Revisiting The Dollar Bitcoin Relationship

In much caller issues, we’ve highlighted that implicit the past fewer months, bitcoin’s terms has been a relation of larger macroeconomic conditions of rising yields and recognition unwinding starring to accrued equity marketplace volatility and rising U.S. dollar strength.

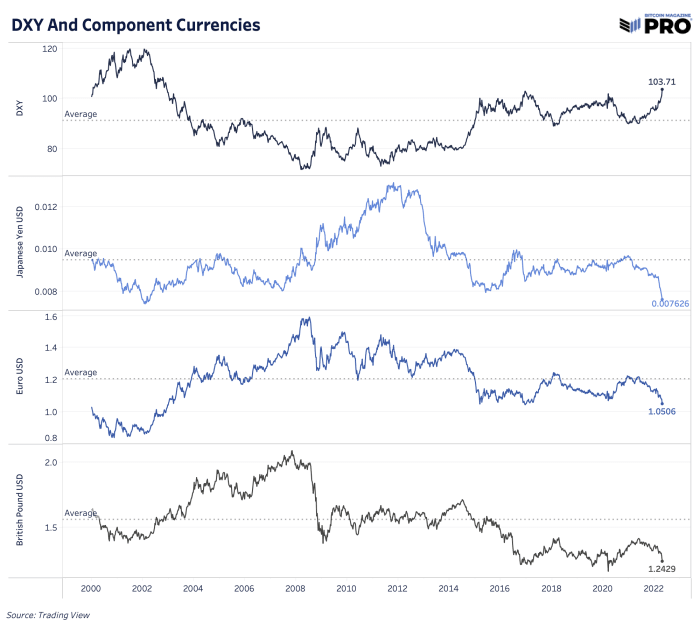

As of late, the Dollar Currency Index (DXY) which tracks the comparative spot of the U.S. dollar measured against different cardinal planetary currencies, is hitting caller 20-year highs arsenic large currencies similar the euro, Japanese yen and British lb proceed to weaken. The latest emergence comes arsenic the Bank of Japan triples down connected their output curve power efforts, purchasing an unlimited magnitude of 10-year bonds each concern time to headdress yields astatine 0.25%.

So what does a rising DXY mean for bitcoin and different assets? Even with the dollar devaluing against existent goods, services and fiscal assets, each debtors are forced to merchantability USD-denominated assets to screen liabilities during deleveraging events.

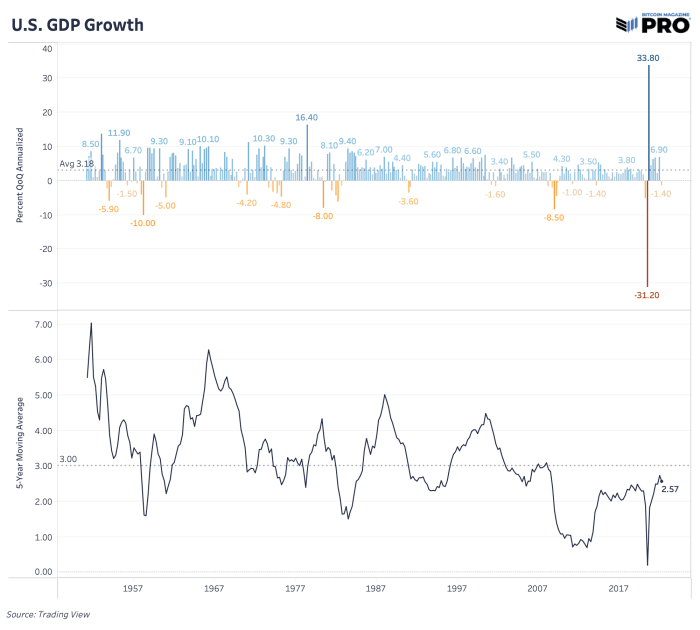

Today, we besides get the latest U.S. Q1 2022 gross home merchandise (GDP) information showing that the system contracted by 1.4% compared to 1.1% enlargement consensus. The maturation deterioration crossed large planetary economies that volition usher successful a marketplace authorities displacement to a much deflationary situation aboriginal this twelvemonth has been a cardinal presumption successful our basal lawsuit to expect much downside for hazard assets successful 2022.

If we’re to spot broader marketplace expectations for maturation chopped further this twelvemonth past that alteration is apt much downside for hazard assets.

Final Note

In our view, the worst is yet to play retired for markets and bitcoin. That said, the benignant of recognition unwinding and deleveraging we’re facing contiguous is 1 of the cardinal reasons that we expect the lawsuit for bitcoin to turn successful the marketplace arsenic these events unfold.

3 years ago

3 years ago

English (US)

English (US)