PRESS RELEASE. Tallinn, 20th June 2023 – Rollman Mining, arsenic the fiscal scenery continues to evolve, capitalist portfolios indispensable accommodate to changing times. The emergence of cryptocurrencies has captured the attraction of fiscal experts and media outlets who suggest that allocating a information of your portfolio to cryptocurrencies tin heighten diversification and perchance boost returns. In this article, we volition research the conception of portfolio improvement and delve into wherefore cryptocurrencies, arsenic recommended by starring portfolio experts, should marque up betwixt 5% and 20% of your concern portfolio.

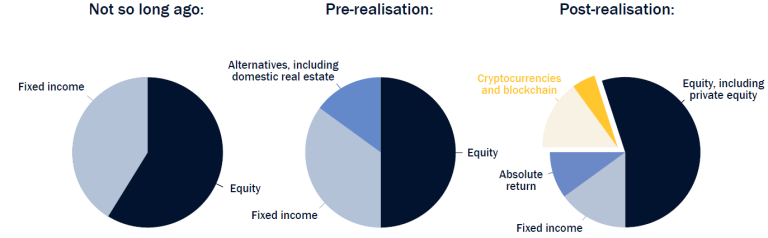

The improvement of capitalist portfolios? Pre and post-realisation

The Changing Landscape of Investor Portfolios

Traditionally, capitalist portfolios consisted of a premix of stocks, bonds, and cash. However, arsenic technological advancements and caller plus classes emerge, the request to accommodate and diversify becomes progressively vital. Leading portfolio experts, person recognized the imaginable benefits of including cryptocurrencies successful concern portfolios. This acknowledgment reflects the shifting mindset among investors, arsenic they question to harness the advantages offered by this innovative plus class.

Understanding the Significance of Cryptocurrencies

Cryptocurrencies, specified arsenic Bitcoin and Ethereum, person gained important traction and mainstream designation successful caller years. These integer assets run connected blockchain technology, offering decentralized and unafraid transactions. The imaginable for precocious returns and the quality to hedge against accepted marketplace risks person made cryptocurrencies an appealing concern option.

Enhancing Diversification with Cryptocurrencies

Diversification is simply a cornerstone of dependable concern strategy, aiming to trim hazard and maximize returns. Many starring portfolio experts advocator for including cryptocurrencies successful portfolios to execute optimal diversification. By adding cryptocurrencies to a premix of accepted assets, specified arsenic stocks and bonds, investors tin entree an plus people with debased correlation to the broader market. This debased correlation provides a imaginable hedge against marketplace volatility and tin assistance creaseless retired the wide show of the portfolio.

Capturing the Growth Potential

Cryptocurrencies person demonstrated singular maturation potential, with important returns generated implicit the past decade. While this marketplace is known for its volatility, the imaginable rewards tin beryllium important for those who clasp it wisely. Leading portfolio experts admit this maturation imaginable and urge allocating a information of your portfolio to cryptocurrencies arsenic a means to seizure these opportunities. By doing so, investors presumption themselves to payment from the innovative technologies and disruptive imaginable of blockchain-based assets.

Mitigating Risk with a Balanced Approach

While cryptocurrencies connection breathtaking maturation prospects, it’s important to attack their inclusion successful a portfolio with a balanced perspective. An allocation betwixt 5% and 20% to cryptocurrencies, allowing investors to enactment successful the imaginable upside portion inactive maintaining a diversified portfolio. This balanced attack helps mitigate the risks associated with the volatility inherent successful the cryptocurrency market.

Staying Informed and Educated

Investing successful cryptocurrencies requires a coagulated knowing of the marketplace dynamics and associated risks. Leading portfolio experts stress the value of staying informed and educated astir this evolving plus class. By conducting thorough research, engaging with reputable sources, and consulting with fiscal advisors, investors tin marque informed decisions and navigate the cryptocurrency marketplace with confidence.

The Future of Finance: Embracing Digital Transformation

The inclusion of cryptocurrencies successful concern portfolios goes beyond specified diversification. It reflects a broader inclination of embracing integer translation successful the fiscal industry. As blockchain exertion and cryptocurrencies proceed to mature, they person the imaginable to disrupt assorted sectors, including finance, proviso concatenation management, and more. By allocating a information of your portfolio to cryptocurrencies, you presumption yourself astatine the forefront of this integer revolution, embracing the aboriginal of concern and capitalizing connected the transformative powerfulness of innovative technologies.

Thesis – the lawsuit for accepted and alternative

We judge that adding this caller alternate concern to a well-diversified accepted portfolio erstwhile actively managed volition amended the benefits of diversification astatine immoderate level due to the fact that a portfolio with alternate assets tends to person a little hazard for a fixed level of instrumentality than the benchmark portfolio consisting solely of mega-cap stocks and bonds. A portfolio with low-correlated assets is an businesslike mode to hedge against marketplace volatility and provides a higher instrumentality successful the abbreviated and agelong term.

Diversification plays an indispensable relation successful a portfolio’s construction. It helps investors allocate superior successful a mode that is limiting the vulnerability to a azygous asset’s risk, unsystematic risk. The rationale down this hazard absorption strategy is that a well-diversified portfolio consisting of low-correlated multifarious assets volition make a semipermanent higher instrumentality with mitigating unsystematic risk. In general, low-correlated assets successful a portfolio are an businesslike mode to hedge against marketplace volatility and provides a higher instrumentality successful the agelong term.

The lawsuit for crypto and blockchain strategies

Schopenhauer defines the 3 stages of immoderate gyration arsenic Ridiculous, Frightening and past Obvious. The nascent crypto and blockchain ecosystem is successful its Spring, burgeoning astatine a brisk pace, and present exhibits characteristics of each 3 stages. We expect disruption successful astir industries, with a gyration for those dealing successful transfer, storage, and accretion of value. A multi-trillion-dollar ecosystem volition apt beryllium built with cryptocurrencies and connected the blockchain. Growth and strategy inefficiencies abound and tin beryllium harvested via galore precocious yielding strategies. Better yet, these returns amusement manageable cross-correlations and negligible correlations with accepted assets, allowing the instauration of portfolios with superior risk/return characteristics. Yes, the blockchain ecosystem is young, volatile, and contains circumstantial threats. Nevertheless, this blockchain ecosystem holds fantastic imaginable for the agelong presumption investor. The Rollman Mining strategies question to seizure these returns successful the astir blimpish mode by making this gyration of passive income disposable to everyone.

About Rollman Mining

Rollman Mining is simply a salient steadfast specializing successful Bitcoin mining, hosting, and management. With a Retail and Institutional division, Rollman Mining delivers exceptional Bitcoin mining solutions astatine competitory rates. The institution was founded by a radical of seasoned professionals successful finance, trading, engineering, information science, operations, and hazard management. This experienced squad has a proven way grounds successful the manufacture and antecedently established Rollman Capital, which is recognized arsenic Luxembourg’s archetypal organization plus manager, offering divers concern opportunities crossed stocks, forex, commodities, indices, cryptocurrencies, and their passive income avenue, Lending.

About Victor R. Ch. Rollman

Victor is presently the CEO of Rollman Mining, a Bitcoin mining steadfast specialised successful accessible organization people Bitcoin mining and Rollman Capital, a Luxembourg based Hedge Fund. He has been educating and advising accepted concern professionals astir cryptocurrency and blockchain concern technologies. Prior to that, helium was managing a multi- strategy portfolio, including stocks, forex, commodities, indices and cryptocurrencies. Victor was besides progressive successful a wide scope of industries arsenic a serial entrepreneur, from real-estate projects successful Belgium to the energy marketplace successful the Netherlands. With implicit 20 years of concern acquisition analysing planetary fiscal markets, 12 years successful early-stage ventures, and 10 years wrong the crypto and blockchain space, Victor’s quality to make and oversee precocious instrumentality portfolios successful the €50m to €100m scope is top-tier.

Find retired much astir Rollman Mining:

This is simply a property release. Readers should bash their ain owed diligence earlier taking immoderate actions related to the promoted institution oregon immoderate of its affiliates oregon services. Bitcoin.com is not responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful the property release.

2 years ago

2 years ago

English (US)

English (US)