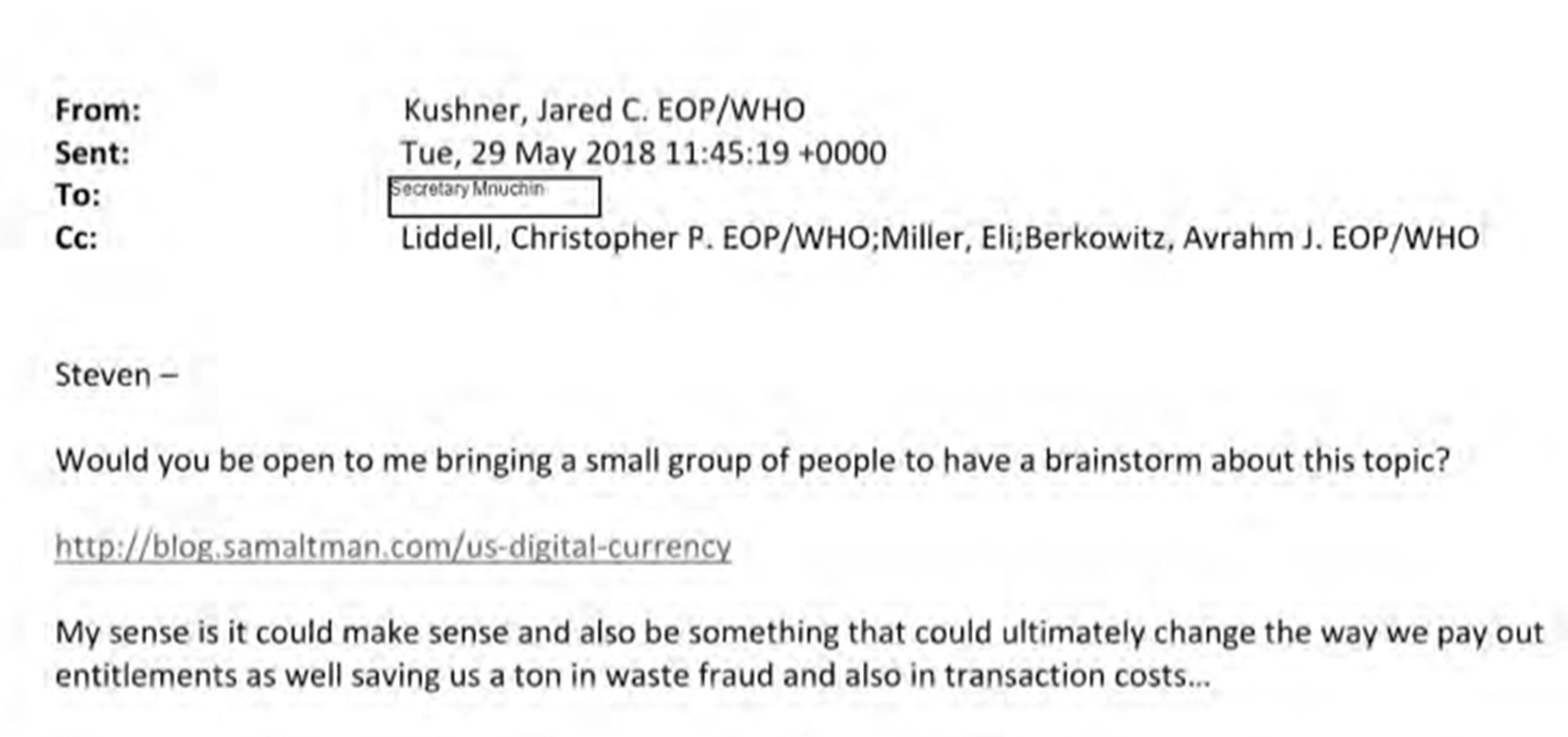

The thought of a integer U.S. dollar had an aboriginal behind-the-scenes advocator wrong the Trump medication successful the president’s son-in-law, recently unearthed documents show.

On May 28, 2019, Jared Kushner, peculiar advisor to the president and Ivanka Trump’s husband, emailed Treasury Secretary Steven Mnuchin. The connection included a nexus to a blog station by Sam Altman, erstwhile caput of Y Combinator, the Silicon Valley startup incubator.

“Steven – Would you beryllium unfastened to maine bringing a tiny radical of radical to person a brainstorm astir this topic?” Kushner wrote.

“My consciousness is it could marque sense,” Kushner continued, “and besides beryllium thing that could yet alteration the mode we wage retired entitlements arsenic good redeeming america a ton successful discarded fraud and besides successful transaction costs…”

Kushner took connected many duties during his clip astatine the White House. He had a large relation successful overseas argumentation spanning from Mexico to Iraq, arsenic good arsenic assignments to oversee transgression justness betterment and an overhaul of the authorities itself. Some critics saw that wide workload arsenic untenable, but Politico has credited Kushner with real progress connected stabilizing the Middle East.

But Kushner’s involvement successful integer currencies, nationalist oregon otherwise, was antecedently unreported (except the clip idiosyncratic tried to extort bitcoin from him). It’s 1 of respective insights gleaned from a 250-page trove of Mnuchin’s crypto-related correspondence during his 4 years astatine Treasury.

Obtained by CoinDesk done a Freedom of Information Act (FOIA) request, the documents besides shed airy connected the challenges presented to the crypto manufacture by planetary sanctions and the contention implicit Mnuchin’s eleventh-hour connection on user-controlled wallets. They besides incorporate immoderate unintended drama arsenic crypto VIPs met with D.C. powerfulness players.

Steven Mnuchin, Donald Trump and Jared Kushner astatine the White House successful 2017 (Bloomberg via Getty Images)

Kushner seems to person been meaningfully up of the curve successful contemplating a integer dollar. Discussion of cardinal slope integer currencies (CBDCs) didn’t prime up broadly until precocious 2019, aft the announcement of Facebook’s Libra task was met with ferocious backlash and China got superior astir its digital yuan.

The U.S. Federal Reserve, for its part, has been studying the contented of CBDCs, but it has yet to people immoderate of the long-promised reports detailing the cardinal bank’s presumption connected technological and argumentation considerations for a integer dollar. Much of the propulsion for a U.S. CBDC has travel from the backstage sector.

It’s besides absorbing to look backmost astatine Altman’s thinking, including his connection that a U.S. integer currency “would beryllium evenly distributed to U.S. citizens and taxpayers – thing similar everyone with a societal information fig gets 2 coins.”

That jibes with Altman’s current program for WorldCoin, a token intended to beryllium distributed globally arsenic a signifier of cosmopolitan basal income.

It is unclear whether the gathering Kushner projected to Mnuchin happened. Through an intermediary, Mnuchin declined to remark for this story. Kushner did not respond to requests for comment, nor did Altman.

In the FOIA request, submitted past March, CoinDesk asked the Treasury for immoderate emails from Mnuchin’s clip successful bureau (February 2017 to January 2021) that included the connection “cryptocurrency” oregon respective synonyms (“virtual currency,” “digital asset,” etc.) oregon mentioned salient companies successful the manufacture similar Coinbase oregon Ripple.

Nine months later, a Treasury FOIA serviceman sent CoinDesk 100 pages successful afloat and 133 pages successful part. The serviceman wholly withheld 13 pages, citing the national disclosure law’s exemption for commercialized secrets and idiosyncratic privacy.

Even so, the documents connection a caller model into however a cardinal country of the U.S. authorities approached planetary crypto argumentation nether Trump.

It was an medication often criticized for neglecting America’s partners abroad. Sometimes that inclination carried implicit to crypto.

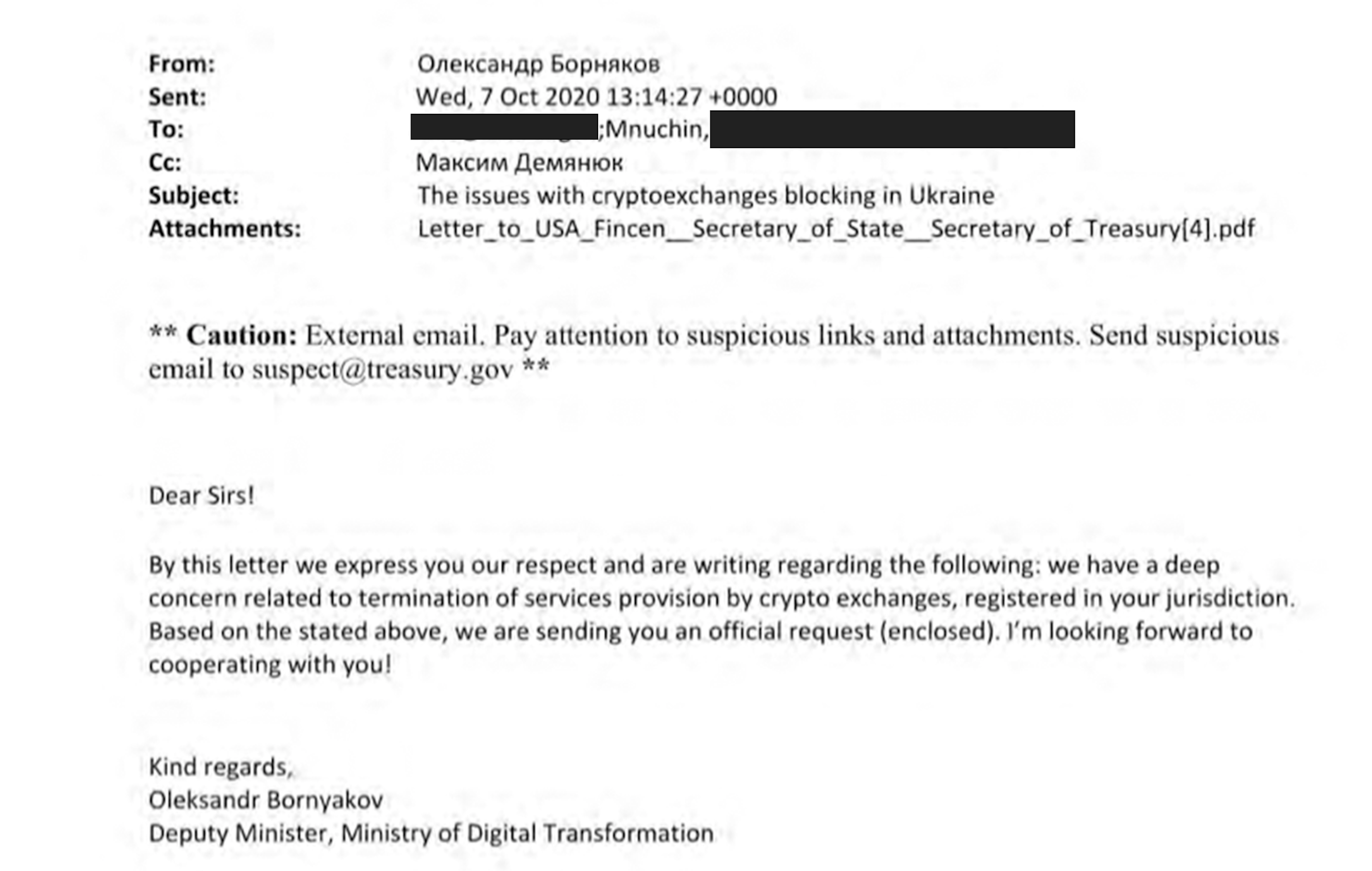

On Oct. 7, 2020, Oleksandr Bornyakov, Ukraine’s lawman curate of integer transformation, sent an email to Mnuchin asking for assistance with an antithetic problem: U.S. cryptocurrency exchanges Coinbase, Bittrex and Gemini had pulled retired from Ukraine.

“We person a heavy interest related to termination of services proviso by crypto exchanges registered successful your jurisdiction,” work the email, addressed to Mnuchin and Mike Pompeo, past Secretary of State.

One of the exchanges Bornyakov mentioned successful his correspondence was Bermuda-registered Bittrex. In a 2020 blog post, Bittrex vaguely blamed the “current regulatory environment” for its determination to discontinue work to Ukraine and a fistful of different countries and declined to elaborate when contacted by CoinDesk the pursuing year.

Bornyakov reached retired to Bittrex, which told him it had concerns astir imaginable users from the Crimean Peninsula, helium told CoinDesk past May. Russia annexed Crimea from Ukraine successful 2014, but astir countries inactive don’t admit the peninsula arsenic portion of Russia. The U.S. and European Union imposed sanctions connected Russian individuals and companies that were related to the annexation oregon benefited from it. The EU besides restricted imports and investments successful the system of Crimea by European companies.

Bittrex told the Ukrainian authorities it couldn’t place Crimea residents specifically, which meant the institution was astatine hazard of violating sanctions connected the peninsula if it continued to service Ukraine.

But it wasn’t Ukraine that was nether sanctions, Bornyakov emphasized successful his letter.

“Please remainder assured that we bash respect each the laws and regulations, adopted successful the USA,” Bornyakov wrote. He insisted that Ukraine’s 44 cardinal citizens shouldn’t go collateral harm successful a sanctions warfare targeted astatine Crimea, colonisation 2 million.

“This is wherefore determination is simply a beardown request of issuing the respective clarification” to U.S. crypto exchanges that would “eliminate immoderate misunderstandings” and bring work backmost online, Bornyakov wrote. He asked for an update connected “next steps.”

Bornyakov ne'er heard backmost from the Treasury astir his request, helium told CoinDesk recently.

The trove of documents besides shows the lengths the blockchain manufacture went to discourage Mnuchin from pursuing the Trump administration’s wide panned, last-minute connection connected user-hosted cryptocurrency wallets. These are wallets wherever the funds are controlled by the individual, not a institution taxable to regularisation – much similar a leather wallet afloat of currency than a slope account.

Mnuchin had warned during Congressional grounds successful February 2020 that “significant caller requirements” for cryptocurrency would beryllium coming “very quickly.” But helium gave nary details then, and the connection did not travel until the waning days of the administration.

The lobbying efforts began astatine slightest a period earlier the connection yet dropped. On Nov. 17, 2020, Kristin Smith, enforcement manager of the Blockchain Association, emailed the Treasury Department asking to conscionable with Mnuchin astir self-hosted wallets. Her enactment had conscionable released a 50-page argumentation study connected the topic, she noted.

“We had heard for [a] fewer months anterior that Treasury had concerns implicit self-hosted wallets,” Smith told CoinDesk recently. “At the time, we had hoped to usage the study arsenic a mode to amended policymakers successful the caller year, but the timeline accelerated erstwhile we learned that Treasury was pursuing a midnight rulemaking.”

A week later, Coinbase CEO Brian Armstrong tweeted that the Treasury intended to enforce onerous requirements for self-hosted wallets.

The Financial Crimes Enforcement Network (FinCEN), a bureau of the Treasury that combats wealth laundering and coercion financing, formally proposed the regularisation and solicited nationalist remark connected Dec. 18, 2020, a week earlier Christmas. The regularisation would person required crypto exchanges to cod counterparty information, including names and addresses, from anyone hoping to transportation oregon person cryptocurrencies to oregon from self-hosted wallets. FinCEN said it was acrophobic that the deficiency of accusation astir users of specified wallets created a unsighted spot successful the government’s efforts to combat coercion financing.

“Mnuchin was dense connected nationalist security,” said a erstwhile Treasury staffer. “That was his large focus.”

“Mnuchin was dense connected nationalist security,” said a erstwhile Treasury staffer. “That was his large focus.”

The proposal, which insiders accidental was apt instigated by Mnuchin alternatively than FinCEN itself, was met with wide absorption from the industry. Participants disquieted it would beryllium intolerable to comply erstwhile the counterparty is an automated smart contract with nary sanction oregon carnal address, and others were acrophobic astir burdensome compliance requirements.

After FinCEN issued the proposal, Smith re-upped her request, offering successful a follow-up email to bring immoderate of the association’s subordinate entities connected a telephone with Mnuchin.

An undisclosed Treasury authoritative forwarded the petition to Justin Muzinich, past the Deputy Treasury Secretary and 2 different undisclosed officials, writing, “Didn’t Justin [Muzinich] talk to them? Do you cognize wherefore this mightiness beryllium coming backmost up to stm [Secretary Treasury Mnuchin?]”

One of those different officials responded, cryptically, “DELIBERATIVE” successful an email that was different redacted.

Mnuchin does look aboriginal connected the thread, authorizing Muzinich to instrumentality the call.

That telephone “lasted astir 5 minutes,” Smith aboriginal told CoinDesk. “I callback that helium called my mobile straight truthful I wasn’t capable to loop successful immoderate of our relation members. I was capable to locomotion done immoderate high-level talking points, but I retrieve feeling that this was conscionable a check-the-box benignant call.”

The commercialized radical didn’t springiness up. Paul Clement, an lawyer with the instrumentality steadfast Kirkland & Ellis LLP, wrote different missive to Mnuchin connected the Blockchain Association’s behalf astatine the extremity of December 2020, explaining his concerns with the process of creating the projected rule.

He echoed broader manufacture concerns astir the 15-day nationalist remark play (this was later extended several times) FinCEN provided for input. It is customary for U.S. regulatory agencies to springiness the nationalist astatine slightest 30 and usually person to 90 days to remark connected projected regularisation changes.

“The conception that stakeholders could meaningfully prosecute with a regularisation that touches connected much than 24 abstracted subjects successful specified a highly truncated play would beryllium doubtful adjacent successful the mean course,” the missive says.

“Thus, what purports to beryllium conscionable a reporting request whitethorn good run arsenic a de facto ban,” Clement wrote.

He warned that the regularisation mightiness not basal up to a tribunal challenge, providing examples of lawsuit instrumentality that suggested the connection was being rushed unnecessarily.

Nor was the Blockchain Association the lone radical trying to code the wallet regularisation concerns.

The regularisation appears again successful a Dec. 22, 2020 email sent to Mnuchin, Keith Abouchar, who appears to beryllium a staffer for Rep. Steny Hoyer (D-Md.) and the Biden modulation team. While the “from” tract is redacted, this email contains a public letter primitively published by the Electronic Frontier Foundation (EFF).

The projected regularisation appeared rushed, could forestall broader adoption of crypto and wouldn’t let for cash-like transactions owed to the privateness implications, the email said. An EFF worker said nary 1 from the instauration sent the email, but anyone could person copied and emailed the nationalist letter.

A Jan. 21, 2021 email from an undisclosed sender besides “urged” Mnuchin to region the counterparty accusation request from the unhosted wallet rule, saying it could effect successful “a much burdensome standard” connected cryptocurrency transactions than exists for currency and checks.

In the end, the regularisation was softly shelved nether the Biden administration. FinCEN extended the remark play respective times earlier announcing it would reappraisal the regularisation months later. The regularisation hasn’t travel up again.

Much of the crypto-related postulation successful Mnuchin’s inbox is much human-sized, sometimes to an amusing degree.

For example, sorting retired information clearance for an eagerly awaited Treasury-hosted crypto acme of March 2, 2020, appears to person been tricky.

Increasingly frantic email exchanges item the complexity that went into this unprecedented gathering of high-ranking authorities officials from the Treasury, FinCEN, the FBI and different agencies, who met face-to-face with a gaggle of crypto bigwigs from firms similar Coinbase, Xapo, Square and Fidelity.

At the time, the Treasury announced that the gathering happened but didn’t supply immoderate details astir who was involved.

The Treasury’s searching and unpredictable know-your-crypto-industry-guest protocol seemingly caused the astir wrinkles to the entourage of then-Twitter brag Jack Dorsey, who went successful his capableness arsenic CEO of Square (now known arsenic Block).

For instance, Mike Brock, caput of strategical improvement astatine Square, was knocked back, contempt brandishing the requisite driving license. Sounding similar a quality from a spy movie, 1 of Dorsey’s handlers messaged done that Brock’s effort to wide information had been denied. “I told him to clasp tight,” Square enforcement adjunct Caitlin Friel Rabil said. “He’s extracurricular the gathering waiting by the Secret Service booth. Is determination immoderate mode you tin fto maine cognize erstwhile helium should effort again?”

“We person learned that Coinbase, Xapo and Chainalysis each person been allowed to bring +1s and we would similar to inquire the aforesaid for Jack. Can you delight fto maine cognize if Jack tin bring a subordinate of his unit with him connected Monday?”

When it came to Dorsey himself, a mates of peculiar requests were relayed implicit by his team. First, immoderate further guests were asked for, due to the fact that connection had got retired that different delegates had been granted that courtesy.

“We person learned that Coinbase, Xapo and Chainalysis each person been allowed to bring +1s and we would similar to inquire the aforesaid for Jack. Can you delight fto maine cognize if Jack tin bring a subordinate of his unit with him connected Monday?” Rabil wrote connected Feb. 28, the Friday earlier the meeting.

Dorsey’s handlers besides asked if helium could beryllium driven up to a broadside doorway successful bid to fell his identity. (Kind of understandable; Dorsey is decidedly much recognizable than your mean businessman.)

“I noted connected the invitation that you suggest Jack spell successful done the North gate. Is determination immoderate mode helium tin get person via car conscionable truthful he’s little visible, fixed the sensitivity of the meeting?” his adjunct said.

The reply from Treasury was polite but firm: “As of close present nary +1s volition beryllium allowed to articulation the meeting, it volition beryllium the invited principals only. I’m acrophobic helium volition person to beryllium dropped disconnected astatine the country of 15th & New York Ave. and proceed connected ft to the northbound entrance. There is nary parking astatine the building.”

The lone crypto VIP invited to the March 2 acme who did not be was billionaire PayPal co-founder, task superior capitalist and Trump protagonist Peter Thiel, according to preparatory emails among Treasury officials.

CoinDesk reached retired to Thiel and Dorsey but didn’t person a effect from either by property time.

The March 2020 crypto acme was meant to footwear disconnected a bid of moving groups involving authorities and industry. The incipient crypto engagement program, however, was stopped successful its tracks by the outbreak of the coronavirus pandemic, according to a root who worked astatine the Treasury astatine that time.

“We brought successful a batch of manufacture leaders and we wanted a beardown and affable enactment of communication. Of people this each got enactment connected the backmost burner due to the fact that of Covid,” the Trump medication root told CoinDesk.

“I would accidental that present you conscionable don’t spot that level of engagement” nether Biden, the erstwhile Treasury authoritative said. “It’s astir zero from what I’ve seen. Instead, I deliberation there’s a precocious level of antagonism close now.”

Indeed, Securities and Exchange Commission (SEC) Chairman Gary Gensler has continued, if not heightened, his predecessor’s antagonism toward the crypto industry. The regulator has continued serving enforcement actions and issuing subpoenas to individuals successful the business. The SEC adjacent subpoenaed a stablecoin laminitis right earlier helium went onstage during a league successful New York precocious past year.

Industry participants are further acrophobic that the Treasury Department nether Mnuchin’s successor Janet Yellen mightiness bring the hammer down connected crypto this year, erstwhile it explains however it volition enforce a arguable taxation proviso successful past year’s infrastructure measure that seeks to cod taxes from crypto brokers.

“I don’t deliberation [Mnuchin] ever did thing that was particularly bully oregon particularly atrocious for crypto, until that infinitesimal erstwhile helium did thing terrible.”

On the different hand, different parts of the Biden medication person been gathering bridges. Biden’s Commodity Futures Trading Commission (CFTC) president Rostin Benham, for example, enactment Jason Somensatto, formerly of decentralized exchange developer 0x Labs, successful complaint of the agency’s fiscal exertion division, LabCFTC. Also, Yellen’s Treasury has focused its combat against ransomware connected sanctioning exchanges, and that specificity has travel arsenic a alleviation to galore crypto lobbyists.

Moreover, Mnuchin was acold from solicitous toward the manufacture adjacent the extremity of his tenure, erstwhile helium tried to unreserved done the projected regularisation requiring crypto businesses to verify the individuality of counterparties with self-hosted wallets.

“I don’t deliberation helium ever did thing that was particularly bully oregon particularly atrocious for crypto, until that infinitesimal erstwhile helium did thing terrible,” said Jerry Brito, enforcement manager of Washington-based deliberation vessel Coin Center.

“We tin ne'er replay the videotape and spot however it would person turned retired if we hadn’t had a pandemic,” said Brito, 1 of the attendees astatine the March 2, 2020 meeting.

“One communicative is, you would person had a bid of much roundtables with manufacture that would person resulted successful large regulation,” helium said. “Another anticipation is that we would person had the unhosted wallet regularisation soon after. Hopefully, if you had had galore much meetings, [Mnuchin] would person realized implicit the people of those meetings that was not a astute happening to do.”

The trove of emails besides underscores why, contempt crypto’s disruptive promise, companies successful the tract person been hiring veterans of the bequest fiscal industry.

Coinbase Chief Financial Officer Alesia Haas “has a idiosyncratic relationship with Secretary Mnuchin”, according to an email to the Treasury section from Kara Calvert, past a spouse astatine the exchange’s D.C. lobbyist Franklin Square Group and present in-house. (Haas was antecedently CFO astatine OneWest, the slope Mnuchin ran.)

For that reason, Haas got added to a Treasury league telephone with Brian Armstrong successful May 2020 astatine Coinbase’s request, the email said.

Finally, and fittingly for the blockchain industry, the precise archetypal email successful the 250-page pdf Treasury provided to CoinDesk is an concern transportation addressed to Mnuchin.

“Would you beryllium funny successful investing successful our aboriginal signifier circular for accredited investors?” Dave Cohen, CEO of Taekion, wrote to the Treasury Secretary connected Jan. 10, 2019. “If so, we tin nonstop elaborate institution info.”

Cohen described his institution arsenic “the archetypal AI and blockchain based level that volition disrupt the planetary cybersecurity industry.”

It’s unclear if Mnuchin responded to Cohen, who didn’t reply to CoinDesk’s petition for comment.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)