Real property ownership is the halfway aspiration driving the Modern Serfdom Model. Debt — and successful particular, mortgages — is the mechanics that binds the serf to the system. Inflation covertly moves the finishing enactment further distant each year. This is simply a crippled that’s intolerable to win. The atrocious quality is it’s getting adjacent harder. But determination are 2 pieces of bully news. First, the exemplary is adjacent to its breaking constituent due to the fact that location ownership is retired of scope for astir each young people. Second, everyone, careless of age, wealthiness oregon circumstances, has bitcoin arsenic an flight hatch. On the strategy successful which we indoctrinate radical into this feudalism, Allan Watts said,

“...What we bash is enactment the kid into the corridor of this people strategy with a benignant of, “Come connected kitty, kitty.” And you spell onto kindergarten and that’s a large happening due to the fact that erstwhile you decorativeness that you get into archetypal grade. Then, “Come on” archetypal people leads to 2nd people and truthful on. And past you get retired of people schoolhouse and you got precocious school. It’s revving up, the happening is coming, past you’re going to spell to college… Then you’ve got postgraduate school, and erstwhile you’re done with postgraduate schoolhouse you spell retired to articulation the world. Then you get into immoderate racket wherever you’re selling insurance. And they’ve got that quota to make, and you’re gonna marque that. And each the clip that happening is coming – It’s coming, it’s coming, that large thing. The occurrence you’re moving for. Then you aftermath up 1 time astir 40 years aged and you say, “My God, I’ve arrived. I’m there.” And you don’t consciousness precise antithetic from what you’ve ever felt. Look astatine the radical who unrecorded to retire; to enactment those savings away. And past erstwhile they’re 65 they don’t person immoderate vigor left. They’re much oregon little impotent. And they spell and rot successful some, aged peoples, elder citizens community. Because we simply cheated ourselves the full mode down the line. If we thought of beingness by analogy with a journey, with a pilgrimage, which had a superior intent astatine that end, and the happening was to get to that happening astatine that end. Success, oregon immoderate it is, oregon possibly eden aft you’re dead. But we missed the constituent the full mode along. It was a philharmonic thing, and you were expected to sing oregon to creation portion the euphony was being played.”

It Starts At School

State schoolhouse systems are wherever the Modern Serfdom Model begins. Children are taught to beryllium obedient supra each else. They larn to fearfulness authority, not to question things oregon talk up, that nine is controlled from the apical down. Of people the consequences aren’t each atrocious — peculiarly if you tin aboriginal harness subject and self-control to your advantage. But astir importantly arsenic it relates to the Model, children are molded to prosecute lone 1 course: higher acquisition and a career, portion being obedient servants of the state.

(Note: this is simply a heavy rabbit spread successful its ain right. I highly urge a abbreviated TED Talk by Sir Ken Robinson titled “Do schools termination creativity?”, arsenic good arsenic assorted podcasts and books by Bitcoiners Daniel Prince and Saifedean Ammous.)

The First Debt Trap

If you’ve done what you were told to astatine school, chances are you’re heading to assemblage oregon university. It’s what you’re expected to do, of course. You’re told (and don’t question it) that you can’t get anyplace without a degree, fto unsocial a occupation that pays capable to bargain a house. The trap is that it isn’t free,no substance however your authorities packages and sells it. In galore countries determination are pupil indebtedness systems. In others, you (and everybody else) pays done higher income taxation rates. In either case, determination is simply a important resistance connected nett income post-graduation. For those successful the countries with pupil indebtedness systems, determination is simply a beardown inducement to find a unafraid occupation arsenic rapidly arsenic imaginable successful bid to discontinue the debt. In the U.S. the total outstanding pupil indebtedness indebtedness is implicit $1.7 trillion. One successful 4 Americans (approx 45 cardinal people) person pupil indebtedness debt, averaging implicit $37,000 each. Numbers successful my autochthonal Australia are akin wherever determination is almost AUD 54 cardinal of outstanding HELP debt owed by 1 successful 10 people. The mean outstanding indebtedness is implicit AUD 20,000 with galore radical having debts implicit AUD 100,000. Try being an 18 twelvemonth aged entrepreneur and getting a indebtedness that size from a accepted fiscal institution.

Notably, not everybody volition take the higher acquisition path. Some volition prosecute immoderate signifier of enactment arsenic soon arsenic imaginable oregon vocational grooming successful a trade. This volition often beryllium a quicker way to income without the aforesaid indebtedness burden. Whether this is leveraged successfully is different matter, but it's worthy highlighting that galore radical find an alternate way for antithetic reasons (not needfully a nonstop rejection of the Model).

The [Insert Country Here] Dream

As discussed successful my nonfiction “Why existent property investors should emotion Bitcoin,” existent property is unquestionably an affectional plus class. Something that presently performs the dual relation of an concern and structure is inevitably going to be. The Australian movie, “The Castle,” encapsulates this perfectly. With classical lines specified arsenic “it’s not a house, it’s a home” and “a man’s location is his castle,” the movie shows that for galore radical existent property is truthful overmuch much than an investment. Similarly, location ownership has been a cornerstone of “The American Dream” for decades. Marketing slogans specified arsenic “rent wealth is dormant money” are treated by galore arsenic concern gospel. The civilization of location ownership and existent property investing is thing astir radical person afloat bought into and clasp dear. It has go the societal norm, adjacent expectation, that you should aspire to ain a home. This is wherefore it’s astatine the halfway of the Modern Serfdom Model. At authorities schoolhouse you were taught not to question these types of norms. And fixed the remainder of the strategy is designed to propulsion you successful that direction, you don’t get overmuch of an opportunity.

Death Pledge

The connection owe derives from Old French and Latin; it virtually means “death pledge.” Many radical volition not participate into a owe connected their archetypal location until good into their 40s. With owe presumption mostly being 30 years (and astir borrowers requiring the longest word imaginable successful bid to maximize borrowing capacity), they won’t beryllium repaid until galore borrowers are good into their 70s. The literal meaning of “mortgage” has ne'er been much appropriate.

The owe is the cardinal mechanics that enforces the Modern Serfdom Model. It would beryllium intolerable for astir radical to bargain a location without a loan. The request to marque your regular repayments creates an inducement for a stable, uninterrupted vocation of employment and disincentivizes entrepreneurial hazard taking. In short, it binds you. Of people it is imaginable to escape. But it's not easy. It's contrary to everything you’ve been taught. And astir volition ne'er try.

Impossible Dream

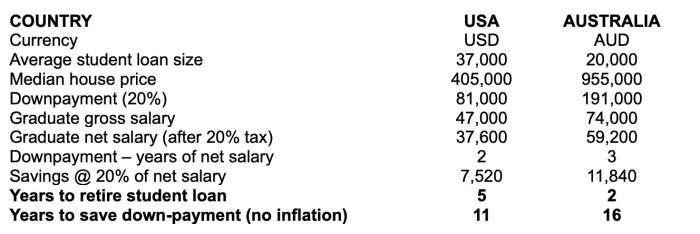

After a emblematic 3-to-5 years of higher education, assuming you’ve hung successful that agelong and graduated, you permission with the credentials that astir employers necessitate simply to see you for an interview. Whether you’ve learnt thing utile is debatable (and degree/school dependant) but that is not the taxable of this article. What’s astir definite is you’ve been burdened with important indebtedness and volition beryllium keen to wage it off. Let’s besides presume you privation to prevention for a location due to the fact that that’s what an big is expected to do, right? So however agelong volition it instrumentality to discontinue the loans and marque a downpayment? Another 3-to-5 years, by the clip you’re 30? Time to crunch immoderate basal numbers.

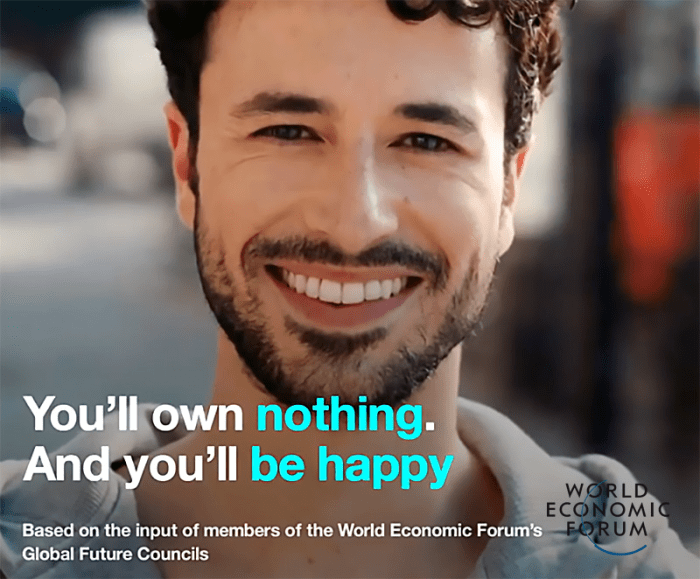

In the U.S., median household income was conscionable nether $69,000 successful 2019, with the average basal wage for a caller postgraduate being conscionable implicit $47,000 — astir 30% little than the median household income. The dynamic is akin successful Australia wherever mean full yearly net are conscionable nether AUD 94,000 with the mean salary being conscionable nether AUD 68,000 and the mean starting wage for graduates ranging betwixt AUD 55,000 and 93,000 depending connected the industry.

The U.S. median location terms is conscionable nether $405,000, astir 6 times median household income and astir 9 times the mean postgraduate salary. The Australian median location terms is implicit AUD 950,000, astir 10 times mean full net and up to 17 times the mean postgraduate salary.

Assuming a elemental 20% downpayment, a emblematic postgraduate needs to prevention 2 years gross wage successful the U.S. and 3 years gross wage successful Australia conscionable for the downpayment. That doesn’t dependable excessively atrocious connected look value, but it needs a deeper dive.

There are flaws successful this analysis; it’s not designed to beryllium cleanable but to show a point. For example, median location prices are much costly than “starter” homes that younger homeowners mightiness target. Or not doing it connected a city-by-city ground truthful that for large cities, higher salaries (but besides substantially higher location prices) are captured. Conversely, the 20% savings complaint is perchance generous for astir caller graduates fixed the idiosyncratic savings complaint successful the U.S. is good nether 10%. Personally, I don’t deliberation these things substance due to the fact that the supra snapshot wholly disregards inflation. Adding it blows the numbers retired of the h2o adjacent connected blimpish assumptions. Taking the U.S. example:

That’s right, assuming 3% yearly maturation successful nett savings (which requires wages to outpace inflation!) and lone 5% maturation successful location prices (well abbreviated of the 15-20% levels successful astir of the satellite today, but successful enactment with the 30-year average), it would instrumentality 21 years to prevention for the deposit. Again, this is imperfect, but the constituent is it doesn’t instrumentality 2.1 years!

To pre-empt criticisms, immoderate radical whitethorn person overmuch larger wage increases implicit clip owed to promotions oregon occupation changes, i.e. astatine immoderate constituent they whitethorn scope oregon transcend the mean household income (but not needfully earlier they person finished redeeming for a down-payment). Interest oregon concern net connected the savings is besides excluded. Interest rates are efficaciously zero presently and determination are trade-offs for riskier investing of the downpayment. Also, immoderate households whitethorn person savings rates successful excess of 20%. For example, determination volition beryllium dual-income, childless households redeeming towards this goal, which volition greatly accelerate the process (although galore would reason this dynamic is simply a nonstop effect to the occupation being discussed). The numbers are for a emblematic azygous person, not an outlier oregon precocious performer. Therefore, for astir radical adjacent getting the keys to a mortgaged location is an progressively hard upland to climb. It should beryllium wide that ostentation makes it adjacent harder.

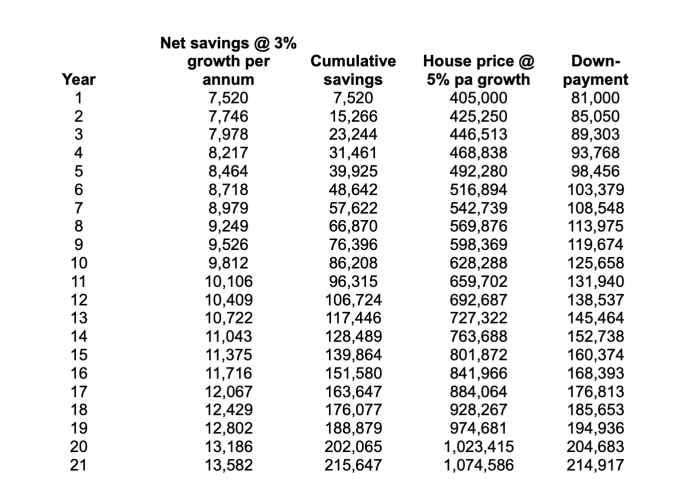

“You’ll Own Nothing. And You’ll Be Happy.”

There’s starting to beryllium a wide designation that astir young radical volition instrumentality decades to prevention for their archetypal home. For example, research successful the U.K. recovered fractional of each 20-35 twelvemonth olds would inactive beryllium renting successful their 40s and a 3rd by the clip they claimed their pensions (timelines that marque consciousness based connected the high-level investigation above). As the World Economic Forum says, “you’ll ain nothing. And you’ll beryllium happy.”

Doing what was the taste norm and societal anticipation has present go highly aspirational and unrealistic for galore who volition springiness up trying oregon acceptable their sights connected a antithetic goal. This unsocial has the imaginable to interruption the Modern Serfdom Model adjacent without the interference and beingness of the astir cleanable alternative: Bitcoin.

Freedom Money

Bitcoin’s value, whether it beryllium measured successful fiat currency presumption oregon purchasing power, is designed to pump forever. It benefits from what is colloquially termed Number Go Up (NgU) Technology. Due to its fixed proviso of 21 cardinal coins, it volition yet beryllium the astir scarce plus that has ever existed. Bitcoin preserves and grows the worth of your savings comparative to each different assets owed to the almighty operation of this scarcity and its adoption curve. It breaks the Modern Serfdom Model:

- Bitcoin provides options. When NgU works implicit a agelong capable timeframe you tin go unafraid capable to locomotion distant from a occupation you don’t similar and not person to find different 1 instantly successful bid to marque a owe repayment.

- You don’t person to prevention for 20 years for a downpayment to bargain bitcoin. It tin beryllium acquired instantly successful tiny sizes owed to its divisibility. You tin commencement increasing your wealthiness arsenic soon arsenic you gain income, alternatively than being forced to speculate successful the banal marketplace oregon hoard a melting crystal cube of currency for a location downpayment. Bitcoin incentivizes redeeming aboriginal successful beingness and avoiding indebtedness — the implicit other of the Model.

- Bitcoin enhances flexibility and state of question by being portable and borderless. If you take to ain bitcoin alternatively of existent estate, you are nary longer bound to a fixed determination wherever your vocation started.

- Bitcoin is immune to and adjacent benefits from cardinal banks’ monetary inflation, a cardinal operator down the location terms maturation that makes the process of redeeming for a downpayment truthful lengthy. That aforesaid ostentation besides grows the equity of existing homeowners but they stay successful a hindrance until the existent property is sold oregon downsized.

Ultimately bitcoin breaks the Modern Serfdom Model by being a superior store of worth than existent estate. The authorities and bequest fiscal strategy fearfulness it for bully reason: it dismantles their mechanisms of power astatine each level.

This is simply a impermanent station by James Santi. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)