A glimpse into the caput and motivations of the proprietor of a $69.3 cardinal NFT.

Cover art/illustration via CryptoSlate

Vignesh Sundaresan mightiness not beryllium a household sanction conscionable yet. Still, the serial entrepreneur has made its people successful the crypto manufacture with a pseudonym that volition surely ringing a bell—Metakovan.

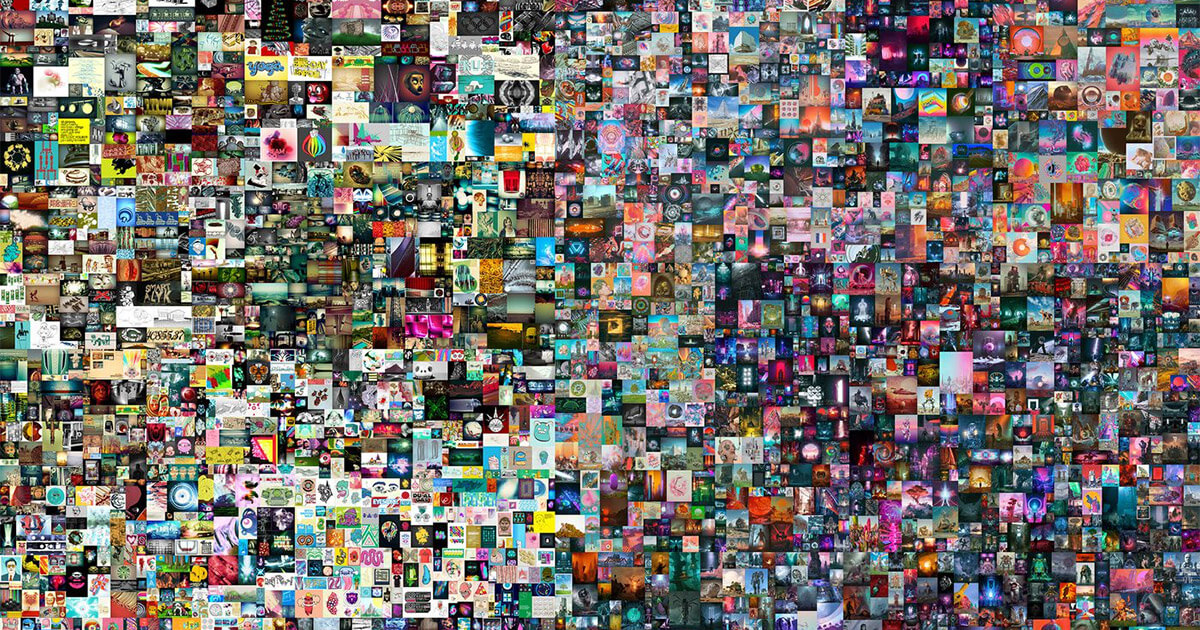

Almost precisely a twelvemonth ago, Sundaresan bought the world’s astir costly NFT and the 3rd astir costly portion sold by a surviving artist. His $69.3 cardinal acquisition of Beeple’s historical “Everydays: The First 500 Days” shocked the manufacture and was, astatine slightest successful part, liable for propelling NFTs into the mainstream.

The “Everydays” NFT sold for $69 million.

The “Everydays” NFT sold for $69 million.The roadworthy to Beeple truly is paved with bully intentions

For months, the nationalist tried to wrapper its caput astir the acquisition and fig retired the individuality of the idiosyncratic that present owned the world’s astir costly non-fungible token.

And portion the individuality of Metakovan, the pseudonym down the purchase, was rapidly revealed, the information down the acquisition remained mostly unknown. In the days aft the humanities purchase, Sundaresan explained that portion of his information to get Beeple’s enactment was to amusement Indians and radical of colour that they could go creation patrons.

“Imagine an investor, a financier, a patron of the arts. Ten times retired of nine, your palette is monochrome. By winning the Christie’s auction of Beeple’s Everydays: The First 5000 Days, we added a dash of mahogany to that colour scheme,” helium said astatine the time.

However, different factors were besides astatine play.

In an interrogation with CryptoSlate, Sundaresan said helium viewed the acquisition arsenic an concern successful himself arsenic helium felt that helium was making history.

“I’m blessed to beryllium portion of the crushed wherefore NFTs are known worldwide. And to springiness backmost to the strategy that provided truthful overmuch to me,” helium told Anastasia Chernikova.

The wealthiness Sundaresan acquired successful the crypto manufacture remains mostly unknown. He notes that helium lone invests successful projects helium believes successful and is lone funny successful the project’s success. The money, helium believes, came arsenic an afterthought.

He archetypal got progressive with the crypto manufacture each the mode backmost successful 2013, erstwhile helium was looking for alternate ways to nonstop money. Bitcoin, past a comparatively obscure caller benignant of currency, presented itself arsenic a cleanable solution to making wealth programmable.

Vignesh Sundaresan

Vignesh SundaresanAfter reaping occurrence by offering escrow services for Bitcoin payments, Sundaresan founded Coins-e. The timing was perfect—the 2013 bull tally brought successful 14,000 users to the speech successful six months. By adjacent summer, helium sold the speech for $160,000, which helium rapidly poured into different project. He co-founded BitAccess, a Y-Combinator-backed task that went connected to instal hundreds of Bitcoin ATMs astir the world.

His quest for promising projects led him to Ethereum successful 2016, erstwhile helium invested a important magnitude of wealth successful its ICO.

“I was much funny successful creating and impacting the world, and I was loyal to the technology. At that point, keeping the coins was astir not waving my mind, but obviously, it seems similar a astute determination now.”

“I ne'er thought it would scope $100, overmuch little $1,000. I wanted to beryllium portion of the community. I retrieve celebrating erstwhile ether was $15 due to the fact that we thought that Ethereum had made it, not due to the fact that we became rich. That’s the feeling that I inactive carry,” helium said.

That aforesaid feeling volition astir apt forestall him from ever selling Beeple’s work, helium aboriginal noted.

There’s besides the origin of sentimental value—Sundaresan explained that the communicative down Beeple’s enactment was what attracted him and led him to outbid Tron’s Justin Sun successful the Christie’s auction.

“It was the labour of the enactment that attracted maine much than the accomplishment oregon endowment oregon creator potential,” helium said of Beeple’s work, which contains 5,000 illustrations that were 13 years successful the making. “It spoke to maine due to the fact that precisely 13 years agone I didn’t person immoderate money. I started coding truthful I felt similar it was akin to my travel – starting with thing and ending up with thing beauteous due to the fact that of hard work. I appreciated it for that much than its creator extent oregon thing else.”

The aboriginal of NFTs is agleam and exciting

Aside from immense wealth, the emergence of NFTs has besides created a schism betwixt its investors. First inhabited by a close-knit assemblage from the creation world, the NFT abstraction present hosts a wide assortment of investors, astir of whom spot them arsenic a bottomless pit of money.

This has created an wholly caller class of NFT projects—hype projects—which saw idiosyncratic NFTs sold for tens of millions of dollars and billions successful trading volume. These types of NFT projects are usually the ones that find their mode into mainstream media, arsenic quality astir pixelized Twitter illustration images sold for $23 cardinal tends to pull the astir attention.

That attention, Sundaresan says, doesn’t payment the wider NFT ecosystem. Instead, they overgarment a representation of exclusivity and marque the abstraction look similar it’s lone reserved for the richest, going against everything the manufacture stands for.

“I’m not a instrumentality of Cryptopunks, the Yacht Club, and different PFP (photo-for-profile) projects. I don’t privation to beryllium portion of exclusive clubs anymore. Instead, I privation to beryllium portion of inclusive clubs and bring much radical successful and make a strategy wherever they get unneurotic and admit something. So I personally person stayed distant from them.”

That doesn’t mean that determination isn’t a conception of the marketplace PFP projects were designed to fulfill. However, the projects themselves astir apt won’t past done different crypto winter.

“There volition beryllium trends, and they volition go, and different trends volition arise. I deliberation projects with unfair organisation are not permanent, and nary 1 tin halt the caller and amended projects, which volition go much common. I americium funny successful the alternate to PFP projects.“

Despite his quest for fulfilling and promising projects, Sundaresan claims that adjacent he’s not immune to FOMO.

“You cannot debar FOMO adjacent if you person everything successful the world. FOMO is simply a authorities of mind.”

Any fears of missing retired are rapidly remedied, though. He notes that anytime helium feels envious of the wealth being made successful a hype project, helium tries to spot wherever the task volition beryllium successful a fewer years.

“And if I don’t judge successful it, I volition beryllium it out,” helium explained. “For example, I’ve ne'er touched Cardano oregon Solano, due to the fact that I don’t hold with their token distribution. And I mightiness consciousness ‘oh, man, if I bought in, I would person made that money,’ but past I would person forgotten my principles.”

His principles authorities that not everything successful the crypto manufacture should beryllium seen arsenic an investment—especially not NFTs. The inclination of buying NFTs to marque wealth disconnected of them volition alteration soon, helium said, arsenic the manufacture begins adding much inferior to them. People volition acquisition the creation successful their NFTs successful galore caller ways arsenic the plus people moves distant from wallets and gets much intertwined with the existent world.

Becoming a larger portion of the existent satellite volition bring astir a full caller acceptable of problems, the biggest 1 being regulation. However, Sundaresan believes that immoderate efforts to modulate the virtual NFT satellite volition beryllium futile, to accidental the least. The accelerated improvement gait we’ve each been accustomed to successful the crypto manufacture means that it volition beryllium intolerable for governments and regulators to drawback up.

“It volition instrumentality 3 years for regulators to enactment a instrumentality into force, and by then, the crypto assemblage volition already beryllium doing thing else. You tin modulate the off-ramps and the on-ramps, which is fine. But banning thing that you don’t recognize is wrong. When politicians fig retired however to modulate NFTs, thing other volition travel up. And I person nary thought what’s going to beryllium next. Regulation has ever lagged down innovation, and I deliberation that’s portion of the design.”

This interrogation was conducted by Anastasia Chernikova, Editor-In-Chief of The Vivid Minds, a media dedicated to stories astir however leaders flooded challenges and determination forward.

Get your regular recap of Bitcoin, DeFi, NFT and Web3 quality from CryptoSlate

It's escaped and you tin unsubscribe anytime.

Get an Edge connected the Crypto Market 👇

Become a subordinate of CryptoSlate Edge and entree our exclusive Discord community, much exclusive contented and analysis.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)