This is an sentiment editorial by Luke Mikic, a writer, podcast big and macro analyst.

This is the 2nd portion successful a two-part bid astir the Dollar Milkshake Theory and the earthy progression of this to the “Bitcoin Milkshake.” In this piece, we’ll research wherever bitcoin fits into a planetary sovereign indebtedness crisis.

The Bitcoin Milkshake Theory

Most radical judge the monetization of bitcoin volition astir wounded the United States arsenic it’s the state with the existent planetary reserve currency. I disagree.

The monetization of bitcoin benefits 1 federation disproportionally much than immoderate different country. Like it, invited it oregon prohibition it, the U.S. is the state that volition payment astir from the monetization of bitcoin. Bitcoin volition assistance to widen the beingness of the USD longer than galore tin conceptualize and this nonfiction explains why.

If we determination guardant connected the presumption that the Dollar Milkshake Thesis continues to decimate weaker currencies astir the world, these countries volition person a determination to marque erstwhile their currency goes done hyperinflation. Some of these countries volition beryllium forced to dollarize, similar the more than 65 countries that are either dollarized oregon person their section currency pegged to the U.S. dollar.

Some whitethorn take to follow a quasi-gold modular similar Russia precocious has. Some whitethorn adjacent take to follow the Chinese yuan oregon the euro arsenic their section mean of speech and portion of account. Some regions could transcript what the shadiness authorities of Myanmar person done and adopt the Tether stablecoin arsenic ineligible tender. But astir importantly, immoderate of these countries volition follow bitcoin.

For the countries that whitethorn follow bitcoin, it volition beryllium excessively volatile to marque economical calculations and usage arsenic a portion of relationship erstwhile it’s inactive truthful aboriginal successful its adoption curve.

Despite what the statement communicative is surrounding those who say, “Bitcoin’s volatility is decreasing due to the fact that the institutions person arrived,” I powerfully judge this is not a instrumentality rooted successful reality. In a erstwhile article written successful precocious 2021 analyzing bitcoin’s adoption curve, I outlined wherefore I judge the volatility of bitcoin volition proceed to summation from present arsenic it travels done $500,000, $1 cardinal and adjacent $5 cardinal per coin. I deliberation bitcoin volition inactive beryllium excessively volatile to usage arsenic a existent portion of relationship until it breaches 8 figures successful today’s dollars — oregon erstwhile it absorbs 30% of the world’s wealth.

For this reason, I judge the countries who volition follow bitcoin, volition besides beryllium forced to follow the U.S. dollar specifically arsenic a portion of account. Countries adopting a bitcoin modular volition beryllium a Trojan equine for continued planetary dollar dominance.

Put speech your opinions connected whether stablecoins are shitcoins for conscionable a second. With caller developments, specified arsenic Taro bringing stablecoins to the Lightning Network, ideate the anticipation of moving stablecoins astir the world, instantly and for astir zero fees.

The Federal Reserve of Cleveland seems to beryllium paying adjacent attraction to these developments, arsenic they precocious published a insubstantial titled, “The Lightning Network: Turning Bitcoin Into Money.”

Zooming out, we tin spot that since March 2020, the stablecoin proviso has grown from nether $5 cardinal to implicit $150 billion.

What I find astir absorbing is not the complaint of maturation of stablecoins, but which stablecoins are increasing the fastest. After the caller Terra/LUNA debacle, superior fled from what’s perceived to beryllium much “risky” stablecoins similar tether, to much “safe” ones similar USDC.

This is due to the fact that USDC is 100% backed by currency and short-term debt.

BlackRock is the world's largest plus manager and precocious headlined a $440 cardinal fundraising round by investing successful Circle. But it wasn’t conscionable a backing round; BlackRock is going to beryllium acting arsenic the superior plus manager for USDC and their treasury reserves, which is present astir $50 billion.

The aforementioned Tether appears to beryllium pursuing successful the footsteps of USDC. Tether has agelong been criticized for its opaqueness and the information it’s backed by risky commercialized paper. Tether has been viewed arsenic the unregulated offshore U.S. dollar stablecoin. That being said, Tether sold their riskier commercialized paper for much pristine U.S. authorities debt. They besides agreed to acquisition a full audit to amended transparency.

If Tether is existent to their connection and continues to backmost USDT with U.S. authorities debt, we could spot a script successful the adjacent aboriginal wherever 80% of the full stablecoin marketplace is backed by U.S. authorities debt. Another stablecoin issuer, MakerDao, besides capitulated this week, buying $500 cardinal government bonds for its treasury.

It was important that the U.S. dollar was the main denomination for bitcoin during the archetypal 13 years of its beingness during which 85% of the bitcoin proviso had been released. Network effects are hard to change, and the U.S. dollar stands to payment astir from the proliferation of the wide “crypto” market.

This Bretton Woods III model correctly describes the contented facing the United States: The state needs to find idiosyncratic to bargain their debt. Many dollar doomsayers presume the Fed volition person to monetize a batch of the debt. Others accidental that accrued regulations are connected the mode for the U.S. commercialized banking system, which was regulated to clasp much Treasurys successful the 2013-2014 era, arsenic countries similar Russia and China began divesting and slowing their purchases. However, what if a proliferating stablecoin market, backed by authorities debt, tin assistance soak up that mislaid request for U.S. Treasurys? Is this however the U.S. finds a solution to the unwinding petrodollar system?

Interestingly, the U.S. needs to find a solution to its indebtedness problems, and fast. Nations astir the satellite are racing to flight the dollar-centric petrodollar strategy that the U.S. for decades has been capable to weaponize to entrench its hegemony. The BRICS nations person announced their intentions to make a new reserve currency and determination are a big of different countries, specified arsenic Saudi Arabia, Iran, Turkey and Argentina that are applying to go a portion of this BRICS partnership. To marque matters worse, the United States has $9 trillion of indebtedness that matures successful the adjacent 24 months.

Who is present going to bargain each that debt?

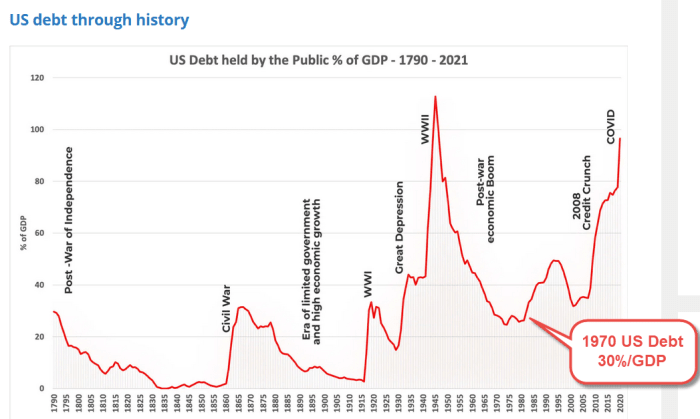

The U.S. is erstwhile again backed into a country similar it was successful the 1970s. How does the state support its astir 100-year hegemony arsenic the planetary reserve currency issuer, and 250-year hegemony arsenic the globe’s ascendant empire?

Currency Wars And Economic Wild Cards

This is wherever the thesis becomes a batch much speculative. Why is the Fed continuing to aggressively rise involvement rates, bankrupting its expected allies similar Europe and Japan, portion seemingly sending the satellite into a planetary depression? “To combat inflation,” is what we’re told.

Let’s research an alternative, imaginable crushed wherefore the Fed could beryllium raising rates truthful aggressively. What options does the U.S. person to support its hegemony?

In a satellite presently nether a blistery war, would it look truthful far-fetched to speculate that we could beryllium entering an economical acold war? A warfare of cardinal banks, if you will? Have we forgotten astir the “weapons of wide destruction?” Have we forgotten what we did to Libya and Iraq for attempting to way astir the petrodollar strategy and halt utilizing the U.S. dollar successful the aboriginal 2000s?

Until six months ago, my basal lawsuit was that the Fed and cardinal banks astir the globe would enactment successful unison, pinning involvement rates debased and usage the “financial repression sandwich” to inflate distant the globe’s tremendous and unsustainable 400% debt-to-GDP ratio. I expected them to travel the economical blueprints laid retired by 2 economical achromatic papers. The archetypal 1 published by the IMF successful 2011 titled, “The Liquidation Of Government Debt” and past the 2nd insubstantial published by BlackRock successful 2019 titled, “Dealing With The Next Downturn.”

I besides expected each the cardinal banks to enactment successful tandem to determination toward implementing cardinal slope integer currencies (CBDCs) and moving unneurotic to instrumentality the “Great Reset.” However, erstwhile the information changes, I alteration my opinions. Since the creepingly coordinated policies from governments and cardinal banks astir the satellite successful aboriginal 2020, I deliberation immoderate countries are not truthful aligned arsenic they erstwhile were.

Until precocious 2021, I held a beardown presumption that it was mathematically intolerable for the U.S. to rise rates — similar Paul Volcker did successful the 1970s — astatine this signifier of the semipermanent indebtedness rhythm without crashing the planetary indebtedness market.

But, what if the Fed wants to clang the planetary indebtedness markets? What if the U.S. recognizes that a strengthening dollar causes much symptom for its planetary competitors than for themselves? What if the U.S. recognizes that they would beryllium the past domino near lasting successful a cascade of sovereign defaults? Would collapsing the planetary indebtedness markets pb to hyperdollarization? Is this the lone economical chaotic paper the U.S. has up its sleeve to prolong its reign arsenic the ascendant planetary hegemon?

While everyone is waiting for the Fed pivot, I deliberation the astir important pivot has already happened: the Dalio pivot.

As a Ray Dalio disciple, I’ve built my full macroeconomic model connected the thought that “cash is trash.” I judge that mantra inactive holds existent for anyone utilizing immoderate different fiat currency, but has Dalio stumbled upon immoderate caller accusation astir the USD that has changed his mind?

Dalio wrote a phenomenal publication “The Changing World Order: Why Nations Succeed oregon Fail” that details however wars hap erstwhile planetary empires clash.

Has helium concluded that the United States could beryllium astir to weaponize the dollar, making it not truthful trashy? Has helium concluded that the U.S. isn’t going to willingly let China to beryllium the world’s adjacent rising empire similar helium erstwhile proclaimed? Would the U.S. aggressively raising rates pb to a superior formation to the U.S., a state that has a comparatively healthier banking strategy than its competitors successful China, Japan and Europe? Do we person immoderate grounds for this outlandish left-field, hypothetical scenario?

Let’s besides not forget, this is not conscionable a contention with the United States versus China. The second-most utilized overseas currency successful the satellite — the euro — astir apt wouldn’t caput gaining powerfulness from a declining U.S. empire. We person to inquire the question, wherefore is Jerome Powell refusing to align monetary policies with 1 of our closest allies successful Europe?

In this illuminating 2021 webinar, astatine the Green Swan cardinal banking conference, Powell blatantly refused to spell on with the “green cardinal banking” policies that were discussed. This visibly infuriated Christine Lagarde, caput of the European Central Bank, who was besides portion of the event.

Some of the quotes from Powell successful that interrogation are illuminating.

Is this a motion the U.S. is nary longer a instrumentality of the Great Reset ideologies coming retired of Europe? Why is the Fed besides ignoring the United Nations begging them to little rates?

We tin speculate astir what Powell’s intentions whitethorn beryllium each day, but I similar to look astatine data. Since Powell’s archetypal heated statement with Lagarde and the Fed’s consequent complaint summation connected the reverse repo days after, the dollar has decimated the euro.

In April 2022, Powell was dragged into different “debate” with Lagarde, led by the caput of the IMF. Powell reaffirmed his stance connected clime alteration and cardinal banking.

The crippled thickens erstwhile we see the implications of the LIBOR and SOFR involvement complaint modulation that occurred astatine the opening of 2022. Will this involvement complaint alteration change the Fed to hike involvement rates and insulate the banking strategy from the contagion that’ll ensue from a question of planetary indebtedness defaults successful the wider eurodollar market?

I bash deliberation it’s absorbing that by immoderate metrics the U.S. banking strategy is showing comparatively less signs of accent than successful Europe oregon the remainder of the world, validating the thesis that SOFR is insulating the U.S. to a degree.

A New Reserve Asset

Whether the U.S. is astatine warfare with different cardinal banks oregon not doesn’t alteration the information that the state needs a caller neutral reserve plus to backmost the dollar. Creating a planetary deflationary bust, and weaponizing the dollar is only a short-term play. Scooping up assets connected the inexpensive and weaponizing the dollar volition lone unit dollarization successful the abbreviated term. The BRICS nations and others that are disillusioned with the SWIFT-centered fiscal strategy volition proceed to de-dollarize and effort to make an alternate to the dollar.

The planetary reserve currency has been informally backed by the U.S. Treasury enactment for the past 50 years, since Nixon closed the golden model successful 1971. In times of risk, radical tally to the reserve plus arsenic a mode to get a clasp of dollars. For the past 50 years, erstwhile equities merchantability off, investors fled to the “safety” of bonds which would admit successful “risk off” environments. This dynamic built the instauration of the infamous 60/40 portfolio — until this commercialized yet broke successful March 2020 erstwhile the Treasury marketplace became illiquid.

As we modulation into the Bretton Woods III era, the Triffin dilemma is yet becoming untenable. The U.S. needs to find thing to backmost the dollar with. I find it improbable that they volition backmost the dollar with gold. This would beryllium playing into the hands of Russia and China who person acold larger golden reserves.

This leaves the U.S. with their backs against a wall. Faith is being mislaid successful the dollar and they would surely privation to clasp their planetary reserve currency status. The past clip the U.S. was successful a likewise susceptible presumption was successful the 1970s with precocious inflation. It looked similar the dollar would neglect until the U.S. efficaciously pegged the dollar to lipid done the petrodollar statement with the Saudis successful 1973.

The state is faced with a akin conundrum contiguous but with a antithetic acceptable of variables. They nary longer person the enactment of backing the dollar with lipid oregon gold.

Enter Bitcoin!

Bitcoin tin stabilize the dollar and adjacent prolong its planetary reserve currency presumption for overmuch longer than galore radical expect! Most importantly, bitcoin gives the U.S. the 1 happening it needs for the 21st-century monetary wars: trust.

Countries whitethorn spot a gold-backed (petro-)ruble/yuan much than a dollar backed by worthless paper. However, a bitcoin-backed dollar is acold much trustworthy than a gold-backed (petro-)ruble/yuan.

As mentioned earlier, the monetization of bitcoin not lone helps the U.S. economically, but it besides straight hurts our monetary competitors, China and to a lesser degree, Europe — our expected ally.

Will the U.S. recognize that backing the dollar with vigor straight hurts China and Europe? China and Europe are some facing important energy-related headwinds and person some infamously banned Bitcoin’s proof-of-work mining. I made the case that the vigor situation successful China was the existent crushed China banned bitcoin mining successful 2021.

Today, arsenic we modulation into the integer age, I judge a cardinal displacement is coming:

For thousands of years, wealth has been backed by spot and gold, and protected by ships. However, successful this millennium, wealth volition present beryllium backed by encryption and math, and protected by chips.

If you volition let maine to erstwhile again prosecute successful immoderate speculation, I judge the U.S. understands this reality, and is preparing for a deglobalized satellite successful galore antithetic ways. The U.S. appears to beryllium the Western federation taking the friendliest attack to Bitcoin. We person senators each crossed the U.S. tripping implicit themselves to marque their states Bitcoin hubs by enacting affable regularisation for mining. The large hash migration of 2021 has seen the lion’s stock of the Chinese hash being transferred to the U.S., which present houses implicit 35% of the world’s hash rate.

Recent sanctions connected Russian miners could lone further accelerate this hash migration. Apart from immoderate noise successful New York, and the delayed spot ETF decision, the U.S. looks arsenic though it’s embracing bitcoin.

In this video, Treasury Secretary Janet Yellen talks astir Satoshi Nakamoto’s innovation. The SEC Chair Gary Gensler continually differentiates Bitcoin from “crypto” and has besides praised Satoshi Nakamoto’s invention.

ExxonMobil is the largest lipid institution successful the U.S. and announced it was utilizing bitcoin mining to offset its c emissions.

Then there’s the question, wherefore has Michael Saylor been allowed to wage a speculative attack connected the dollar to buy bitcoin? Why is the Fed releasing tools highlighting however to terms eggs (and different goods) successful bitcoin terms? If the U.S. was truthful opposed to banning bitcoin, wherefore has each of this been allowed successful the country?

We’re transitioning from an oil-backed dollar to a bitcoin-backed dollar reserve asset. Crypto-eurodollars, aka stablecoins backed by U.S. debt, volition supply the span betwixt the existing energy-backed dollar strategy and this caller energy-backed bitcoin/dollar system. I find it awfully poetic that the state founded connected the ideology of state and self-sovereignty appears to beryllium positioning itself to beryllium the 1 that astir takes vantage of this technological innovation. The bitcoin-backed dollar is the lone alternate to a rising Chinese menace positioning for the planetary reserve currency.

Yes, the United States has committed galore atrocities, I’d reason that astatine times they’ve been blameworthy of abusing their powerfulness arsenic the planetary hegemon. However, successful a satellite that’s being rapidly consumed by ramped totalitarianism, what happens if the mighty U.S. experimentation fails? What happens to our civilization if we let a social-credit-scoring Chinese empire to emergence and export its CBDC-backed integer panopticon to the world? I was erstwhile 1 of these radical cheering for the demise of the U.S. empire, but I present fearfulness the endurance of our precise civilization is babelike upon the endurance of the state that was primitively founded connected the principles of life, liberty and property.

Conclusions

Zooming out, I basal by my archetypal thesis that we are successful a caller monetary bid by the extremity of the decade. However, the events of the erstwhile months person surely accelerated that already-rapid 2030 timeline. I besides basal by my archetypal thesis from the 2021 article surrounding however bitcoin’s adoption curve unfolds due to the fact that of however breached the existent monetary authorities is.

I judge 2020 was the monetary inflection constituent that volition beryllium the catalyst that takes bitcoin from 3.9% planetary adoption to 90% adoption this decade. This is what crossing the chasm entails for each transformative technologies that scope mainstream penetration.

There volition nevertheless beryllium galore “hopeful moments” on the way, similar determination was successful the German Weimar hyperinflationary lawsuit of the 1920s.

There volition beryllium dips and spikes successful inflation, similar determination was successful the 1940s during U.S. authorities deleveraging.

Deglobalization volition beryllium the cleanable scapegoat for what was ever going to beryllium a decennary of authorities indebtedness deleveraging. The monetary contractions and spasms are becoming much predominant and much convulsive with each drawdown we encounter. I judge the bulk of fiat currencies are successful the 1917 stages of the Weimar hyperinflation.

This nonfiction was precise centered connected nation-state adoption of bitcoin, but don’t suffer show of what’s genuinely unfolding here. Bitcoin is simply a Trojan equine for state and self-sovereignty successful the integer age. Interestingly, I besides consciousness that hyperdollarization volition accelerate this peaceful revolution.

Hyperinflation is the lawsuit that causes radical to bash the enactment and larn astir money. Once galore of these power-hungry dictators are forced to dollarize and nary longer person the power of their section wealth printer, they whitethorn beryllium much incentivized to instrumentality a stake connected thing similar bitcoin. Some whitethorn adjacent bash it retired of spite, not wanting to person their monetary argumentation dictated to them by the U.S.

Money is the superior instrumentality utilized by states to workout their autocratic, authoritarian powers. Bitcoin is the technological innovation that’ll dissolve the nation-state, and fracture the powerfulness the authorities has, by removing its monopoly connected the wealth supply. In the aforesaid mode the printing property fractured the powerfulness of the dynamic duo that was the religion and state, bitcoin volition abstracted wealth from authorities for the archetypal clip successful 5,000+ years of monetary history.

So, to reply the dollar doomsdayers, “Is the dollar going to die?” Yes! But what volition we spot successful the interim? De-dollarization? Maybe connected the margins, but I judge we volition spot hyperdollarization followed by hyperbitcoinization.

This is simply a impermanent station by Luke Mikic. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)