Bitcoin, portion the astir superior existent basal cash, is an improvement upon those that nine has already utilized — but what is basal cash?

This is an sentiment editorial by Matthew Mezinskis, creator of the “Crypto Voices” podcast and Porkopolis Economics.

Take a infinitesimal to bespeak connected however agelong you’ve been successful Bitcoin. Now instrumentality different to inquire yourself however galore articles connected wealth you’ve work on the way; And not conscionable those medium-of-exchange oregon store-of-value pieces. Think astir the philosophizing diatribes which purport to place the mysterious meanings of what “money” is. And past the eventual twist, however does Bitcoin acceptable in? Many words person been written by Bitcoiners, galore by its detractors. From the “social declaration theory” and “something we each hold on,” to the “transactional currency” and that ever-important “cup of coffee” metaphor, everyone ever has thing to accidental astir money, and frankincense wherefore oregon wherefore not Bitcoin.

What astir its concern implications? What astir transporting the productive worth of your labour — your savings — crossed spacetime? Sometimes radical constitute astir bully money, sometimes they constitute astir atrocious money. And lest we hide the instrumentality favourite — ne'er a dearth of chatter connected this, however the wealth printer goes “brrrr” and what it means for our economy. There are much articles musing connected wealth each twelvemonth than Christmas markets successful Vienna.

This portion is referenced from the author’s ain monetary research, published quarterly, which tracks the proviso and maturation of basal wealth successful the world.

I’ll effort to bring you thing antithetic here. Let’s spell for it directly. The tract of economics already has a category, a systemized classification, for what benignant of “money” Bitcoin is. I volition archer you close present what it is, but you indispensable understand, the backstory present is thousands of years old.

Ready? They telephone it “high-powered money” successful the West. It’s referred to arsenic “reserve money” successful the East. Historically, it’s often called “base money.” In the planetary fiscal strategy today, we telephone it the “monetary base.”

There it is. That’s what benignant of money Bitcoin is, and that’s what benignant of settlement occurs erstwhile bitcoin trades hands, erstwhile UTXOs are destroyed and created anew. That is the economical statement that wholly encompasses what the Bitcoin web is and what it does.

Basic wealth is so a mostly accepted mean of exchange. Sure. But again, that’s a antithetic benignant of article. What basal wealth truly is and wherefore it matters is the communicative I privation to archer you here.

What Base Money Is Not

This investigation volition successful information beryllium mode easier if we commencement from the different side. We’ll get to what it is. But to commencement let’s look astatine everything successful the fiscal strategy that is not basal money.

What is not basal money? Basic currency is not immoderate mean of speech that is controlled oregon issued by a 3rd party. If there’s an intermediary progressive — a slope oregon fiscal instauration — past you tin beryllium rather definite the worldly you’re playing with is not basal money.1 Another mode to find this is if you person an “account” with someone. Anyone. Any fiscal services provider. Do you clasp an relationship with a bank? Then immoderate is successful it is not basal cash.

Right, immoderate examples: The British and American systems person agelong been fans of insubstantial checks. And I already cognize what you’re thinking. Besides being an exertion for fraud (you know, with your afloat name, address, and relationship fig punched close connected them), wherefore should I adjacent attraction astir checks today? Well, I’m telling a communicative astir wealth and banking here, truthful conscionable cognize that checks erstwhile served a captious relation successful payments, and were instrumental successful the maturation of occidental economies, erstwhile determination was zero oregon escaped cardinal slope oversight. Checks are really way, mode much profound than they appear, regarding innovations successful moneyness. Anyway, backmost to what the happening is. Think astir it. What other is written connected a check? The payee’s name? Sure. But what other still? Who issued that check? Who really came up with the thing? Is determination an instauration involved?

It is your bank, of course.

But archer maine still. Whose thought was it to connection you those checks? Does it substance however large the checkbooks are? Who decides what the cheque looks like? Should determination beryllium circumstantial quantities of checks that each slope offers its clients? Is determination a cheque commissar sitting successful each municipality, alongside the mayor, keeping a moving tally of checks that process their mode done the city? I mean we are inactive talking astir wealth here, and checks person been utilized for hundreds of years … truthful this worldly needfully indispensable beryllium tally done the government, right?

Nope.

Exactly zero radical told the bankers however galore checks they could oregon should issue, and nary 1 knows the (precise) reply to this successful aggregate. All of this is inactive managed arsenic it was 200 years ago, successful a escaped market, wherever clients spot their banks (their intermediaries) to wide checks betwixt 1 another, successful bid for everyone to marque payments and facilitate economical growth.

So that’s a check. Definitely not basal money.

What astir debit cards? I’m going to springiness you, beloved reader, the payment of the uncertainty by this 2nd example, that you person already guessed that these monetary instruments are again, not basal money. Yet again issued by a bank, these things are seemingly chill for immoderate folks; hotels similar them and they’ve been astir since the 1950s and the dawn of physics banking … but they are fundamentally integrative checks that are reusable, and wide quicker. And yeah, nary 1 told the banks however galore customers, oregon what benignant of customers, to connection them to. The process has been reasonably decentralized, for decades.

(Note, recognition cards are really a precise antithetic beast than debit cards, and successful an important economical mode erstwhile it comes to moneyness, but nary clip for that here. Still, recognition cards are not basal money.)

What next? What other bash you usage to wage for stuff? It’s astir apt clip to speech astir mobile apps and online banking. Maybe the information that these things are digitally native—then they mightiness classify arsenic basal money? Remember however to archer — the cardinal is whether a 3rd enactment is moving the amusement for this product.

One illustration of utilizing apps for purchases is Apple Pay. So it’s … Apple, right? Goldman Sachs, really (ha-ha). Either way, a third-party instauration is offering you that product, truthful it’s decidedly not basal money. Same goes for PayPal, Venmo, Skrill, Revolut, Wise, Paysera and each the different online-only banking apps and accounts. And for sure, you don’t request a bank relationship to usage these types of services. Even if it’s conscionable a outgo processing company, that’s inactive a 3rd enactment issuing those accounts. It means each those integer outgo options are inactive not basal money.

So that’s the main stuff, erstwhile we deliberation of payments (stablecoins — we’ll get there!). You whitethorn recognize that, too the existent checks and cards themselves, too the instruments, each of this is astatine the extremity of time linked backmost to your checking relationship oregon deposit account. Again, let’s permission recognition cards speech for now. They’re adjacent much distant “money.” But we besides person different types of “accounts” successful the fiscal strategy that cipher understands.

One is the savings account. This utilized to really beryllium a thing. Savings accounts utilized to (and successful immoderate countries inactive do) person much withdrawal restrictions than checking accounts. In instrumentality for this you’d person a higher involvement complaint connected your wealth deposited there. Not truthful today.

We besides person clip deposit accounts, which person yet further withdrawal restrictions and wage adjacent higher involvement than savings. Again, immoderate basal wealth successful there? Nope.

We person different aged schoolhouse instruments similar wealth marketplace funds. These are typically not insured by the government, should wage a higher involvement than checking deposits and commercialized much similar a banal (one stock should beryllium astir 1 autochthonal currency unit) if you privation to get them. Base money? Again, surely, no.

So let’s rehash, and delight enactment this applies careless of retail oregon organization nature:

- Checks, debit cards and mobile apps linked to deposit accounts are not basal money.

- Credit cards are decidedly not basal money.

- Savings, clip deposits, wealth market, and different interest-bearing accounts are besides not basal money.

Alright, hopefully that was a semi-productive workout successful hashing done each the monetary instruments that are not basal wealth but are inactive utilized for payments. And for a portion present you whitethorn person been asking, “So, what are these damn things really called then?!”

Answer: Fiduciary media.

This is an important term. It’s crucial. And the astir logical of names. I’m not asking you to go an economist present — delight don’t — but what I anticipation you bash recognize is that each the emblematic worldly we deliberation astir and usage arsenic “money” successful our existent fiscal strategy is economically referred to arsenic fiduciary media.

It’s a claim. It’s an IOU. It’s a token.

It’s wealth successful a “moneyness” sense, but it’s not wealth successful a “base money” sense.

“Again, what?”

It means precisely what we've been talking about. Fiduciary media is simply not basal money, and if you ain specified a claim, you don’t ain immoderate basal money! Yet erstwhile you clasp this claim, you don’t clasp “nothing.” This fiduciary media tin and does circulate freely and is utilized for payments.

Bitcoin, Briefly

If I asked you now, is bitcoin basal money, what would you say? It’s not a instrumentality question. Don’t deliberation excessively much.

I anticipation you answered yes. Bitcoin isn’t issued by 3rd parties. To get it, to clasp it, I don’t request a 3rd enactment astatine all. I could excavation it. The autochthonal portion bitcoin, equaling immoderate fig of UTXOs, person nary reliance connected immoderate fiduciary whatsoever. It is simply a basal plus that you tin get and clasp by yourself, Requiring nary permission, nary intermediary. What astir the large miners? Miners bash supply a work successful producing blocks, and their costs successful the aggregate are costly today, but this expensiveness shouldn’t beryllium thought of arsenic “required” by the system. If each miners left, trouble would adjust, and obtaining caller bitcoin would beryllium a little “expensive” proposition than it is today.

But crucially, different than bitcoin, everything else successful the fiscal satellite described supra is fiduciary media. It’s good to telephone it money, but if you privation to cognize precisely what it is successful an economical sense, it’s simply called fiduciary media. If you’re waiting connected your wage to beryllium direct-deposited into your slope account, oregon you’re waiting connected a cheque to wide from your relationship to your payee’s (really, you inactive are?), past you’re waiting connected a fiscal intermediary to enactment connected your behalf. You’re utilizing fiduciary media to settee debts and marque payments.

But Why Fiduciary Media?

“So brass tacks: Are you saying fiduciary media is bad?”

Nope.

“Are you saying it’s a fraud?”

Nope.

“Are you saying it causes atrocious macro things to hap economically?”

Nope.

“But inactive you’re saying fiduciary media is simply a benignant of money?”

Yep.

“And astir importantly, fiduciary media is not basal money?”

Yes.

In each my speeches connected money, I find the supra points are hardest to grok. I get it. In your regular daily each you truly attraction astir is however the card, cheque oregon banking app looks and behaves. You privation it to work. Fine. But the important questions I’d similar you to inquire yourself aft speechmaking this are ones like, “Who issued your card?” “Who issued your account?” “Who processed that outgo connected your behalf?” “Who is your fiduciary?” If you tin deliberation astir these instruments successful these terms, past you’ve won the battle, and you cognize much astir wealth than astir economists. It’s truly not much analyzable than this erstwhile it comes to what fiduciary media is and basal wealth is not.

As to the “why” of fiduciary media, this should beryllium self-evident. The intent of fiduciary media is this: Institutions person issued these claims passim the centuries (and inactive bash truthful today) successful bid to facilitate payments, arsenic traditionally they are much businesslike successful doing truthful than basal money.

“Hold connected though, are you definite fiduciary media doesn’t origin atrocious things to hap successful the economy?”

Yes I’m sure, but arsenic always, the large asterisk is this: As agelong arsenic cardinal banks are not involved. We volition travel backmost to this.

The main takeaways for present are that fiduciary media isn’t basal cash, fiduciary media is bully for payments, and it’s besides not inherently bad, nor fraudulent.

Base Money

So if you’re utilizing a cheque oregon integrative oregon their integer equivalents connected your phone, issued and managed by a backstage bank, past you are utilizing fiduciary media. You are not utilizing basal money. After each that, I’ll effort and support this abbreviated arsenic to what basal wealth is.

If you simply intuited that basal wealth would beryllium the other of fiduciary media, this presumption volition get you beauteous close. What forms of wealth bash we person successful the marketplace that aren’t managed by a (monopolized) 3rd party? What forms of wealth are assets of eventual settlement, wherever you don’t person to trust connected anyone other to settle? What signifier of wealth is supplied by the market, owed to its request to beryllium held arsenic a store of worth and mean of exchange?

History has lone illustrated 2 long-lasting forms of basal money. One is silver, and the different is gold. These aren’t the lone two. Certain shells (specifically cowrie shells and wampum) came adjacent successful definite times and places, but didn’t marque it worldwide, nor beryllium long-lasting. Nick Szabo has written wonderfully astir the past of beads and shells arsenic primitive money, highlighting the important relation these collectibles played for millennia.

Gold and metallic are the deepest, astir balanced, and astir documented instances of basal wealth that achieved worldwide adoption. As acold arsenic coinage goes, metallic has agelong been historically documented arsenic the archetypal mover from past times, and golden roseate to prominence later, astir from medieval times.

But Why Base Money?

My speechmaking of past arsenic to the “why” for basal currency is twofold. Both reasons applied passim the centuries and some inactive bash today. However, depending connected wherever you unrecorded (likely a Western state if you’re inactive bothering to work this English), these 2 reasons mightiness not beryllium obvious.

The archetypal crushed basal wealth is needed is during a “non-local” commercialized situation. You, arsenic 1 enactment to the deal, whitethorn ne'er spot your counterparty again, and you request the currency earlier moving on. Take a European spice trader successful the East Indies oregon a rum trader successful the West. When the woody is done, he’s getting backmost connected his vessel to Europe, and astatine champion helium doesn’t spot these radical again until adjacent season, if ever. He needs to settee the woody earlier helium leaves port. Enter golden and silver. A planetary mean of speech that works abroad, and works astatine home. Obviously, the full woody doesn’t request to beryllium done 100% successful gold; it could beryllium 80% successful goods, and past 20% settled successful golden oregon metallic connected the margin. An aboriginal episode connected our podcast with Dr. George Selgin covers this improvement well.

The 2nd basal crushed for basal wealth is the store of worth function. But not conscionable store of worth successful the generic sense; rather, successful a precise circumstantial and idiosyncratic one: the heirloom. Heirlooms let for the transporting of your life’s savings to your children. Yes, arsenic humanity develops, we’ve been capable to transportation connected different goods too wealth to our heirs, specified arsenic good art, spot oregon adjacent a portfolio of stocks; however, those examples typically trust connected a ineligible system, and (here’s that connection again) a fiduciary. This crushed for basal currency alludes backmost to the Szabo nonfiction connected everything from shells to heirlooms and collectibles with heavy and definite worth transfer. Gold, jewelry and silverware inactive fulfill this relation today. Dowries and inheritances are immense successful the processing world, successful peculiar India and China.

That’s the “why” for basal cash. Now, let’s statesman to instrumentality a hard look astatine what it really is.

Gold And Silver

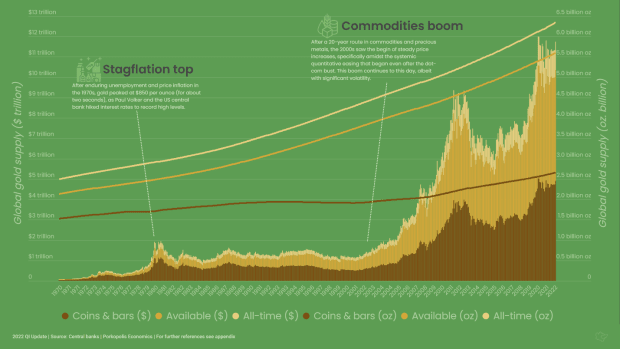

Even a kid knows that golden and metallic person thing to bash with money. Whether it beryllium from video games oregon fairy tales, it’s ingrained successful our DNA that these metals are precious. I’m going to amusement you their proviso curves close now. Here’s gold, implicit the past 50 years:

Unfortunately, this representation is not a portion of our astir basal fiscal education. It should be. You tin verify my numbers from galore manufacture and mining publications, though uncovering the nonstop format and figures volition beryllium hard arsenic again, for immoderate crushed this worldly is ne'er explained simply. Note there’s going to beryllium a borderline of mistake successful what you spot modeled above, versus world (or different research). No 1 knows precisely however overmuch golden has been produced, but these are my figures and I’m sticking to them.

Another contented is that the manufacture typically quotes golden units mined successful metric tonnes, which is simply a horrible happening to do. They should ever beryllium displayed successful the autochthonal units that the marketplace quotes for price, which is “per troy ounce.” Why should we bash it immoderate different way? As with galore things successful life, don’t fto CNBC oregon Bloomberg confuse you connected what’s relevant. In the illustration above, the right-hand broadside measures mined golden successful billions of troy ounces, and the left-hand broadside displays the magnitude of mined golden expressed successful the existent planetary portion of account: the U.S. dollar.

Throughout each of humanity, we’ve pulled 6.3 cardinal ounces of golden retired of the ground. At existent prices that’s astir $11.3 trillion successful value. Does it mean that if the full satellite sells its golden close now, they would and could get $11.3 trillion (if they desired)? Obviously not, but we’ll get to that.

6.3 cardinal ounces is really 60% much than 50 years ago, meaning that astir two-thirds of each golden passim past has been mined since 1970.

But not each of that golden comes successful the signifier that we typically deliberation of from fairy tales; namely, successful bullion form, successful coins and bars. 12% of this is deemed to beryllium “lost oregon consumed” by industry, from wherever it isn’t easy recovered. Of the golden that remains, astir 50% of it is successful jewelry form, and 50% of it successful the signifier of coins and bars.

Nonetheless, we tin deliberation of each jewelry and bullion arsenic golden that is liquid and global. Isolating again the worth that’s mislaid to industry, we get astir 5.6 cardinal ounces, oregon $10 trillion equivalent, astatine existent prices.

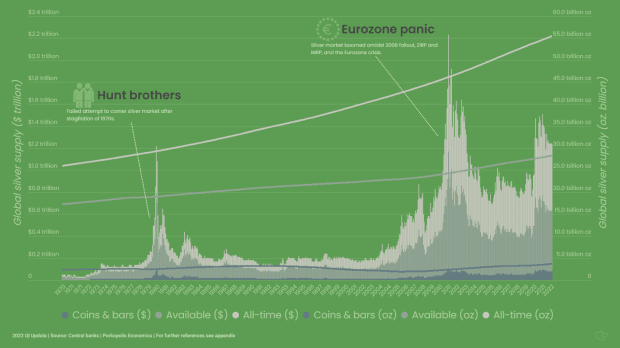

Here is the nonstop aforesaid benignant of graph, yet present for silver. Some 55.3 cardinal ounces of metallic person been mined passim humanity. Similar to gold, the bulk (53%) of each metallic supra crushed has been dug up since 1970:

Though metallic preceded golden successful the past arsenic a mostly monetary (coinage) asset, contiguous it’s a antithetic carnal connected a macro level. A overmuch larger chunk of its mined proviso has gone into manufacture and deemed not easy recoverable. 27 cardinal ounces beardown successful fact, oregon $600 cardinal successful equivalent value, is lost. This metallic sits successful technological devices, successful conduits, successful machinery, and successful buildings. The request drivers for metallic contiguous are overmuch much industrial, and overmuch little monetary and ornamental than gold.

Now of the non-industrial metallic supra ground, it’s adjacent much antithetic from golden successful that lone a tiny fraction of it is successful bullion signifier (coins and bars), lone astir 3.6 cardinal ounces, oregon $80 cardinal worth. But adjacent if we called that metallic “monetary” silver, we should inactive see each the different wealth-transferring, liquid metallic supra ground. There’s astir 24.6 cardinal ounces of that stuff, $550 cardinal worthy astatine today’s prices. And a ample information of that includes not lone jewelry, but your grandmother’s fancy silverware.

Now without getting overmuch further into the weeds here, let’s inquire ourselves immoderate questions astir this golden and metallic worldly that is liquid, ornamental and monetary:

- Gold: 5.6 cardinal ounces ($10 trillion equivalent)

- Silver: 28.2 cardinal ounces ($610 cardinal equivalent)

If I clasp immoderate of this personally, successful my home, is it decidedly “mine?” Yes. Would it classify arsenic an “asset” connected my ain idiosyncratic equilibrium sheet? Yes. Can I transport this wealthiness into the aboriginal by passing it down to my heirs? Yes. Did immoderate institution “deem” these metals into existence? No.

The answers to the supra questions, alongside the evident demand-tendencies for them passim quality history, arsenic good arsenic their exchange-medium function, tin lone pb america to 1 economical conclusion. The chemic compounds of aurum and argentum are basal cash. They are classifiable arsenic basal money.

Closing The Loop

The favoritism that matters is that of basal cash, versus fiduciary media. Before you get to the benefits of one, versus the risks of the other, not lone does it assistance to cognize the mechanics, but besides to cognize that we truly tin zoom retired sufficiently and look astatine however some of these things interplay successful the planetary fiscal system.

So far, we’ve looked astatine what fiduciary media really is successful the modern fiscal system, and wherefore it matters. We’ve taken a bully gander astatine humanities basal money, which is golden and silver. We’ve talked astir wherefore that matters. We’ve concisely looked astatine wherefore bitcoin besides classifies arsenic basal cash, with akin (albeit superior) qualities to those of golden and silver.

In Part 2 we’ll adjacent it out. We’ll sojourn those goldsmiths and wealth traders successful the aged days of the golden and metallic trade. We’ll spot however fiduciary media developed here, and began to correspond the request for golden and silver. This volition bring america into modern banking. Along the mode we’ll surely request to scan the inevitable scope of the sovereign, of the state, astir each this. Remember, arsenic the fantastic Ron Paul simply observed, “Money is one-half of each transaction.” It’s intolerable that the authorities would not ogle and past determination successful connected the wealth market.

I’ll besides enactment a small much colour connected this word “moneyness.” Money is simply a connection that straddles “basic cash,” “currency,” and “fiduciary media,” often without a 2nd thought by its speaker, truthful we request to bash immoderate enactment there.

The emergence of the modern cardinal slope volition beryllium intolerable to disregard arsenic well. I ever accidental I’m not definite which is the husband, and which 1 is the wife, but it is undeniable that the astir profitable matrimony of each clip is that betwixt a nation-state’s treasury, and its cardinal bank.

And that volition bring america to the modern, fiat monetary base. And surely not conscionable a passing statement of the lazy economist, I’ll amusement you precisely what it means, and precisely what it looks like.

And past of people we’ll spot however each roads pb to Bitcoin. Why bitcoin is basal currency similar that of yore, and wherefore this time, it whitethorn beryllium different.

This is simply a impermanent station by Matthew Mezinskis. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC, Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)