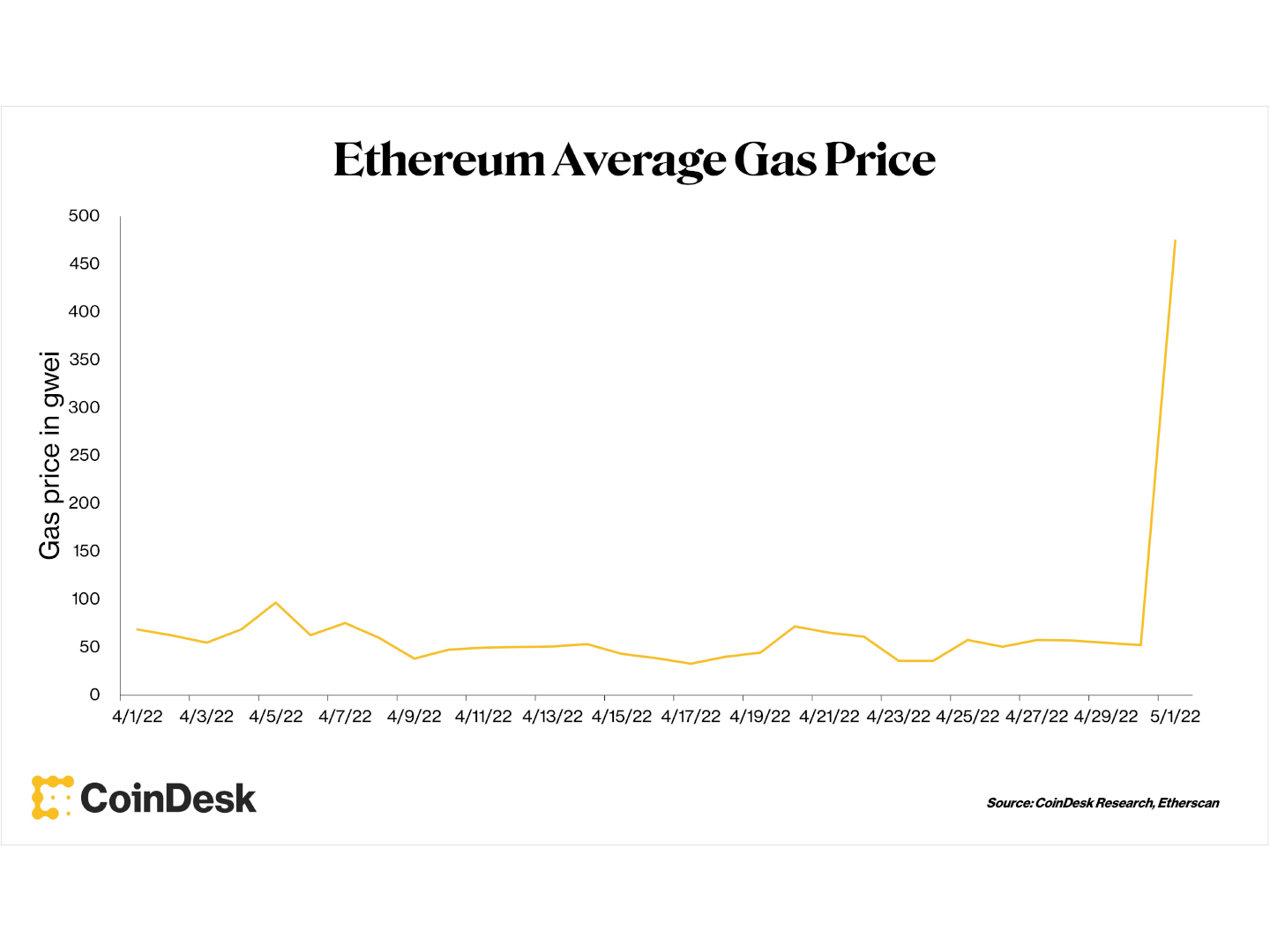

Possibly the largest non-fungible token (NFT) merchantability successful Ethereum history, the Otherside “virtual onshore sale” pushed Ethereum fees precocious capable to render the full web virtually unusable for respective hours connected Saturday.

In lawsuit you missed it – the highly anticipated NFT motorboat netted implicit $400 cardinal successful income for Yuga Labs, the startup down the Bored Ape Yacht Club NFT collection. It besides generated an unprecedented $100 cardinal successful Ethereum state fees successful conscionable nether an hour.

In astatine slightest 1 sense, the caller spike successful Ethereum state prices is benignant of similar the surge successful prices for the different benignant of state – the 1 that fuels your car.

In some cases, there’s a blasted crippled going on. With real-world ostentation of substance and different surviving costs, depending connected whom you ask, the culprit is either money printing oregon COVID stimulus oregon corporate greed or, astir recently, Vladimir Putin.

With the on-chain “gas wars,” the question past play became however overmuch of the occupation was attributable to Ethereum’s limitations versus mediocre readying (or deliberate scheming) from Yuga Labs, whose merchantability of integer “land” was the proximate origin of the run-up successful fees.

Gas fees – which users are required to wage whenever they transact connected Ethereum – summation successful effect to higher web activity. While immoderate state is “burned” by the network, users tin besides acceptable a “tip” to spell to the alleged miners who process transactions.

A higher extremity tin beryllium utilized to expedite a transaction – bumping that transaction to the beforehand of the enactment truthful it tin beryllium processed much quickly. Too debased of a extremity tin pb to transactions that stall oregon neglect entirely, arsenic happened often passim Saturday night.

Enough radical wanted successful connected Otherside this past play that state fees crossed Ethereum changeable up to historical highs. Twitter was rapidly flooded with reports of users spending thousands of dollars’ worthy of state connected idiosyncratic transactions.

Some users claimed to person paid the precocious fees by accident, whereas others paid the state knowingly, lone to larn aboriginal connected that their transactions had failed.

(CoinDesk Research, Etherscan)

Yuga quickly promised to refund state fees for Otherside minters with failed transactions, but the exorbitant fees and failures afflicted Ethereum users networkwide.

The Yuga Labs debacle: What happened

In a tweeted apology, Yuga said connected Saturday that Ethereum’s debased web capableness posed a “bottleneck” for the project. According to Yuga, the debacle made it “abundantly clear” that it would request its ain concatenation successful bid to “properly scale” moving forward.

But not everyone viewed Sunday’s merchantability arsenic conscionable an indictment of Ethereum. Critics of Yuga said its engineers could person easy programmed Otherside’s astute contracts to expend little gas.

Will Papper, co-founder of SyndicateDAO, explained successful a fashionable Twitter thread that “[m]odifying a fewer words would person saved $80M+.”

On apical of failing to optimize astute contracts, Yuga didn’t look to follow capable safeguards to forestall the request for Otherside from clogging up the network.

On 1 hand, Yuga seemed cognizant of the information that the Otherside mint was going to pull sizable traffic. In portion to forestall a state warfare (like the 1 that yet ensued), Yuga restricted minting abilities to users who identified themselves via a ceremonial verification process. Yuga besides created a bounds of 2 “Otherdeed” NFTs per each preapproved wallet.

These gating tactics might’ve eased web postulation somewhat, but Yuga besides played a manus successful expanding congestion by, astatine the past minute, forgoing its emblematic Dutch auction format. In a Dutch auction, Yuga’s Otherdeed NFTs would person started astatine 1 terms and past dropped little implicit clip until the proviso ran out.

While ditching the Dutch auction was framed by Yuga arsenic a mode to marque things much equitable, it besides turned the mint lawsuit into a huffy dash wherever everyone was trying to mint astatine the aforesaid time.

In airy of Yuga’s mediocre readying and shoddy engineering, Yuga’s abrupt proposition that it mightiness pivot to its ain blockchain made immoderate onlookers suspicious. Crypto Twitter rapidly grew rife with speculation (without evidence) that Yuga intentionally clogged up the Ethereum web successful bid to warrant a determination distant from the network.

Yuga wouldn’t beryllium the archetypal large NFT institution to rotation retired of Ethereum onto its ain blockchain.

This weekend’s events were peculiarly reminiscent of a similar incidental successful 2017 which saw CryptoKitties – the archetypal NFT task to summation important traction connected Ethereum – grind the Ethereum web to a halt arsenic a effect of precocious demand.

The creator of CryptoKitties, Dapper Labs, has since launched the Flow blockchain successful bid to standard its NFT gaming empire.

The astir notable NFT institution to permission Ethereum for its ain concatenation is Sky Mavis, which launched the Ronin web successful bid to grip the transaction measurement of its play-to-earn gaming juggernaut Axie Infinity.

In bid to scale, Ronin appears to person made sacrifices to information and decentralization that enabled hackers to siphon implicit $600 cardinal distant from the web successful March.

Given the (much maligned) centralization of Flow and Ronin comparative to Ethereum, Yuga’s astir vocal critics consciousness the institution might’ve felt the request to front-run disapproval that would travel if it launched its blockchain.

While Yuga’s screwups were immense, it’s hard to judge they were premeditated.

A little cynical mentation – the 1 Papper subscribes to – is that Yuga simply enactment the blasted connected Ethereum arsenic a mode to prevention face.

“I don't judge that Yuga would permission $100 cardinal to $150 cardinal connected the array for a selling stunt. … The rumors circulating that this was intentional and done to beforehand a caller concatenation are incorrect,” Papper said.

While it is astir apt just to knock Yuga for its seemingly mediocre engineering practices, Papper notes “gas optimization standards are inactive emerging.” It is imaginable (albeit embarrassing) that Yuga’s engineers simply screwed up.

Yuga besides did look to expect request for the mint by requiring verification and primitively readying a Dutch auction, and it’s imaginable they truly did judge changing to a fixed-price exemplary would’ve accrued equity without spurring a state war.

Finally, there’s not adjacent immoderate warrant that Yuga (or its DAO) volition physique retired its ain concatenation erstwhile each is said and done. Ultimately, it wouldn’t beryllium astonishing to spot Yuga determination implicit to an Ethereum developer-friendly blockchain that already exists similar Polygon oregon Avalanche. (Given however the Otherside astute contracts were engineered, it’s hard to ideate radical would spot a Yuga-made concatenation anyway.)

It’s been a portion since Ethereum faced a slowdown of this magnitude, and Yuga surely made mistakes successful the pb up to the Otherside launch. Still, it’s hard not to presumption this past weekend’s debacle arsenic yet different illustration successful a agelong database showing that Ethereum desperately needs to summation its transaction capacity.

The much-anticipated Merge, which volition soon crook Ethereum into a proof-of-stake network, volition not, astatine slightest successful the abbreviated term, person overmuch of an interaction connected the network’s throughput. The displacement to proof-of-stake volition amended the biology interaction of Ethereum, but it isn’t expected to person overmuch of an effect connected state fees oregon web speeds.

Sharding, an Ethereum upgrade that could theoretically amended upon these aspects, was delayed successful favour of expediting the power to proof-of-stake. For now, it doesn’t look arsenic if sharding volition beryllium coming anytime soon.

The main mode the Ethereum assemblage is presently moving to standard is done layer 2 rollups, specified arsenic Optimism and Arbitrum, which process transactions connected abstracted blockchains earlier bundling them up and passing them backmost down to Ethereum.

Though rollups person experienced maturation implicit the past year, they’ve yet to trim prices to the level of chains similar Solana and Polygon (which is gathering retired its ain rollup). Unless furniture 2 solutions negociate to grow their developer communities and userbases, Ethereum volition proceed to spot much teams similar Yuga moving for greener pastures.

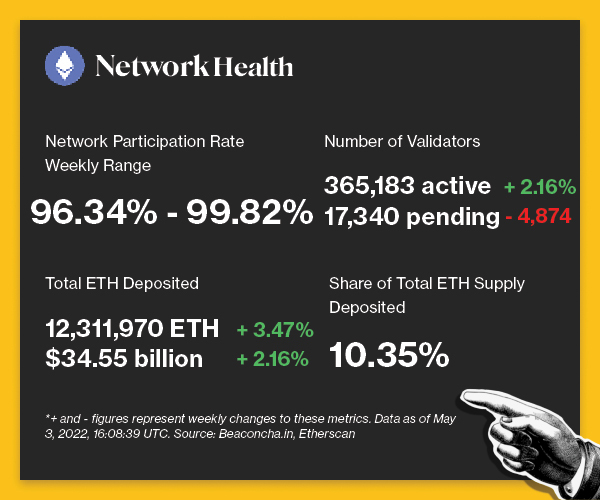

The pursuing is an overview of web enactment connected the Ethereum Beacon Chain implicit the past week. For much accusation astir the metrics featured successful this section, cheque retired our 101 explainer connected Eth 2.0 metrics.

(Beaconcha.in, Etherscan)

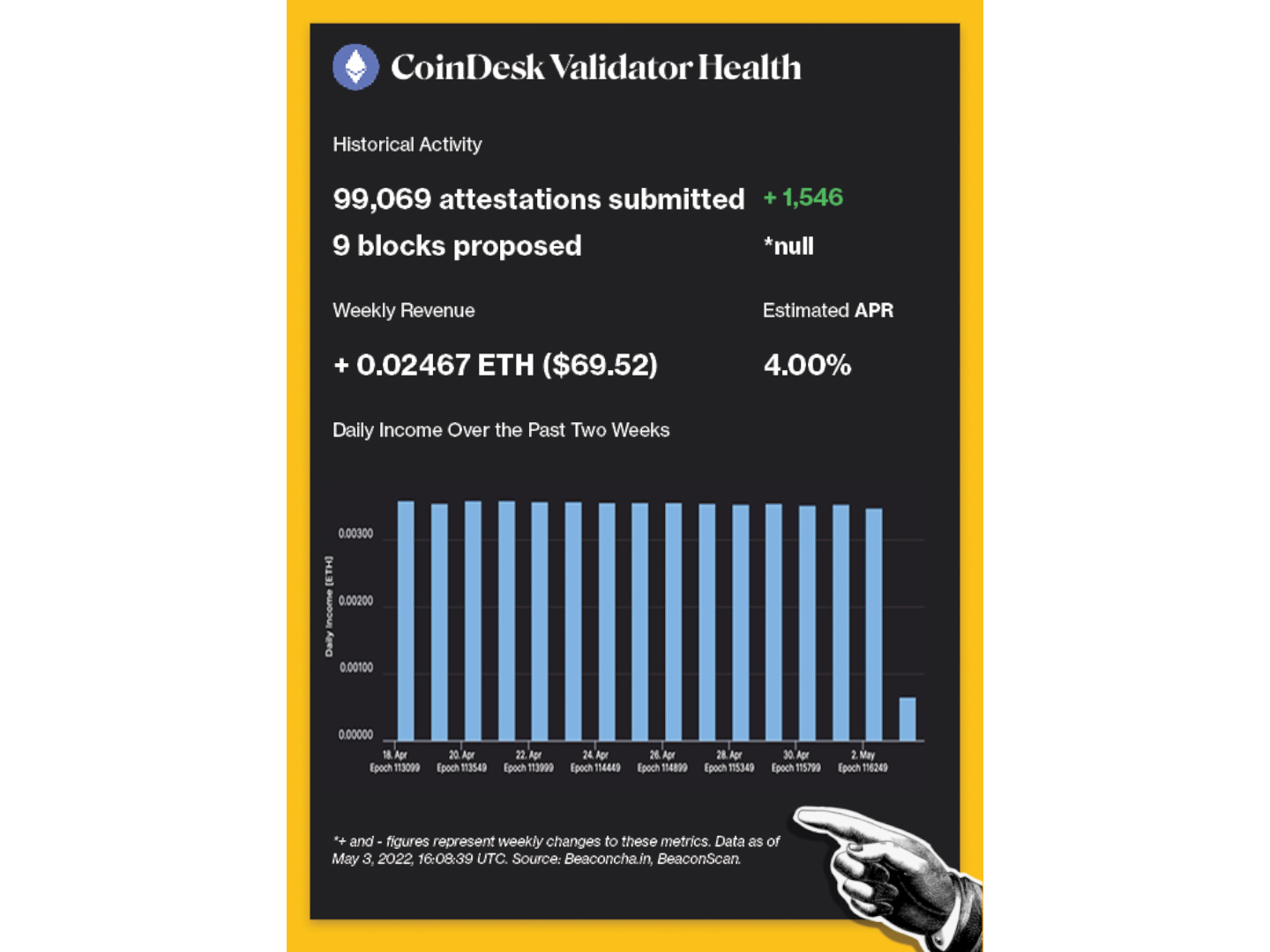

(Beaconcha.in, Beaconscan)

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking task volition beryllium donated to a foundation of the company’s choosing erstwhile transfers are enabled connected the network.

WHY IT MATTERS: On May 1, FIFA President Gianni Infantino and Algorand laminitis Silvio Micali announced that Algorand volition supply a blockchain-supported wallet solution for FIFA and assistance FIFA successful further processing its integer plus strategy. Read much here.

WHY IT MATTERS: Solana processes an mean of 2,700 transactions per second, but connected the evening of April 30, millions of transactions bombarded the web each second. Consequently, web validators, which unafraid the network, ran retired of representation and crashed, according to Solana developers. This is not the lone clip Solana has suffered from respective hours of downtime owed to a flood of transactions. Read much here.

WHY IT MATTERS: Jane Street, a salient quantitative trading firm, dived further into decentralized concern (DeFi) by borrowing $25 cardinal from BlockTower Capital. This is the archetypal clip a large instauration connected Wall Street borrowed connected a DeFi protocol, according to Clearpool. Jane Street’s determination to get USDC follows their concern successful Bastion, a decentralized lending protocol built connected the Near blockchain. Read much here.

Rari Capital and Fei Protocol lost much than $80 cardinal successful an attack.

WHY IT MATTERS: On April 30, the DeFi platforms suffered a nonaccomplishment of much than $80 cardinal successful funds. According to astute declaration investigation steadfast Block Sec, the basal origin of this onslaught was a reentrancy vulnerability. The protocols person paused borrowing globally to mitigate further harm and are offering a $10 cardinal bounty to the exploiter with nary questions asked if they instrumentality the funds. Read much here.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for State of Crypto, our play newsletter examining the intersection of cryptocurrency and government

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)