Ethereum’s power to proof-of-stake is scheduled for mid-September. What are the imaginable risks? How does it enactment compared to Bitcoin’s proof-of-work consensus?

The beneath is simply a afloat escaped nonfiction from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

The Merge

On September 15, Ethereum is readying to acquisition its long-promised “Merge,” wherever the protocol volition displacement from a PoW (proof-of-work) statement mechanics to a PoS (proof-of-stake) statement mechanism.

In this report, we volition supply details connected however the proof-of-stake mechanics works for Ethereum, utilizing method definitions provided from Ethereum documents. Second, we volition measure the determination to proof-of-stake from archetypal principles, which volition see an mentation arsenic to wherefore overmuch of the reasoning for the determination is perchance flawed. Last, we volition screen the hazard factors of the Ethereum PoS mechanics comparing and contrasting the governance to Bitcoin and a PoW statement mechanics to articulate the cardinal differences betwixt the systems.

This portion was partially inspired by Glassnode’s Lead Analyst, Checkmate’s latest enactment connected Why The Ethereum Merge is simply a Monumental Blunder.

The Basics

With the displacement successful statement mechanisms, Ethereum shifts its artifact accumulation distant from GPU (graphics processing unit) miners implicit to staking validators.

Validators: “To enactment arsenic a validator, a idiosyncratic indispensable deposit 32 ETH into the deposit declaration and tally 3 abstracted pieces of software: an execution client, a statement client, and a validator. On depositing their ether, the idiosyncratic joins an activation queue that limits the complaint of caller validators joining the network. Once activated, validators person caller blocks from peers connected the Ethereum network. The transactions delivered successful the artifact are re-executed, and the artifact signature is checked to guarantee the artifact is valid. The validator past sends a ballot (called an attestation) successful favour of that artifact crossed the network.” - Ethereum.org

Validators instrumentality the relation of artifact accumulation distant from miners, and importantly, transportation the powerfulness operation distant from existent satellite vigor input (in the signifier of hashes) towards capital, successful the signifier of staked ether.

Security: “The menace of a 51% onslaught inactive exists connected proof-of-stake arsenic it does connected proof-of-work, but it's adjacent riskier for the attackers. An attacker would request 51% of the staked ETH (about $15,000,000,000 USD). They could past usage their ain attestations to guarantee their preferred fork was the 1 with the astir accumulated attestations. The 'weight' of accumulated attestations is what statement clients usage to find the close chain, truthful this attacker would beryllium capable to marque their fork the canonical one. However, a spot of proof-of-stake implicit proof-of-work is that the assemblage has flexibility successful mounting a counter-attack. For example, the honorable validators could determine to support gathering connected the number concatenation and disregard the attacker's fork portion encouraging apps, exchanges, and pools to bash the same. They could besides determine to forcibly region the attacker from the web and destruct their staked ether. These are beardown economical defenses against a 51% attack.” - Ethereum.org

The Ethereum website claims that the information volition beryllium stronger successful a PoS statement strategy alternatively than a PoW statement system, but we see this to beryllium highly controversial.

While a proof-of-work protocol relies purely connected economical incentives and existent satellite carnal constraints to unafraid the concatenation against attackers successful the signifier of an attack, PoS relies connected “social governance” done slashing to effort to support stakers honest. To clarify further, to 51% onslaught the Bitcoin web (to execute a treble spend), an attacker would request entree to an immense magnitude of carnal infrastructure and vigor resources successful the signifier of ASIC miners, electrical infrastructure, and (cheap) energy, earlier an onslaught is adjacent attempted. To headdress it each off, immoderate hypothetical attacker that does summation entree to these things volition rapidly recognize it is much economical to simply beryllium an honorable miner.

With proof-of-stake, stakers are kept honorable done slashing, wherever hostile peers spot their ether get destroyed (for actions specified arsenic proposing aggregate blocks successful the aforesaid slot oregon violating consensus). Similarly, successful the lawsuit of imaginable censorship by a ascendant bulk of stakers (more connected this later), determination is an enactment for a number brushed fork. To quote Vitalik Buterin,

“For other, harder-to-detect attacks (notably, a 51% conjugation censoring everyone else), the assemblage tin coordinate connected a number user-activated brushed fork (UASF) successful which the attacker's funds are erstwhile again mostly destroyed (in Ethereum, this is done via the "inactivity leak mechanism"). No explicit "hard fork to delete coins" is required; with the objection of the request to coordinate connected the UASF to prime a number block, everything other is automated and simply pursuing the execution of the protocol rules.”

Miner Extractable Value (MEV)

MEV is an abbreviation of “Miner Extractable Value” that has precocious changed to “Maximal Extractable Value” which refers to the profits that tin beryllium made by extracting worth from Ethereum users done artifact production.

Given the immense fiscal exertion ecosystem built connected Ethereum, determination is often an arbitrage accidental successful the ordering of transactions. The producers of blocks tin reorder, sandwich (the enactment of front-running a ample order, lone to usage their marketplace bid arsenic exit liquidity to nett from the spread), oregon censor transactions wrong blocks being produced. It typically affects DeFi users interacting with automated marketplace makers and different apps.

Treasury Sanctions And The Looming Threat Of OFAC Regulations

Last week, the U.S. Treasury announced that Tornado Cash was added to the U.S. OFAC (Office of Foreign Assets Control) SDN database (the database of specially designated nationals with whom Americans and American businesses are not allowed to transact). The sanctions placed connected Tornado Cash were peculiarly notable due to the fact that they were placed not connected an idiosyncratic individual oregon peculiar integer wallet address, but alternatively the usage of a astute declaration protocol, which successful the astir basal signifier is conscionable information. The precedent acceptable by these actions are not perfect for open-source bundle development.

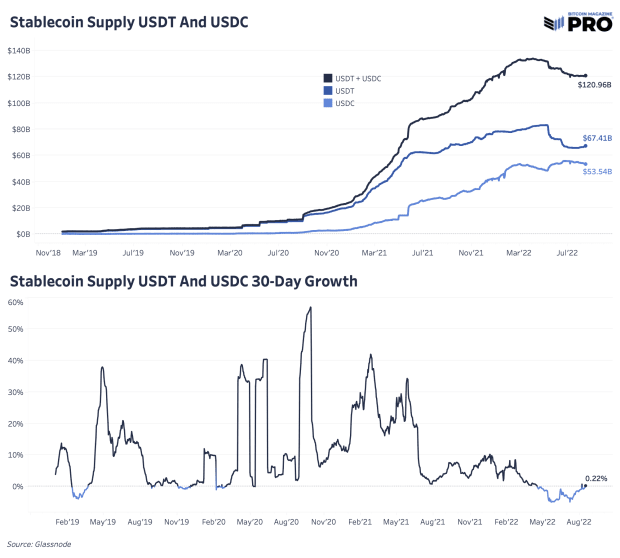

Regardless of the ineligible and law precedent of the move, the effect from stakeholders crossed the Ethereum and DeFi ecosystems was the biggest eyeopener. Merely hours aft the Treasury added Tornado Cash to the SDN list, Circle, issuer of $53.5 cardinal stablecoin USDC, had updated its blacklist to see each sanctioned code and astute contract, officially disbanding holders of USDC from interacting with the protocol, and adjacent seizing a tiny magnitude of funds.

USDT and USDC stablecoin supply

USDT and USDC stablecoin supply

Circle released the pursuing connection pursuing the move,

“Circle is simply a regulated institution that created, and present manages and issues 1 of the largest dollar integer currencies successful the world. As such, we conform with sanctions and compliance requirements, and person done truthful for years, due to the fact that gathering a faster, safer, and much businesslike mode to determination worth globally requires trust, and due to the fact that it’s the law. That spot has helped USD Coin (USDC) turn tremendously successful the past fewer years and has established USDC crossed the integer plus system globally.” - Circle blog

This acceptable disconnected a concatenation absorption successful the DeFi ecosystem, wherever overmuch of the infrastructure that had been built connected apical of / astir USDC, portion it had present go progressively evident that this wasn’t a sustainable semipermanent solution for supposedly decentralized finance. MakerDAO

In particular, determination began to beryllium an expanding magnitude of interest astir DeFi protocol MakerDAO, which leverages the Ethereum blockchain to make an over-collateralized soft-pegged stablecoin utilizing blockchain-based collateral.

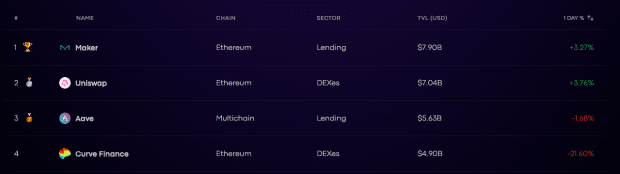

Lending platforms and alleged "decentralized" exchanges

Lending platforms and alleged "decentralized" exchanges

Despite the galore flaws of utilizing TVL (total worth locked) arsenic a measure, Maker’s spot atop the database for DeFi protocols is telling. Within an ecosystem that saw explosive maturation station 2020, Maker’s emergence was among the astir meteoric.

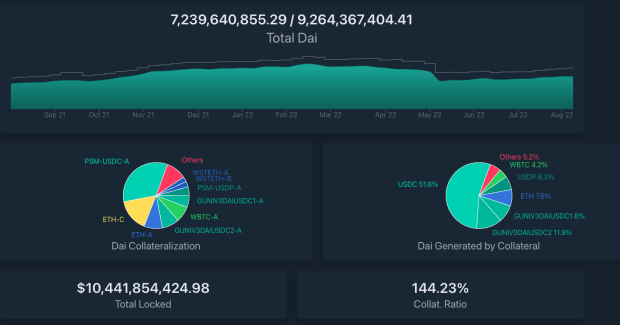

MakerDAO allows users to make DAI (an algorithmic stablecoin) by depositing collateral assets into Maker Vaults, which has go progressively reliant connected USDC.

At the clip of writing, Maker has astir $10.44 cardinal successful assets locked successful its vaults, with $7.23 cardinal of DAI issued against that collateral.

(Source)

(Source)

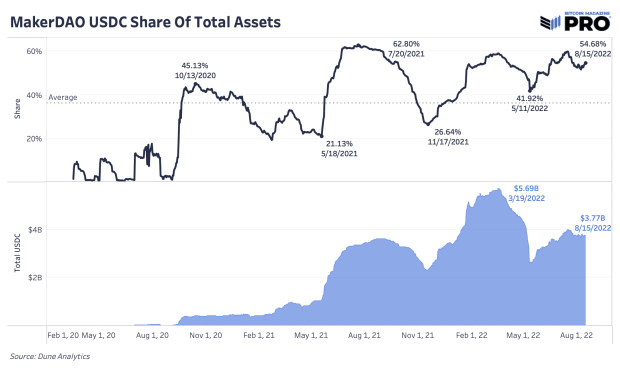

Shown beneath is the percent of MakerDAOs collateral that is USDC on with the aggregate USDC worth successful the pane below:

MakerDAO's USDC stock of full assets

MakerDAO's USDC stock of full assets

It is problematic erstwhile the instauration of a alleged decentralized fiscal gyration is truthful reliant connected collateral that’s the liability of a cardinal issuer.

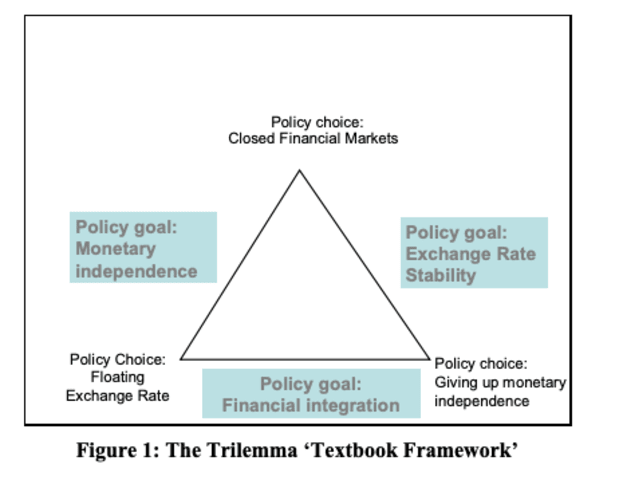

However, you can’t truly blasted Maker for its reliance connected USDC. They are attempting to lick an economical occupation that has existed for centuries. As a effect of attempting to peg DAI to $1, the architects of MakerDAO faced the classical currency peg trilemma. Economic past has shown that it is lone imaginable to execute 2 of 3 desired argumentation outcomes astatine 1 time:

- Setting a fixed currency speech rate

- Allowing superior to travel freely with nary fixed currency speech complaint agreement

- Autonomous monetary policy

(Source)

(Source)

In the lawsuit of DAI, MakerDAO’s algorithmic stablecoin, the options are similar, but the caller Treasury sanctions and consequent compliance connected behalf of Circle has led MakerDAO to question its expanding reliance connected USDC:

The trilemma successful Maker’s lawsuit is the following:

- Maintain USD peg

- Abandon stablecoins arsenic collateral

- Scale MakerDAO

Maker tin lone take 2 of the 3 options.

With the caller developments with USDC, it seems similar Maker is considering the second two, with the effect being the abandonment of the USD peg for DAI. With this decision, the thought was floated to person each USDC into ETH, fixed the bearer plus quality of the cryptocurrency plus comparative to the tokenized liability of Circle, a centralized instauration regulated by the U.S. government.

This led to a effect from Vitalik Buterin, which highlighted the risks of backing an algorithmic stablecoin with volatility collateral (albeit overcollateralized arsenic it presently stands).

This is simply a ample occupation for the DeFi abstraction successful general. How bash you physique a decentralized ecosystem of borrowing/lending, erstwhile the precise happening that is successful the astir request to beryllium borrowed is simply a permissioned “off-chain” plus (the U.S. dollar)? Algorithmic stablecoins are possible, but necessitate over-collateralization and permission users prone to the hazard of borderline calls/liquidation if the terms of the pledged collateral drops.

The progressively realized menace of censorship and regulations coming done the tube means that DeFi arsenic it is known today, with ample reliance connected centralized stablecoins arsenic collateral, is vulnerable.

To punctuation Lyn Alden,

“Stablecoins are useful, but centralized. And by extension, they centralize immoderate web that is overly reliant connected them.”

Additional Infrastructure Censorship

Shortly aft the Treasury announcement and blacklists from Circle, cardinal Ethereum infrastructure task Infura, which allows for users/apps to link to the Ethereum blockchain, began to block RPC (remote process call) requests to Tornado Cash. Infura is the work supplier for the most-used wallet exertion successful Ethereum, MetaMask, among different applications. Infura is the largest node supplier successful the Ethereum ecosystem, and adjacent though precocious users way astir the prohibition utilizing their ain clients, the marginal idiosyncratic is simply not astatine that level of method competency.

Following the Tornado Cash incident, laminitis and CEO of Coinbase Brian Armstrong spoke retired astir the sanctions from the U.S. Treasury, citing the atrocious precedent that comes with sanctioning a exertion alternatively than a nonstop idiosyncratic oregon entity. He followed the disapproval by stating,

“Hopefully evident point: we volition ever travel the law.”

The Centralization Problem With PoS Ethereum

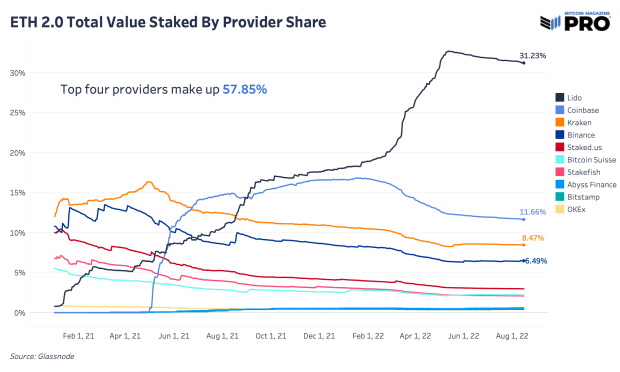

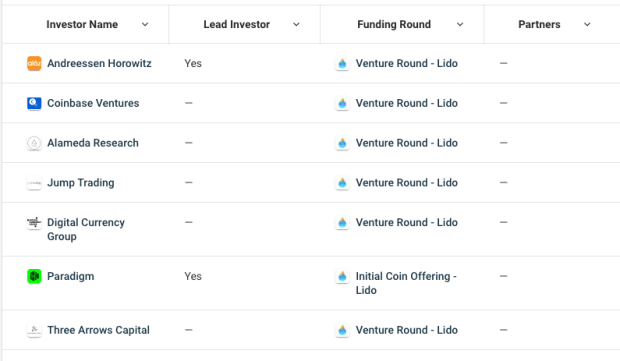

While Ethereum proponents and developers volition assertion that the power to PoS makes Ethereum overmuch much decentralized and resistant to hostile attack, the empirical grounds points to an expanding magnitude of staking centralization, which tin pb to immoderate ample problems. At the clip of writing, 57.85% of ether is being staked with 4 providers, with Lido holding by acold the largest marketplace share.

Total worth of ETH 2.0 staked by platform

Total worth of ETH 2.0 staked by platform

Lido is simply a liquid staking solution which allows users to involvement their ether (and forgo the 32 ETH threshold for smaller holders) successful speech for stETH token, which is simply a assertion that tin beryllium redeemable for ether astatine immoderate constituent successful the future.

By design, existent stakers of ether cannot unstake their coins, adjacent straight aft the Merge takes place, with Ethereum roadmap estimates suggesting the imaginable enabling of withdrawals from staking validators astatine immoderate constituent successful 2023.

The afloat codification enabling withdrawals post-Merge has not yet been completed.

Given that the withdrawals to unstake ETH is not yet an enactment for users, a liquid staking solution specified arsenic Lido (which is acold and distant the marketplace leader) is an highly charismatic enactment for users who privation to person entree to their coins to trade/hedge/collateralize their ETH.

In a erstwhile contented of ours, Celsius and stETH - A Lesson connected (il)Liquidity, we wrote astir the one-way dynamic of stETH redeemability:

“stETH is simply a token issued by Lido which provides users a work wherever they are capable to fastener immoderate magnitude of ETH successful speech for the stETH token, which tin beryllium rehypothecated successful DeFi to gain yield, service arsenic collateral, etc. This contrasts to different forms of ETH staking wherever your assets are not liquid.” - Celsius and stETH - A Lesson connected (il)Liquidity.

(Liquid) Staking looks to beryllium a winner-take-all (or most) dynamic, wherever users take the work that has the smoothest idiosyncratic experience, the astir liquid secondary marketplace (ETH to stETH is presently a one-way marketplace until PoS withdrawals are enable, but users tin swap successful the secondary market), and the astir charismatic interest gross (more connected this later). These are conscionable immoderate of the reasons that Lido’s proof-of-stake marketplace stock is arsenic ample arsenic it is.

The Growing Risks Of Lido

In a blog post written connected Ethereum.org by Danny Ryan, a pb researcher for the proof-of-stake rollout for the Ethereum Foundation, Ryan highlighted the expanding risks that centralization of involvement successful Lido could pb to for Ethereum:

“Liquid staking derivatives (LSD) specified arsenic Lido and akin protocols are a stratum for cartelization and induce important risks to the Ethereum protocol and to the associated pooled superior erstwhile exceeding captious statement thresholds. Capital allocators should beryllium alert of the risks connected their superior and allocate to alternate protocols. LSD protocols should self-limit to debar centralization and protocol hazard that tin yet destruct their product.

“In the extreme, if an LSD protocol exceeds captious statement thresholds specified arsenic 1/3, 1/2, and 2/3, the staking derivative tin execute outsized profits compared to non-pooled superior owed to coordinated MEV extraction, block-timing manipulation, and/or censorship – the cartelization of artifact space. And successful this scenario, staked superior becomes discouraged from staking elsewhere owed to outsized cartel rewards, aforesaid reinforcing the cartel’s clasp connected staking.”

In Ryan’s words, risks beryllium if a staking solution grows to clasp a captious magnitude of involvement successful a PoS system, owed to the quality to usage coordinated MEV (miner extractable value), and/or the quality to censor definite actors/transactions astatine a whim.

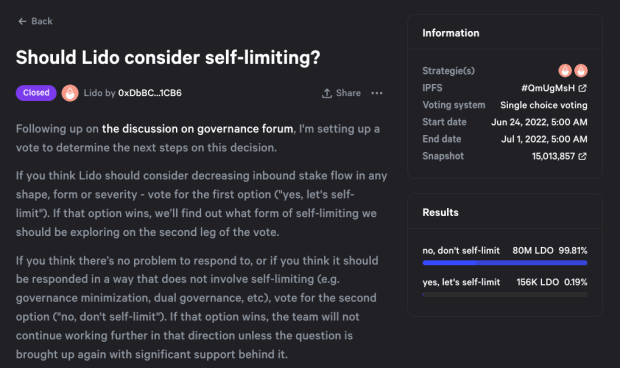

Ryan’s suggestion, to person the liquid staking protocol self-limit to debar centralization and protocol risk, was enactment up to ballot by Lido via the governance token LDO.

Votes conducted with the LDO governance token is however cardinal Lido decisions are made.

A ballot for LDO holders was taken to self-limit the staking stock for Lido, with the canvass starting connected June 24 and concluding connected July 1. The ballot was conducted connected Snapshot, a fashionable instrumentality for DAOs (decentralized autonomous organizations) connected Ethereum to behaviour protocol voting/governance.

The results?

A 99% landslide for choosing to not self-limit by LDO holders.

(Source)

(Source)

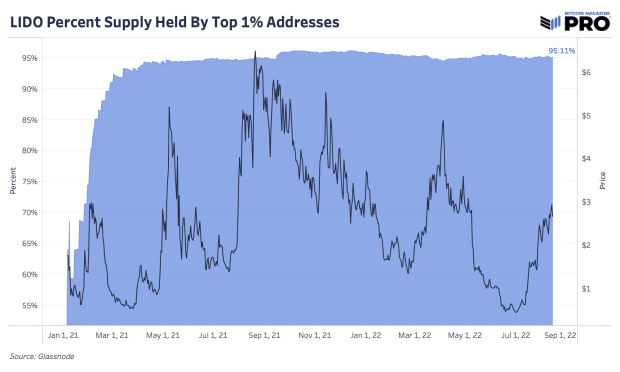

The landslide ballot shouldn't travel arsenic a surprise, fixed that 95.11% of LDO tokens are held wrong the apical 1% of addresses, astir of which are U.S.-regulated task capitalist (VC) firms.

LIDO proviso held by apical 1% of addresses

LIDO proviso held by apical 1% of addresses

(Source)

(Source)

Given that Lido governance is indirectly controlled by large task capitalist firms, of which astir run nether U.S. jurisdictions, ETH has a increasing centralization problem.

When summing up the magnitude of staked ETH crossed Lido, Coinbase, Kraken, and Staked alone, 56.57% of staked ETH presently resides successful work providers straight oregon indirectly nether the jurisdiction of the U.S. government.

Circling backmost to the Merge arsenic a statement change, bash you retrieve the cardinal alteration that Ethereum is undertaking to spell from a proof-of-work to a proof-of-stake network?

Block accumulation is moving from a work conducted by miners to validators.

This means that validators, those who are staking 32 ETH, are the ones successful complaint of the artifact accumulation of the Ethereum network. The hazard for Ethereum arsenic good arsenic the centralized work providers, is that unit from U.S. authorities to censor astatine the protocol level. Referring backmost to Buterin’s post, the Ethereum assemblage successful effect to censorship from centralized entities would brushed fork, to delete the “attacker’s” stake:

“For other, harder-to-detect attacks (notably, a 51% conjugation censoring everyone else), the assemblage tin coordinate connected a number user-activated brushed fork (UASF) successful which the attacker's funds are erstwhile again mostly destroyed (in Ethereum, this is done via the "inactivity leak mechanism"). No explicit "hard fork to delete coins" is required; with the objection of the request to coordinate connected the UASF to prime a number block, everything other is automated and simply pursuing the execution of the protocol rules.”

The occupation with this strategy is that owed to the ample DeFi/L2 ecosystem built astir Ethereum implicit the years, immoderate dissident fork (rebelling against OFAC compliance) would apt suffer its ecosystems of stablecoins and trusted oracles.

Fork Ethereum without the backing of USDC, and a daisy concatenation of DeFi liquidations begins arsenic the non-compliant fork present has USDC-forked tokens that are intrinsically worthless, sparking a monolithic contagion effect / borderline telephone scenario.

Bitcoin underwent a akin trial successful 2017 with the fork wars, wherever a monolithic propulsion was made by representatives from implicit 50 companies attending a meeting, notoriously referred to arsenic the New York Agreement, to grow the artifact size of Bitcoin, which was a required alteration successful consensus.

Individual users of bitcoin revolted against specified changes, fixed the precedent that coordinated hard forks and changing statement rules would have, and alternatively implemented a brushed fork that enabled the aboriginal build-out of scaling solutions specified arsenic the Lighting Network. The cardinal quality betwixt the fork projected by the New York Agreement conspirators and the ones activated by a ample fig of mean bitcoin users was that the erstwhile was a connection to hard fork, portion the second was an opt-in brushed fork, meaning that statement is inactive backwards-compatible for nodes that did not upgrade.

In Ethereum's lawsuit today, the expanding encroachment of imaginable aboriginal censorship astatine the artifact accumulation level would not necessitate different fork, different than the 1 that is already planned for the Merge today. The fork would beryllium connected the dissident users, who are pushing for an open, censorship-resistant future.

The chiseled quality betwixt what Bitcoin accomplished successful 2017 versus what Ethereum whitethorn precise good look successful the aboriginal is that a ample information of its ecosystem would apt beryllium mislaid on the mode fixed the dependence connected centralized stablecoins specified arsenic USDC successful its DeFi ecosystem.

PoS Slashing Hypothetical

Let’s database a elemental hypothetical and spot however it whitethorn play out. The U.S. authorities imposes accrued regulations connected Circle, the USDC issuser. They suggest to bounds transactions from a database of associated Ethereum addresses. Centralized U.S. companies that are Ethereum staking validators indispensable adhere to these regulations by rejecting blocks with these transactions oregon blacklisting addresses. If they bash not, they volition look accrued scrutiny, fines, sanctions, etc.

The projected Ethereum solution is slashing by consensus. Slashing would destruct a percent of the validator’s ETH involvement forcing them to reconsider their atrocious censorship actions. Yet, statement needs to travel from a bulk of nodes portion the bulk of staked ETH already sits with these centralized validators (and cannot beryllium withdrawn arsenic of now).

By not having much solo validators and nodes, statement would beryllium with these larger centralized groups and not with the bulk of ETH users. In the scenario, centralized groups wouldn’t person the inducement to bravely combat against authorities regulations. While users, who person staked their ETH with these centralized institutions, would not person the inducement to privation to slash their ain ETH holdings successful the sanction of censorship resistance.

Other ETH users and nodes tin propulsion against this to unit a imaginable number fork oregon UASF (user-activated brushed fork). However this would apt travel astatine the disbursal of losing Circle and overmuch of the developed DeFi infrastructure that has been built connected Ethereum implicit the past fewer years.

In an adversarial scenario, fixed the precedent acceptable by Circle past week, is determination a morganatic lawsuit to beryllium made for Circle not choosing the OFAC-compliant chain/fork?

We should beryllium wide that we unequivocally bash not enactment the sanctioning of astute contracts, base-level censorship, oregon imposed top-down authorities power implicit the mediums of connection oregon economical value.

All we are aiming to bash is airs what we presumption are morganatic questions. Bitcoin, Ethereum, and broadly the cryptocurrency marketplace astatine ample are attempting to instrumentality the issuance and power of wealth distant from the state.

History shows that determination volition beryllium a vested involvement successful controlling/co-opting this endeavor.

Never-Ending Forks

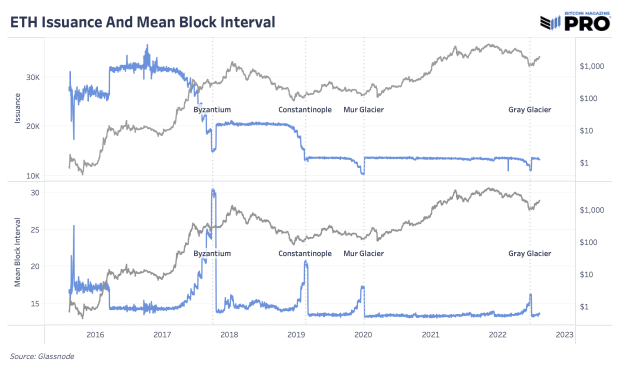

Throughout Ethereum’s history, there’s been a fig of important hard forks and updates by plan to make an ever-evolving protocol. Many of these changes person included changes to trouble bombs to propulsion backmost imaginable Merge dates and altering proviso issuance implicit clip to beryllium progressively disinflationary. Proponents of Ethereum reason this makes ether “ultra-sound” money, which is paradoxical fixed that the soundness of wealth is derived from the inability to beryllium changed/altered/diluted successful immoderate way, particularly for governmental purposes.

Hard forks and large updates astatine the halfway of Ethereum’s strategy is astir the nonstop other of Bitcoin’s. Updates and changes to the statement protocol person changed arsenic the narratives and imaginativeness of what Ethereum should beryllium has changed. While this whitethorn beryllium charismatic for its idealist users/proponents, this leaves Ethereum’s governance to beryllium taxable to aboriginal politics.

With the rising uncertainty and risks of beingness station the PoS Merge, each we tin expect is for hard forks and large updates to continue. For many, this is charismatic arsenic the Ethereum assemblage volition enactment to physique caller solutions and analyzable protocol designs depending connected what large situation they face. Yet for others, Ethereum arsenic an plus and protocol look similar an engineering experimentation that is lacking existent stability.

ETH issuance and mean artifact interval

ETH issuance and mean artifact interval

10/16/2017: Byzantium update, “A hard fork is simply a alteration to the underlying Ethereum protocol, creating caller rules to amended the system. The protocol changes are activated astatine a circumstantial artifact number. All Ethereum clients request to upgrade, different they volition beryllium stuck connected an incompatible concatenation pursuing the aged rules.”

02/28/2019: Constantinople update, “The mean artifact times are expanding owed to the trouble weaponry (also known arsenic the “ice age”) dilatory accelerating. This EIP proposes to hold the trouble weaponry for astir 12 months and to trim the artifact rewards with the Constantinople fork, the 2nd portion of the Metropolis fork.”

1/2/2020: Muir Glacier update, “The mean artifact times are expanding owed to the trouble weaponry (also known arsenic the “ice age”) and dilatory accelerating. This EIP proposes to hold the trouble weaponry for different 4,000,000 blocks (~611 days)”

8/5/2021: EIP-1559 - London hard fork, “A transaction pricing mechanics that includes fixed-per-block web interest that is burned and dynamically expands/contracts artifact sizes to woody with transient congestion.”

12/8/21: Arrow Glacier Update, “The Arrow Glacier web upgrade, likewise to Muir Glacier, changes the parameters of the Ice Age/Difficulty Bomb, pushing it backmost respective months. This has besides been done successful the Byzantium, Constantinople and London web upgrades. No different changes are introduced arsenic portion of Arrow Glacier.”

6/29/2022: Gray Glacier Update, “The Gray Glacier web upgrade changes the parameters of the Ice Age/Difficulty Bomb, pushing it backmost by 700,000 blocks, oregon astir 100 days. This has besides been done successful the Byzantium, Constantinople, Muir Glacier, London and Arrow Glacier web upgrades. No different changes are introduced arsenic portion of Gray Glacier.”

Near-Term Market Outlook

Lastly, we antecedently highlighted conscionable however leveraged and speculative the Ethereum derivatives marketplace is close now. Reaching implicit 100% from its lows successful June, ETH has been riding the Merge hype portion acting arsenic precocious beta to bitcoin (which has been precocious beta to equities). Traders person piled successful going agelong into the Merge. There’s nary uncertainty that the Merge communicative has helped to determination terms upwards implicit the past 2 months. But it perfectly indispensable beryllium noted that ETH has conscionable been pursuing the way of broader equities and risk.

Over the past fewer days, those relationships person been breaking down and ETH, on with bitcoin, are showing signs of weakness astatine cardinal breakout terms areas. The marketplace looks to beryllium astatine 1 of its astir pivotal points of the rhythm crossed a imaginable carnivore marketplace rally conclusion, the Merge successful 4 weeks and a September FOMC gathering successful the aforesaid month.

Final Note

Our presumption is that with the advent of bitcoin, the Byzantine Generals’ Problem (otherwise known arsenic the double-spend problem) recovered an engineering solution. With the operation of proof-of-work and a dynamic trouble adjustment, humanity had astatine past figured retired however to store and determination worth successful a trustless mode crossed the internet. The system’s statement mechanics is secured by a web of autarkic node runners, operating a bundle that is arsenic simple, robust and resilient arsenic technically possible, successful bid to bootstrap a caller decentralized monetary strategy from the crushed up against the interests of the world's astir almighty institutions.

We judge that ether arsenic an plus and Ethereum arsenic a level are thing antithetic entirely, and galore of the design/engineering decisions made by the assemblage person led it to perchance go susceptible to seizure successful the future.

From an idealist constituent of view, an effort to conception a caller permissionless infrastructure of fiscal applications utilizing Ethereum is novel, but the rationalist successful america believes that the narratives of existent decentralized infrastructure and “ultra-sound” monetary properties are much of a selling gimmick than reality.

“Governments are bully astatine cutting disconnected the heads of a centrally controlled networks similar Napster, but axenic P2P networks similar Gnutella and Tor look to beryllium holding their own.” — Satoshi Nakamoto, November 7, 2008

3 years ago

3 years ago

English (US)

English (US)