The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

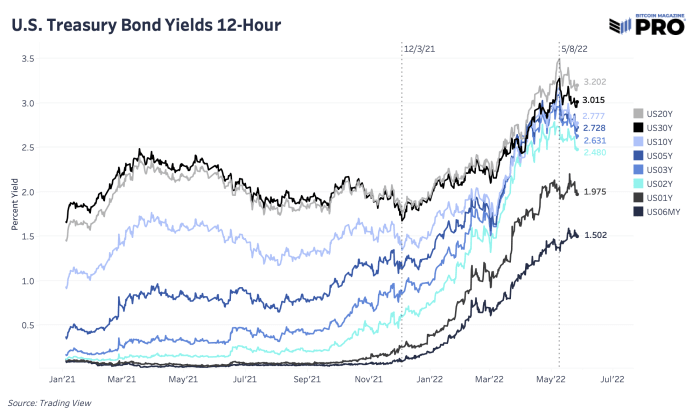

U.S. 10-Year Peaks At 3.19%

Over the past fewer weeks, we’ve seen a crisp reversal successful involvement rates, particularly longer duration, arsenic markets look to beryllium pricing successful little semipermanent ostentation expectations and the rising probability of a much deflationary marketplace authorities connected the horizon. The U.S. 10-year treasury output has fallen implicit 50 ground points to astir 2.78%.

The caller rally successful bonds could beryllium caused by a fewer antithetic factors, with the astir evident being the ample organization players specified arsenic pension funds that are (and person been) successful hopeless request of yield. The 2nd origin astatine play could beryllium the impending economical slowdown taking spot successful the United States, arsenic enslaved investors (often touted arsenic being the astute money) front-run a slowdown successful user spending and ostentation expectations.

With the autumn successful enslaved yields, equity indices person rebounded, with the S&P 500 presently trading 6.7% disconnected of its May 20 lows. With bonds and equities bouncing disconnected the section lows, the looks of a prototypical carnivore marketplace rally look to beryllium successful the works.

Final Note

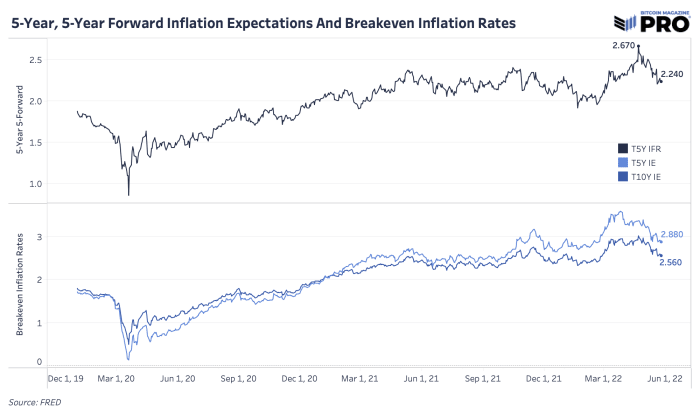

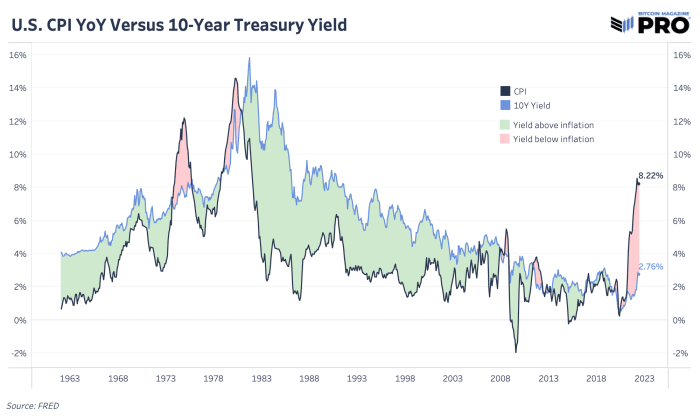

While guardant ostentation expectations for the adjacent 5 years are sitting astatine 2.24%, existent twelvemonth implicit twelvemonth user terms ostentation is 8.22%, meaning the existent output connected each planetary fixed income instruments has been profoundly negative. This dynamic has been a ample absorption of our probe implicit the erstwhile year, and owed to planetary indebtedness levels, this volition request to persist.

In 2022, the liquidity tide has been pulling back. In owed time, the tide volition reverse, solely based connected the realities of a debt-based monetary system. Every rational capitalist volition beryllium searching for a harmless haven for their capital.

3 years ago

3 years ago

English (US)

English (US)