U.S. Sen. Elizabeth Warren wants to task the Biden medication and Treasury Department with monitoring crypto transactions for fearfulness of sanctions violations. The 2 Treasury agencies that would bash truthful mightiness already person the authorization they request – but not the money.

You’re speechmaking State of Crypto, a CoinDesk newsletter looking astatine the intersection of cryptocurrency and government. Click here to motion up for aboriginal editions.

U.S. Sen. Elizabeth Warren’s (D-Mass.) new measure announced during a caller legislature hearing drew the ire of the crypto industry. What seems to person garnered little attraction are immoderate of the statements made by the hearing’s witnesses.

Federal agencies are already tasked with monitoring illicit transactions, including crypto-related ones. What they mightiness inactive request is simply a fund promised but yet to beryllium delivered.

I’ll fto Michael Mosier, presently astatine Espresso Systems and formerly of the Financial Crimes Enforcement Network (FinCEN) and Chainalysis, explain:

“Fifteen months aft the transition of landmark [anti-money laundering] modernization legislation, nary of the tens of millions of dollars needed to instrumentality it has been appropriated.”

Mosier was 1 of the 4 witnesses successful past week’s panel. In his pre-written testimony, which helium work arsenic his opening statement, helium recommended Congress walk a due budget, the 1 “that was owed past October.”

He went connected to explicate that FinCEN and the Office of Foreign Assets Control – the Treasury Department helping that oversees sanctions – person not received $74 cardinal ($64 cardinal for FinCEN, $10 cardinal for OFAC) they should person aft the Anti-Money Laundering Act of 2020 was passed arsenic portion of the broader National Defense Authorization Act.

Congress has passed continuing resolutions alternatively than a due fund for 2021. Under these CRs, backing levels fundamentally stay frozen astatine their 2020 levels. The caller funds the agencies should person received would spell to boosting their unit and exertion support, Mosier said successful his testimony.

“Empower FinCEN to usage the information already coming to them earlier burdening them – and manufacture – with further information postulation for which they volition beryllium asked what bully usage they made of it,” Mosier said. “They are being acceptable up for nonaccomplishment by unfunded mandates.”

Which brings america backmost to Warren’s bill. I emailed 2 property aides asking if Warren would see a backing proviso (among different things).

Have the U.S. President (guessing this means Treasury) constitute a study identifying non-U.S.-based crypto exchanges that prosecute with sanctioned Russian individuals

Have the President (Treasury?) authorisation these individuals and exchanges

Allow the U.S. Treasury Secretary to artifact U.S. crypto exchanges oregon exchanges operating successful the U.S. from operating successful Russia oregon facilitating transactions for Russia-based individuals

Have FinCEN record currency transaction reports for individuals who transact much than $10,000 successful crypto done astatine slightest 1 offshore account

Have the Treasury Secretary place immoderate resources that Treasury needs 120 days aft the measure is signed into law

Have the Treasury Secretary place immoderate exchanges that are “high risk” for sanctions evasion and different crimes

Point 4 supra powerfully resembles a proviso successful the unhosted wallet regularisation the manufacture was intensely focused connected astatine the extremity of 2020 (albeit the less-unpopular proviso – connected the look of it this would bring crypto reporting successful enactment with existing rules for cash).

The remainder of it seems much focused connected this theoretical contented that crypto is being utilized to evade sanctions.

In my email to Warren’s property folks, I asked:

If determination was immoderate information oregon grounds that suggests crypto is being utilized to evade sanctions

How the FinCEN connection (reporting individuals who transact with much than $10,000 per day) ties into the Russia-specific provisions

What authorities the measure provides for that FinCEN/OFAC don't already have

Whether Sen. Warren volition see a backing proviso for these caller tasks

I did not person a effect to my email.

Now, to beryllium clear, Warren’s concerns are not unwarranted. Her stated concern, which she has reiterated clip and again, is that Russian oligarchs oregon the Russian authorities mightiness crook to crypto arsenic a instrumentality to evade sanctions resulting from Russia’s penetration of Ukraine. Which is surely possible.

It seems incredibly improbable astatine this constituent the Russian authorities volition usage crypto arsenic a sanctions evasion instrumentality for a assortment of reasons, which I’ve discussed successful past editions of this newsletter.

Individuals, connected the different hand, whitethorn beryllium amended capable to instrumentality vantage of crypto. Even here, however, it seems improbable determination volition beryllium immoderate crypto-for-sanctions-evasion astatine scale. Several Treasury officials, connected the record, person said they’re not acrophobic astir this issue.

Nellie Liang, the undersecretary for home concern astatine the Treasury Department, told Reuters the U.S. authorities has seen an summation successful integer plus usage for illicit finance, but it’s a “fairly small” magnitude of transactions.

"Of course, we admit we whitethorn not spot everything, but determination is simply a just magnitude of oversight. At this point, we conscionable don't spot that it could beryllium utilized successful a large-scale mode to evade sanctions,” she told the quality service.

During the hearing, Warren asked Jonathan Levin of Chainalysis whether oligarchs could interruption their fortunes into chunks of $100 million, person that into crypto and usage that to evade sanctions.

Chainalysis has bundle that tin way these funds, adjacent if mixers oregon concatenation hopping tools are used, Levin said.

Shane Stansbury, a erstwhile cyber crimes authoritative and existent chap astatine Duke University, would lone spell truthful acold arsenic to accidental crypto for sanctions evasion is “theoretically possible.”

“Obviously, it’s hard but astatine slightest if [an oligarch] is capable to spell to a affable jurisdiction and usage cryptocurrency exchanges oregon immoderate different level that’s not successful compliance with internationally recognized anti-money laundering standards arsenic you’ve suggested, that is possible,” he said.

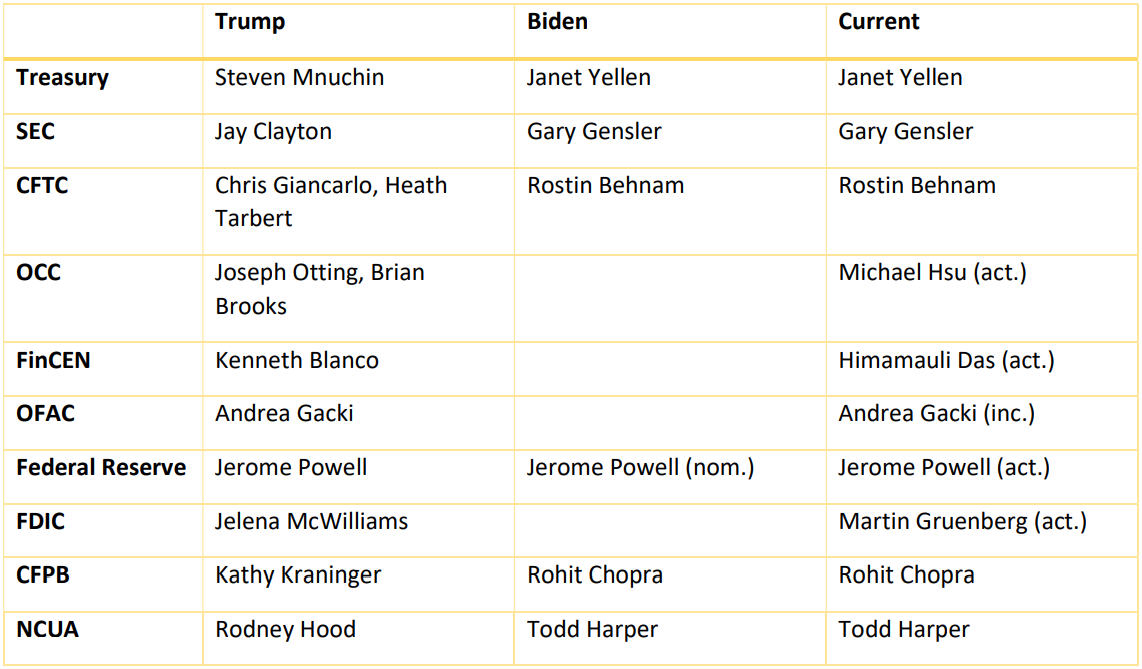

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

Federal Reserve Vice Chair for Supervision nominee Sarah Bloom Raskin withdrew her sanction from information past week. Almost instantly after, the Senate Banking Committee voted to beforehand the nominations of Fed Chair Pro Tempore and Chair nominee Jerome Powell, Fed Vice Chair nominee Lael Brainard (currently a Fed governor) and Fed committee nominees Philip Jefferson and Lisa Cook.

Introducing CoinDesk’s Mining Week: CoinDesk’s latest taxable week acceptable of features, reports and discussions looks into the satellite of crypto mining. Follow the bid each week for stories astir this captious facet of the crypto industry.

(Bleeping Computer) “Microsoft is investigating ads successful the Windows 11 File Explorer.” Microsoft, stahp.

(Rest of World) Rest of World visited El Salvador to cheque successful connected its bitcoin-as-legal-tender experimentation six months in. The radical RoW spoke to expressed concerns astir the rollout of El Salvador’s bitcoin (BTC) wallet Chivo and respective different aspects of the law’s implementation.

(The Washington Post) The Post spoke to the residents of Limestone, a municipality successful Tennessee that is present location to a bitcoin mining firm. Locals believed they were welcoming a information halfway but don’t look to person realized conscionable what a crypto mining steadfast came with, namely a monolithic sound contented locals bash not welcome.

(BuzzFeed News) According to BuzzFeed newsman Paul McLeod, the U.S. Senate passed a measure to marque daylight savings clip imperishable by a dependable ballot due to the fact that respective lawmakers had nary thought the ballot was happening to statesman with.

(The Washington Post) Post newsman Greg Jaffe spoke to Khalid Payenda, who was Afghanistan’s concern curate a twelvemonth agone and – arsenic of past week anyhow – an Uber operator successful Washington, D.C.

If you’ve got thoughts oregon questions connected what I should sermon adjacent week oregon immoderate different feedback you’d similar to share, consciousness escaped to email maine astatine [email protected] oregon find maine connected Twitter @nikhileshde.

You tin besides articulation the radical speech connected Telegram.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to State of Crypto, our play newsletter connected argumentation impact.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)