The beneath is an excerpt from the Bitcoin Magazine Pro study connected the emergence and autumn of FTX. To work and download the full 30-page report, follow this link.

The Beginnings

Where did it each commencement for Sam Bankman-Fried? As the communicative goes, Bankman-Fried, a erstwhile planetary ETF trader astatine Jane Street Capital, stumbled upon the nascent bitcoin/cryptocurrency markets successful 2017 and was shocked astatine the magnitude of “risk-free” arbitrage accidental that existed.

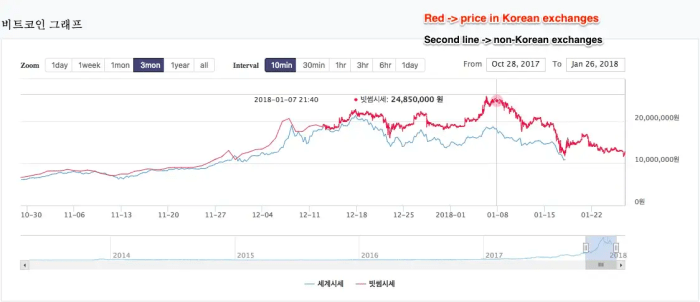

In particular, Bankman-Fried said the infamous Kimchi Premium, which is the ample quality betwixt the terms of bitcoin successful South Korea versus different planetary markets (due to superior controls), was a peculiar accidental that helium took vantage of to archetypal commencement making his millions, and yet billions …

At slightest that’s however the communicative goes.

The Kimchi Premium - Source: Santiment Content

The existent story, portion perchance akin to what SBF liked to archer to explicate the meteoric emergence of Alameda and subsequently FTX, looks to person been 1 riddled with deception and fraud, arsenic the “smartest feline successful the room” narrative, 1 that saw Bankman-Fried connected the screen of Forbes and touted arsenic the “modern time JP Morgan,” rapidly changed to 1 of monolithic ungraded successful what looks to beryllium the largest fiscal fraud successful modern history.

The Start Of The Alameda Ponzi

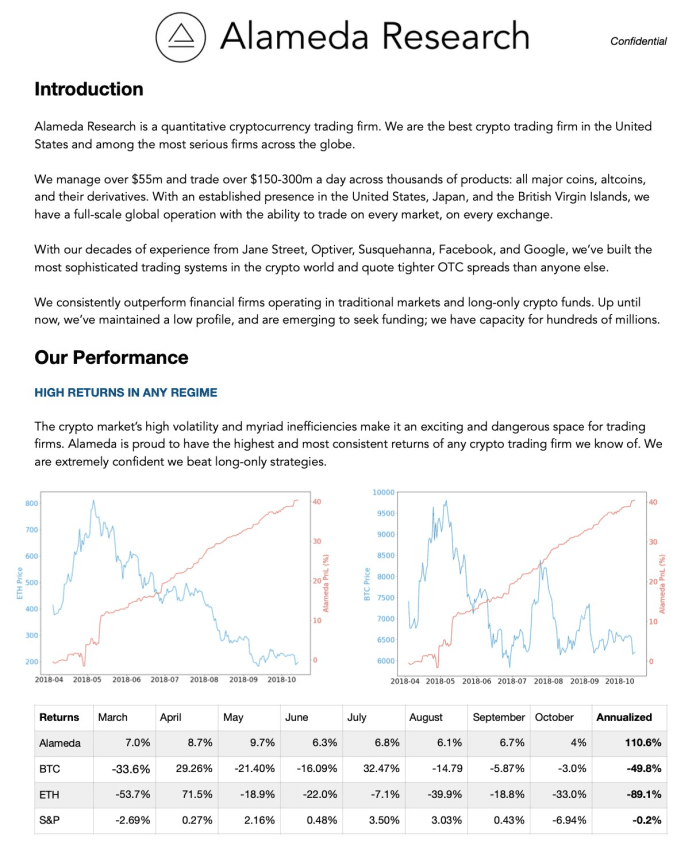

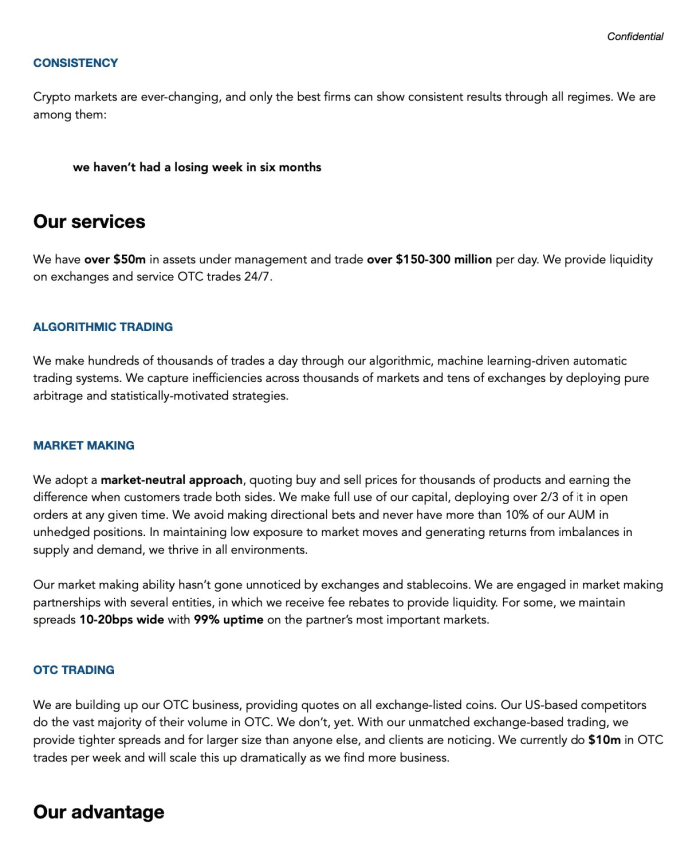

As the communicative goes, Alameda Research was a high-flying proprietary trading money that utilized quantitative strategies to execute outsized returns successful the cryptocurrency market. While the communicative was believable connected the surface, owed to the seemingly inefficient quality of the cryptocurrency market/industry, the reddish flags for Alameda were glaring from the start.

As the fallout of FTX unfolded, erstwhile Alameda Research transportation decks from 2019 began to circulate, and for galore the contented was rather shocking. We volition see the afloat platform beneath earlier diving into our analysis.

The platform contains galore glaring reddish flags, including aggregate grammatical errors, including the offering of lone 1 concern merchandise of “15% annualized fixed complaint loans” that committedness to person “no downside.”

All glaring reddish flags.

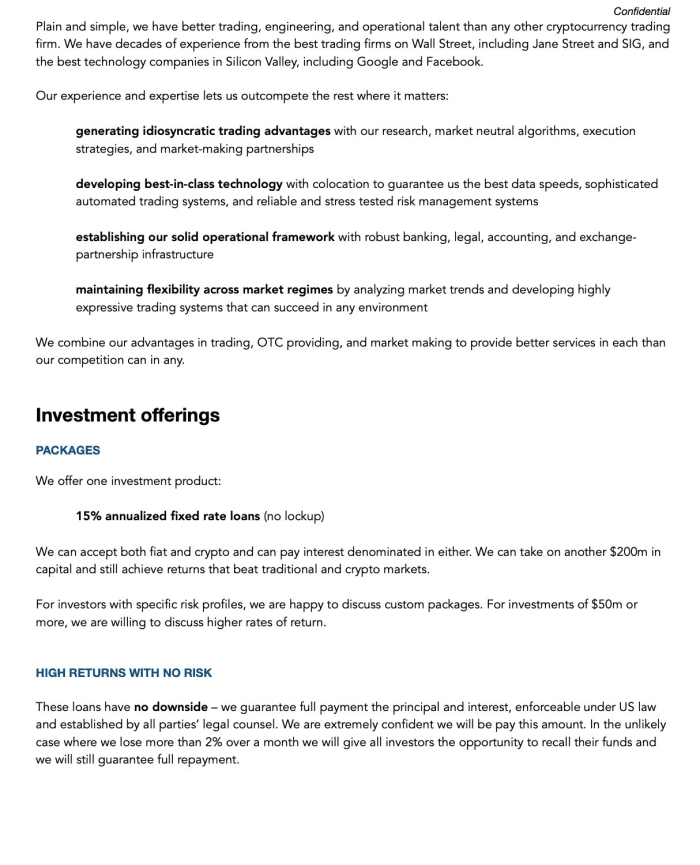

Similarly, the signifier of the advertised Alameda equity curve (visualized successful red), which seemingly was up and to the close with minimal volatility, portion the broader cryptocurrency markets were successful the midst of a convulsive carnivore marketplace with vicious carnivore marketplace rallies. While it is 100% imaginable for a steadfast to execute good successful a carnivore marketplace connected the abbreviated side, the quality to make accordant returns with adjacent infinitesimal portfolio drawdowns is not a people occurring world successful fiscal markets. Actually, it is simply a tell-tale motion of a Ponzi scheme, of which we person seen before, passim history.

The show of Bernie Madoff’s Fairfield Sentry Ltd for astir 2 decades operated rather likewise to what Alameda was promoting via their transportation platform successful 2019:

- Up-only returns careless of broader marketplace regime

- Minimal volatility/drawdowns

- Guaranteeing the payout of returns portion fraudulently paying retired aboriginal investors with the superior of caller investors

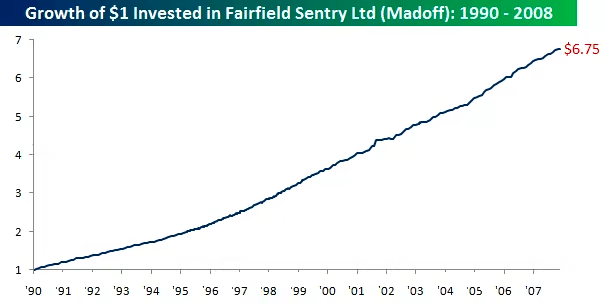

It appears that Alameda’s strategy began to tally retired of steam successful 2019, which is erstwhile the steadfast pivoted to creating an speech with an ICO (initial coin offering) successful the signifier of FTT to proceed to root capital. Zhu Su, the co-founder of now-defunct hedge money Three Arrows Capital, seemed skeptical.

Approximately 3 months later, Zhu took to Twitter again to explicit his skepticism astir Alameda’s adjacent venture, the motorboat of an ICO and a caller crypto derivatives exchange.

“These aforesaid guys are present trying to motorboat a "bitmex competitor" and bash an ICO for it. 🤔” - Tweet, 4/13/19

Beneath this tweet, Zhu said the pursuing portion posting a screenshot of the FTT achromatic paper:

“Last clip they pressured my biz spouse to get maine to delete the tweet. They started doing this ICO aft they couldn't find immoderate much greater fools to get from adjacent astatine 20%+. I get wherefore cipher calls retired scams aboriginal enough. Risk of exclusion higher than instrumentality from exposing.” - Tweet, 4/13/19

Additionally, FTT could beryllium utilized arsenic collateral successful the FTX cross-collateralized liquidation engine. FTT received a collateral weighting of 0.95, whereas USDT & BTC received 0.975 and USD & USDC received a weighting of 1.00. This was existent until the illness of the exchange.

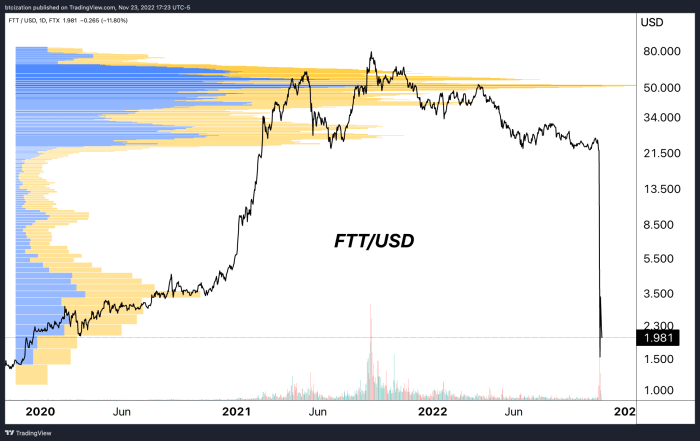

FTT Token

The FTT token was described arsenic the “backbone” of the FTX speech and was issued connected Ethereum arsenic a ERC20 token. In reality, it was mostly a rewards based selling strategy to pull much users to the FTX level and to prop up equilibrium sheets. Most of the FTT proviso was held by FTX and Alameda Research and Alameda was adjacent successful the archetypal effect circular to money the token. Out of the 350 cardinal full proviso of FTT, 280 cardinal (80%) of it was controlled by FTX and 27.5 cardinal made their mode to an Alameda wallet.

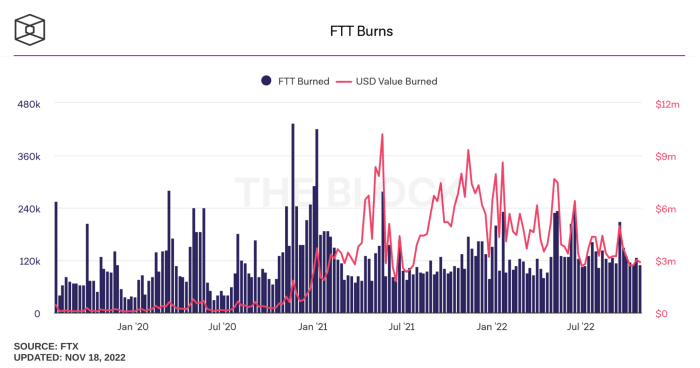

FTT holders benefited from further FTX perks specified arsenic little trading fees, discounts, rebates and the quality to usage FTT arsenic collateral to commercialized derivatives. To enactment FTT’s value, FTX routinely purchased FTT tokens utilizing a percent of trading interest gross generated connected the platform. Tokens were purchased and past burned play to proceed driving up the worth of FTT.

FTX repurchased burned FTT tokens based connected 33% of fees generated connected FTX markets, 10% of nett additions to a backstop liquidity money and 5% of fees earned from different uses of the FTX platform. The FTT token does not entitle its holders to FTX revenue, shares successful FTX nor governance decisions implicit FTX’s treasury.

Alameda’s equilibrium expanse was archetypal mentioned successful this Coindesk article showing that the money held $3.66 cardinal successful FTT tokens portion $2.16 cardinal of that was utilized arsenic collateral. The crippled was to thrust up the perceived marketplace worth of FTT past usage the token arsenic collateral to get against it. The emergence of Alameda’s equilibrium expanse roseate with the worth of FTT. As agelong arsenic the marketplace didn’t unreserved to merchantability and illness the terms of FTT past the crippled could proceed on.

FTT rode connected the backs of the FTX selling push, rising to a highest marketplace headdress of $9.6 cardinal backmost successful September 2021 (not including locked allocations, each the portion Alameda leveraged against it down the scenes. The Alameda assets of $3.66b FTT & $2.16b “FTT collateral” successful June of this year, on with its OXY, MAPs, and SRM allocations, were combined worthy tens of billions of dollars astatine the apical of the marketplace successful 2021.

The terms of FTT with a broadside illustration showing FTT trading measurement connected FTX (logarithmic scale)

FTT Market Cap (logarithmic scale) - Source:CoinMarketCap

CZ Chooses Blood

In one determination and tweet, CEO of Binance, CZ, kicked disconnected the toppling of a location of cards that successful hindsight, seems inevitable. Concerned that Binance would beryllium near holding a worthless FTT token, the institution aimed to merchantability $580 cardinal of FTT astatine the time. That was bombshell quality since Binance’s FTT holdings accounted for implicit 17% of the marketplace headdress value. This is the treble edged sword of having the bulk of FTT proviso successful the hands of a fewer and an illiquid FTT marketplace that was utilized to thrust and manipulate the terms higher. When idiosyncratic goes to merchantability thing big, worth collapses.

As a effect to CZ’s announcement, Caroline of Alameda Research, made a captious mistake to denote their plans to bargain each of Binance’s FTT astatine the current marketplace terms of $22. Doing that publically sparked a question of marketplace unfastened involvement to spot their bets connected wherever FTT would spell next. Short sellers piled successful to thrust the token terms to zero with the thesis that thing was disconnected and the hazard of insolvency was successful play.

Ultimately, this script has been brewing since the Three Arrows Capital and Luna collapsed this past summer. It’s apt that Alameda had important losses and vulnerability but were capable to past based connected FTT token loans and leveraging FTX lawsuit funds. It besides makes consciousness present wherefore FTX had an involvement successful bailing retired companies similar Voyager and BlockFi successful the archetypal fallout. Those firms whitethorn person had ample FTT holdings and it was indispensable to support them afloat to prolong the FTT marketplace value. In the latest bankruptcy documents, it was revealed that $250 cardinal successful FTT was loaned to BlockFi.

With hindsight, present we cognize wherefore Sam was buying up each of the FTT tokens helium could get his hands connected each week. No marginal buyers, deficiency of usage cases and precocious hazard loans with the FTT token were a ticking clip weaponry waiting to stroke up.

How It All Ends

After pulling backmost the curtain, we present cognize that each of this led FTX and Alameda consecutive into bankruptcy with the firms disclosing that their apical 50 creditors are owed $3.1 cardinal with lone a $1.24 currency equilibrium to wage it. The institution apt has implicit a cardinal creditors that are owed money.

The original bankruptcy document is riddled with glaring gaps, equilibrium expanse holes and a deficiency of fiscal controls and structures that were worse than Enron. All it took was 1 tweet astir selling a ample magnitude of FTT tokens and a unreserved for customers to commencement withdrawing their funds overnight to exposure the plus and liability mismatch FTX was facing. Customer deposits weren’t adjacent listed arsenic liabilities successful the equilibrium expanse documents provided successful the bankruptcy tribunal filing contempt what we cognize to beryllium astir $8.9 cardinal now. Now we tin spot that FTX ne'er had truly backed oregon decently accounted for the bitcoin and different crypto assets that customers were holding connected their platform.

It was each a web of misallocated capital, leverage and the moving of lawsuit funds astir to effort and support the assurance crippled going and the 2 entities afloat.

.

.

.

This concludes an excerpt from “The FTX Ponzi: Uncovering The Largest Fraud In Crypto History.” To work and download the afloat 30-page report, follow this link.

3 years ago

3 years ago

English (US)

English (US)