Bitcoin’s pullback to $90,000 caused rather a disturbance successful the market. Although its betterment to supra $96,000 connected Jan. 14 offered immoderate relief, galore on-chain indicators revealed underlying accent successful marketplace health.

Key metrics similar Net Unrealized Profit/Loss (NUPL) and the percent of proviso successful nett showed important declines implicit the past week, reflecting shifts successful the market’s unrealized gains and losses.

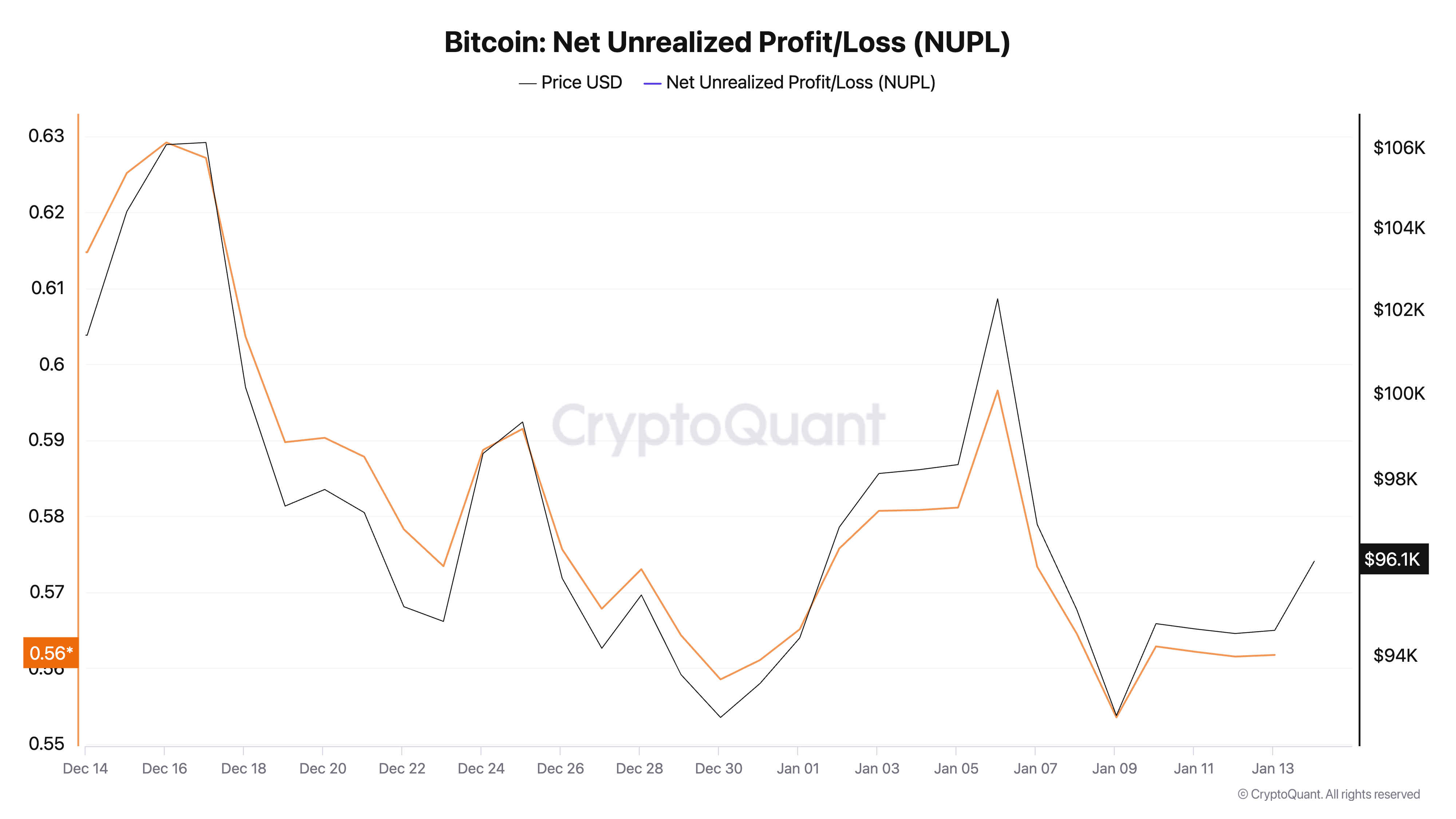

NUPL, a metric calculated arsenic the quality betwixt unrealized profits and unrealized losses divided by the full marketplace value, serves arsenic a barometer for marketplace sentiment. A affirmative NUPL indicates that the marketplace is successful a authorities of unrealized profit, suggesting optimism among holders.

Over the past week, NUPL dropped from 0.615 to 0.562, signaling a mean simplification successful aggregate unrealized gains. This alteration reflects a cooling of marketplace exuberance, but the NUPL’s presumption firmly successful affirmative territory suggests that important unrealized profits inactive enactment the marketplace structure. A driblet of this magnitude (–0.053) indicates a softening successful sentiment alternatively than a cardinal shift.

Graph showing Bitcoin’s nett unrealized profit/loss (NUPL) ratio from Dec. 14, 2024, to Jan. 13, 2025 (Source: CryptoQuant)

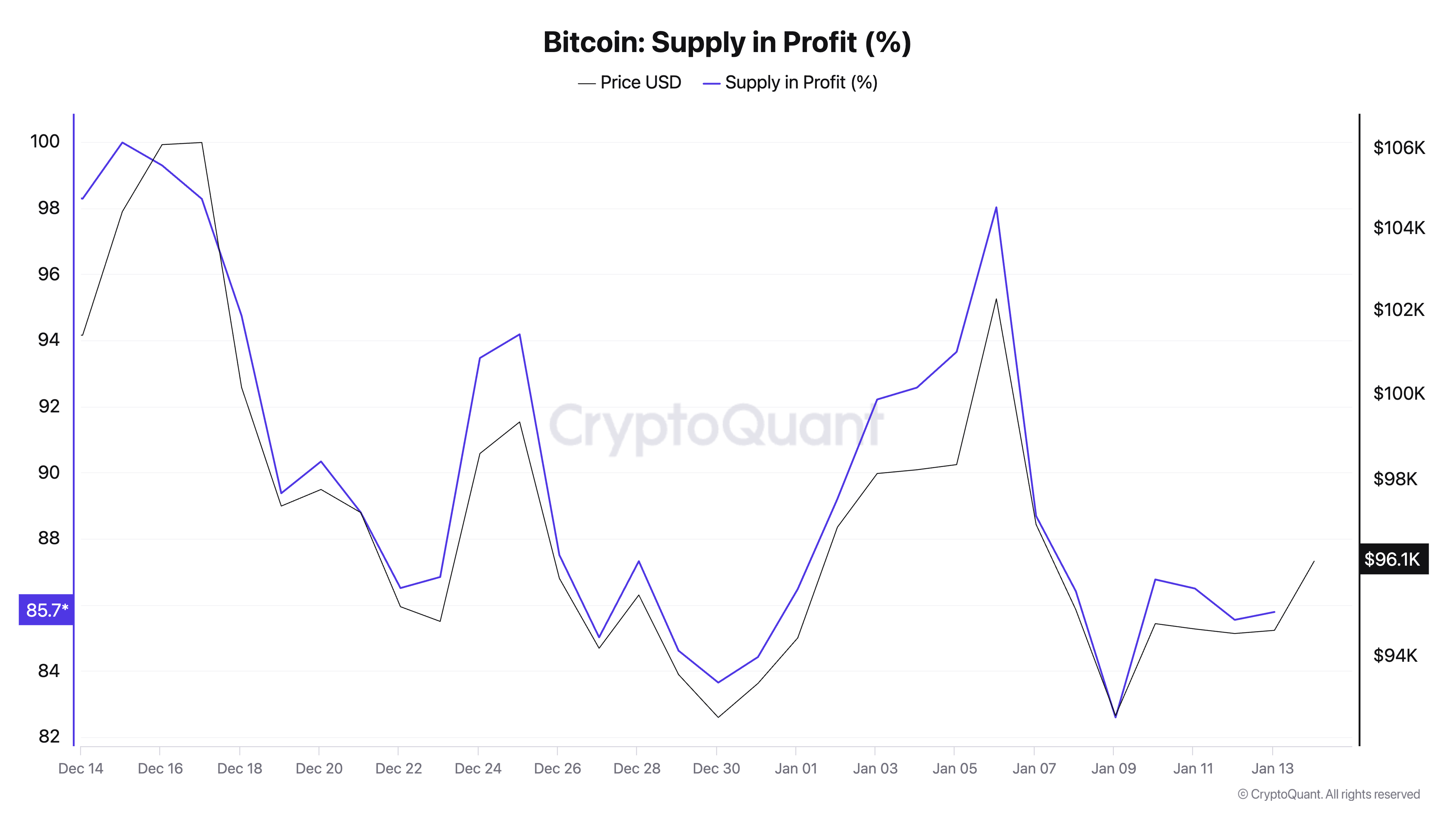

Graph showing Bitcoin’s nett unrealized profit/loss (NUPL) ratio from Dec. 14, 2024, to Jan. 13, 2025 (Source: CryptoQuant)The percent of Bitcoin’s proviso successful nett is calculated by comparing the acquisition outgo of coins with existent marketplace prices. It dropped sharply from 98.52% to 85.78% implicit the past week, revealing that a important information of Bitcoin’s proviso moved from unrealized nett to unrealized nonaccomplishment owed to terms fluctuations.

On Jan. 13, 85.78% of Bitcoin’s proviso was inactive successful profit, indicating that astir holders acquired their Bitcoin astatine prices beneath the existent marketplace price. This shows that contempt the marketplace being highly delicate to terms volatility, a ample proportionality of it inactive remains resilient.

Graph showing Bitcoin’s proviso successful nett from Dec. 14, 2024, to Jan. 13, 2025 (Source: CryptoQuant)

Graph showing Bitcoin’s proviso successful nett from Dec. 14, 2024, to Jan. 13, 2025 (Source: CryptoQuant)These metrics are important successful knowing Bitcoin’s cost-basis organisation and wide marketplace health. NUPL and proviso successful nett collectively item the economical positioning of Bitcoin holders. While 14.2% of Bitcoin’s proviso present has a outgo ground supra the existent price, the information indicates robust underlying enactment for Bitcoin’s terms to stay supra $90,000. This further confirms that the marketplace has not entered a prolonged organisation phase.

Supply successful nett and NUPL measurement the narration betwixt humanities acquisition costs and existent prices but bash not relationship for existent trading enactment oregon behavior. For instance, portion a diminution successful unrealized profits mightiness suggest accrued selling pressure, these indicators cannot corroborate whether holders are actively selling oregon simply holding done volatility.

These metrics connection a macro-level presumption of the market’s outgo basis, acting arsenic a “thermometer” for Bitcoin’s economical positioning. The information reinforces the presumption that astir Bitcoin holders are inactive successful profit, a origin that tin supply stableness successful times of terms turbulence.

While the crisp driblet successful unrealized profits mightiness rise concerns astir accrued selling pressure, the resilience successful the percent of proviso successful nett suggests a beardown basal of holders who stay optimistic astir Bitcoin.

The station The marketplace is inactive successful nett contempt Bitcoin’s terms slump appeared archetypal connected CryptoSlate.

11 months ago

11 months ago

English (US)

English (US)