Bitcoin mining companies proceed struggling to past the ongoing carnivore market. Dreams of outperforming bitcoin arsenic a nationalist mining institution are agelong gone. Bankruptcies and lawsuits marque regular headlines. And adjacent Wall Street analysts that were erstwhile bullish connected bitcoin mining concern opportunities present accidental they’re “pulling the plug” until the marketplace improves. But precisely however atrocious is the existent carnivore market?

It’s ever darkest earlier dawn, arsenic the adage says. And compared to erstwhile carnivore markets, the mining manufacture looks overmuch person to the extremity of a turbulent marketplace signifier than the opening of it. This nonfiction explores a clump of information sets from the existent and erstwhile carnivore markets to contextualize the authorities of the manufacture and however the mining assemblage is faring. From hardware lifecycles and miner balances, to hash complaint maturation and hash terms declines, each of these information archer a unsocial communicative astir 1 of Bitcoin’s astir important economical sectors.

Mining Revenue Is Evaporating

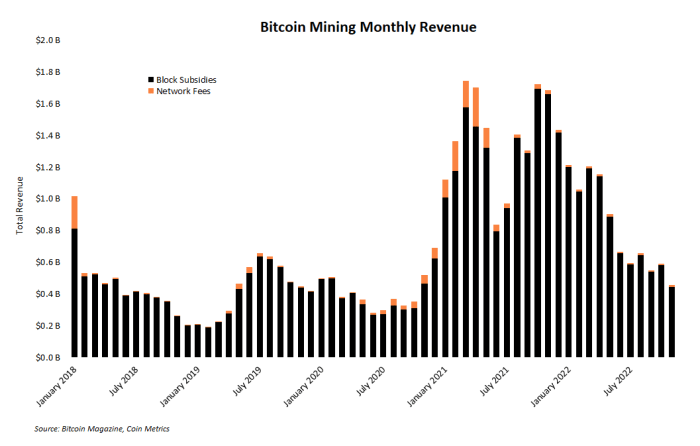

When bitcoin’s terms drops, it’s not astonishing that dollar-denominated mining gross besides drops. But it has – a lot. Roughly 900 BTC are inactive mined each day and volition beryllium until the adjacent halving successful 2024. But the fiat terms for those bitcoin has plummeted this year, meaning miners person acold less dollars for expenses similar electricity, attraction and the servicing of loans.

As the illustration beneath demonstrates, successful November, the full bitcoin mining manufacture earned little than $500 cardinal from processing transactions and issuing caller coins. The barroom illustration beneath shows this monthly gross compared to the past 5 years. November mining gross marks a two-year debased for monthly earnings.

Potential Hash Rate Uptrend Reversal

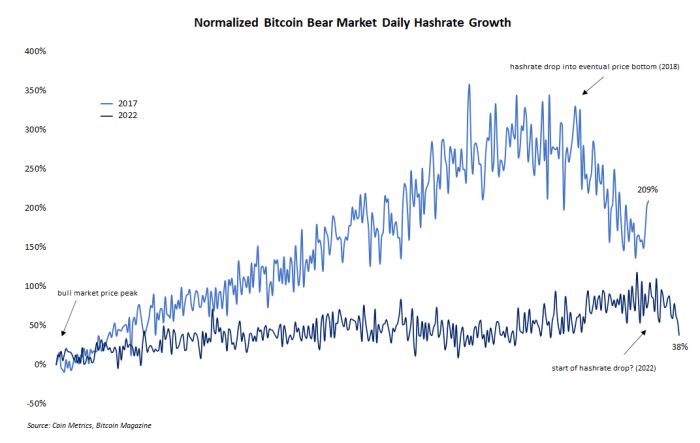

Comparing the existent carnivore marketplace to the erstwhile 1 successful 2018 offers immoderate absorbing insights into however the mining manufacture has changed and however it has remained the same. One specified examination is hash complaint maturation during downward terms trends. It’s not uncommon to spot hash complaint turn during carnivore markets. The annotated enactment illustration beneath shows normalized hash complaint maturation during the 2018 and 2022 carnivore markets from bitcoin’s terms highest to the drawdowns’ past (or current) lows.

But 1 happening that is evidently missing from the supra illustration is simply a correction successful hash complaint maturation during the aboriginal play of the bearish phase. In 2018, for example, the maturation inclination intelligibly changed people and dropped arsenic the marketplace yet recovered a debased for bitcoin’s price. But successful the existent market, hash complaint has lone grown. Perhaps a flimsy driblet successful hash complaint done precocious November signals a inclination change, but the question is inactive open.

Collapse Of Public Mining Companies

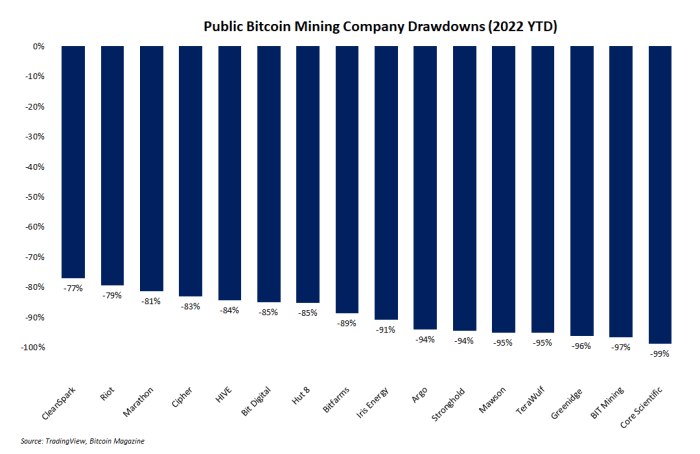

Perhaps the astir brutal bitcoin mining illustration of each shows the drawdowns of publicly-traded mining companies this year. It’s nary concealed that the past twelvemonth has been brutal for bitcoin, different cryptocurrencies, and the planetary system successful general. But mining companies successful peculiar person been clobbered. Over fractional of these companies person seen their stock prices autumn implicit 90% since January. Only 2 — CleanSpark and Riot Blockchain — person not dropped much than 80%.

Mining companies successful wide are often considered to beryllium a high-beta concern successful bitcoin, meaning erstwhile bitcoin goes up, mining banal prices spell up more. But this marketplace dynamic cuts some ways, and erstwhile bitcoin falls, the downside for mining stocks is adjacent much brutal. The barroom illustration beneath shows the massacre these stocks person endured.

The Rise And Fall Of Bitcoin Mining’s ‘AK-47’

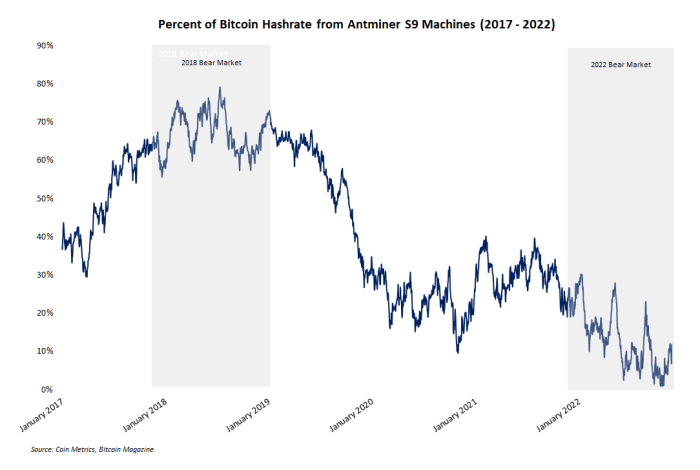

An underappreciated hallmark of the existent bitcoin carnivore marketplace is the precipitous diminution successful hash complaint contributed by Bitmain’s Antminer S9 machines. This exemplary of mining instrumentality is occasionally referred to arsenic the “AK-47” of mining due to the fact that of its durability and reliable performance. And astatine 1 constituent successful the 2018 carnivore market, the S9 was king. Nearly 80% of Bitcoin’s full hash complaint came from this Bitmain exemplary during the depths of the erstwhile carnivore market.

But the existent carnivore marketplace tells a wholly antithetic story. Thanks to new, much businesslike hardware and a vice-grip compression connected mining nett margins, the percent of hash complaint from S9s dropped beneath 2% successful aboriginal November. The annotated enactment illustration beneath shows the emergence and autumn of this machine.

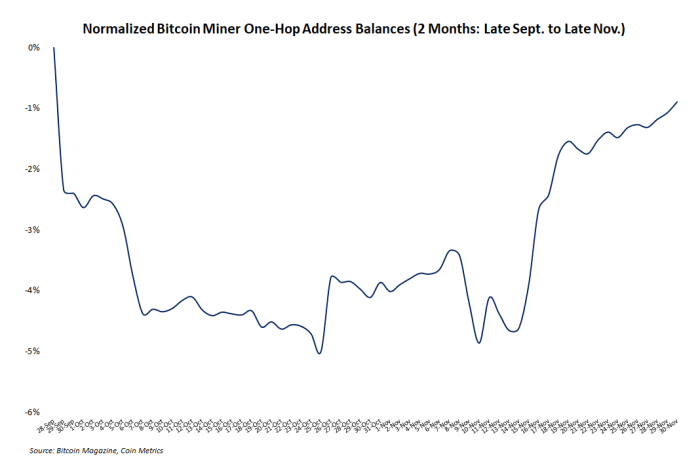

Miner Balance Retraces Its Sell Off

The past fewer months person been disastrous for the “crypto” manufacture arsenic speech wars, insolvent custodians and other forms of fiscal contagion swept the market. Many bitcoin investors similar to presume their conception of the manufacture is mostly insulated from the chaos of the remainder of “crypto,” but this is usually false. In the lawsuit of miners, who are notoriously atrocious astatine timing the market, immoderate panic was evident arsenic code balances and miner outflows appeared to driblet and spike, respectively.

But this enactment was abbreviated lived. The enactment illustration beneath shows that miner code balances person astir afloat retraced their driblet from precocious September done October. In short, miners look to beryllium backmost successful HODL mode, impervious to exogenous marketplace events. Whether the carnivore marketplace is implicit oregon not is unknown. But miners look to beryllium accumulating much than selling.

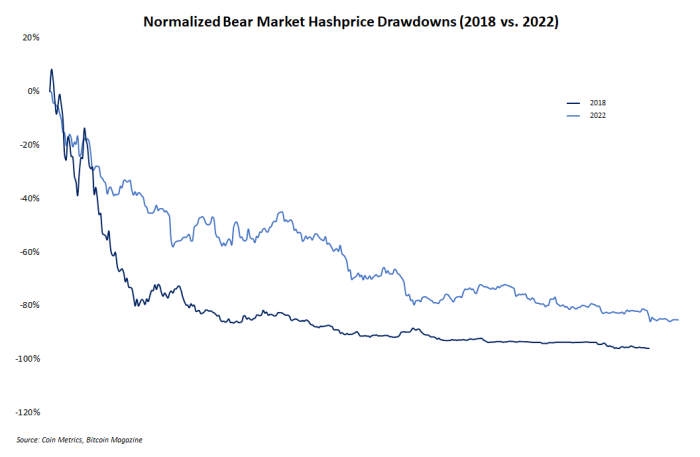

Hash Price Drop Today Vs. 2018

Hash terms is 1 of the astir fashionable economical metrics for miners to track, adjacent though fewer radical extracurricular of the mining assemblage recognize it. In short, this metric represents the dollar-denominated gross expected to beryllium earned per marginal portion of hash rate. And similar everything other successful the carnivore market, hash terms has fallen significantly. But its diminution is not unusual, particularly erstwhile it's compared to the hash terms diminution successful 2018.

Shown successful the illustration beneath are normalized hash terms drawdowns from 2018 and 2022. Readers volition announcement the reasonably akin slope and size of the drawdowns. 2018 was somewhat steeper. 2022 to day has been shallower but longer. But some were and are brutal for fledgling mining operations.

The Next Phase Of Mining

Boom and bust cycles are a earthy bid of events for immoderate decently functioning market. The bitcoin mining assemblage is nary exception. For the past year, mining has seen its weaker, unprepared operators weeded retired arsenic the excesses from the bull marketplace are brought to account. Now, successful the depths of a bearish period, the existent builders tin proceed to grow their operations and physique a coagulated instauration for the adjacent signifier of euphoric bullishness.

This is simply a impermanent station by Zack Voell. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)