The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

November FOMC Meeting

All eyes crossed planetary markets are connected the November FOMC meeting. At this constituent successful the planetary liquidity cycle, seemingly each plus people is portion of the aforesaid implicit trade. The pugnacious speech from the Fed, the cardinal slope of the dollar indebted world, has held up truthful acold successful 2022, arsenic they embark upon the fastest tightening rhythm successful modern history.

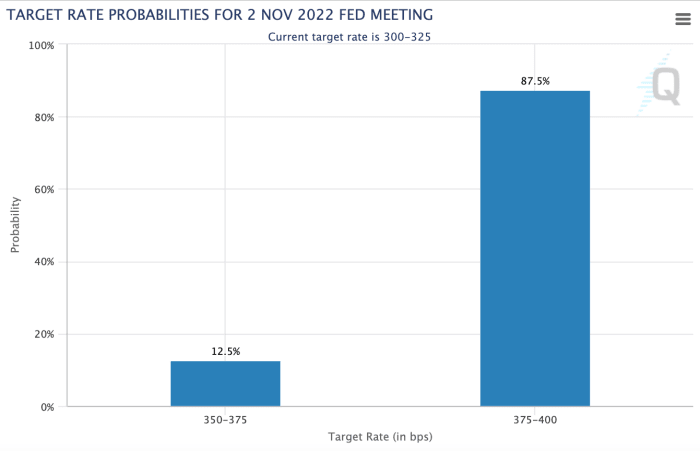

Consensus for the size of the complaint hike is 75bps, which would rise the argumentation complaint to 4.00%.

Consensus for the size of the complaint hike is 75bps, which would rise the argumentation complaint to 4.00%.

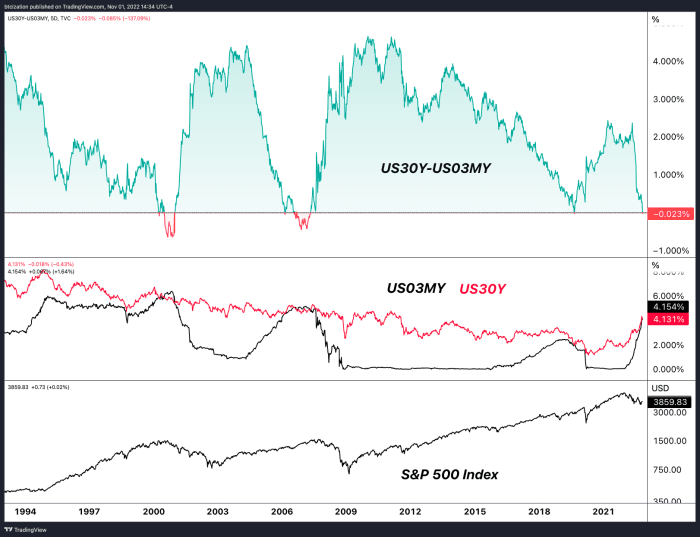

Much of this hiking has already priced itself into the beforehand extremity of the U.S. Treasury curve, which has led to each sorts of inversions crossed assorted maturities.

In presumption of the output curve, crossed immoderate duration that matters, an inversion has happened — a improvement that typically occurs earlier an economical slowdown, arsenic abbreviated word yields rising disincentivizes the concern of superior implicit agelong durations owed to “attractive” abbreviated extremity yields. Lend your wealth to the U.S. authorities for 30 years and fastener successful 4.13% oregon for 3 months astatine 4.13% and reevaluate then? Duration hazard is existent and the gait of this tightening rhythm connected the backs of grounds inflationary conditions crossed the globe has near investors uneasy connected the semipermanent imaginable of authorities paper. No kidding.

Arguably, the Fed is inactive down the curve and, per their mandate, shouldn't person “let” inflationary pressures get this retired of power portion inactive stoking the flames with zero-interest complaint argumentation and $120B/month of quantitative easing enslaved purchases. Due to the blunder and consequent deed to their credibility, the Fed is attempting to induce symptom successful the labour marketplace and successful plus prices until inflationary concerns abate.

It's a bold strategy and it’s 1 that is wholly destined to fail. But they’ll apt extremity up crashing everything portion trying. However, the nominal system — meaning gross home merchandise expectations (not ostentation adjusted) and the labour marketplace — is inactive piping hot. The marketplace looks to beryllium believing that Fed argumentation is successful an wholly caller authorities going forward.

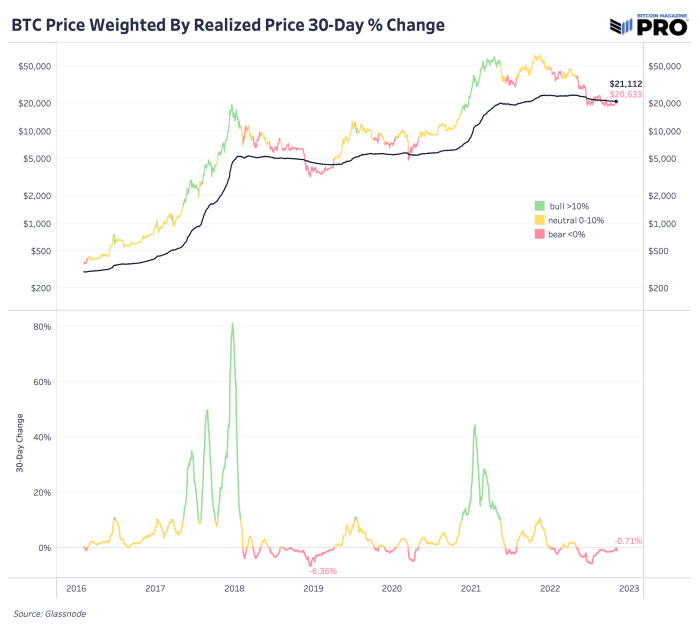

Shown beneath is the bitcoin terms with its mean on-chain holder outgo ground (realized price). Bitcoin is successful a classical carnivore marketplace consolidation phase, that galore whitethorn not person much symptom ahead. These periods, wherever panicked/leveraged investors transportation their holdings to the prudent and good capitalized, are what make the conditions for the adjacent bull run.

3 years ago

3 years ago

English (US)

English (US)