Crypto.com › Bitcoin › Adoption

If the complaint of crypto adoption remains the same, we could spot implicit 1 cardinal crypto users by December—60% of which would ain Bitcoin.

The complaint of cryptocurrency adoption is increasing astatine an exponential rate. As the marketplace gets much mature, much and much users are jumping onto the crypto bid and expanding the planetary complaint of crypto ownership.

According to the latest study from Crypto.com, we are presently connected way to scope 1 cardinal crypto users by the extremity of 2022.

Adoption grows contempt the onset of a carnivore market

The increasing propulsion towards cryptocurrencies has been steadily expanding successful the past fewer years. And portion the retail marketplace has ever been the 1 driving this adoption, this twelvemonth we’ve seen monolithic organization efforts arsenic well.

El Salvador’s groundbreaking Bitcoin instrumentality was a cherry connected apical of an full twelvemonth of companies and fiscal institutions jumping aboard the crypto train.

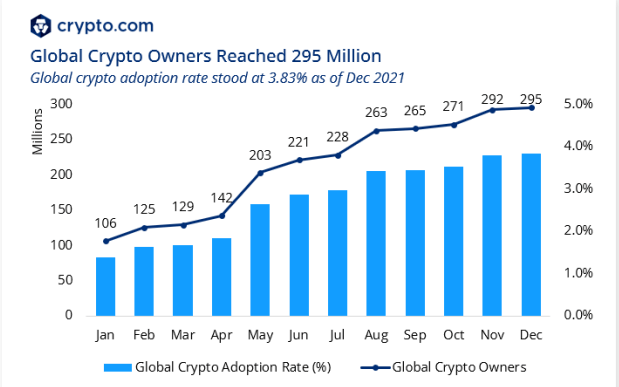

All of this has translated into a important summation successful the fig of crypto users. According to information from Crypto.com, determination were 295 cardinal crypto users globally arsenic of December 29th, 2021. And portion this fig is conscionable an aggregate of each of the users (cross-checked for treble addresses) crossed 2 twelve centralized exchanges, it’s inactive a reasonably bully practice of the market.

Last year, the fig of crypto users has astir tripled, expanding from 106 cardinal successful January to 295 cardinal successful December. If we spot the aforesaid complaint of summation successful 2022, we are connected way to scope 1 cardinal users by the extremity of the year.

Chart showing the summation successful planetary crypto owners 2021 (Source: Crypto.com)

Chart showing the summation successful planetary crypto owners 2021 (Source: Crypto.com)This complaint of summation successful the fig of crypto users volition person a important effect connected the market. As of 2022, astir 176 cardinal planetary crypto users, oregon conscionable nether 60%, ain Bitcoin. Only astir 23 cardinal ain Ethereum, but 23% of the full idiosyncratic basal ain some Bitcoin and Ethereum.

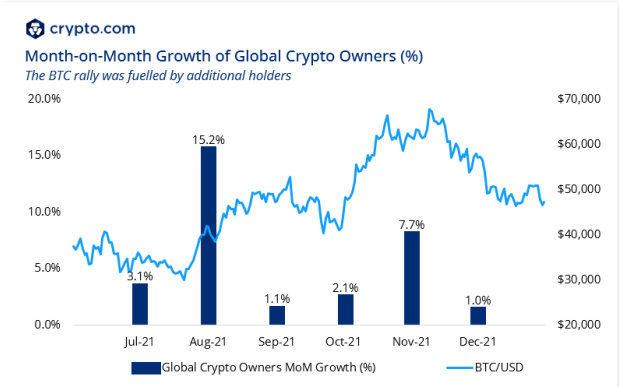

We’ve seen the biggest month-on-month maturation of crypto users successful August past twelvemonth erstwhile the fig of users grew by 15.2% erstwhile compared to the erstwhile month. This summation successful the fig of users was partially liable for Bitcoin’s stellar show successful the pursuing months, peaking successful November erstwhile it reached its ATH of $69,000.

The 15.2% maturation complaint we’ve seen successful August was hard to replicate successful the pursuing months—MoM maturation rates successful September and October 2021 were conscionable 1.1% and 2.1%, respectively.

Chart showing the month-on-month maturation of planetary crypto owners successful 2021 (Source: Crypto.com)

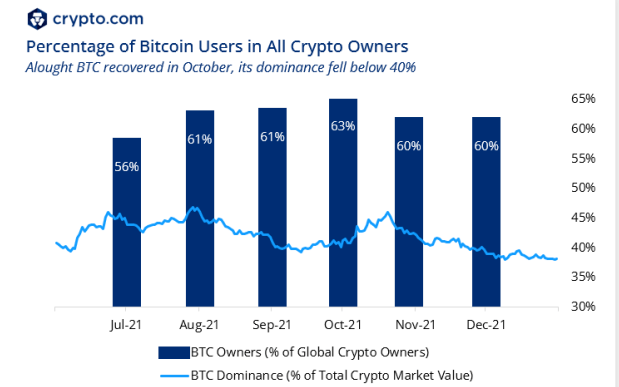

Chart showing the month-on-month maturation of planetary crypto owners successful 2021 (Source: Crypto.com)Despite this, Bitcoin continued to seizure the largest portion of the crypto market—both successful presumption of marketplace capitalization and the fig of users. In July 2021, conscionable nether 56% of each crypto users owned Bitcoin. This marketplace stock continued to turn until October erstwhile it reached 63%. Once Bitcoin touched its ATH and began its two-month-long drawdown, its marketplace stock decreased to 60%.

When it comes to Bitcoin’s marketplace capitalization, it excessively began to alteration astatine the opening of November 2021, falling beneath 40% astatine the extremity of the year. If this downtrend was to proceed successful 2022, we could spot its dominance driblet to humanities lows.

However, nary of that volition impact the fig of radical owning Bitcoin. If the complaint of ownership among crypto users was to stay astir its existent 60% level, it would mean that 600 cardinal radical would ain Bitcoin.

Chart showing the percent of Bitcoin users among each crypto owners successful 2021 (Source: Crypto.com)

Chart showing the percent of Bitcoin users among each crypto owners successful 2021 (Source: Crypto.com)New crypto users are much apt to follow Bitcoin than Ethereum

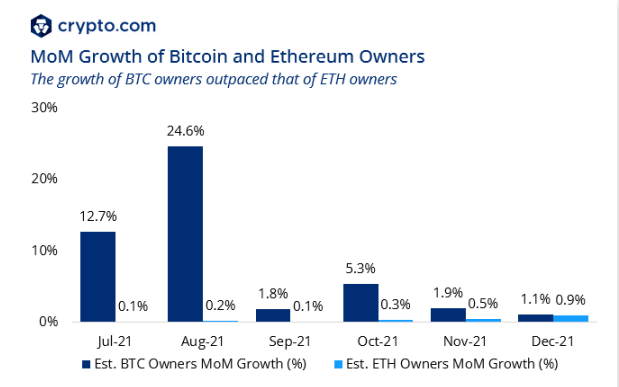

Breaking down this information adjacent further reveals an absorbing phenomenon. In the 2nd fractional of 2021, the fig of Bitcoin users grew by 37.5%, expanding from 128 cardinal successful July to 176 cardinal successful December. Ethereum, connected the different hand, saw the fig of its users summation by lone 1.4% during this period.

Chart showing the month-on-month maturation of Bitcoin and Ethereum owners successful 2021 (Source: Crypto.com)

Chart showing the month-on-month maturation of Bitcoin and Ethereum owners successful 2021 (Source: Crypto.com)This means that the fig of Ethereum users remained dependable astatine astir 23 cardinal passim the 2nd fractional of the year. However, successful the archetypal fractional of 2021, the fig of Ethereum users grew by 64%. Ethereum besides spent the entirety of 2021 losing its marketplace share, which decreased from 13% successful January to 8% successful December 2021.

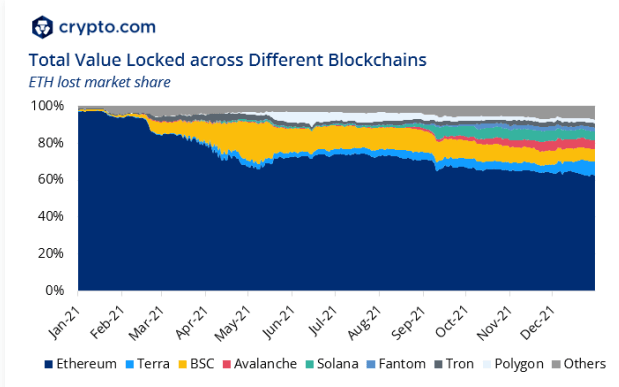

Crypto.com noted successful its study that this mightiness beryllium owed to the information that assorted EVM-compatible blockchains and Layer-2 solutions drew distant users and assets from Ethereum.

Graph showing the full worth locked crossed antithetic blockchains successful 2021 (Source: Crypto.com)

Graph showing the full worth locked crossed antithetic blockchains successful 2021 (Source: Crypto.com)However, determination could beryllium different mentation for the deficiency of Ethereum adoption identified successful the report.

As Crypto.com’s probe methodology lone considered centralized exchanges, it could person overlooked the immense DeFi marketplace and perchance tens of millions of DEX users. In summation to that, Bitcoin has agelong received much mainstream property than Ethereum has, which could person made it much charismatic to those wholly caller to the crypto industry.

There is besides the contented of cost that could person driven much radical to Bitcoin. Ethereum has been struggling with highly precocious state costs this past year, driving transaction fees done the roof. With the outgo of a swap connected a decentralized speech often reaching hundreds of dollars, state prices mightiness person enactment Ethereum retired of scope for galore small-time retail investors caller to crypto.

The complexity of the Ethereum ecosystem could person besides been a important origin successful its deficiency of adoption. Out of the full market, Bitcoin is the lone cryptocurrency that looks and behaves successful a mode akin to accepted fiscal assets. This makes it a bully gateway to the satellite of cryptocurrencies for galore caller users.

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)