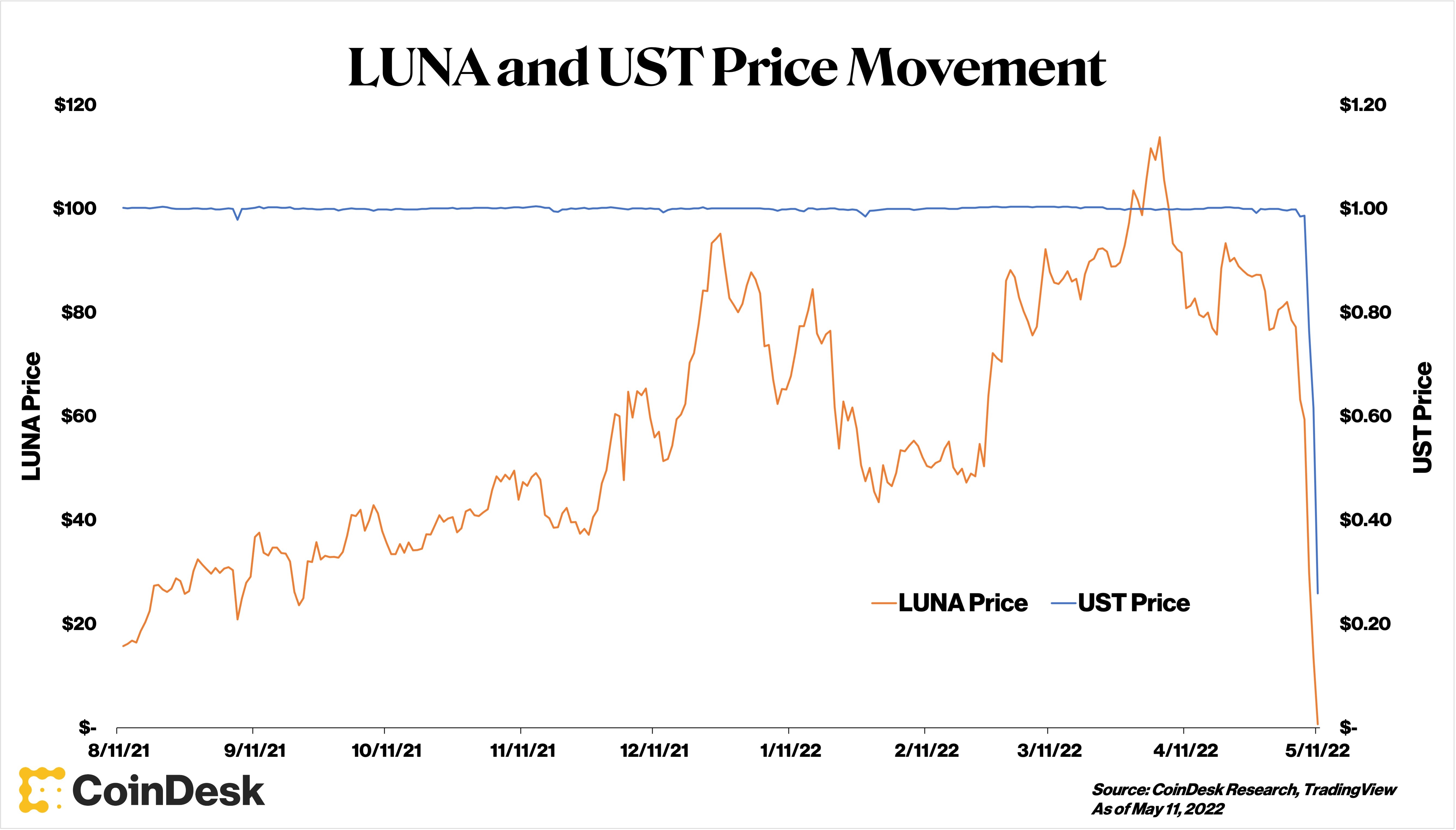

The Terra wealth instrumentality collapsed astir wholly today. The UST stablecoin remains heavy successful the sub-dollar doldrums for the 3rd time running, and LUNA, its sister token, has fallen astir 97% disconnected its 2022 high. The near-complete nonaccomplishment of a darling of decentralized concern (DeFi) stands arsenic an important acquisition successful the systemic risks of algorithmic stablecoins – crypto’s elusive beatified grail.

(CoinDesk Research, Anchor Protocol Dashboard)

Understanding wherefore Terra collapsed this past week means knowing its Achilles bottommost – the Anchor lending protocol.

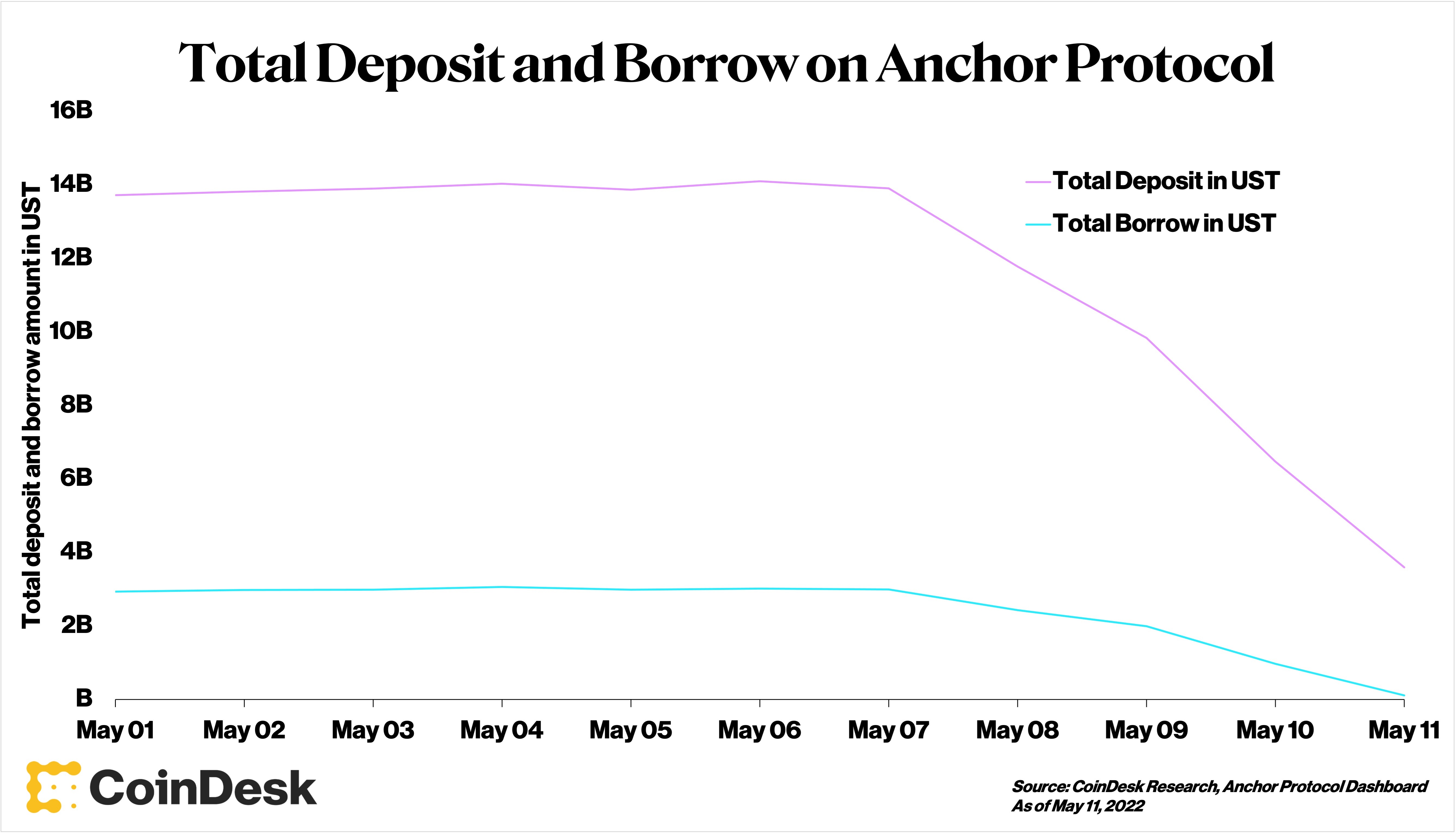

One of the earliest signs that things were going incorrect for Terra came erstwhile UST deposits connected Anchor started dropping Saturday.

Anchor offers marketplace starring yields of up to 20% connected the twelvemonth to users who deposit their UST connected the platform. Before UST started its diminution precocious connected Saturday, Anchor was location to 75% of LUNA’s full circulating supply. That’s $14 cardinal of UST retired of a full circulating proviso of $18 billion.

With truthful overmuch UST locked up successful Anchor, it became wide that astir investors were buying the stablecoin with the sole intent of reaping those sweet, saccharine Anchor yields. Depending connected whom you ask, Anchor’s narration with UST was either an ingenious mechanics to manufacture inferior for the fledgling stablecoin, oregon a wasteful selling walk attracting stingy mercenary capital.

Critics said Anchor’s high yields were unsustainable – artificially propped up by Terra builders Terraform Labs (TFL) and its large wealth backers. A output decrease, they say, would’ve sent UST depositors fleeing Anchor (and UST) successful hunt of higher returns.

The strategy looked akin to that of a young Uber, wherever VCs subsidized peoples’ thrust fees successful a longterm bid to execute marketplace dominance. Instead of cheaper cab fares, inflated Anchor yields were utilized to propulsion radical into the Terra ecosystem – hopefully permanently. The problem, according to critics, was that TFL and its partners could lone spend to subsidize investors for truthful long. At immoderate point, the wealth would adust up, and truthful would Anchor’s customer’s (and UST’s consenting holders).

Though Anchor was ne'er forced to alteration its output rates excessively significantly, UST deposits dropped sharply done the commencement of this week, from $14 cardinal to arsenic debased arsenic $3 billion. So overmuch wealth draining from UST’s superior hub signaled a monolithic nonaccomplishment successful assurance successful the full UST protocol. With fewer different use-cases for UST beyond Anchor, astir withdrawals from the level astir apt ended up connected the unfastened market.

(CoinDesk Research, TradingView)

As 1 mightiness expect, the monolithic drain from Anchor onto the unfastened marketplace contributed large selling unit to the Terra ecosystem.

UST, a alleged algorithmic stablecoin, works with its sister token, LUNA, to support a terms astir $1 utilizing a acceptable of on-chain mint-and-burn mechanics. In theory, these mechanics are expected to guarantee $1 worthy of UST tin beryllium utilized to mint $1 of LUNA – which serves arsenic a benignant of floating terms daze absorber for UST volatility.

The monolithic merchantability unit led to crisp drops successful the prices of some LUNA and of UST. Eventually, the marketplace headdress of LUNA flipped that of UST for the archetypal time. When determination was nary longer $1 worthy of LUNA for each $1 of UST, immoderate watchful traders feared the full strategy mightiness go insolvent (since UST holders would person nary wide mode to “cash out” into LUNA successful the lawsuit of a full-scale slope run). Whether this fearfulness was just oregon not (we’ll speech successful the adjacent conception astir LUNA’s bitcoin backstop), it’s hard to ideate that the intelligence interaction of nose-diving prices and a UST-LUNA marketplace headdress “flippening” didn’t origin adjacent further merchantability action.

(CoinDesk Research, Luna Foundation Guard, Blockchair)

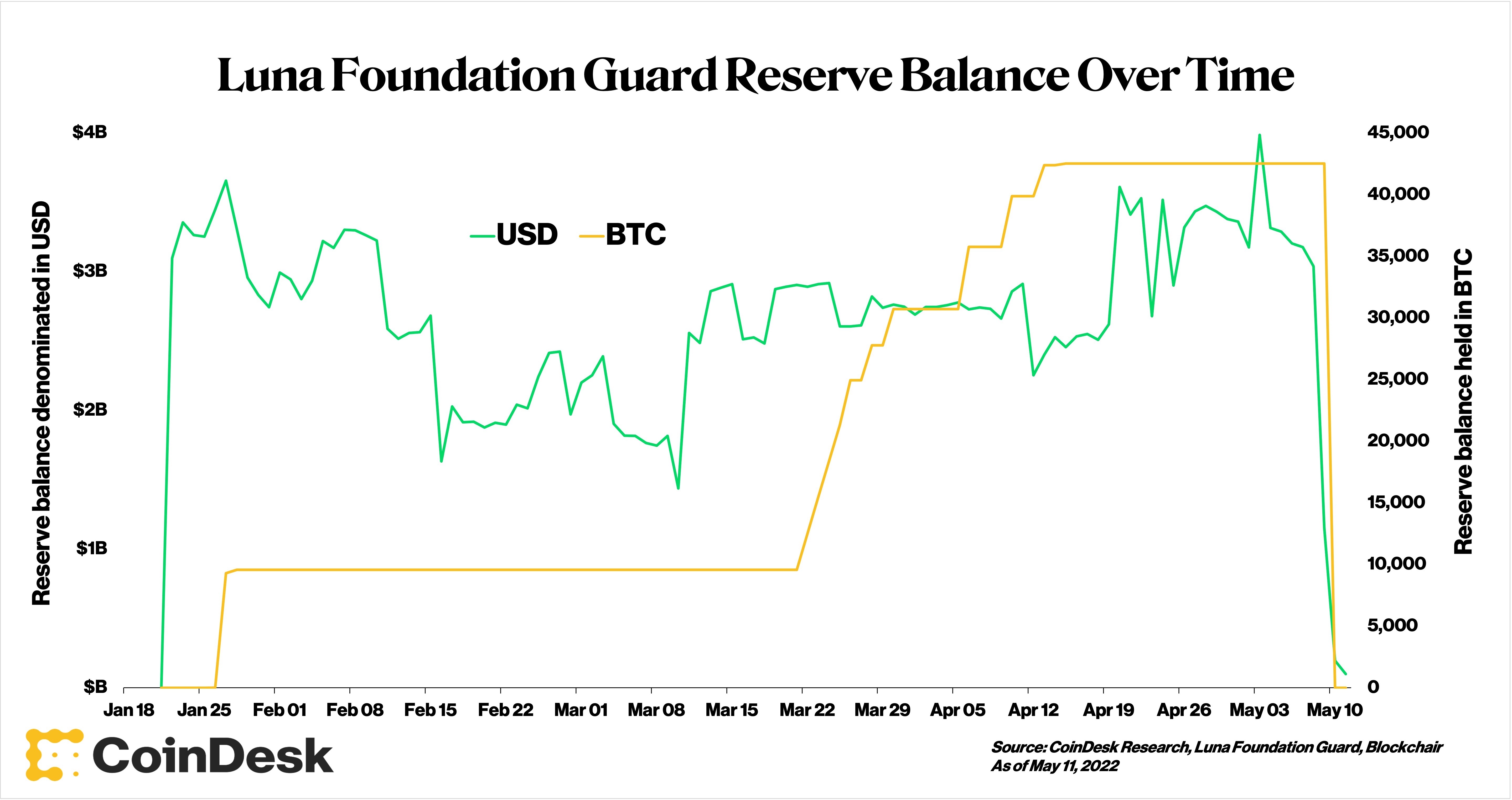

In bid to enactment up UST’s price, the Luna Foundation Guard (LFG), Terra’s authoritative peg defenders, deployed implicit $2 cardinal successful its recently formed bitcoin reserves.

Do Kwon started sweeping BTC disconnected the marketplace successful caller months successful an effort to backstop Terra should its peg ever request defending.

In its archetypal (and perhaps, final) trial of this mechanism, LFG “loaned” billions of dollars worthy of reserve assets to nonrecreational marketplace makers, draining LFG’s blockchain wallets astir wholly successful the process.

Now, As LFG struggles to apical up its bare reserves with caller investors, marketplace makers person are connected a quest to actively support Terra’s peg by deploying rescue superior connected exchanges and liquidity pools.

(CoinDesk Research, TradingView)

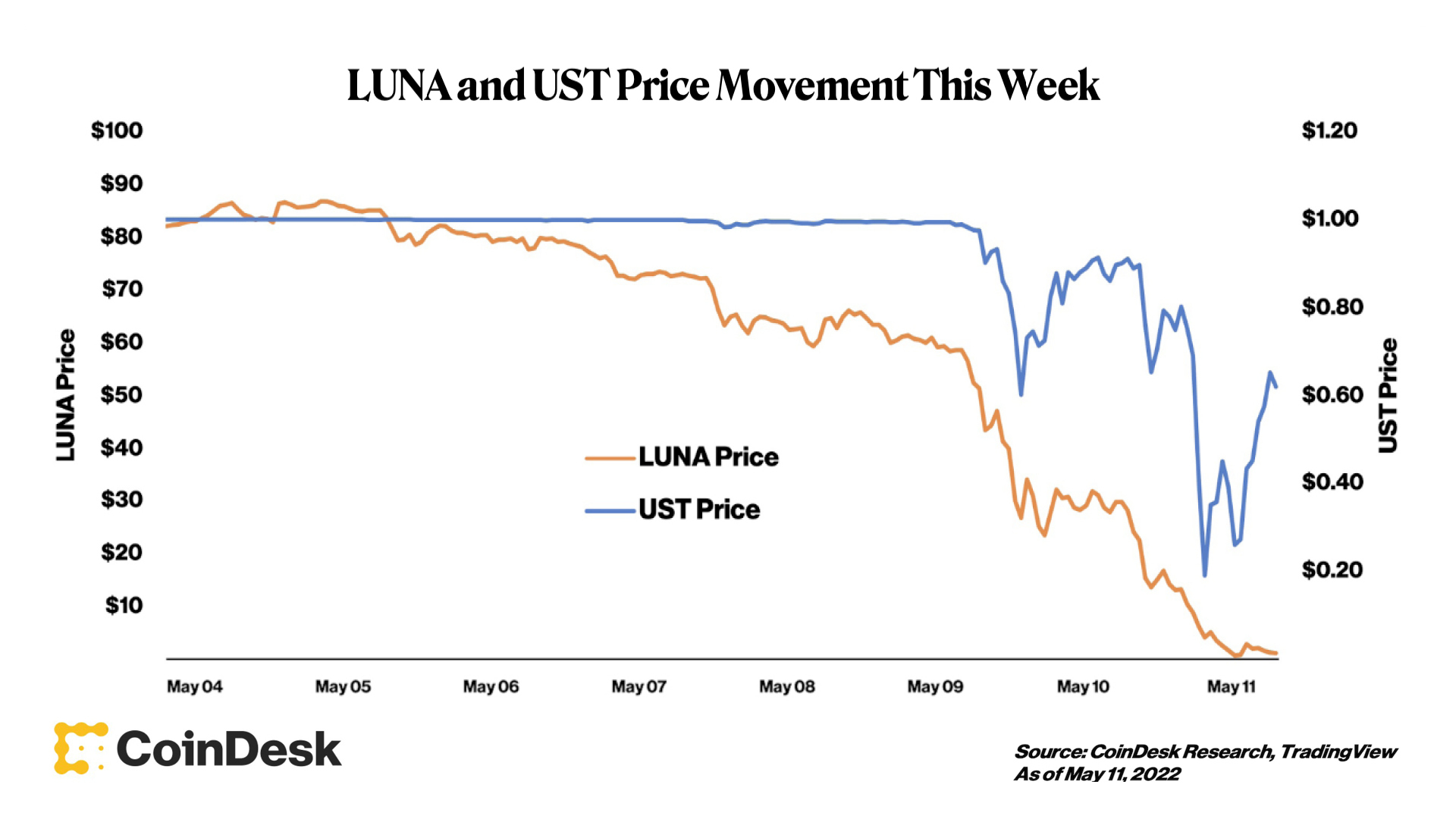

While the rescue superior from Terra’s reserves had humble occurrence bumping up the prices of UST and Luna connected Tuesday, the prices of some tokens were highly volatile starring into the aboriginal greeting hours of Wednesday.

It was astatine this constituent that each bets seemed to beryllium disconnected for a creaseless UST recovery. Even arsenic Do Kwon announced connected Twitter a Terra rescue program was successful the works,market assurance successful the task appeared to autumn to all-time lows. At 1 point, LUNA – priced implicit $120 earlier this twelvemonth – fell beneath a dollar. UST fell beneath 30 cents for a little moment, starring to questions astir whether the “stable” coin volition ever beryllium capable regain its stability.

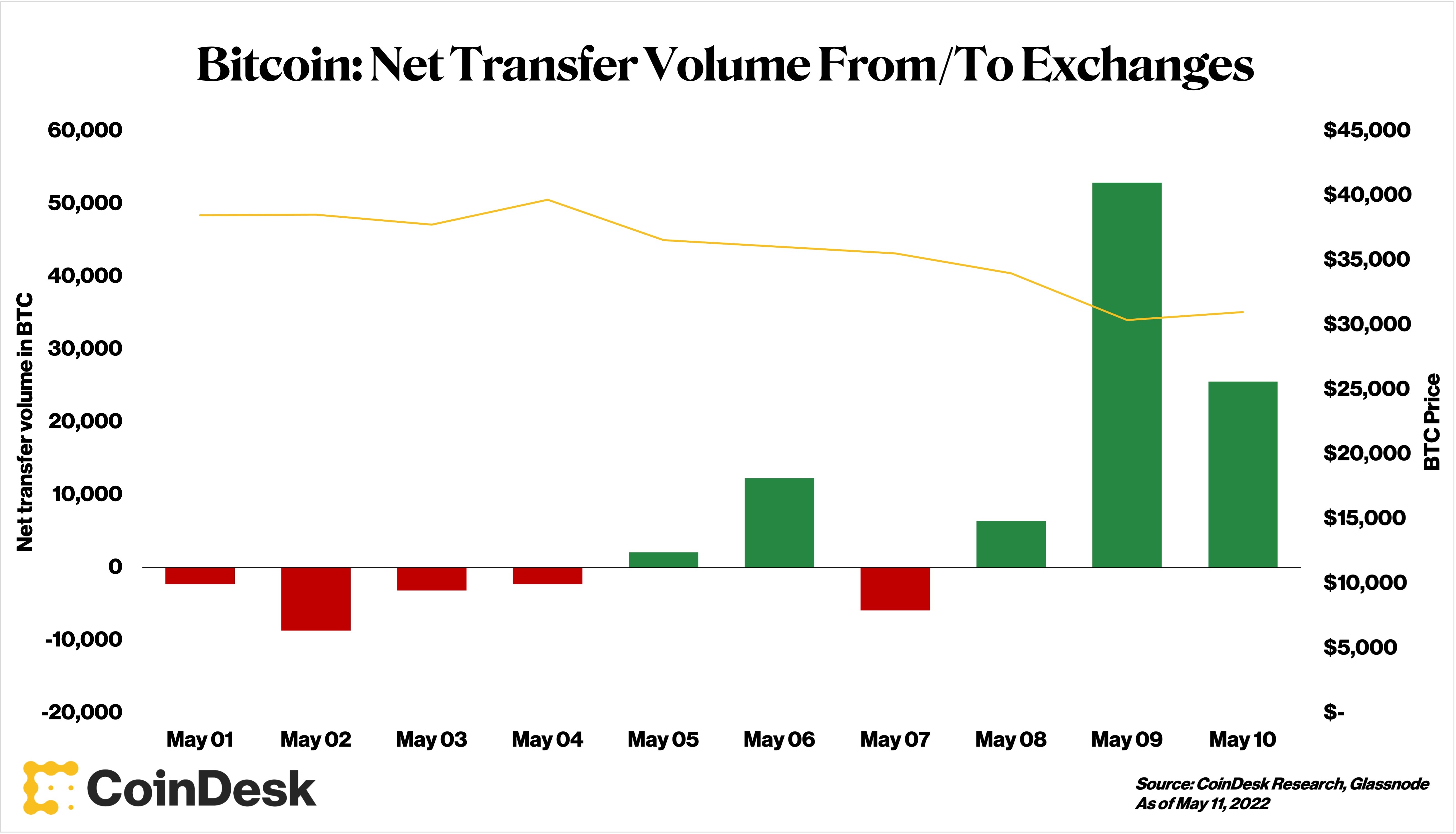

(CoinDesk Research, Glassnode)

Much of the hundreds of millions of dollars successful bitcoin utilized to rescue UST were apt sold consecutive to marketplace aboriginal this week. Cash-outs to non-BTC currencies would person been indispensable for traders hoping to support Terra’s peg.

Charts of BTC nett transportation volumes archer this story, showing monolithic measurement spikes connected May 9 and 10 arsenic Terra’s reserves were archetypal deployed. While Terra doesn’t relationship for the entirety of these spikes, billions of dollars successful freed-up Terra reserves would surely person made an impact.

Terra’s BTC reserve dumps astir apt added sell-pressure to an already tumultuous market.

The interaction of UST connected the wider marketplace is an important footnote amid each of this week's chaos. It stands arsenic a reminder of wherefore stablecoins – which signifier the instauration of decentralized concern – not lone airs a hazard to idiosyncratic traders, but airs a systemic hazard for the full crypto ecosystem if not managed responsibly.

Don’t beryllium amazed erstwhile the regulators travel knocking.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)