This is an sentiment editorial by Scott Worden, an engineer, an lawyer and the laminitis of BTC Trusts.

“I’ve been moving connected a caller physics currency strategy that’s afloat peer-to-peer, with nary trusted 3rd party.” — Satoshi Nakamoto

It's 1 of those cleanable autumn days successful Colorado, and I’m sitting extracurricular of a pub successful the precocious afternoon. I’m gathering with a chap bitcoiner, a antheral I met successful Austin astatine the extremity of this summer. As the prima fell down the mountains, the entity turned orange, mounting the cleanable backdrop for lively bitcoin conversation.

As we ticked down the emblematic database of everything we agreed connected — censorship is bad, reddish nutrient is good, etc., — I made an offhand remark astir wishing much businesses would judge bitcoin arsenic payment. “Well I don’t, wherefore would you privation to portion with your sats?” was the reply helium tossed back. The implication, of course, is that a existent Bitcoiner values satoshis much than thing other successful the world. Why would you commercialized them for groceries, t-shirts oregon beer? “Haven’t you heard of Laslo Hanyecz? That fool traded 10,000 bitcoin for a mates of pizzas. I’m not repeating that mistake. Talk to maine erstwhile bitcoin hits $200k, past possibly it would marque sense.”

My caller person isn’t unsocial with this enactment of thinking. It’s a sentiment that’s proffered by folks similar Michael Saylor and others successful the HODL community. They’ll espouse, “The scarcest plus successful the satellite is Bitcoin. It's integer gold,” “Buying bitcoin is similar purchasing spot successful Manhattan 100 years ago”, and “Don’t merchantability your bitcoin!” Yet astatine the aforesaid time, determination is an intuitive designation that if bitcoin can’t ever beryllium traded for a bully oregon service, it successful effect has nary value, nary substance what terms is flashing connected the BLOCKCLOCK successful the office. I telephone this the HODLer’s dilemma.

But is this truly a dilemma? Are these mantras, arsenic prolific arsenic they are, accordant with the tone of Satoshi’s innovation? Does the proliferation of the Lightning Network and non-custodial mobile wallets that our parents (or children) tin intuitively run necessitate america to germinate our knowing of Bitcoin’s worth proposition? Personally, I judge the clip is present to halt reasoning of bitcoin arsenic simply a store of worth and statesman to conceptualize it primarily arsenic a mean of speech … that besides happens to store worth amended than immoderate plus connected earth. In lawsuit you weren’t already paying attention, here’s a fewer reasons why.

Privacy

“Bitcoin would beryllium convenient for radical who don’t person a recognition paper oregon don’t privation to usage the cards they have.” — Satoshi Nakamoto

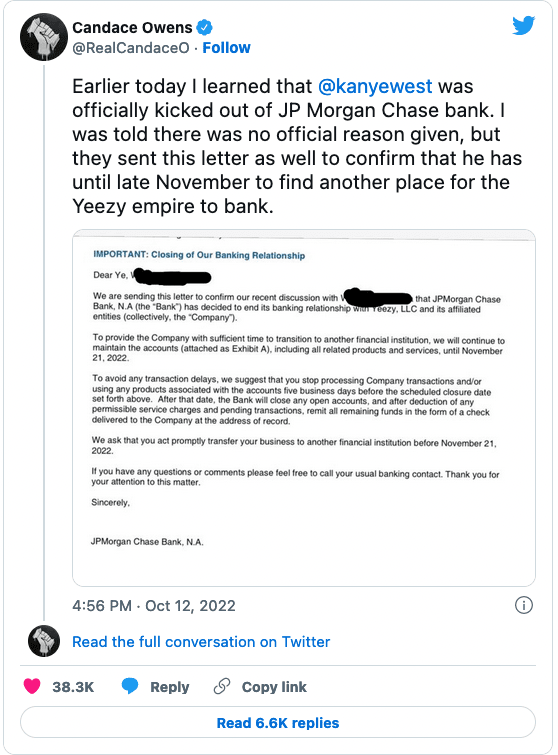

The clip to commencement exiting the strategy is close now. The awesome has ne'er been stronger. Today we unrecorded successful a satellite wherever the fiat strategy can:

All of this is happening today, and it is apt conscionable the extremity of the iceberg. In a retail strategy wherever currency transactions are becoming progressively scarce and inconvenient, the bulk of large banks, recognition agencies and outgo systems person acquiesced to the demands of a authorities that appears to person an existential involvement successful controlling our behavior.

Of course, bitcoin isn’t a panacea to censorship — astatine slightest however it’s astir commonly purchased and exchanged today. The Canadian Trucker Protest showed america that a authorities committed to suppressing the dependable of their citizens volition spell to astir immoderate magnitude to bash so, and successful the process taught america that licensed exchanges and concatenation investigation techniques tin beryllium highly effectual successful blacklisting addresses and adjacent identifying donors. These vulnerabilities volition request to beryllium flooded successful bid to supply a much censorship-free currency-of-exchange. But by transacting successful bitcoin with peers and merchants for mundane goods and services arsenic often arsenic possible, we incentivize others to some judge and transact successful bitcoin. Through numbers unsocial we tin render the bitcoin system much robust, decentralized and hard to censor. A assemblage that values privateness volition people take to follow non-custodial wallets, prosecute successful collaborative transactions and debar KYC exchanges. Growing and educating this assemblage has ne'er been much important.

Convenience And Autonomy

“With e-currency based connected cryptographic proof, without the request to spot a third-party middleman, wealth tin beryllium unafraid and transactions effortless.” — Satoshi Nakamoto

A communal counter-argument to transacting successful bitcoin is that it’s either excessively analyzable oregon excessively dilatory compared with swiping a recognition card. This is simply nary longer true. Today, immoderate beginner-level Bitcoiner tin download Muun Wallet and wrong minutes nonstop Lightning invoices to clients for outgo via QR Code. Coinkite has an NFC instrumentality that allows users to motion for transactions with a pat of their card. There are much examples, and galore much to come. The quality of these solutions is that they are afloat non-custodial, i.e., determination is nary cardinal 3rd enactment that controls your coins. The bundle is simply enabling transactions to beryllium broadcast to the network. Lightning transactions wide instantaneously, with fees an bid of magnitude little than Visa oregon Mastercard’s accepted 2–3%. (For example, it precocious outgo maine astir $.60 successful fees to nonstop the equivalent of $700 USD to Wrich Ranches past week for beef. That aforesaid transaction would person outgo the merchant astir $20 had I utilized Visa.)

In addition, these transactions beforehand autonomy connected some sides. Lightning transactions, similar everything other backed by Bitcoin’s proof-of-work, hap without counterparty risk. Removed from the equation is the hazard that a user won’t wage his bill, quality a charge, not person capable wealth successful his relationship oregon record for bankruptcy down the road. All of this hazard manifests arsenic transactional inefficiency, and its costs are straight oregon indirectly absorbed by merchants and consumers. A trustless strategy similar bitcoin is frankincense much efficient, reducing hazard for merchants, and yet rendering goods and services little costly for liable consumers.

“I’m definite that successful 20 years determination volition either beryllium precise ample transaction measurement oregon nary volume.” — Satoshi Nakamoto

We would bash good to deliberation of each of our transactions successful presumption of bitcoin. When wealth is genuinely a store of value, we instrumentality a measured attack to spending and relationship for the imaginable summation successful worth that wealth whitethorn person successful the future. This is logical, and applies whether you’re spending sats oregon dollars. The website bitcoinorshit.com drives this constituent location rather bluntly.

There’s besides the communicative of Laszlo Hanyecz, who successful 2010, famously purchased 2 pizzas for 10,000 BTC. In effect, Laszlo paid a mates of cardinal U.S. dollars for pizza, if we instrumentality into information BTC’s marketplace worth implicit a decennary later. It surprises maine though, erstwhile Bitcoiners leap connected Laszlo for being economically naive, and usage this illustration to enactment their presumption that bitcoin should ne'er beryllium spent. The elemental information is that everyone who bought pizza successful 2010 efficaciously spent thousands of bitcoin connected it. The lone mode to debar this would beryllium to devour thing little costly oregon spell hungry. The information is, each fiat transaction we marque is simply a nonstop commercialized disconnected for perchance expanding our stack. Once we recognize this, the nationalist contention implicit spending bitcoin connected products oregon services is fundamentally dead.

The overwhelming bulk of america request to commercialized monetary vigor for goods and services to past successful today’s society. The lone contention that remains is which products oregon services instrumentality precedence implicit the accidental to get much sats. It’s a determination that is idiosyncratic and unsocial for each of us. The reply should beryllium thought of independently and irrespective of whether that monetary vigor is spent successful sats, dollars oregon yen — it’s lone the monetary vigor saved — that which is near implicit — that is applicable erstwhile it comes to the HODLer’s dilemma.

We are each apt to prevention much BTC if we statesman transacting much successful BTC. For 1 thing, erstwhile we woody successful a dependable wealth that is simply a proven store-of-value, we’re much apt to beryllium discerning successful our purchases. Sure, we truly privation the caller iPhone, but is it worthy 5 cardinal sats if you expect a sat to beryllium worthy a penny someday? We mightiness determine to hold different twelvemonth earlier we upgrade and clasp those sats for the future. On the different manus we each request food, structure and clothing. If I person a prime betwixt buying my nutrient from Costco with my Visa card, oregon buying nonstop from a rancher who accepts bitcoin, wherefore wouldn’t I take the latter?

Today, the fig of merchants that judge bitcoin is comparatively small, though increasing steadily. As bitcoiners statesman to recognize that their “spend dollars, prevention sats,” mentation whitethorn beryllium counterproductive, greater numbers volition statesman to question goods from merchants that judge bitcoin for payment. This spike successful request volition thrust merchant adoption, perchance shifting the timeline for a bitcoin system importantly to the left.

More Exchange Equals More Value

“As the fig of users grows, the worth per coin increases. It has the imaginable for a affirmative feedback loop; arsenic users increase, the worth goes up, which could pull much users to instrumentality vantage of the expanding value.” — Satoshi Nakamoto

This is wherever we beryllium today. There’s a increasing fig of speculators and bitcoin enthusiasts who person bought into the thought that Bitcoin is simply a bona fide store of value. This assemblage further believes that the asset’s scarcity volition inevitably lend to a proviso compression that volition origin the terms to rocket upwards. Sure, it’s imaginable that this could hap done the specified enactment of HODLing, but arsenic Satoshi Nakamoto points out, the worth goes up erstwhile the numbers of users go up. Does buying and holding an plus suffice arsenic use? If the brilliance down bitcoin is enabling peer-to-peer transactions without a third-party middleman, are we truly leveraging that capableness by exclusively stacking and not spending?

I judge that bitcoin needs to go a existent mean of speech successful bid for it to afloat recognize its imaginable arsenic a store of value. Since worth is not derived from scarcity unsocial — request is cardinal to bitcoin’s price. If bitcoin’s utility becomes the driving unit for its demand, it is astatine this infinitesimal that its existent imaginable arsenic a store of worth volition beryllium realized. Today’s economical and governmental backdrop mightiness conscionable beryllium the information we each need. But until bitcoin becomes an indispensable portion of our regular economical activity, it is apt to beryllium valued alongside different speculative assets, and taxable to the whims of the aforesaid fiat strategy it was meant to supplant.

This is simply a impermanent station by Scott Worden. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)