“Fair value” is simply a word that’s not often utilized successful the crypto market, but it’s 1 that tin assistance investors presumption their trades to marque the astir retired of the volatile market. Knowing a “fair value” of a crypto plus enables investors to cognize whether the plus is overvalued oregon undervalued astatine its existent price.

The ratio that shows the quality betwixt an asset’s marketplace headdress and realized headdress is called the MVRV-Z Score. The people besides shows the modular deviation of each humanities marketplace headdress data.

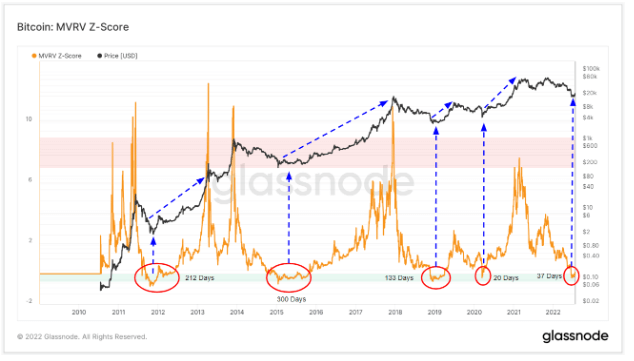

Historically, the MVRV-Z Score has been utilized to people tops and bottoms successful Bitcoin marketplace cycles with awesome reliability. A precocious MVRV-Z Score usually indicated a marketplace top, portion a debased MVRV-Z Score showed a marketplace bottommost followed by an upturn.

In the illustration below, Bitcoin’s terms perfectly correlates with marketplace tops predicted by the MVRV-Z Score. Overheated marketplace cycles pushed Bitcoin’s MVRV-Z Score heavy into the reddish portion and person ever resulted successful an assertive terms slump. On the different hand, erstwhile the marketplace worth falls beneath the realized value, it has historically indicated a marketplace bottom.

MVRV Z-Score from Glassnode annotated by CryptoSlate

MVRV Z-Score from Glassnode annotated by CryptoSlateIn June, the MVRV-Z Score dropped importantly and entered the “green zone,” a determination that indicated a imaginable terms bottommost during this carnivore market.

According to Bitcoin’s erstwhile MVRV-Z Scores, the past rhythm bottommost occurred successful March 2020, erstwhile the onset of the COVID-19 pandemic acceptable planetary markets spiraling down arsenic investors rushed to currency out.

The MVRV Z-Score has correctly called the past 4 carnivore marketplace bottoms. The illustration supra showed that the MVRV-Z Score spent 212 days successful the greenish portion successful 2012. In 2015, the MVRV-Z Score spent implicit 300 days successful the greenish zone. In 2019, the debased MVRV-Z Score lasted for 133 days, portion 2020 saw it walk lone 20 days successful the greenish zone. The greenish portion connected the MVRV Z-Score illustration shows erstwhile Bitcoin is “undervalued.”

Still, the MVRV-Z Score isn’t foolproof.

The ratio can’t foretell however agelong an plus volition stay undervalued oregon overvalued and shows nary discernible repeating pattern. How agelong the people spends successful the greenish oregon reddish zones tin besides alteration significantly, arsenic the ratio doesn’t see macroeconomic factors that impact terms movements.

Take, for example, the planetary marketplace clang successful March 2020. Caused by the onset of assertive economical measures to combat the COVID-19 pandemic, the clang wiped retired trillions from the planetary economy, decimating the crypto market. Bitcoin’s MVRV-Z Score experienced a crisp driblet astatine the time, indicating that the plus was importantly undervalued. However, it stayed undervalued for lone 20 days, arsenic a monolithic information of stimulus checks provided by cardinal banks worldwide went straight into the crypto market, astir notably Bitcoin.

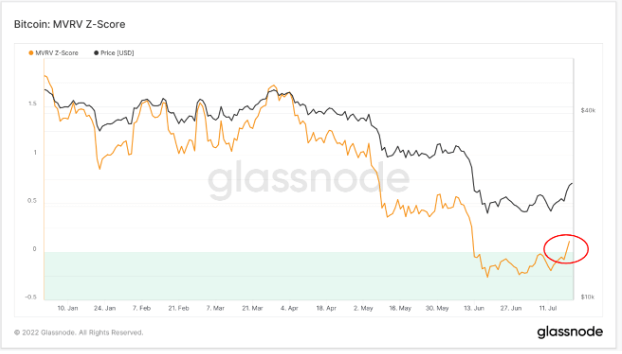

After spending 37 days successful the “green zone,” Bitcoin’s MVRV-Z Score accrued and showed the plus was nary longer undervalued. While this could bespeak a revival of the market’s bullish sentiment, investors should stay cautious, arsenic this isn’t the archetypal clip Bitcoin’s MVRV-Z Score concisely exited the greenish zone.

Until the planetary macro sentiment changes and request for Bitcoin returns to its pre-crash levels, Bitcoin tin proceed to autumn successful and retired of the “unvervalued” category.

MVRV Z-Score from Glassnode annotated by CryptoSlate

MVRV Z-Score from Glassnode annotated by CryptoSlateThe station The MVRV-Z Score: a reliable apical and bottommost indicator appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)