“Fed Watch” is simply a macro podcast, existent to bitcoin’s rebel nature. In each episode, we question mainstream and Bitcoin narratives by examining existent events successful macro from crossed the globe, with an accent connected cardinal banks and currencies.

Watch This Episode On YouTube Or Rumble

Listen To The Episode Here:

In this episode, CK and I screen a ample chunk of the ongoing macro news. First, we covered New York Federal Reserve President John William’s code connected inflation, past the U.N. study demanding cardinal banks alteration people and yet the OPEC determination to chopped quotas by 2 cardinal barrels per time (mbd).

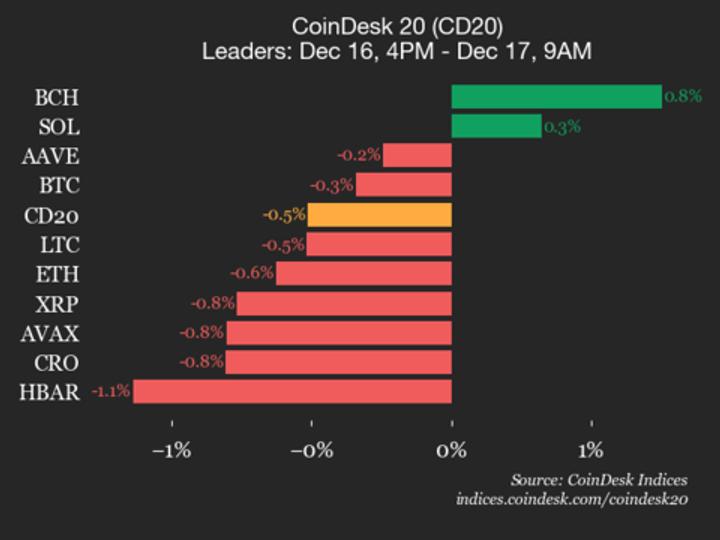

Charts And Bitcoin Sentiment

Each week, CK and I pb disconnected with a bitcoin illustration to halfway our macro speech from this perspective.

The regular illustration from this week shows a flimsy bullish curl arsenic it approaches the diagonal inclination line. Several indicators are bullish, including much important play and monthly signals.

On the play chart, the archetypal ever play bullish divergence has locked in. This does not mean we can’t person further downside. If you look astatine the reddish columns connected the illustration beneath that signify play bearish divergences, you tin spot they often travel successful multiples. However, astatine the archetypal motion of a play divergence, it does awesome that we are precise adjacent to the eventual reversal.

The sentiment successful the Bitcoin ecosystem has started to displacement from fearfulness to being somewhat much positive. If the terms tin capitalize present and interruption out, we could acquisition a sizable displacement into bullish momentum.

In this section, CK and I besides sermon a imaginable bitcoin decoupling from stocks. The correlation has been rather precocious recently, but bitcoin does connection immoderate fundamentally antithetic properties. As CK points out, bitcoin is not weakened by being exposed to a circumstantial company’s revenues successful a recognition crisis. Where companies mightiness look harsh recognition conditions, bitcoin doesn’t. Bitcoin really benefits from a formation distant from recognition risk.

How The Fed Defines Inflation

In this segment, I work respective quotes from a recent speech by John Williams, president of the New York Federal Reserve. Most of it revolved astir a comic explanation of inflation, which Williams calls the “Inflation Onion.”

The archetypal furniture of this bulb is commodity prices, the 2nd furniture is prices of products similar appliances and vehicles. The innermost furniture of the ostentation bulb is — hold for it — underlying inflation.

There we person it: Inflation is an bulb of antithetic layers of prices. At the basal is proviso and request and underlying inflation. No notation astatine each of wealth printing oregon debasement. I deliberation what helium intends to represent is that ostentation works its mode done the economy. Prices of commodities trickle inward to products, successful this case, which successful crook trickle inward to things similar rents and labor.

U.N. Tells Central Banks To Halt Rate Hikes

This week saw the merchandise of the United Nations’ yearly Trade and Development Report, successful which they described the existent presumption of the planetary system and provided argumentation recommendations. Overall, I was amazed by the cogent quality of the report, getting galore things right. They adjacent utilized presumption similar “super-hysteresis” and shadiness banking, ideas we’ve been talking astir connected “Fed Watch” for years.

We spell done respective quotes close retired of the study and find ourselves agreeing with them aggregate times. It is lone erstwhile the U.N. comes to marque recommendations that they suffer us.

The argumentation choices are consecutive retired of the World Economic Forum oregon communist playbook. They are afloat of phrases similar “equitable organisation of income” and “redistributive policies.” What they privation the Fed to bash is to halt complaint hikes that are disproportionately hurting emerging markets and alternatively usage terms controls and regressive taxation.

OPEC+ Reduces Quota By 2 Million Barrels Per Day

A batch of this communicative doesn’t marque consciousness to me. OPEC+ had an in-person gathering connected October 5, 2022 and decided to trim their lipid accumulation quota by 2 mbd. However, this comes arsenic they are presently producing 3.6 mbd beneath their existent quota.

Under the voluntary accumulation quota cut, OPEC’s full voluntary quota successful November is 42.1 mbd, but their August accumulation was 40.45 mbd. As it stands now, the simplification successful the quota of 2 mbd, with existent accumulation levels, lone shrinks OPEC's shortfall. They volition inactive person 1.6 mbd of country to summation production!

Some radical are figuring the caller voluntary quotas by country, which results successful a 0.86 mbd reduction, mostly from Saudi Arabia, but the full is arsenic stated above. I’ve been calling it voluntary due to the fact that OPEC officials stressed that these quotas were voluntary.

Wait, what? How is this immoderate benignant of emergency? It’s not. CK and I speculate connected precisely wherefore we spot each the fear-mongering headlines we bash from this communicative and it boils down to predetermination play timing and narratives.

This is simply a impermanent station by Ansel Lindner. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)