In an interrogation with writer Natalie Brunell, Michael Saylor, enforcement president and co-founder of MicroStrategy, laid retired his imaginativeness for what could adjacent propel the terms of Bitcoin. His insights travel astatine a clip erstwhile the integer currency scenery is experiencing pivotal regulatory and organization developments.

The Next Big Catalyst For Bitcoin Price

Saylor pinpointed the circumstantial infinitesimal helium believes heralded the onset of a caller epoch for Bitcoin. “January of 2024 marked the opening of the play of firm adoption of Bitcoin,” helium stated. The value of this shift, according to Saylor, is tied intimately to regulatory approvals and the distinctive way Bitcoin is carving for itself amidst a oversea of integer assets.

The crux of Saylor’s statement is the US Securities and Exchange Commission’s (SEC) decision-making process regarding cryptocurrency spot Exchange-Traded Funds (ETFs). He described the SEC’s approval of Bitcoin spot ETFs arsenic the “first large catalyst.” This regulatory motion not lone legitimizes Bitcoin successful the eyes of organization investors but besides enhances its entreaty arsenic a viable firm treasury asset.

Now, Saylor argues that the adjacent decisive infinitesimal volition hinge connected the SEC’s handling of different cryptocurrencies. “The 2nd large catalyst volition beryllium the SEC’s denial of each different crypto exertion for spot ETFs,” Saylor explained. By denying these applications, the SEC would efficaciously presumption Bitcoin arsenic the premier, unreplicated prime among cryptocurrencies, an result Saylor sees arsenic captious for dispelling doubts astir Bitcoin’s semipermanent viability and uniqueness.

“And erstwhile we really spot the regulators contradict the applications of the copies of different crypto assets, past we volition person checked the box. It won’t beryllium banned, it won’t beryllium copied,” Saylor remarked.

Expanding connected the implications of specified regulatory decisions, Saylor employed a metaphor involving the prime of materials successful large-scale engineering projects. He compared the decision-making process successful firm concern successful Bitcoin to choosing betwixt alloy oregon bronze for constructing a skyscraper.

“Once you recognize there’s conscionable alloy and determination is nary 2nd champion metallic for structural civilian engineering, the task moves forward,” helium noted. In this analogy, Bitcoin is likened to alloy — the foundational worldly without substitute — clearing immoderate hesitation astir its adoption successful firm portfolios.

Should we beryllium watching for different catalyst that volition spur much #Bitcoin adoption?

"The archetypal large catalyst was the SEC's support of spot #ETFs for Bitcoin…the 2nd large catalyst is going to beryllium the SEC's denial of each different #crypto exertion for a spot ETF…" –@saylor… pic.twitter.com/4aKarg6eAS

— Natalie Brunell ⚡️ (@natbrunell) May 6, 2024

Notably, this narrative is timely arsenic the crypto assemblage watches the SEC closely, peculiarly with respect to Ethereum, the second-largest cryptocurrency by marketplace cap. The last deadline for the SEC to o.k. oregon contradict the VanEck spot Ethereum ETF is May 23, 2024, a determination that has been postponed repeatedly.

Bloomberg’s elder ETF analyst, Eric Balchunas, noted a alteration successful the likelihood of support successful March, citing a deficiency of communication betwixt the SEC and ETF applicants, which helium viewed arsenic a antagonistic awesome for Ethereum’s contiguous ETF prospects.

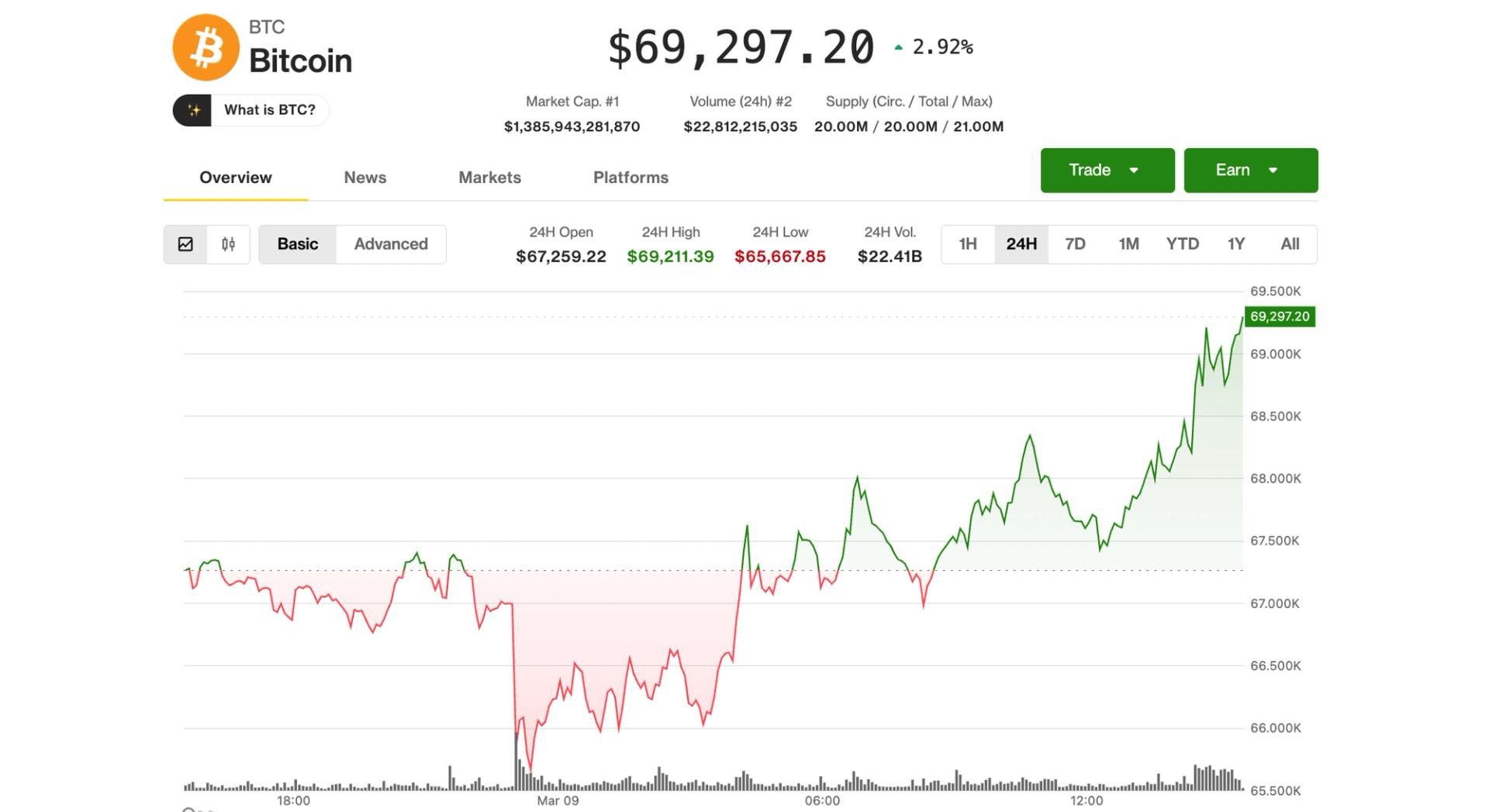

At property time, BTC traded astatine $63,835.

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.com

BTC price, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from tesmanian, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)