Reason to trust

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Created by manufacture experts and meticulously reviewed

The highest standards successful reporting and publishing

Strict editorial argumentation that focuses connected accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

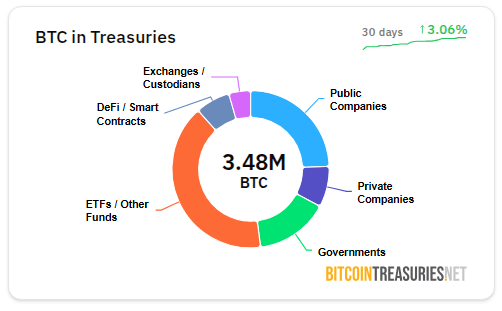

According to caller data, nationalist companies person raced up of Bitcoin spot ETF issuers by snapping up much than doubly arsenic overmuch BTC successful the archetypal fractional of 2025.

Public firms added 245,510 BTC to their equilibrium sheets from January done June, a 375% leap implicit the 51,653 BTC they bought successful the aforesaid agelong past year.

At the aforesaid time, spot ETF issuers purchased 118,424 BTC, leaving them good down their firm counterparts.

Public Firm Purchases Smash ETF Buys

According to information from Bitcoin Treasuries, the 245,510 BTC bought by nationalist companies during H1 2025 is much than 4 times the 118,424 BTC ETF issuers gathered.

That ETF constituent is 56% little than the 267,878 BTC they purchased successful H1 2024, contempt the funds experiencing much robust inflows than they experienced towards the extremity of 2024.

The quality indicates progressively companies are holding Bitcoin straight alternatively of relying connected exchange‑traded products.

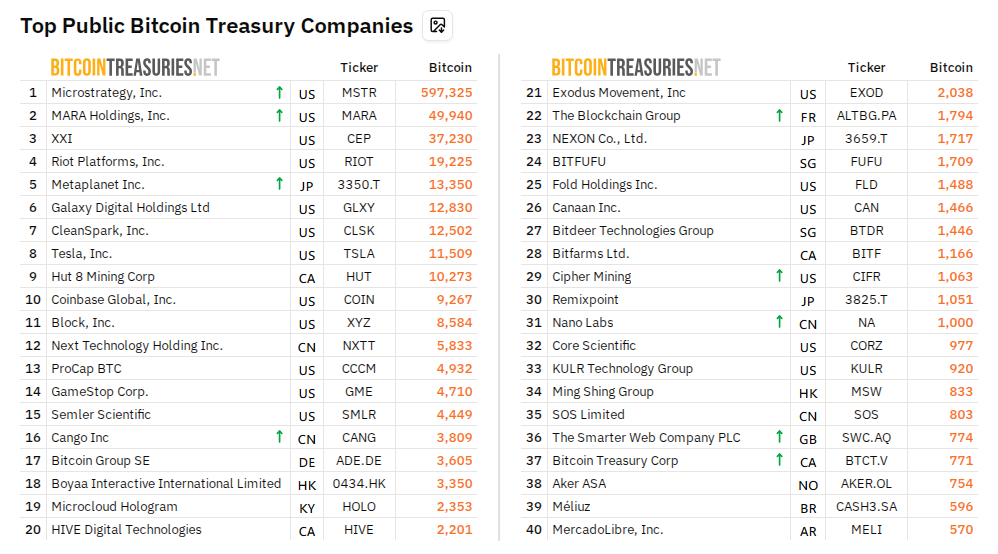

Source: Bitcoin Treasuries

Source: Bitcoin TreasuriesMore Companies Join Bitcoin Rush

Data shows 254 entities present clasp Bitcoin, and 141 of those are nationalist companies. That marks large maturation from the commencement of the year, erstwhile lone 67 firms had BTC, and the extremity of March, erstwhile the fig deed 79.

Those counts construe to a 140% emergence successful six months and a astir 80% summation successful 3 months, underlining however galore caller players person jumped in.

Source: Bitcoin Treasuries

Source: Bitcoin TreasuriesStrategy’s Share Of Acquisition Dips

Strategy (formerly MicroStrategy) inactive leads firm buyers, but its portion of the full has shrunk. In H1 2024, Strategy’s acquisition of 37,190 BTC made up 72% of each firm buys.

In the archetypal fractional of 2025, the Michael Saylor‑led institution purchased 135,600 BTC but present accounts for 55% of the total—down from its erstwhile dominance. Firms specified arsenic Metaplanet,

GameStop and ProCap person stepped into the spotlight, each adding ample sums to their Bitcoin holdings.

Supply Shock Could Be Coming

According to manufacture commentary, the summation successful firm purchasing successful summation to continuing ETF request could instrumentality a wound retired of disposable supply.

When the adjacent halving lawsuit reduces caller Bitcoin issuance, little volition travel into the market. Analysts caution that expanding organization involvement and declining proviso mightiness nutrient a important terms response.

As nationalist firms ascent aboard and ETFs support connected buying—though astatine a reduced rate—the conflict for Bitcoin is escalating. Although Strategy’s investments person accrued successful implicit value, the accomplishment of caller buyers indicates the marketplace is expanding.

If that inclination continues and reward for miners decreases pursuing the halving, the conflict for Bitcoin’s scarce proviso could get fiercer.

Investors and analysts alike volition beryllium paying adjacent attraction to however these forces power the terms of Bitcoin successful the 2nd fractional of 2025.

Featured representation from StormGain, illustration from TradingView

2 months ago

2 months ago

English (US)

English (US)