NFTs are becoming progressively utilized for wealth laundering, portion lavation trading continues to plague the emerging market.

As caller and breathtaking usage cases for NFTs emerged, truthful did their imaginable for abuse, revealed a caller study by Chainalysis.

The blockchain probe and investigation institution investigated 2 forms of illicit enactment successful the NFT market–wash trading and wealth laundering–uncovering worrying stats.

Wash traders collectively made $8.9 cardinal successful profit

Wash trading implies fictitious income successful which the seller is connected some sides of the transaction–a signifier intended to deceive the market, aka imaginable buyers, into believing determination is simply a precocious request for the asset–inflating its price.

NFT lavation traders are making their integer collectibles look much invaluable by selling them to caller wallets, which they concern themselves.

As Chainalysis pointed out, astir NFT trading platforms let users to commercialized by simply connecting their wallet, without further recognition needed, which greatly facilitates this signifier of abuse.

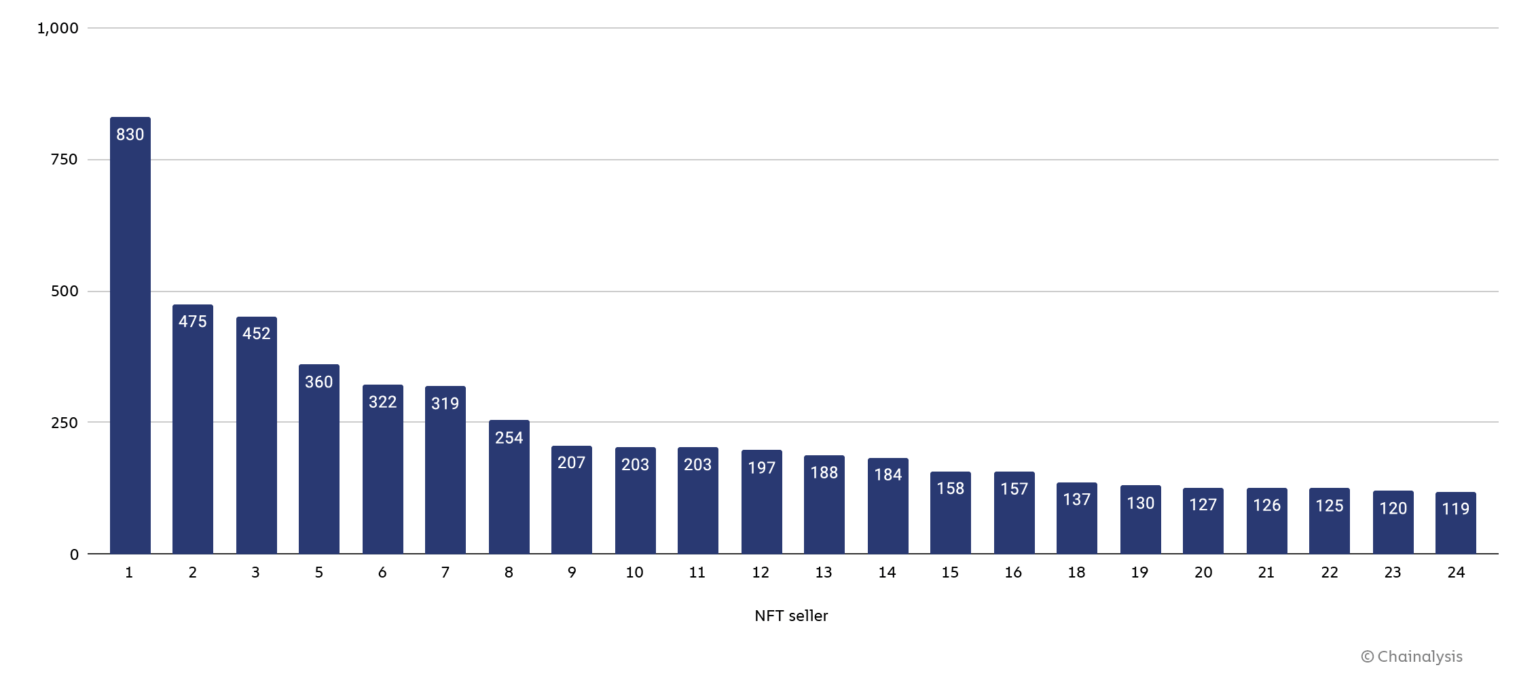

The study dove into NFT income to self-financed addresses and uncovered that immoderate NFT sellers person executed hundreds of lavation trades.

NFT sellers by fig of income to self-financed addresses successful 2021 (Chainalysis)

NFT sellers by fig of income to self-financed addresses successful 2021 (Chainalysis)NFT lavation trading tin beryllium tracked by analyzing income of NFTs to addresses that were self-financed–meaning funded by the selling code oregon by the code that funded the selling address.

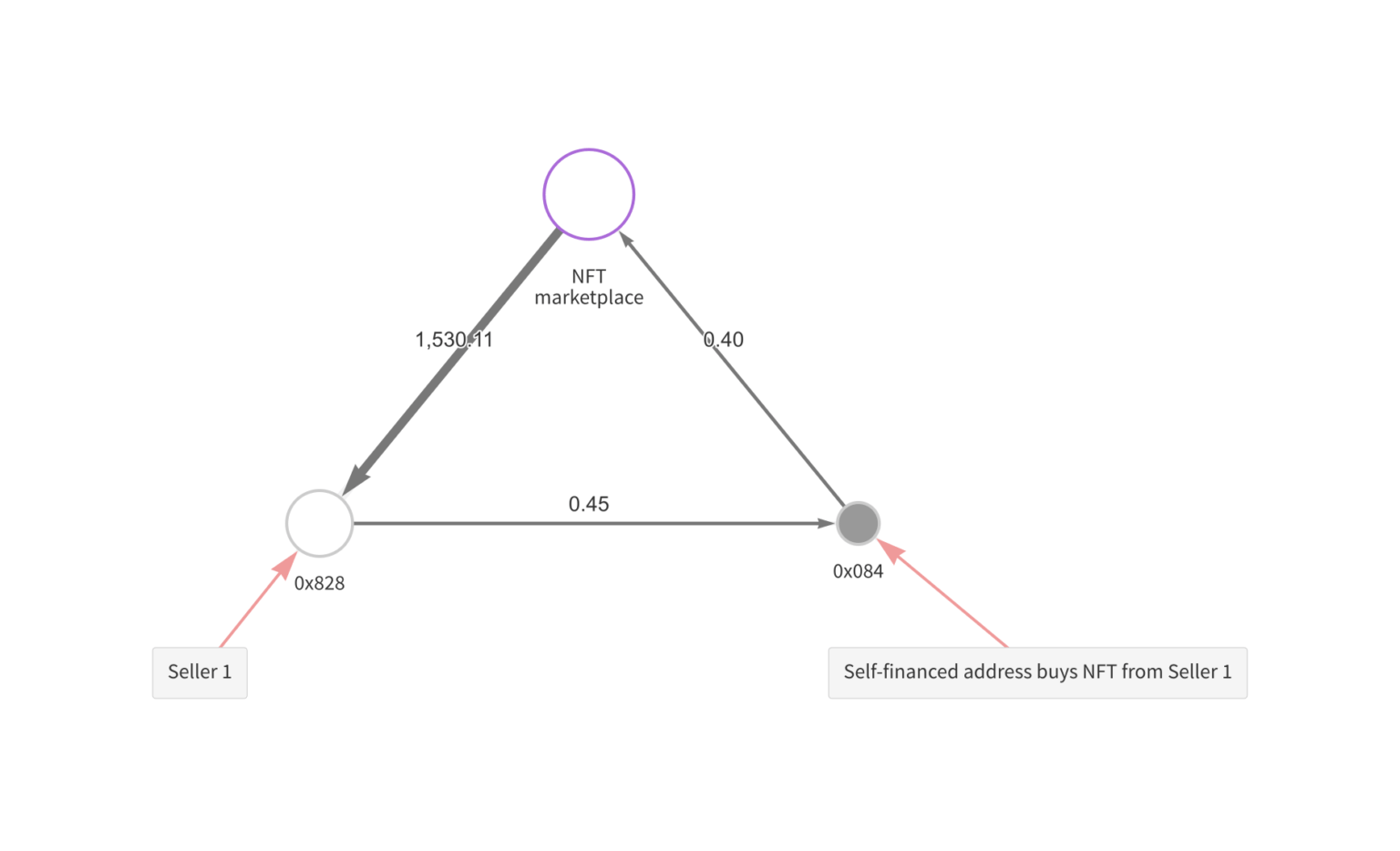

Reactor showing that code 0x828 sent 0.45 Ethereum to the code 0x084 soon earlier the NFT merchantability (Chainalysis)

Reactor showing that code 0x828 sent 0.45 Ethereum to the code 0x084 soon earlier the NFT merchantability (Chainalysis)Using blockchain analysis, Chainalysis identified 262 users who sold an NFT to a self-financed wallet much than 25 times. Their wide profits were further calculated by subtracting the magnitude they’ve spent connected state fees from the magnitude they’ve made selling NFTs.

“Most NFT lavation traders person been unprofitable, but the palmy NFT lavation traders person profited truthful overmuch that, arsenic a whole, this radical of 262 has profited immensely overall,” work the report.

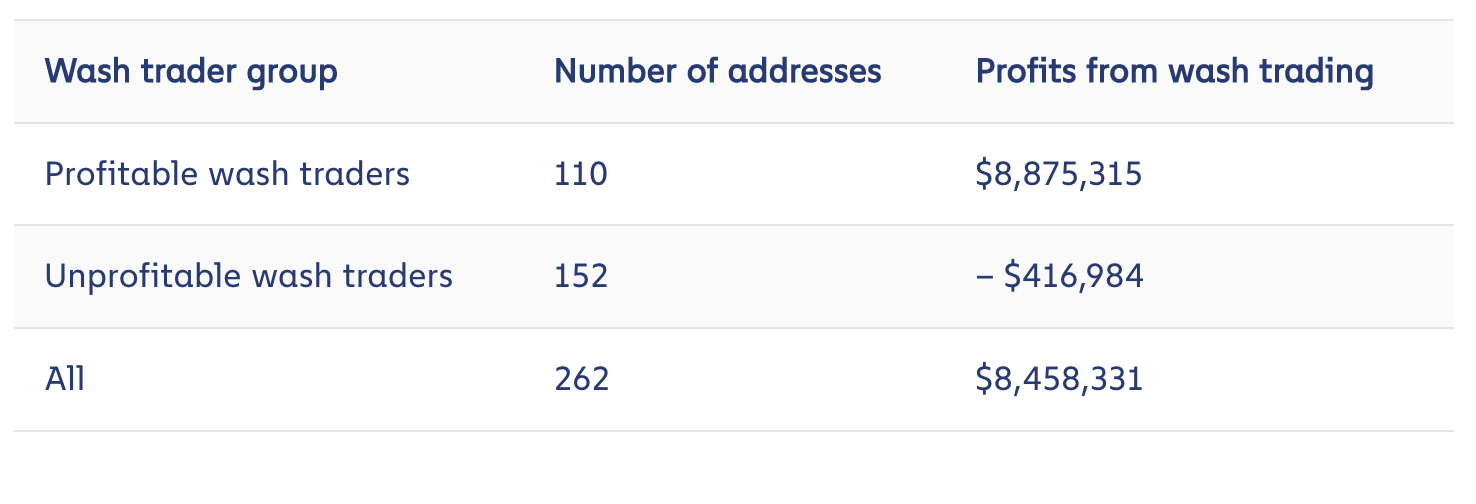

NFT lavation traders and their profits/losses (Chainalysis)

NFT lavation traders and their profits/losses (Chainalysis)The applied investigation lone captured trades made successful Ethereum and Wrapped Ethereum, pointed retired Chainalysis, adding that the appraisal of lavation trading could beryllium considered conservative.

The 110 profitable lavation traders collectively amassed astir $8.9 cardinal successful profit, trivializing the $416,984 successful losses made by the 152 unprofitable lavation traders.

“Even worse, that $8.9 cardinal is astir apt derived from income to unsuspecting buyers who judge the NFT they’re purchasing has been increasing successful value, sold from 1 chiseled collector to another,” the study concluded.

Blockchain information and investigation facilitates identifying this benignant of abuse, and arsenic Chanalysis pointed out, “marketplaces whitethorn privation to see bans oregon different penalties for the worst offenders.”

NFTs are becoming progressively utilized for wealth laundering

Although not arsenic important arsenic lavation trading, the usage of NFTs for wealth laundering is connected the rise, revealed the 2nd portion of the report.

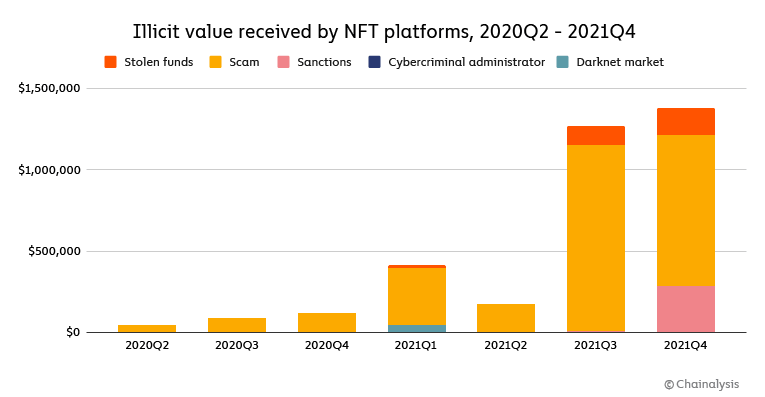

The information shows that illicit funds are becoming progressively progressive successful NFT purchases–with worth sent to NFT marketplaces by flagged addresses jumping importantly successful the 3rd 4th of 2021, crossing $1 million.

Cybercriminals utilizing illicit funds to acquisition NFTs: Value done clip (Chainalysis)

Cybercriminals utilizing illicit funds to acquisition NFTs: Value done clip (Chainalysis)The worth further accrued successful the 4th quarter, reaching astir $1.4 million.

In some quarters, the biggest information of this enactment came from scam-associated addresses sending funds to NFT marketplaces to marque purchases.

Both quarters besides saw important amounts of stolen funds sent to marketplaces.

Meanwhile, addresses with sanctions hazard became progressively progressive successful Q4–a bump straight connected to P2P cryptocurrency speech Chatex, which was indicted and sanctioned for engagement successful ransomware operations.

Although connected the rise, this enactment inactive represents “a driblet successful the bucket”–compared to the $8.6 cardinal worthy of cryptocurrency-based wealth laundering Chainalysis tracked successful 2021.

“Nevertheless, wealth laundering, and successful peculiar transfers from sanctioned cryptocurrency businesses, represents a ample hazard to gathering spot successful NFTs, and should beryllium monitored much intimately by marketplaces, regulators, and instrumentality enforcement,” the study concluded.

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)