The twelvemonth is lone weeks aged and Wall Street analysts are already trying to foretell 2022 winners and losers. But Mike McGlone, Bloomberg's elder commodity strategist, is going backmost to the basics: proviso and demand.

This week, McGlone, who won plaudits successful crypto markets past twelvemonth for being 1 of the archetypal salient Wall Street analysts to accurately foretell that bitcoin's terms would deed $50,000, penned a brace of reports this week comparing the dynamic successful the bitcoin marketplace with that of earthy materials lipid and copper.

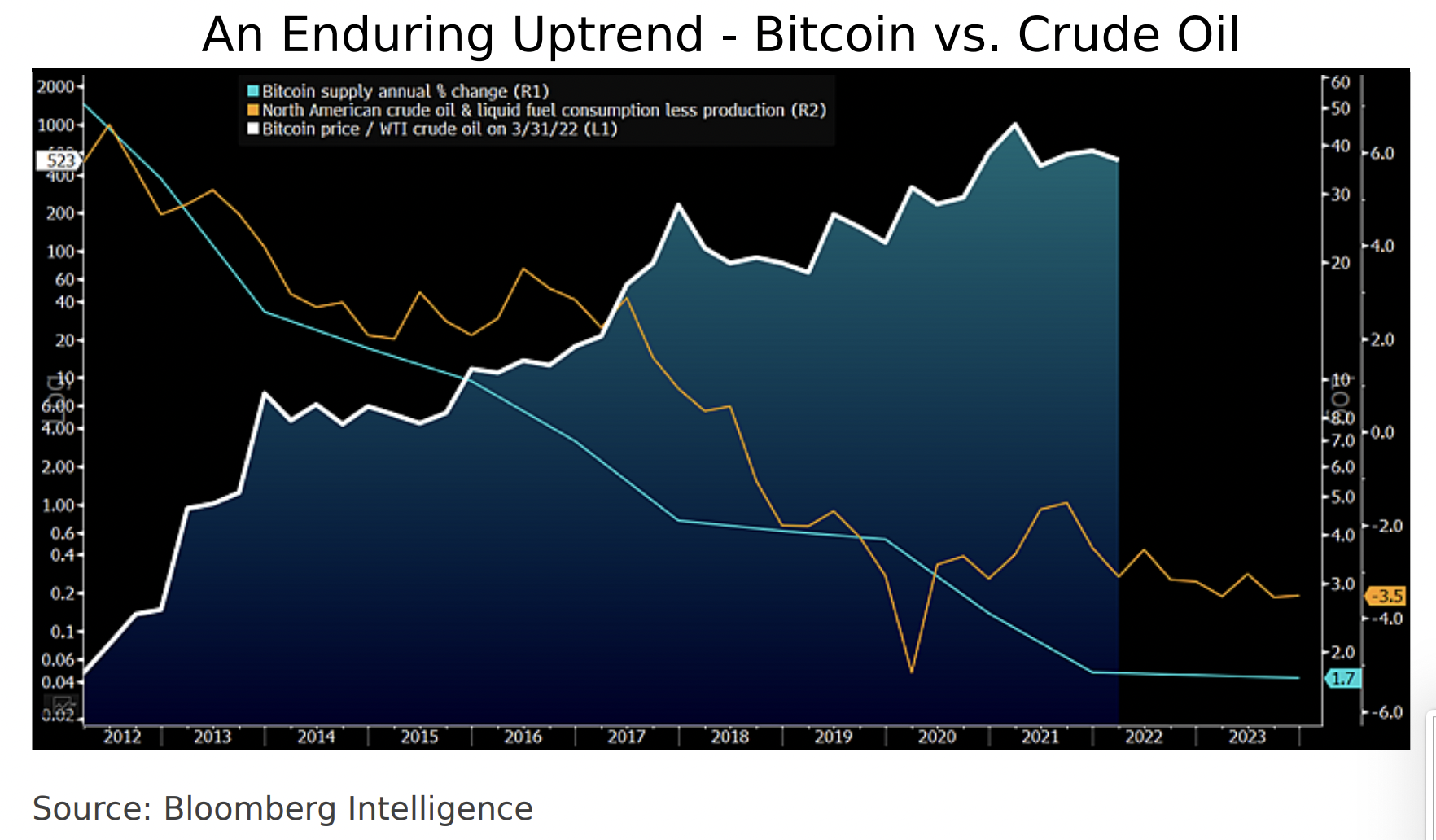

Taking a look astatine oil, McGlone pointed retired that prices for the benchmark U.S. crude assortment West Texas Intermediate are down astir 20% implicit the past twelvemonth due to the fact that of shifts successful the supply-demand balance. In 2012, request exceeded proviso by 6 cardinal barrels a time successful North America, but there's present a proviso surplus of 3 cardinal barrels a day, according to his report. A driving unit is that much lipid tin beryllium extracted for little money.

Then there's copper. McGlone predicts copper prices person peaked and are facing headwinds due to the fact that Chinese request has slowed.

What's antithetic astir bitcoin, according to McGlone, is the apical cryptocurrency by marketplace headdress comes with a "lack of proviso elasticity." Because the gait of caller bitcoin accumulation is already acceptable by the underlying blockchain's programming, a higher terms won't automatically pb to much supply.

According to the analyst's calculations, 1 bitcoin is present worthy much than 500 barrels of oil, up from "a specified fraction" of what a tube of lipid was worthy successful 2012.

“Supply, demand, adoption and advancing exertion constituent to the crypto continuing to outperform fossil substance successful the adjacent 10 years,” McGlone wrote.

Bitcoin's terms comparative to lipid (white line) charted against oil's supply-demand equilibrium (orange) and the complaint of summation successful caller bitcoin proviso (blue). (Bloomberg Intelligence)

Similarly, 1 bitcoin is present worthy astir 4.4 tons of copper, compared with a specified fraction a decennary ago.

"Copper whitethorn beryllium a bully illustration of the debased imaginable for a commodity supercycle, notably versus an advancing bitcoin," McGlone wrote. "It's not that profound to expect 1 of the best-performing assets of the past decennary to support outpacing the old-guard concern metal, and we spot bitcoin's precocious manus gaining endurance, and maturity, versus copper."

One caveat is however challenging it tin beryllium to foretell the aboriginal trajectory of the blockchain manufacture – not to notation cryptocurrency prices.

But bitcoin is presently changing hands astir $43,000, good disconnected the all-time precocious terms adjacent $69,000 reached successful November.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)