Over the past 30 days, Bitcoin’s hashrate has been coasting on astatine the highest levels ever recorded during the network’s lifetime. Bitcoin’s terms improved precocious but it is inactive down 38% from the crypto asset’s high, making bitcoin little profitable to mine. However, bitcoin mining is inactive profitable, successful opposition to 10 years ago, erstwhile the starring crypto asset’s worth crashed beneath the outgo of production.

Bitcoin’s Price Is 38% Lower Than It’s All-Time High, Bitcoin Miners Still Profit

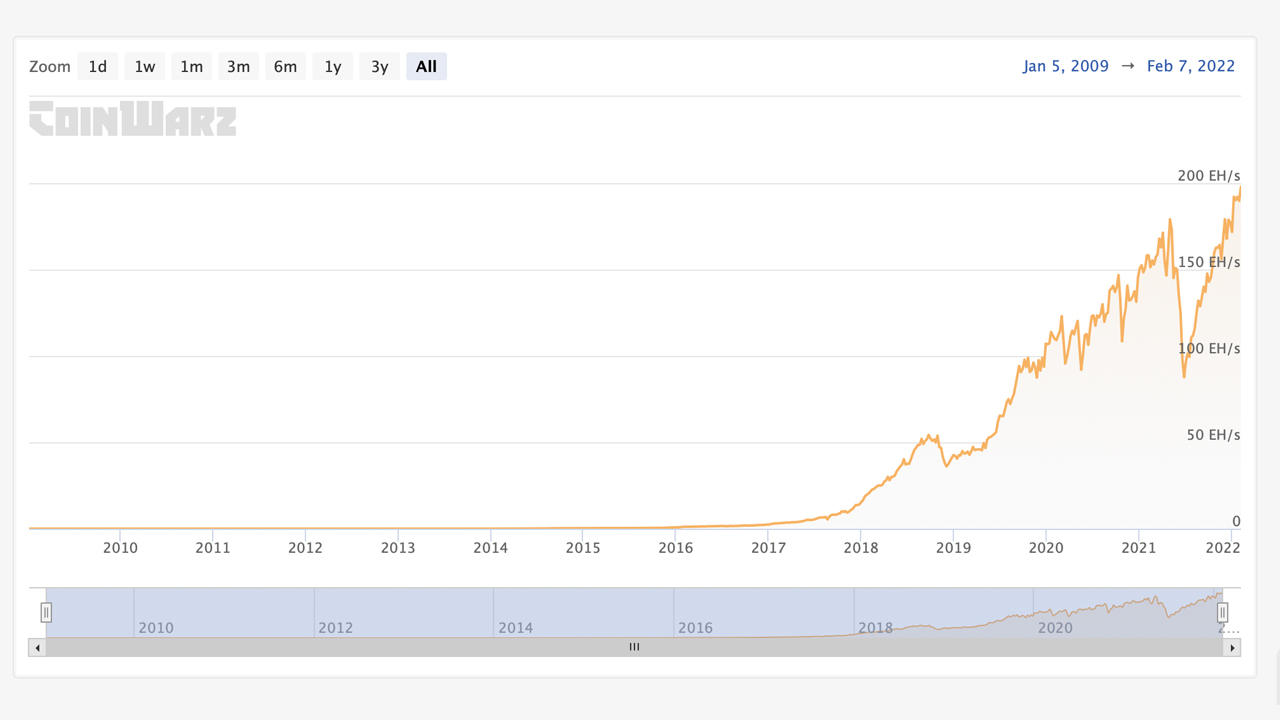

While bitcoin’s terms worth has climbed rather precocious against the U.S. dollar during the past 13 years, the network’s hashrate has besides risen to all-time highs. Today, the hashrate is coasting on supra 2 100 quintillion hashes per 2nd (H/s) which is simply a batch stronger than the Bitcoin network’s hashrate was connected January 5, 2009. On that day, statistic amusement that 9 100 forty-eight 1000 H/s was dedicated to the protocol’s security. Calculations amusement Bitcoin’s hashrate has accrued by twenty-one quadrillion percent — oregon 21,093,375,098,215,930% — since January 5, 2009.

Bitcoin hashrate betwixt January 5, 2009 and February 7, 2022.

Bitcoin hashrate betwixt January 5, 2009 and February 7, 2022.Bitcoin’s hashrate is coasting on astatine all-time highs, but the crypto asset’s worth is 38% little than it was 3 months ago, connected November 10, 2021. This successful crook has made it little profitable to excavation bitcoin (BTC), but inactive profitable for a decent bulk of high-powered mining rigs. For instance, utilizing today’s BTC speech rates, the Bitmain Antminer S19 Pro with 110 terahash per 2nd (TH/s) volition nutrient $16.81 per time if the machine’s electrical costs are astir $0.12 per kilowatt-hour (kWh). SHA256 machines that nutrient astatine slightest 25 TH/s volition inactive crook a nett utilizing today’s BTC speech complaint and $0.12 per kWh.

Mid-October, 2011: Bitcoin’s Price Drops Below the Cost of Production

Over 10 years ago, connected October 18, 2011, the outgo of a azygous bitcoin fell beneath the terms to nutrient bitcoin (BTC). It wasn’t the lone clip this has happened, but it was 1 of the archetypal times the terms of bitcoin was said to beryllium little than the outgo to excavation the integer currency. That week successful 2011, the network’s hashrate was astir 8.596 TH/s oregon 8,596,000,000,000 hashes per second. While the hashrate was overmuch little than today, it was inactive nine-hundred-six cardinal percent (906,593,161.72%) higher successful 2011 than connected January 5, 2009.

At the time, erstwhile BTC’s terms fell beneath the outgo of production, it made planetary headlines. The Guardian’s contributor Charles Arthur wrote astir the incidental connected October 18, 2011, erstwhile helium explained however BTC’s terms crashed from a precocious of implicit $30 per portion to $1-2 per BTC successful mid-October. That year, Arthur called BTC a “‘Hackers’ virtual currency and favoured means of exchange.” The Guardian writer’s study said that BTC’s terms “plummeted crossed exchanges – to a level wherever it costs much to ‘mine’ them than they are worth.”

Bitcoin’s Value Drops Below Production Cost successful 2015, 2018, and 2020 — Estimates Say ‘Current Production Cost Is $34K’

About a twelvemonth aft the 2013 terms high, BTC’s worth started to adjacent dropping beneath the outgo of accumulation again. During the archetypal week of December, the web hashrate declined and the CEO of Spondoolies-Tech, Guy Corem, explained however the crypto asset’s marketplace worth was affecting miners astatine the time. “Under the existent bitcoin value, mining cogwheel ratio of 0.5–0.7 J/GH scope and vigor cost, we’ll scope equilibrium precise soon,” Corem said. The outgo to excavation BTC was reportedly much than they were worthy successful mid-January 2015 aft Corem made those statements. That period successful 2015, the terms of bitcoin (BTC) dropped beneath the $200 mark.

According to reports successful mid-December 2018, BTC’s terms was little than accumulation costs again. At that clip successful 2018, BTC was changing hands for $3,200 per unit. Furthermore, connected March 12, 2020, often referred to arsenic ‘Black Thursday,’ BTC’s terms shuddered and tanked down to the mid-$3K range, making it unprofitable for a bulk of the network’s mining participants. While BTC’s terms is 38% little than the all-time high, immoderate judge that it is inactive adjacent existent mining costs. In mid-January of this year, the fashionable Twitter relationship dubbed ‘Venture Founder’ told his 14,600 societal media followers that “current accumulation outgo is $34K.”

Venture Founder besides mentioned the crypto asset’s worth crashing beneath the outgo of accumulation successful December 2018 and March 2020. “The worst dumps bitcoin ever had were owed to miners capitulation (Dec 2018, Mar 2020), erstwhile BTC fell beneath accumulation costs, it is astatine hazard for miner capitulation,” Venture Founder tweeted. “BTC was astatine hazard for miner capitulation astatine $30K successful May. The existent accumulation outgo is $34K,” helium added.

Can Bitcoin’s All-in Sustaining Production Cost Rise?

Knowing precisely what the outgo of accumulation is, and what a bitcoin miner’s all-in sustaining outgo is, would beryllium highly hard to estimate, but determination person been galore who judge determination is simply a number. The aforementioned instances describing the times and price-points wherever radical believed the terms of BTC had fallen beneath the outgo to excavation the crypto plus are a cleanable illustration of this belief.

For example, portion a miner leverages a 100 TH/s instrumentality and gets a regular nett for that instrumentality of astir $16.81 per time with energy costing $0.12 per kWh, different miner could wage $0.06 per kWh. Moreover, 1 study published successful October 2020 claims that “the outgo of bitcoin mining has ne'er truly increased.”

Tags successful this story

What bash you deliberation astir the reported instances wherever it’s been said that the terms of bitcoin fell beneath the outgo of production? What bash you deliberation astir the estimated $34K existent outgo of accumulation statement? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)