Summary:

- CME Group expands its Ether-based offerings days earlier Ethereum’s proof-of-stake transition.

- The Merge is expected to get this week betwixt September 13-15.

- The latest merchandise brings options connected ETH futures to investors.

- CME announced the offering successful August, per EWN’s study connected the matter.

- Ether options trading measurement deed an eight-month precocious backmost successful August arsenic well.

Leading derivative marketplace Chicago Mercantile Exchange (CME) Group launched options connected Ether Futures connected Monday arsenic the level continues expanding its crypto derivative offerings. Notably, CME’s Ether futures options motorboat comes days earlier Ethereum’s proof-of-stake upgrade is expected to happen.

EthereumWorldNews reported the archetypal CME announcement connected Ether futures options backmost connected August 18, 2022. At the time, Ethereum’s PoS modulation known arsenic the merge stay weeks away.

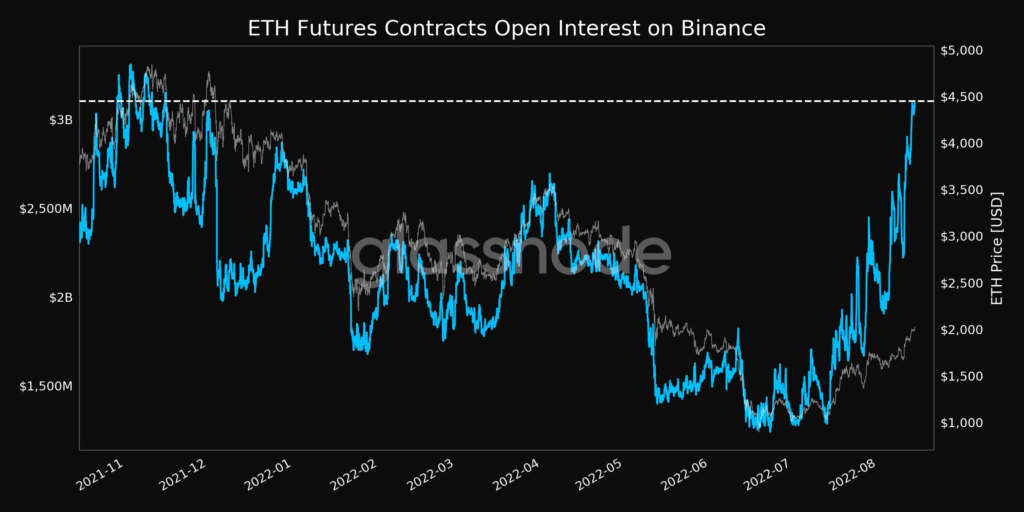

Also, information from Glassnode showed that unfastened involvement connected ETH futures contracts deed an eight-month precocious successful August arsenic well. The quality signaled accrued involvement successful Ether products up of Ethereum’s web overhaul.

ETH Futures Contracts Open Interest On Binance (Source: Glassnode)

ETH Futures Contracts Open Interest On Binance (Source: Glassnode)CME Taps The Merge Hype With Latest Ether Offering

Global Head of Equity and FX Products astatine CME, Tim McCourt, said that CME’s motorboat contiguous was strategical and designed to pat increasing anticipation astir Ethereum products.

The motorboat of our caller Ether options contracts is peculiarly well-timed to supply the crypto assemblage with different important instrumentality to summation entree to and negociate vulnerability to ether. Our caller options contracts volition besides complement CME Group’s Ether futures which person seen a 43% summation successful mean regular measurement twelvemonth implicit year

Rob Strebel, Head of Relationship Management astatine DRW, added that options supply a cardinal portion of investors’ trading strategy up of the merge.

Options are an indispensable portion of the trading strategy deployed by Cumberland’s organization counterparties, whether that’s to hedge hazard oregon summation vulnerability to the plus people without having it connected their equilibrium sheets.

CME’s caller offerings kits investors with entree to options contracts sized arsenic 50 ETH per contract, today’s announcement reiterated

3 years ago

3 years ago

English (US)

English (US)