernie loans retired thousands of coins present and determination to hedge funds and businesses.

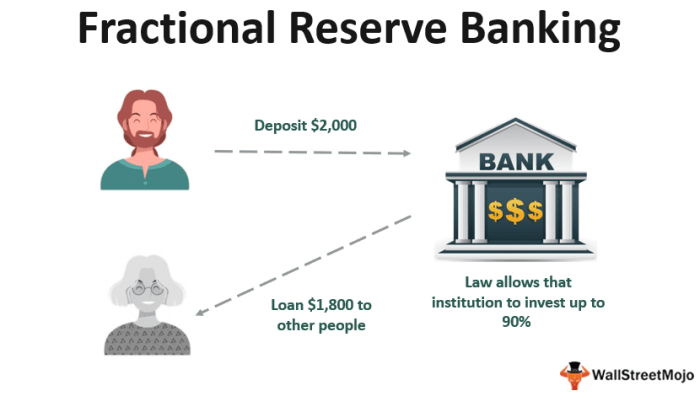

Source. Traditional banks are adjacent worse than ExchangeCorp. And from March 2020, they tin present lend retired 100% of your money!

Now there's different acceptable of claims to consider. Customers person a assertion connected their bitcoin astatine ExchangeCorp, but ExchangeCorp nary longer has the existent bitcoin — they lone person a assertion connected the coin they lent out. What customers present person is simply a assertion connected Paper BTC held by ExchangeCorp, with the existent bitcoin successful the hands of borrowers.

This is wherever things get weird. All of ExchangeCorp's customers inactive deliberation they person a nonstop assertion connected existent bitcoin held safely by ExchangeCorp. However, that existent bitcoin is successful information successful the hands of those who borrowed from ExchangeCorp, and those entities are selling it retired successful the market.

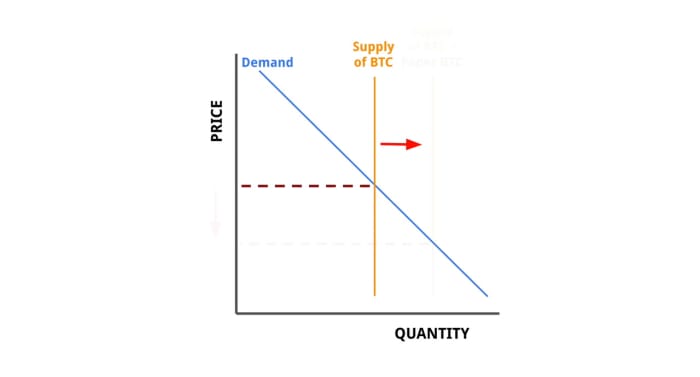

What happens erstwhile ExchangeCorp lends retired a ample quantity of the bitcoin its customers deposited? A batch of other bitcoin starts to interval astir successful the market, due to the fact that investors who deliberation they're holding existent bitcoin are lone holding insubstantial BTC. All of that other proviso of bitcoin successful the marketplace absorbs bargain pressure, which suppresses the terms of bitcoin.

Let's look astatine elemental proviso and request here:

When insubstantial BTC comes into the market, due to the fact that marketplace participants are unaware that this caller proviso is not existent bitcoin, it has the aforesaid effect arsenic expanding the proviso of existent bitcoin — until the fraud is uncovered.

Does this hypothetical communicative dependable thing similar the caller quality astir FTX?

The Paper BTC At The Center Of The FTX Fraud

The communicative of ExchangeCorp and Bernie is precisely the communicative of FTX and its laminitis Sam Bankman-Fried, with immoderate save-the-world complexes, survey drugs and polyamorous orgies redacted.

By lending retired lawsuit funds, FTX fundamentally inflated the proviso of bitcoin by taking vantage of the spot users placed successful FTX to safeguard their funds. FTX created tons of insubstantial BTC.

Just however overmuch insubstantial BTC mightiness FTX person created? We cannot beryllium definite of the nonstop amounts fixed its absolutely horrid bookkeeping, but the estimation beneath suggests FTX had 80,000 insubstantial BTC connected its books — bitcoin owed to customers that is not backed by existent bitcoin.

That would correspond a staggering 24% of the astir 330,000 caller bitcoin that were created implicit the past twelvemonth done the predictable mining issuance process. That is simply a ton of other bitcoin entering the marketplace that cipher — speech from a tiny radical of insiders astatine FTX — knew about!

It's intolerable to archer wherever the terms would person gone without that other bitcoin proviso entering the market, but we tin beryllium astir definite that the terms would person climbed higher than it did successful 2021.

While the FTX illness is caller and inactive unfolding, past has a fewer cautionary tales to archer astir the dangers of insubstantial assets and terms manipulation. The communicative of gold's nonaccomplishment to defy centralized capture, for instance, tin archer america wherever Bitcoin is headed if we proceed to spot exchanges and 3rd parties to clasp our bitcoin for us.

The Fall Of Gold

Gold was erstwhile utilized successful regular transactions — it takes nary much than a sojourn to a depository of past past to spot the collections of aged golden coins erstwhile circulating successful section markets. The accepted presumption of the demise of golden arsenic a transactional currency was that it became excessively cumbersome oregon excessively invaluable to proceed to relation good arsenic a means to bargain groceries and beer.

However, this communicative omits a fewer cardinal components that lone uncover themselves erstwhile we hint the improvement that societies took from golden coins to insubstantial bills and integer slope accounts.

Centuries ago, banks started taking customer’s golden successful speech for slope notes — giving customers a measurement of information for their golden and a much convenient means of transacting. However, entrusting a slope with your precious metallic meant the slope was capable to lend it retired oregon marque atrocious investments without the depositor’s consent. When a slope was caught betwixt atrocious loans and a high complaint of depositor withdrawals, they had to state bankruptcy and unopen down — leaving galore depositors penniless, holding insubstantial claims connected golden present worthy thing astatine all.

Then cardinal banks came on to “fix” the occupation of bankrupt banks leaving depositors penniless. Central banks held golden for radical and commercialized banks, giving them banknotes from the cardinal slope arsenic receipts for their gold. By 1960, cardinal slope authoritative holdings accounted for about 50% of each aboveground golden stocks, with their banknotes circulating freely. Commercial banks and individuals didn’t mind, since each enactment was convertible to a acceptable value of golden by the cardinal slope that issued it.

Notice the enactment successful the precocious left? This $5 Federal Reserve enactment — besides known arsenic a $5 measure — is redeemable successful gold. Source

This would person worked well, but that cardinal banks — particularly the Federal Reserve successful the U.S. — started creating much bills than they had golden to back. Creating much bills than the Fed had golden to backmost was fundamentally creating insubstantial gold, since each measure was a assertion connected gold. Doing this successful concealed meant the Fed was manipulating the terms of gold, fixed the other circulating proviso which the marketplace was not alert of. When galore depositors of golden astatine the Federal Reserve — similar the French government — started questioning the Fed’s golden holdings and creating the threat of a tally connected gold successful the U.S., the U.S. authorities had to intervene.

In 1971, this came to a caput with the Nixon shock. One night, President Nixon announced the U.S. would temporarily halt allowing depositors to commercialized successful their Federal Reserve notes for the golden they promised.

This impermanent halt successful withdrawals was ne'er lifted. Since each currencies were connected to golden done the U.S. dollar nether the Bretton Woods agreement, the Nixon Shock meant that the full satellite went disconnected the golden modular astatine once. All currencies were present conscionable pieces of paper, alternatively of notes giving the holder a assertion connected a quantity of gold.

This was lone achievable due to the fact that gold, implicit time, was deposited into commercialized banks and past to cardinal banks. Once cardinal banks held astir of the gold, they could manipulate the terms of golden and region it wholly from regular commerce. Everyday radical chose the convenience of insubstantial notes implicit the information of holding gold, and paid the price.

Instead of a neutral wealth backed by a precious metallic that is hard to excavation up and intolerable to synthesize, currencies became casual to people and frankincense highly politicized. Keeping the dollar astatine the apical of the nutrient concatenation nary longer required restraint and bully stewardship to guarantee its backing successful gold. Instead, it required subject expeditions and beardown policing to guarantee planetary governments and citizens continued to usage the dollar to transact.

A instrumentality to golden astatine this constituent would beryllium impractical — the world’s commercialized networks span excessively large a region with transactions happening astatine excessively precocious a speed. With insubstantial currency and yet integer banking systems, what we gained successful velocity and convenience we mislaid successful soundness and neutrality. We mislaid our savings, our societal cohesion and our governmental institutions arsenic a result.

Preventing Bitcoin's Fall

Taking your bitcoin disconnected of your speech is not conscionable bully signifier for your ain security, it's protecting the terms of your bitcoin arsenic well. Our freedoms beryllium connected individuals having power implicit their ain wealth. When we entrust our wealthiness to companies oregon states, we spell down the way we witnessed with gold.

Thanks to bitcoin’s divisibility and integer nature, it overcomes the hurdles that held golden backmost from supporting our modern, interconnected economy. Bitcoin tin enactment a planetary marketplace, but it volition lone get determination if we each clasp our ain bitcoin.

Don’t fto the banksters and bureaucrats manipulate the terms of your bitcoin: instrumentality it disconnected the speech and get it connected your ain hardware wallet.

This is simply a impermanent station by Captain Sidd. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

2 years ago

2 years ago

English (US)

English (US)