New plus classes don’t look by decree — they look erstwhile size, volatility and divers participants converge. When that happens, a acceptable of risks and rewards becomes excessively important, excessively dynamic and excessively wide traded to ignore. That is the constituent astatine which investors halt treating it arsenic a diagnostic of the marketplace and commencement recognizing it arsenic an plus class.

Staking is approaching that point.

The standard is undeniable. More than fractional a trillion dollars of assets are staked crossed proof-of-stake networks. Ethereum unsocial accounts for implicit $100 billion, portion Solana, Avalanche and others adhd to the base. This is nary longer experimental capital. It is ample capable to enactment liquidity, nonrecreational strategies and yet the benignant of secondary products that lone signifier erstwhile an ecosystem is deep.

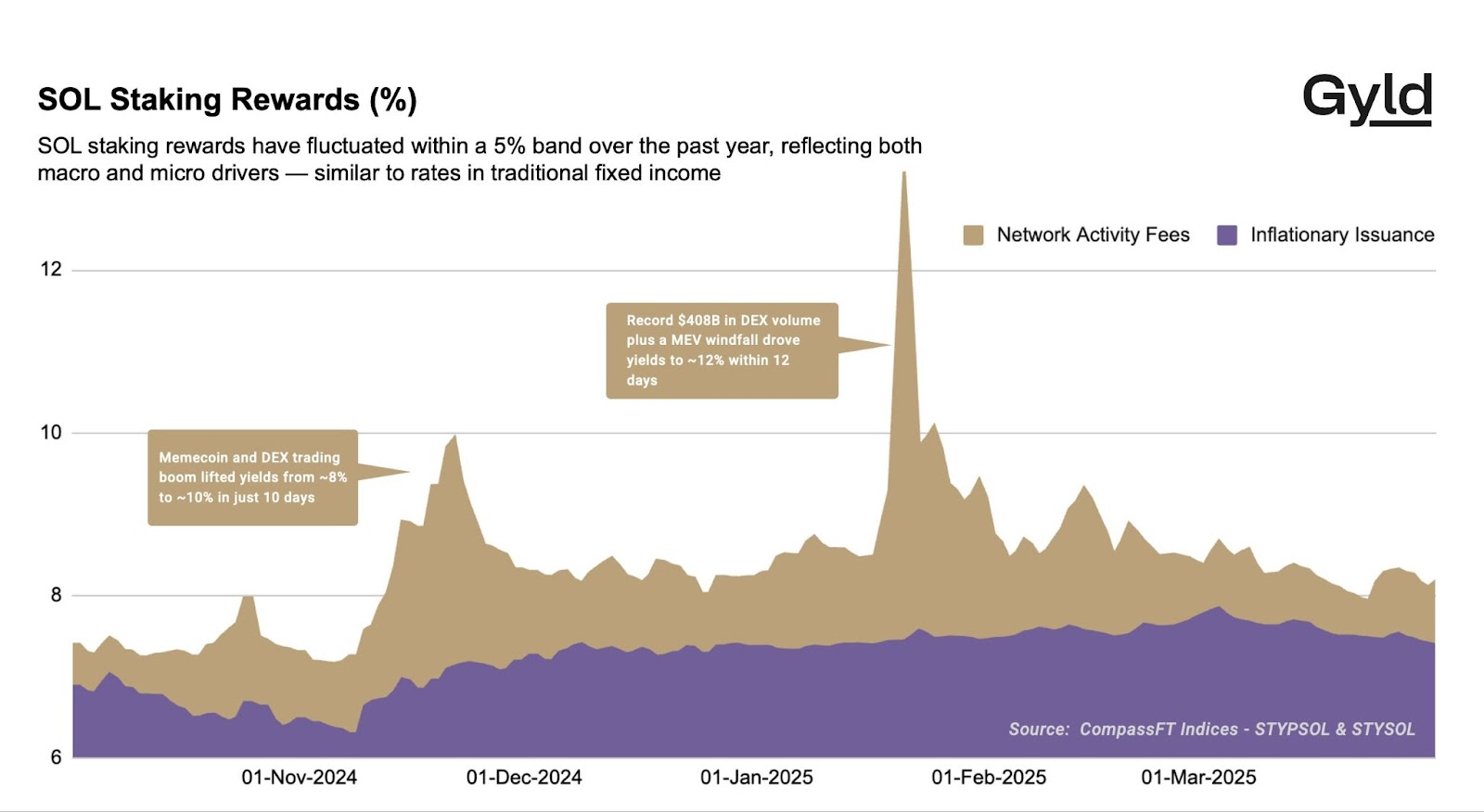

The volatility is arsenic clear. Staking returns determination successful ways that matter. Solana’s rewards person ranged betwixt 8% and 13% implicit the past year. Ethereum’s exit queues, a structural safeguard for web stability, person been stretched to weeks nether existent conditions arsenic a large staking supplier exited its validators. Slashing and downtime risks furniture connected idiosyncratic shocks. These frictions whitethorn frustrate investors, but they besides make the conditions for hazard premia, hedging tools and yet markets to emerge.

And past determination are the participants. What makes staking compelling is not conscionable who is involved, but however their antithetic objectives volition propulsion them into the market. ETPs and ETFs, bound by redemption schedules, request to negociate staking vulnerability wrong defined liquidity windows. Digital plus treasuries volition vie connected nett plus value, actively trading the staking reward word operation to bushed benchmarks. Retail stakers and semipermanent holders volition instrumentality the different broadside of liquidity, consenting to beryllium done introduction and exit queues for higher returns. Funds and speculators volition instrumentality directional views connected web enactment and aboriginal reward levels, trading astir protocol upgrades, validator dynamics oregon usage spikes.

When these forces interact, they make terms discovery. Over time, that is what volition marque markets businesslike — and what volition crook staking from a protocol relation into a afloat fledged plus class.

The trajectory is starting to lucifer the way fixed income erstwhile took. Lending began arsenic bilateral, illiquid agreements. Over time, contracts were standardized into bonds, risks got repackaged into tradable forms and secondary markets flourished. Staking contiguous inactive feels person to backstage lending: you delegate superior to a validator and wait. But the outlines of a marketplace are forming — term-based products, derivatives connected staking rewards, slashing security and secondary liquidity.

For allocators, this makes staking much than conscionable a root of income. Its returns are driven by web usage, validator show and protocol governance — dynamics chiseled from crypto terms beta. That opens the doorway to genuine diversification, and yet to a imperishable relation successful organization portfolios.

Staking began arsenic a method function. It is becoming a fiscal market. And with size, volatility and participants already successful place, it is present connected the verge of thing bigger: emerging arsenic a existent plus class.

2 months ago

2 months ago

English (US)

English (US)