Leading on-chain expert James Check, popularly known arsenic Checkmatey, has precocious delved into the intricacies of Bitcoin’s marketplace dynamics, offering a elaborate on-chain information analysis that sheds airy connected the forces driving Bitcoin prices. His latest insights item a play helium describes arsenic “Quiet and Trending,” suggesting a robust underpinning contempt important sell-side pressures and shifts successful volatility.

Bitcoin Follows The Stair-Stepping Rally-Consolidation-Rally Pattern

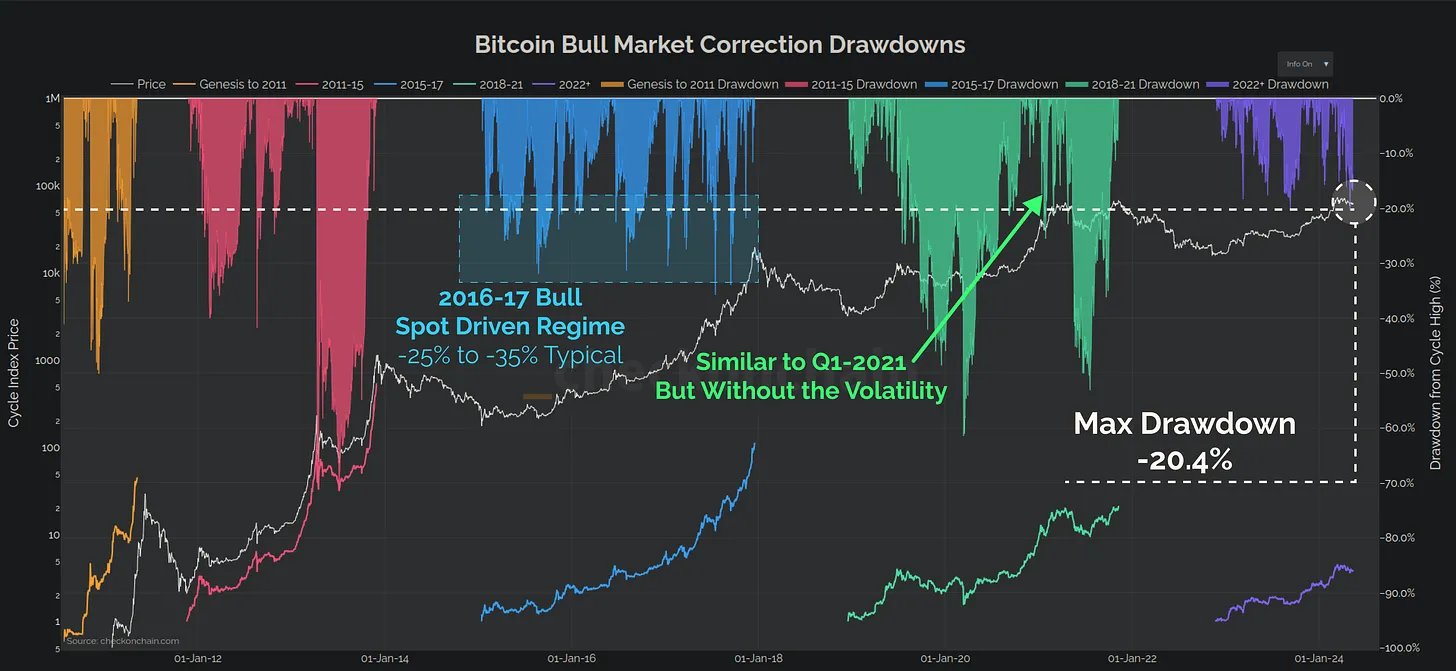

Since December, Bitcoin has experienced important sell-side pressure, with implicit 1.5 cardinal BTC being sold. “Around 30% of this came retired of GBTC, but the remainder of it was bully aged fashioned nett taking,” Check explains.

Despite specified important marketplace sales, Bitcoin has demonstrated resilience with a comparatively humble terms correction of conscionable -20%. This suggests that the foundational enactment levels for Bitcoin are stronger than what surface-level marketplace movements mightiness imply.

Bitcoin bull marketplace drawdowns | Source: X @_Checkmatey_

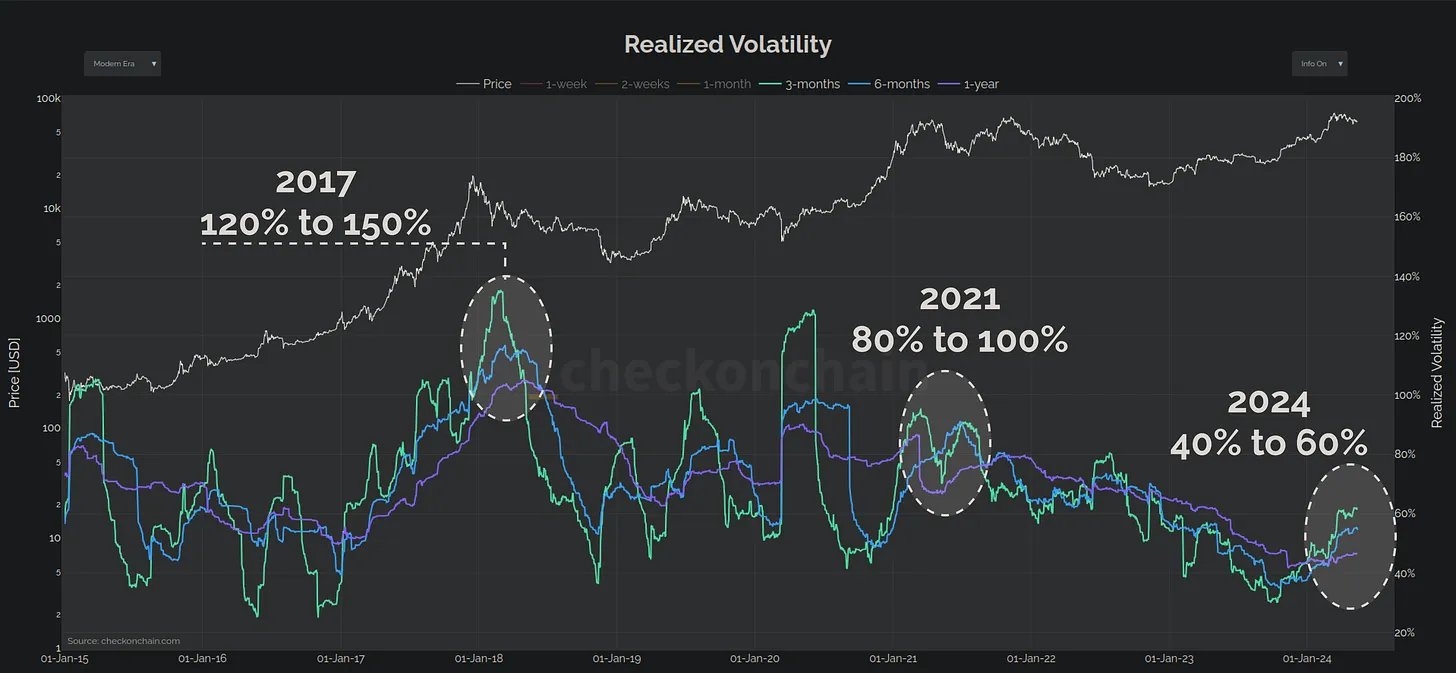

Bitcoin bull marketplace drawdowns | Source: X @_Checkmatey_A striking facet of Check’s investigation is the translation successful Bitcoin’s volatility profile. “The wide realized volatility illustration for Bitcoin is fractional what it was successful 2021, and 3x smaller than 2017,” states Check. This inclination indicates a increasing maturity wrong the Bitcoin market, reflecting its improvement into a much unchangeable plus implicit clip compared to its aboriginal years.

Bitcoin Realized Volatility | Source: X @_Checkmatey_

Bitcoin Realized Volatility | Source: X @_Checkmatey_Check counters the emblematic communicative surrounding Bitcoin’s volatility: “What a batch of radical hide nevertheless is that Bitcoin is volatile to the upside. Volatility to the upside is good!” He posits that the existent increment successful volatility is mean and suggests that the marketplace is inactive successful the aboriginal phases of a bull run, alternatively than nearing its end.

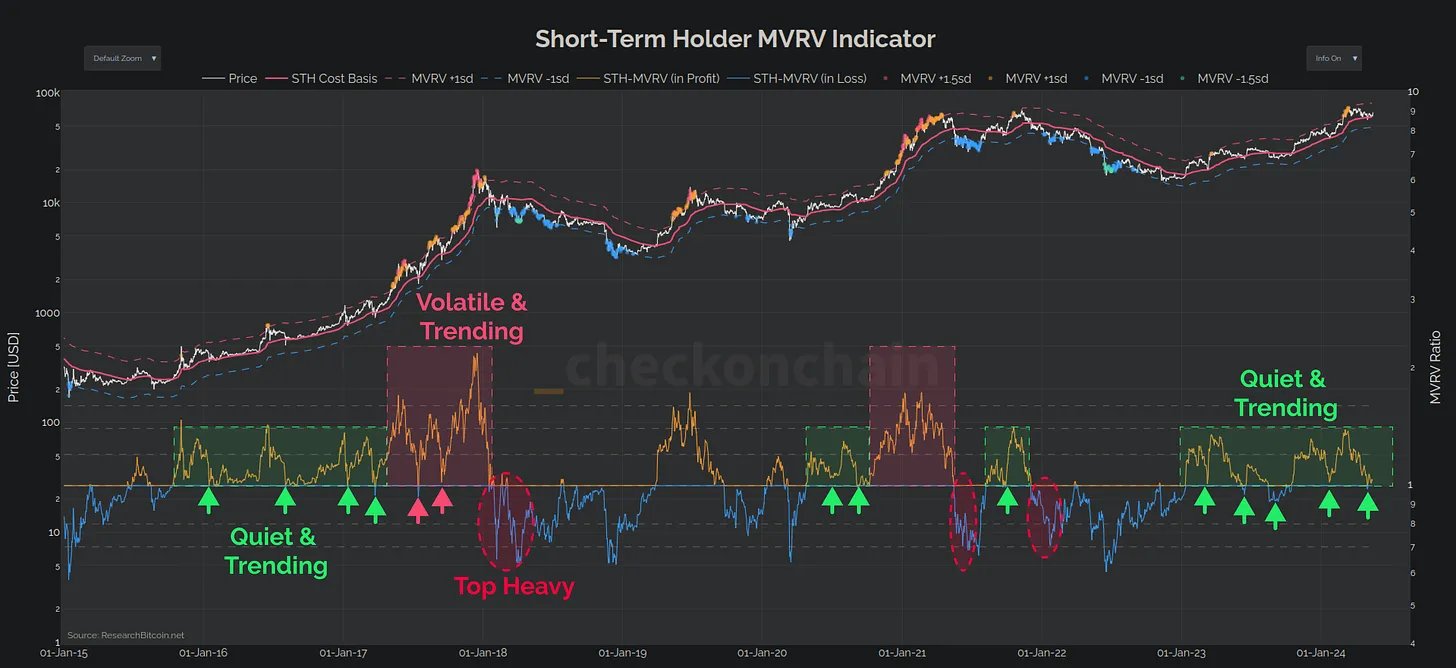

A captious instrumentality successful Check’s investigation is the Short-Term Holder MVRV (STH-MVRV) Ratio, which helium uses to gauge marketplace sentiment and phases. According to Check, this ratio consistently finds enactment astatine 1.0 and absorption astatine 1.4 during unchangeable uptrends. Stability is maintained arsenic agelong arsenic the ratio remains wrong these bounds. “Only erstwhile it breaks supra this ceiling bash things go unstable,” Check notes, which could awesome a modulation to bearish conditions.

Short-Term Holder MVRV | Source: X @_Checkmatey_

Short-Term Holder MVRV | Source: X @_Checkmatey_Despite the sell-off that brought Bitcoin down to $57k, Check observes that this has not importantly dented the profitability of short-term holders. “The magnitude of Unrealised Loss was precise overmuch successful enactment with bull marketplace corrections, calming fears of a top-heavy market.”

He further highlights that respective of the section apical buyers panic sold their Bitcoin astatine the lows, an enactment helium interprets arsenic beneficial for the correction phase, serving to stabilize the marketplace by shaking retired anemic hands.

Expanding his analysis, Check refutes the disapproval that Bitcoin’s volatility makes it a little viable asset. He points to a illustration examination of Bitcoin’s 30-day volatility against top-performing US stocks, showing that Bitcoin’s volatility is good wrong a manageable range.

Furthermore, helium discusses the little realized volatility of the SPY index, attributing it to the “out sized show of the Magnificent-7,” which is counterbalanced by the poorer show of the different components.

By highlighting the structural aspects of the existent “Quiet and Trending” marketplace phase, Check offers a refined position connected however Bitcoin is navigating its maturation pathway, balancing betwixt its speculative origins and its imaginable arsenic a mainstream fiscal asset.

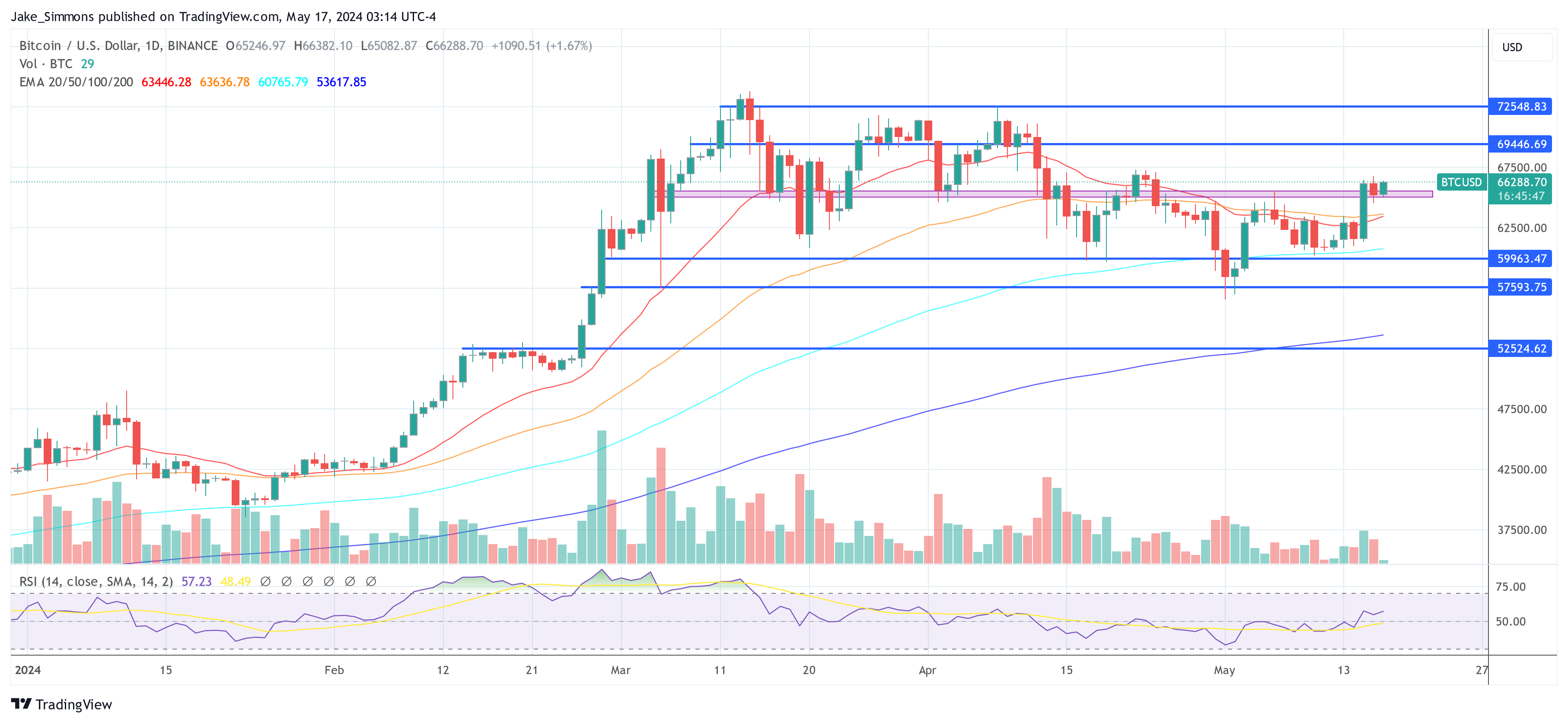

He concludes, “Overall, the Bitcoin uptrend successful 2023-24 looks reasonably structured, pursuing stair-stepping rally-consolidation-rally pattern. However, arsenic the charts supra show, volatility tends to prime up during a consolidation, and that tin pb to instability.”

At property time, BTC traded astatine $66,288.

BTC terms reclaims $66,000, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC terms reclaims $66,000, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)