For decades, firm treasuries person relied connected cash, bonds and short-term investments to sphere capital. But inflation, devaluing fiat currencies and near-zero involvement rates person challenged this approach. A caller acheronian equine is emerging and firm concern is astir to alteration forever.

BTC arsenic a firm reserve asset

Historically, corporations person kept important currency reserves for some stableness and liquidity. However, arsenic Michael Saylor, Executive Chairman of MicroStrategy has argued, currency is similar a melting crystal cube — losing its purchasing powerfulness owed to monetary debasement. Bitcoin offers an alternative: an plus with a fixed supply, planetary liquidity and asymmetric upside.

Since 2020, MicroStrategy has aggressively accumulated bitcoin, transforming its firm equilibrium expanse into a quasi BTC bank. The institution issues convertible indebtedness and equity to money its purchases, leveraging a accepted concern attack to gathering a bitcoin treasury. In 2024 alone, MicroStrategy acquired 257,000 BTC. This strategy has indirectly turned MicroStrategy into a publically traded bitcoin ETF and accumulation machine, granting shareholders vulnerability to BTC done its publically traded banal $MSTR. You're speechmaking Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor. Sign up here to get it successful your inbox each Wednesday.

Two cardinal metrics: bitcoin per stock & BTC yield

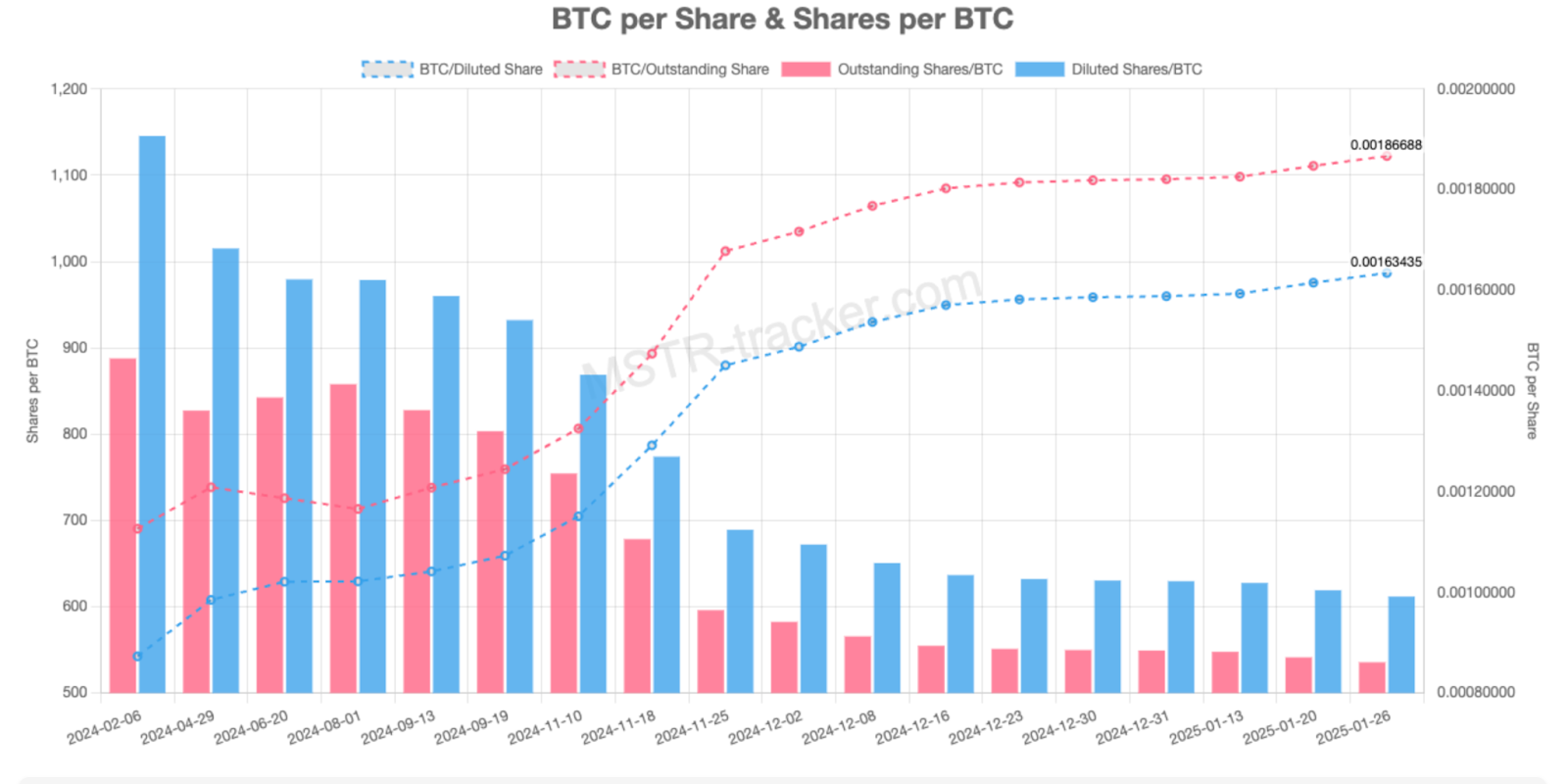

Microstrategy has popularized 2 cardinal metrics each corp studying this strategy needs to recognize intimately: bitcoin per stock (BPS) and BTC yield.

Bitcoin per stock (BPS): The fig of bitcoin held per outstanding share. This metric allows investors to measurement a company’s indirect BTC exposure.

BTC yield: The percent alteration successful the fig of bitcoin per stock implicit time. This KPI attempts to bespeak however efficiently a institution acquires BTC.

Source: MSTRtracker.com

The firm supercycle

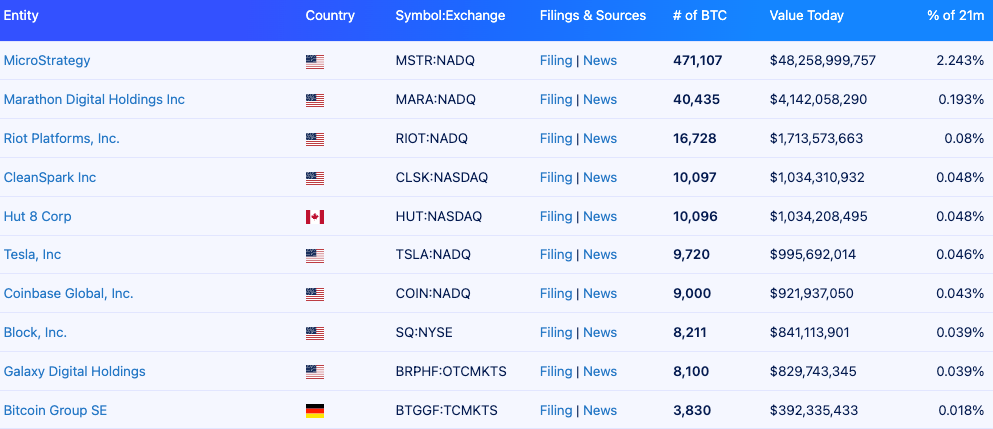

While galore corporations support accepted treasury strategies, a cardinal displacement successful firm concern is emerging. Over 70 publically traded companies present clasp bitcoin connected their equilibrium sheets, including Tesla, Coinbase and Block. Even companies extracurricular the exertion and concern sectors are adopting this approach, demonstrating its wide applicability crossed industries.

This adoption represents much than a inclination — it's a translation successful however companies tin make and sphere shareholder value. The regulatory situation is evolving to enactment this displacement successful 3 captious ways:

SAB21's reversal has fundamentally enhanced bitcoin's inferior arsenic a treasury asset. By enabling regulated fiscal institutions to supply custody services, corporations tin present leverage their bitcoin holdings much efficiently done established banking relationships.

The FASB's landmark accounting changes make a much close reflection of bitcoin's economics connected firm fiscal statements. Under these rules, companies accumulating bitcoin tin present admit appreciation successful their net statements, providing a wide mechanics for worth instauration done strategical bitcoin acquisition.

The projected Bitcoin Act 2024 and broader regulatory clarity awesome increasing organization acceptance, reducing systemic risks for firm adoption.

Companies tin present make net maturation done strategical bitcoin accumulation portion simultaneously gathering a presumption successful an plus with important imaginable for appreciation. This operation of existent net interaction and aboriginal worth imaginable echoes classical Warren Buffett principles of uncovering businesses that tin some make existent returns and reinvest superior astatine charismatic rates.

The translation up isn't simply astir adding bitcoin to equilibrium sheets — it's astir fundamentally rethinking firm treasury absorption for an epoch of integer scarcity. Companies that recognize this displacement aboriginal volition person a important vantage successful gathering treasury positions astatine charismatic prices, overmuch similar aboriginal net adopters.

We’re entering a caller epoch successful firm finance, wherever bitcoin's unsocial properties harvester with evolving fiscal infrastructure to make unprecedented opportunities for worth instauration and preservation.

The companies that admit and enactment connected this displacement aboriginal volition apt look arsenic the Berkshire Hathaways of the integer age.

10 months ago

10 months ago

English (US)

English (US)